Wednesday, January 09 2013

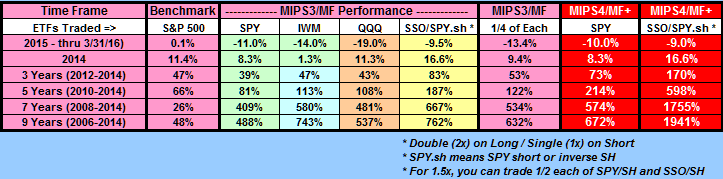

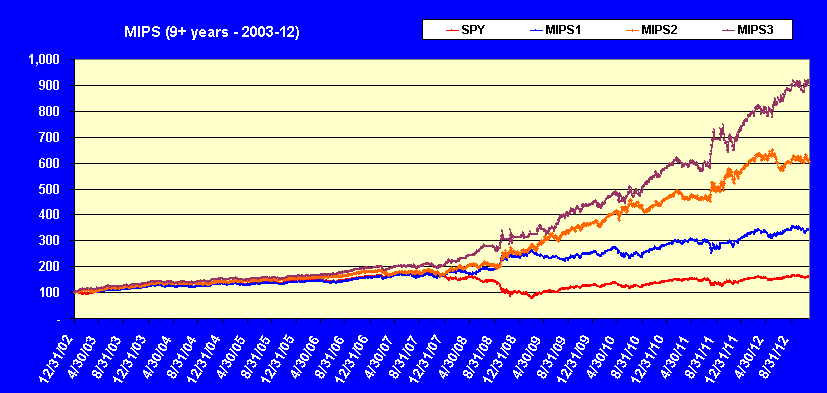

Our flagship MIPS3/MF model did NOT do really well in 2012. Our portfolio managed by MIPS3/MF trading

SPY long and short was up about 8.5% for the year (9% counting dividends earned and commissions

paid), versus about 13% growth for the SPY. So, what can we do to perform better?

Here are three ways to do better using the MIPS3/MF model (at least they have been better over the last 7 years).

Improvement #1 - Trade Multiple ETFs

As most of you know, our MIPS models are tracking the ETF for the S&P500 Index (SPY), because we

believe that the S&P500 is a very good representation of "the market". For this reason and this reason

only, we report our performance of MIPS models trading the SPY.

However, as you most likely know, MIPS members are not restricted to trading just the SPY. In fact, as

you can read under the "Services" tab on our homepage, MIPS members can trade any ETF that

"correlates" well with the SPY (or any mix thereof). Most of he ETFs that represents the major USA

indices (SPY, MDY, IWM, QQQ), fill this bill. See the definition of "correlates" at Investopedia.com:

http://www.investopedia.com/terms/c/correlation.asp#axzz2HRqpl6YI )

Therefore, if so desired, MIPS investors can trade the following:

I.) Conservative investors trading SPY long and short (or buying SH on shorts).

II.) Aggressive investors buying 1/3 each of SPY, IWM, QQQ on long signals, but only

shorting the SPY on short signals (or buying SH).

III.) More Aggressive investors buying 1/3 each of SPY, IWM, QQQ long and either shorting

these ETFs or buying their corresponding inverse ETFs on short signals (SH, RWM, PSQ).

BTW, I usually apply profile "II" or "III" above to my trading.

So, in the last 3 years 2010-2011-2012 (certainly not the best time for MIPS3/MF), when the SPY with

buy/hold was up 28%, MIPS3/MF trading just SPY (using profile "I") was up 42% (not at all bad). But,

trading with profile "III" in this time period, MIPS3/MF would have been up a whopping 58% (tons better

than the 28% with buy/hold, and also better than 42% from trading just the SPY with MIPS3/MF).

If we look at the last 7 years (longer-term view), the SPY was up 14%, and the trading profile "III" with

MIPS3/MF would have been up 379% (verified by TimerTrac.com) !!!

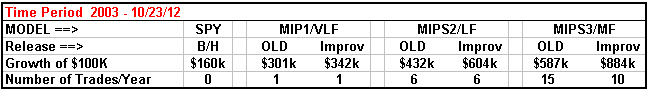

Improvement #2 - New "Improv" Release

This one is on the house. The performance of the current MIPS models are some of the very best in

the industry. However, as most of you know, we at MIPS are continually trying to make our models

even better.

