Sunday, November 03 2013

When trading double leverage ETFs (like for the SPY, IWM, QQQ, etc), we recommend:

(1) trading double leverage on long signals and single leverage on short signals, or

(2) simpy trading double leverage long only.

Here is how MIPS3/MF performed trading double leverage SPY (SSO) long only over the last 12 months.

SPY +23.4% SSO Long Only +50.5%

Friday, October 18 2013

Whether it is the sequester, Fed tapering, debt limit fiasco, etc., the market in 2013 has been volatile. But, it has remained mainly in an identifiable up-trend. During this time, however, the market has had enough major "dips" to drive some market timing systems crazy. But, the MIPS models have remained Long for almost the entire year.

The last several months have been illustrative of this, and show that the MIPS models have not gotten "fooled" into costly short signals. For example, the MIPS models have been long since 9/3/13 (after a 6-day, nondescript "short" on 8/27/13). In other words, the MIPS models have ignored the recent Bear Trap in the graph below by staying Long, and have, hence, "dodged a bullet".

Many MIPS members are worried about the Market Crash of 2014, and wonder how MIPS will handle it.

Some timing systems have traded 15-25 times in 2013 and many have gotten whipsawed. In 2013, the MIPS models have been Long for the majority of the year, but are lagging the SPY by about 5%. Others have not traded at all and have "matched" the market. The problem with timing systems is that some do very well in up-markets and many of these do terribly in down markets, and vice-versa.

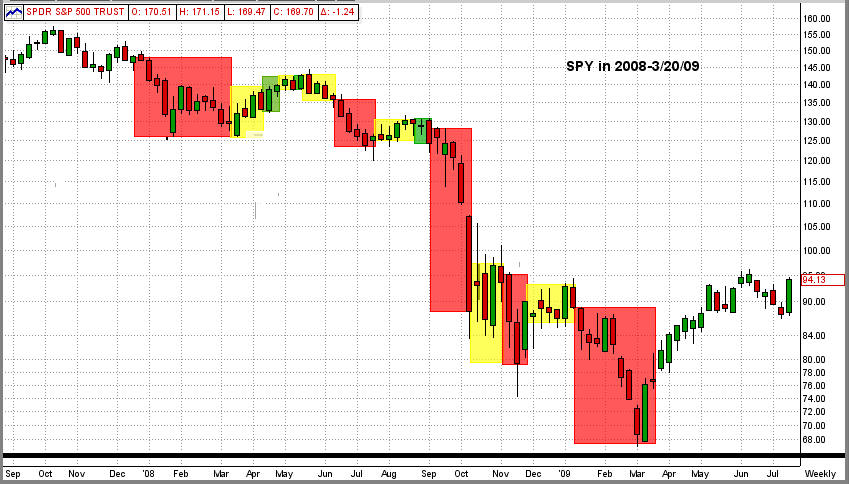

So, how does MIPS do in down markets? Our best example of this is in the year of 2008. The graph below shows the Long/Short/Cash Signals from our MIPS3/MF model in the time period 2008-3/20/09 (verified by TimerTrac).

Just how did MIPS3/MF handle the BIG market crash of 2008?

- well, it started with a short call on 12/12/07 for a 12% gain, followed by 4 other profitable short trades.

- for example, the total gain on the last 3 short trades between Sep'08-Mar'09 was about +40% !!!

This gives me great comfort and confidence in MIPS to get us out and to MAKE MONEY is the next CRASH !!

Legend: Red Box = Short Signals; Green = Long Signals; Yellow = Cash

Saturday, September 28 2013

It is not really whether or not a market crash is coming, it's when. How do we know this? Because the big-bad-bear ALWAYS comes.

