There are lots of "experts" that suggest that the market has established a new, long-term up trend. On a very short-term basis (days), they are correct.

MIPS is looking for long-term trends (weeks/months).

See the graph below. MIPS is looking for trends that develop after the market breaks out of a trading range (as in 3Q'09), but NOT the short-term swing trends within the trading range.

So, where is the market at this time

So, where is the market at this time.

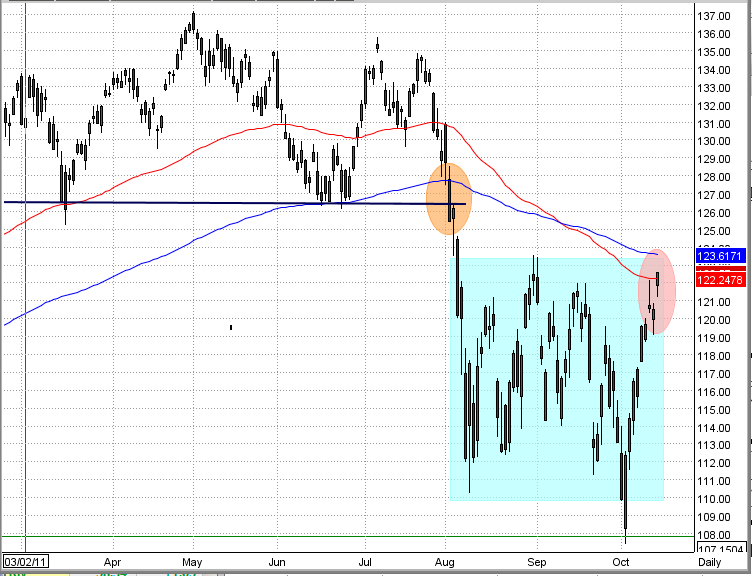

The graph below shows that:

1) The SPY broke its 200-day EMA and the neckline of a head-and-shoulders top on 8/2/11

2) The SPY has been in a volitile "trading range" for 10 weeks (2-1/2 months)

3) The SPY is at another "critical point" at the upper end of its trading range; AND it is between

its 100-day EMA and its 200-day EMA.

4) Many investors see this as positive because of the short-term up trend; but "channel traders"

will see it at the top of its trading range and will sell/short SPY at the top of its trading range.

What does the past tell us

What does the past tell us.

Look at the chart below from 2007.

1) You should see the similarity between 2007 and today.

2) In 2007, the SPY broke the neckline of its head-and-shoulders top and 200-day EMA, and went into

a 2-1/2 month "trading range" (sound familar?).

3) After a strong "bounce back" that would suggest a new up trend (like today), the SPY truned around

at the top of this trading range, broke through the bottom of the trading range, and continued down

for 18 months, resulting in a 55% drop from the Oct'07 top.

The majority of the commercially available market timing systems have been through hell with this trading range (getting whipsawed) and MIPS has had some problems itself. [Of course, there are some high-frequency trading models (100 trades/year) that may have "caught" the top of some of these waves and done well, but they are in the minority.]

The market will eventually break out of this trading range (like it always does), and MIPS will tell us what to do. Over time, MIPS performs as well or better that most other timing system, most of the time with 1/5th as many trades.