To that end, we recently updated some of the algorithms in our models to respond more effectively

in flat or sideways market (like the markets in 2011-12), and hence these MIPS models will do a lot better

in these types of markets in the future. This, of course, will improve the overall results of all MIPS models

going forward.

Please note that these are NOT NEW models, they are simply the old models with relatively simple

but very effective revisions. When we develop a completely different model, the name of the new

model, or course, will definitely be different from that of any existing models (as in MIPS3/MF versus

MIPS2/LF).

Improvement #3 - Trading Leveraged ETFs

Investors who are willing to take more risk would most likely do better with the MIPS3/MF model trading

"double leveraged" ETFs. I personally do not like to trade leveraged ETFs on every trade. Sometimes

I do use double leveraged SPY on long signals, but I use single leveraged SPY on short signals. The

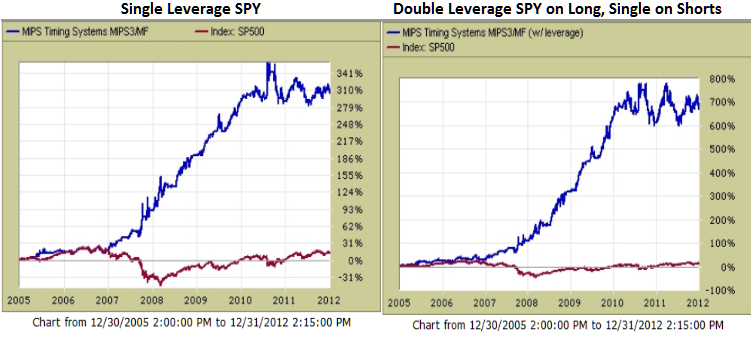

results of using MIPS3/MF signals with this trading strategy are shown below (from TimerTrac.com).

In the 7-year period of 2006-12, MIPS3/MF trading single leveraged SPY was up 314% (left graph); but trading

double leveraged SPY on long signals and single leveraged SPY on short signals would have produced gains of

about 700% (right graph). Please pay close attention to the vertical axis in both graphs below.

Thursday, December 27 2012

We got a real scare in the market today as the stock market fell more than 1% after Senate Majority Leader Harry Reid said that is unlikely that a deal could be reached in Congress before the Dec. 31st "deadline". This made us revisit our thoughts that we may be on a downward path in an eerily similar fashion to that in 2007-08 (see the graph immediately below and the first graph in our "Previous email"). Had the rapid fall continued, this could have been a grim day for the bulls. It is good to note that the pullback of the last 4 days has been on low volume.

On the positive side for the bulls, the SPY experienced what could prove to be a "one-day key reversal" where the market drops dramatically on a day following a short-term pullback, but recovers and closes above or near its open on that same day. Also positive is that the SPY broke its 100-day EMA, but recovered and closed above it (blue dotted line). Of course, this DOES NOT MEAN that the downward move is over, but it is a good sign.

We all know that the market's next short-term move is going to depend upon any progress (or lack thereof) in the negotiations in Congress regarding taxes and spending cuts and whether concrete progress is apparent in avoiding going over the "Fiscal Cliff".

It is impossible for any of us predict the outcome of these negotiations, so we will have to wait until these negotiations progress (or stall), and let MIPS decide what we should do.

Stock Market Crash of 2012 ???