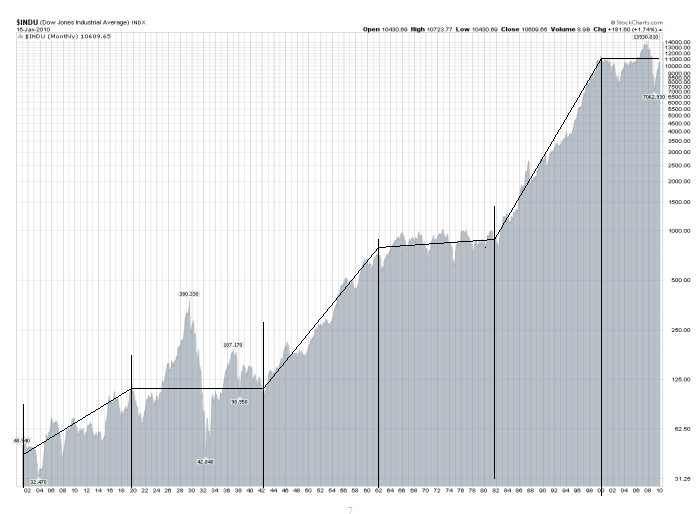

The very same "evidence" that Buy and Hold pundits (liars) use to prove that buy and hold works, actually proves that it does not!!! Their basic evidence is the "100 Year Dow" graph below. Upon close examination, starting with 1900-1920, you will see 20 good years followed by 20 flat/down years, over and over. BTW, being flat or "even" after 20 years is really a tremendous loss, because one would have doubled their money over 20 years with bonds paying only 3.6% !!!

From the graph below it would seem that, if people lived 100 years or more, the Buy/Hold liars may have a point. But most investors' prime "equity" investment years are from the time that they are, say, 45 years old (bought house, kids in college, career sound, etc.) until they are 65 years old (approaching retirement, need safe investments, more money in bonds, etc.) So, the prime time span for investors having a large portion of their portfolios in equities is about 20 years.

In the last 110 years, the 20-year good/bad periods were:

Good 1900-1920 1940-1960 1980-2000

Bad 1920-1940 1960-1980 2000-????

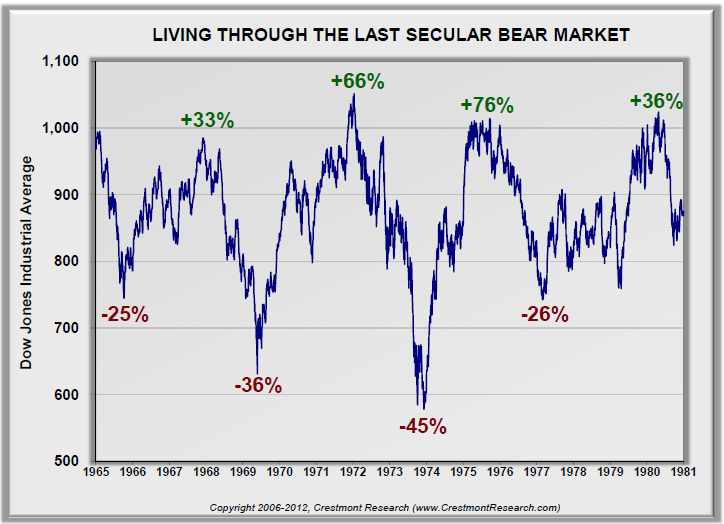

Almost everyone knows that the stock market in 1920-1940 experienced the biggest crash in the last 110 years, and we have personally "lived" through the market up/downs in 2000-2013. But, what about the market in 1960-1980? For that, see the graph below. One could say that the graph speaks for itself.

It should be obvious by now that this leaves the time period 2000-???? to dissect. Will we have another big drop? If so, when? And, how fast will the market turn down, and will MIPS catch the turn? My experience has shown the market crashes that result from bad fundamentals change slowly (long bubbles like housing, etc.), whereas, crashes that come from surprise "events" (like Lehman Bros.) change quickly.

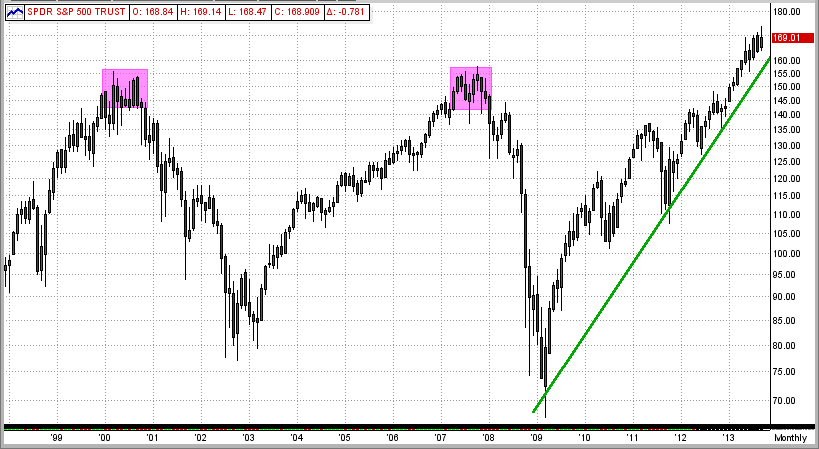

See the graph between 2000-2013 below. We all know (unfortunately) that we have had two big market drops of over 50%. You will probably be relieved to see that, at the top, these markets traded in a range of (+ and -) 5% of their market tops for 8-9 months, before they headed down fast !!!

How did MIPS handle the market crash of 2008? Well, it started with a short call on 12/12/07 (+12%), followed by another short on 6/11/08 (+10), and then the mother of all shorts on 9/04/08 (+27%). What, me worry?

Saturday, September 21 2013

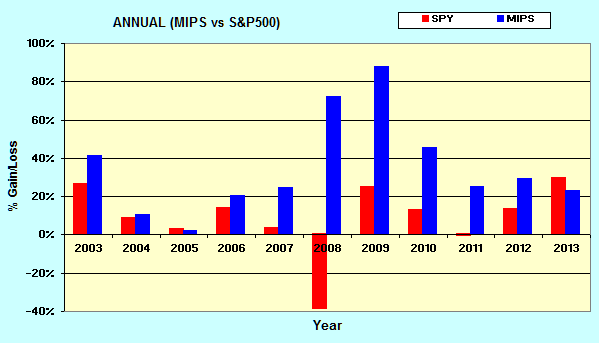

See the Annual Returns for the MIPS/Nitro model from 2003-2013 YTD below.

It is interesting to see that, in 2008, Nitro was up almost 90% when the SPY was down over 40%.

You might ask "How can that happen?"

- It happened because: (a) Nitro was not short the entire year, and

(b) the SPY did have some up periods in 2008, and Nitro was long in these up periods.

So, Nitro caught most of the up and down trends in 2008 (see Nitro signals and performance on the MIPS website).

Saturday, September 21 2013

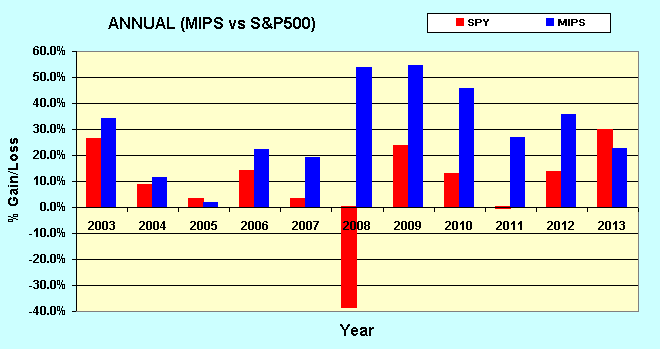

See the Annual Returns from the MIPS4/MF+ Model for 2003-2013 YTD below:

Wednesday, September 18 2013

Our Beloved Ben did it again !!!

- when he stood up and said "No Tapering," the markets went wild immediately.

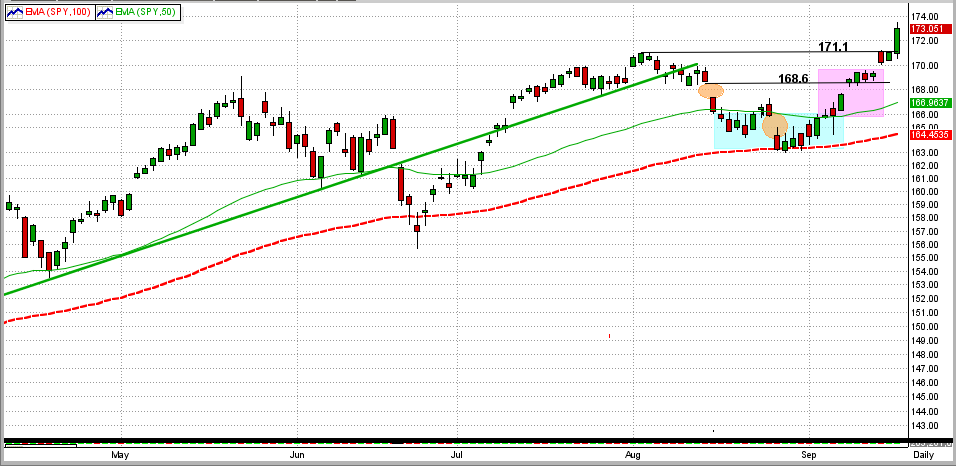

- the SPY easily broke its all-time upside resistance at $171.1 and closed at $173.05 (see the 1st graph below).

With liquidity coming from (a) Brother Ben, (b) mom-and-pop coming back in the market, (c) a mass exodus from bonds to stocks, etc., how could the markets go anywhere but up? [Bonds are such a bad investment now, we have read that even bond funds are buying stocks!]