Saturday, December 22 2012

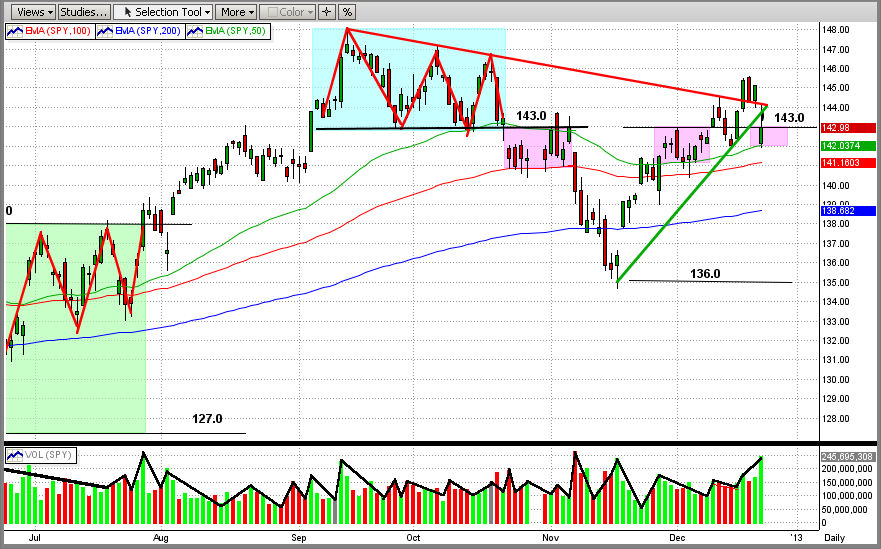

Responding to the bad news from John Boehner that he was calling off the vote in the House on the GOP's "Plan B" to avoid going over the "Fiscal Cliff", the SPY (and all other USA markets) fell substantially Friday. The SPY opened on Friday at $142.17 (approx $1421.7 on the SP500), which accounted for the downside "gap" of -$1.93 (or 1.34%) from Thursday's close of $144.10. Then, the SPY gained back $0.62 to close at $142.79, for a total loss of-$1.31 from Thursday's close (see the graph below). This $1.31 drop equates to approximately -$13 on the SP500 (or almost -1%).

An interesting phenomenon has developed in the market around $143/share (neckline of the triple top).

1) In late Oct/Nov, the SPY bounced between $143 and the top of the 100-day EMA for 2 weeks, and

then fell almost 5% to $136 (left-most pink box).

2) Then again in late Nov/early Dec, after bouncing off of its support at 136, the SPY came all the way

back and traded between $143 and the top of its 50-day EMA for 8 trading days, before it broke out

to the upside (middle pink box).

3) Unfortunately, the upside move did not last long, as the SPY again fell back to between $143 and

50-day EMA. This is where we stand now (right-most pink box).

4) If the SPY does not again challenge the $143 resistance and goes down from here, we would of course,

face an immediate correction.

5) On the other hand, another attempt by the SPY to break $143 to the upside would be its 3rd attempt.

We believe that, if the SPY does break above $143 on this 3rd attempt, the upside move will last a while.

But, if the SPY fails to break above $143, the immediate future could be very worrisome, or worse.

Of course, what happens to the US stock markets in the short-term (weeks) will most likely depend upon:

(a) what our "heroes" in Congress decide to do about our country's financial future (taxes, spending, debt),

if they can decide on anything at all, or

(b) if they will continue to prove that they are incompetent and can't get anything done, thus letting our

country fall over the "Fiscal Cliff" into a financial abyss.

[Sorry for my nasty tone in the above paragraph, but I am fed up with our congressional "leaders" on both sides.]

But remember, we can follow the above with interest but without having to decide which way the markets will go (or why), because we can rely on MIPS to tell us what to do, and when.

The above has nothing to do with the MIPS models, and are simply observations and/or opinions of the author.

Tuesday, December 11 2012

The previous email below was from 12/03/12, and was entitled "Year-End Rally or New Bear?" (2nd graph below).

After today's nice market gain, it seems like the "Year-End Rally" has won. All MIPS models are long, so that's a good thing.

In the 1st graph immediately below, you can see that the SPY danced between its 50-day EMA and the strong upside resistance level of $143/share (the neckline of the triple top) for almost two weeks. But, today the SPY broke out of this tight trading range and closed up at $143.44 on slightly higher volume.

We all know that one day does not dictate a new market direction, but today's breakout was impressive. If indeed this turns into a nice new intermediate uptrend (year-end rally), MIPS should stay long. However, if it turns south, we can expect MIPS to pick up the new downtrend and take us short. More later ...