We see more upside (and maybe even much more upside) in this bull run, but the market does not always follow my direction. Because of this, when the time comes to hold-or-fold, we rely on MIPS to tell us what to do.

More on this later...

Saturday, September 14 2013

MIPS Members:

In our previous blog from 9/9/2013, we showed the SPY's breakout from a several week, tight trading pattern. For the last several weeks, the SPY has been very volatile.

In the graph below, we can see that since 8/8/13:

1) the SPY broke its long-term trendline (top green line)

2) the SPY gapped down twice (orange circles),

3) it bounced off of the 100-day EMA and turned up (inflection point) on 8/28/13,

4) the SPY then broke above its 50-day EMA and closed both gaps,

5) it has held above both gaps (above 168.6) for 4 days now (purple rectangle).

From here, of course, the SPY could challenge (and hopefully surpass) its all-time high at 171.1 or it could fall back significantly. I'm glad that we have MIPS to detect and tell us what we should do (see the MIPS Market Strength Indicator below).

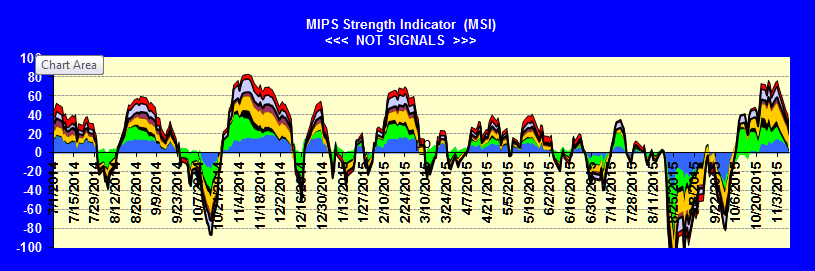

The MIPS Market Strength Indicator (MSI) has improved significantly in September. See graph below:

Monday, September 09 2013

In our previous blog from last Thursday, we showed that the SPY was ready for a breakout from its tight sideways trading range between its 50-day and 100-day EMAs. On Friday, the bulls pushed the SPY up above its 50-day EMA (and above the trading range), but the bears sold it back down to close just slightly above its 50-day EMA.

Today, however, the SPY make a nice, solid break out of the range and well above its 50-day EMA (orange ellipse). This would normally mean a run up, but we never know for sure. That's MIPS' job.

Thursday, September 05 2013

The SPY is stuck between its 50-day EMA and 100-day EMA, but not for long (see graph below):

Green Line = 50-day EMA

Red Line = 100-day EMA

Straight Black Lines = Trend Lines

Blue Box = Trading Range

In 2013, we have lived through meager gains in the economy, small setbacks, the Fed's QE3 and hints at "tapering" its purchasing of Treasury bonds, and the crisis in Syria, with the recent U.S. markets going nowhere. Sometime soon, we believe that the market will establish a new trend (up or down). It is difficult to digest all of this activity, but a technical analysis of the SPY's performance offers some insight.

The SPY broke its 6-month "primary" trend to the downside on 8/12/13.

- Then, on 8/15/13, it broke its 50-day EMA.

- In the last 3 weeks (15 trading days), the SPY has formed a trading range between the bottom of its

50-day EMA ($165.8) and the top of its 100-day EMA ($163.4).

- This is a "tight" trading range, with the top and bottom being only 0.7 of 1% around the mid-line of the trading range.

We believe that the SPY will break this range soon (up or down) and MIPS will instruct us to go long or short in due time to make money on this new trend.

Monday, August 26 2013

Crazy markets these days...

But, we all know at least two things:

1) Economic conditions are bad enough to send the US stock market through the floor, and

2) It is foolish to bet against the Fed, and if the Feb keeps printing money at a record pace, it

will be hard for the markets to fall.

It's not worth going over this again, but you can get the general idea from our previous blogs.

So, what do the tea leaves say now (see graph below) ???

1) In early July, the SPY recovered from a fast (but rather small) correction and then bounced off

of the bottom of its 50-day EMA for 5 days (purple box) before heading up (orange circle) and then reaching new

all-time highs.

2) After falling below its 50-day EMA for the second time a week ago, the SPY has again bounced off

its 50-day EMA for 5 days (2nd purple box); and again, it appears to have stuck its nose above the

50-day EMA (orange circle).

3) Of course, if the bulls can get a strong break-out to the upside at this point, we could see more new

highs; but if not, things could get ugly fast.

Instead of guessing, it is best for us to depend on MIPS to tell us what to do, and when.

|