Saturday, December 08 2012

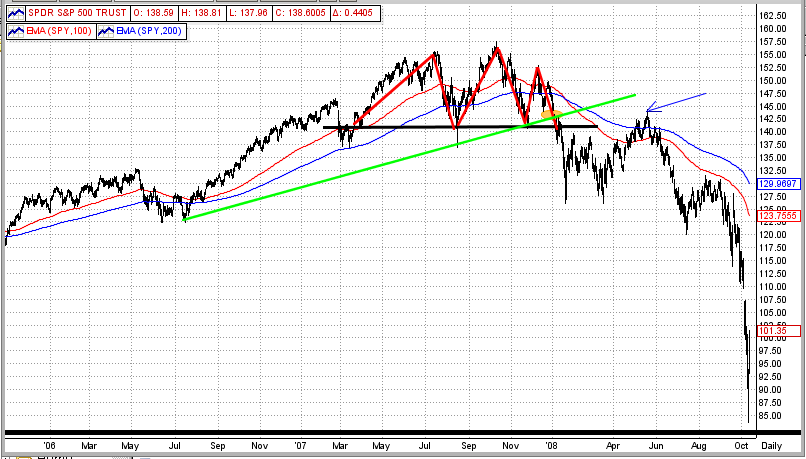

Does history repeat itself? If so, does stock market behavior repeat itself? There are a lot of people that hope that it doesn't, but we know that many times it does.

The two graphs below are pretty compelling.

The first graph is a picture of the stock market crash of 2008, and the second one is the market behavior in 2012.

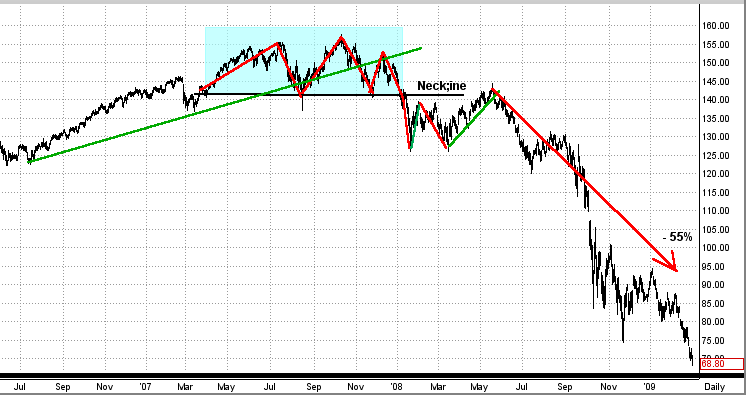

First Graph (2007-08)

In 2007-08 the SPY formed a triple top in the second half of the year. During that time, the SPY broke its intermediate-term trend line and then it broke through the bottom of the neckline of the triple top. After a fall through the neckline, the SPY re-tested the resistance of the neckline, fell back some, and then re-tested the neckline again. After two attempts to break the neckline to the upside, the SPY fell apart and dropped 55% !!!

2nd Graph (2012)

In 2012 the SPY formed a triple top in the second half of the year. During that time, the SPY broke its intermediate-term trend line and then it broke through the bottom of the neckline of the triple top. After a fall through the neckline, the SPY re-tested the resistance of the neckline, fell back some, and then re-tested tested the neckline again. After two attempts to break the neckline to the upside, the SPY does what ??? (End of story for now.)

Pretty darn compelling and scary. Of course, the direction of the SPY (the market) most likely will show its hand in the next 2-3 months, and we will have either: (a) a booming bull market or (b) a big drop in the market. The good news it that, the bigger the move, the more we will make after MIPS determines the "new trend".

BTW- I follow MIPS, not the charts. But, over the years, I have found the charts to be a reasonable indicator (better than nothing). MIPS does not follow the the charts either; it is much more intricate than any one indicator.

Stock Market Crash of 2008 (graph is for the SPY)

Stock Market Crash of 2012 ???

Tuesday, December 04 2012

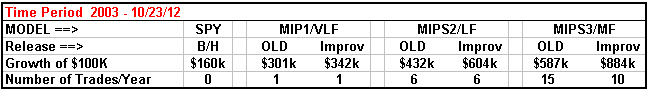

Good news, we are introducing new releases of our MIPS1/VLF, MIPS2/LF, and MIPS3/MF MIPS models that produce better results than our current models. The current models are very good, but the improved models ("Improv") are even better, with lower drawdowns and fewer trades/year. Please note that these are NOT new models, but simply revisions to the current models. Therefore, all models will retain their current names. BTW, "Improv" is an in-house project name for the development of these new models, and this name will not be used commercially. In this email, any reference to "Old" models means the current ones.

Of course, the past performance on our website and the past performance verified by TimerTrac.com will not change (can't change the past). But, our "release" process requires that we extensively "backtest" all new models (like the "Improv" models) to verify that they perform better than the current models over all time frames.

For example, see the table and graph immediately below

- the performance table and graph below were generated with "Improv" signals.

Performance with our "current" models can see seen on our website under the "Performance"

tab or under the "Signals" tab (past signals button); or performance results from our MIPS3/MF

model can be calculated and verified on TimerTrac.com from 11/04/05.

Monday, December 03 2012

As we all know, there is now somewhat equal pressure to push the market up as there is to push it down. The optimists are banking on our leaders solving our budget problems before we go over the fiscal cliff and on a Santa Claus rally that they have become accustomed to as in past Decembers. On the other hand, the pessimists are concentrating on a weakening EURO from defaults in some of the PIIGS countries, and are betting against the fiscal cliff problems being solved prior to Dec 31, 2012.

The graph below shows the recent market action (SPY price graph). From this, you can see the SPY breaking out of its November downdraft (red line) and forming a new, short-term up-trendline (rightmost green line).

Today (Dec 3rd), the SPY hit a strong upside resistance level at $143/share and bounced back down. That, of course, is bearish. This upside resistance is from the neckline of the recent triple-top (cyan box). The fact that the SPY hit and held above the 50-day EMA is bullish. The next support level is at $135/share on the SPY.

The greatest threat facing intermediate-term traders is if the SPY goes into a fast sideways trading pattern, like the one seemingly forming with tops at $143/share and bottoms at $135/share. This pattern would result in a sideways trading pattern with highs/lows plus and minus about 3% around the midpoint at $139/share. Unless an investor can trade close to these high/low points, they could get whipsawed and lose lots of $'s. Most investors cannot trade this pattern successfully on their own, and these investors need to follow a good timing system (like MIPS) or go to cash until the market breaks out of the sideways pattern, if it does form.

Or course, the SPY could simply turn around and break above $143/share into a rally or fall straight through $135/share into a new bear market. This is the type of market where MIPS can issue frequent trades because there is no solid intermediate-term trend, but that is better than being out of sync with the market and getting clobbered with fewer trades.

Friday, November 16 2012

We have received several emails from our subscribers asking how a model like MIPS3/MF, which trades an average of 15 times/year, can issue 2-3 trade signals in one week.,

The happens because:

1) the 15 trades/year for MIPS3/MF is an “average”, which means in some years it can trade

only 9 times (like in 2009) and in other years it may trade as many as 24 times (like in 2011), and

2) in any time frame, MIPS can trade 2-3 times in one month, and only one time in 3-5 months

(like at the end of 2010).

The main reason for this is the MIPS models have multiple “stop-gap” and “safe-guard” measures built in that “test” the integrity and accuracy of each and every signal. Specifically, for a few days after every trade, MIPS checks to see if the recent signal really is on the right track. These stop-gaps and safe-guards are NOT simply “stops” as we know them, but are proprietary algorithms that check to see if the SPY is following the expected price/volume pattern predicted by the algorithms in the recent signal.

Normally, the MIPS models issue new signals based on many indicators/algorithms that believe that they have found a directional change in the market, like an “Inflection Point” or a “Key Reversal”, etc. When MIPS issues a signal based on the consensus of these algorithms, it then spends the next few days verifying the “expected outcome”. If the “expected outcome” is not met, MIPS will either (a) reverse its position or (b) get out entirely (i.e., go to cash).

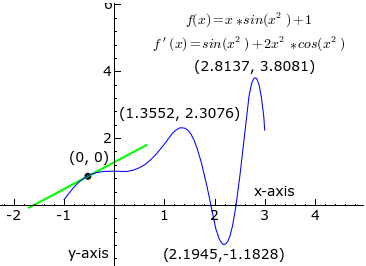

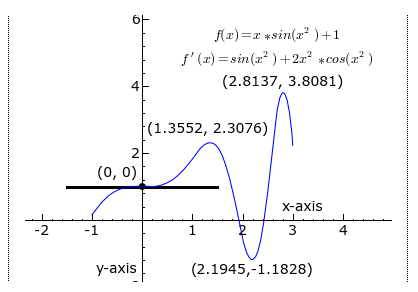

See the example below for Inflection Points

Click here for animated example =>

http://en.wikipedia.org/wiki/File:Graph_of_sliding_derivative_line.gif

In this graphic animated presentation from Wikipedia above, imagine that the curved blue line is the price of the SPY and the traveling lines are the “slope” of this price curve at any point on the curve. Therefore,

1) when the slope is pointed up, the SPY is in an upward pattern, and

2) when the slope is pointed down (red line), the SPY is in a downward pattern, and

3) when the slope is flat or zero (black line), the SPY is in a flat or sideways pattern, and

is signaling the potential of having reached an “Inflection Point”.

In the Wikipedia example above, at first the SPY is going up and the slope is pointing up (green up-line). When the slope turns flat/zero like it does near the Y-axis (black flat line), MIPS is looking for a change in direction in the SPY price from up to down (Inflection Point), and could signal a short signal. If the slope stays flat for a while or if the slope turns back up instead of turning down, MIPS could reverse its short signal and either (a) go long, or (b) go to cash. If MIPS does issue a cash signal and the slope then continues back up from there (as in the Wikipedia example as it crosses the Y-axis), MIPS will ultimately go long again. Over time, MIPS will go through tough periods trying to find a new trend and goes through 3-4 trades of –3% to +3%, but MIPS will ultimately find an intermediate trend (up or down) that will make us +10 to +15%, and the cycle repeats.

These “safety” algorithms above result in:

1) Negative - a few more trades than normal, and

2) Positive - greatly reduced losses on incorrect signals.

This can be seen in the MIPS long-term trading results below:

Winning/Losing Trades Average Gain/Loss

Winning Trades = 65% +3.0% Avg Gain/Trade

Losing Trades = 35% - 1.1% Avg Loss/Trade

After 100 trades, the win/loss ratio above equates to 195% up (65 x 3%) and 38.5% down (35 x 1.1), or 156% up (not compounded). Compounded, this would be in the range of 250% up (or more). And this happened in a market that was up only about 1% after 8 years and 100 MIPS trades.

We are not certain how many timing models have built in stop-gaps and safe-guards like MIPS, but we know a very large number of them that don’t.

Friday, November 16 2012

MIPS Members:

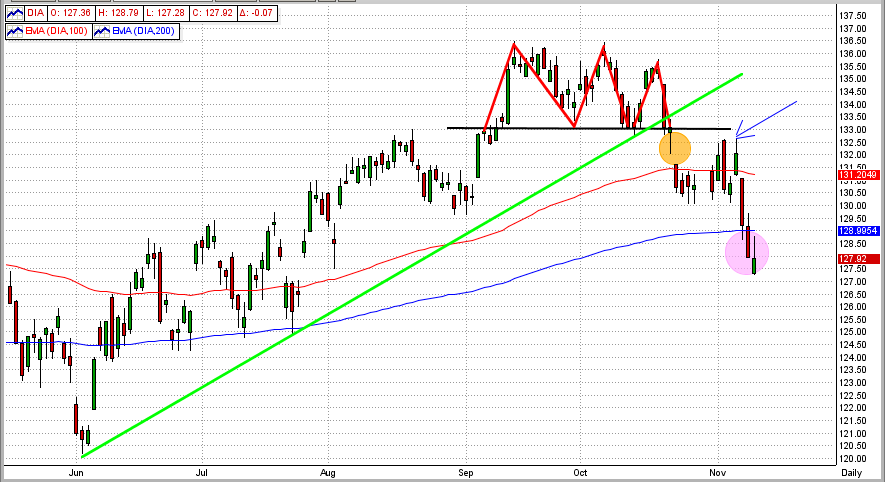

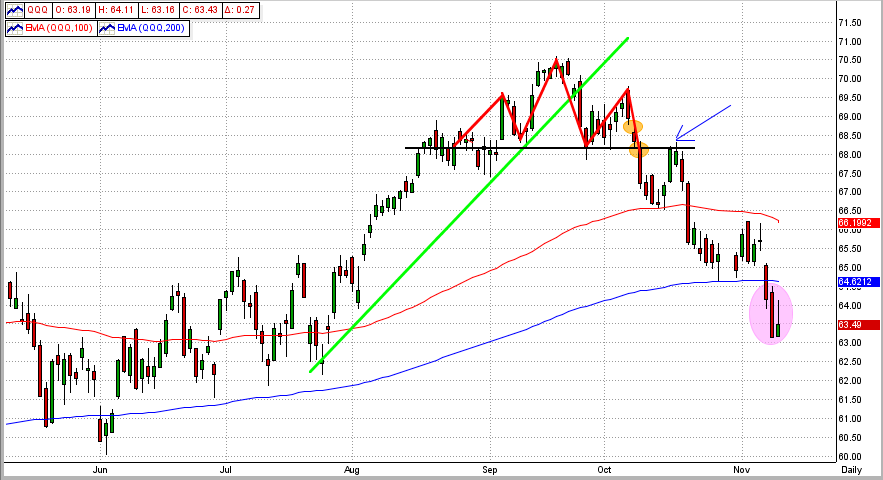

The SPY decisively broke its 200-day EMA on Wednesday, and the DIA and QQQ have been trading below their 200-day EMAs for the last 7-8 trading days. Thus far, of course, the market has not shown any signs of a rebound (see graph immediately below). All MIPS models have been short since late October, so let's keep our eyes and ears on government action regarding the "Fiscal Cliff". Remember, just a little good news can send an oversold market like this one straight up, if even for a short period of time and a "small" rally. And, don't forget about the Santa Claus rally the we wait for each year. With all of this to assimilate, we need to rely on new signals from the MIPS models for future guidance.

Monday, November 12 2012

This market pullback is scary all right, but is it leading into a full-out bear market ?

- First, let's take a look at how markets normally behave heading into a bear market.

For a bear market to occur, it is usually preceded by most of the following:

1) a 3-6 year bull market,

2) bad news raises its ugly head (economic, political, etc.),

3) the market begins to react negatively to the bad news,

4) we see "topping" behavior in recent market moves,

5) a correction that breaks several important long-term resistance levels occurs,

6) an uptick that challenges some previous downside resistance levels occurs somewhere along the way,

7) a "free fall" begins, and

8) if the "free fall" is widespread (SPY, DIA, QQQ, small/large cap, across sectors, etc), it turns into a secular

bear market.

So, how has the market (as measured by the S&P 500 ETF, SPY) performed according to the above ?

(please refer to the graphs below)

1) we have had a bull market since March 2009 (S&P 500 up over 120%),

2) the economic/political news from all over the world (including the USA) couldn't be much worse,

3) the SPY is down almost 10% from its mid-September high,

4) the SPY (and the DIA and QQQ) have all formed either a triple top or a head-and-shoulders top (red triangles),

5) this last drop had broken the SPY's 6-month up trendline (green line) , its head-and-shoulder's

neckline (black line), its 100-day EMA (red line), and its 200-day EMA (blue line)

- the orange ellipse shows down "gaps"

6) after it broke the neckline, the SPY made a kick up to test that resistance level (blue arrow),

7) we are NOT technically in a "free fall" yet, but the future does not look good, and

8) the SPY barely broke its 200-day EMA and has only been there for one day, but the DIA and QQQ have

experienced very definitive 200-day EMA breaches (shown by the purple ellipses in the graphs).

Technical analysis would lead us to believe that we are on the verge of a serious downturn, but just the slightest good news (like our executive and legislative branches getting things done for our country instead of staying in gridlock for their own personal gains), could change that in a heartbeat. Thankfully, MIPS is much better equipped than us to make long/short decisions in this environment. Besides that, a mechanical mathematical system like MIPS is not too proud or too stubborn to admit a mistake and reverse its decision if it has made an incorrect call (as opposed to human behavior). So, as usual, let's wait for MIPS to tell us what to do next. BTW, all MIPS models are short now.

PS - Take a look at the 4th graph below (labeled 2007) to see how the market was unfolding in 2007.

See any similarities ?

SPY

DIA

DIA

QQQ

2007

|