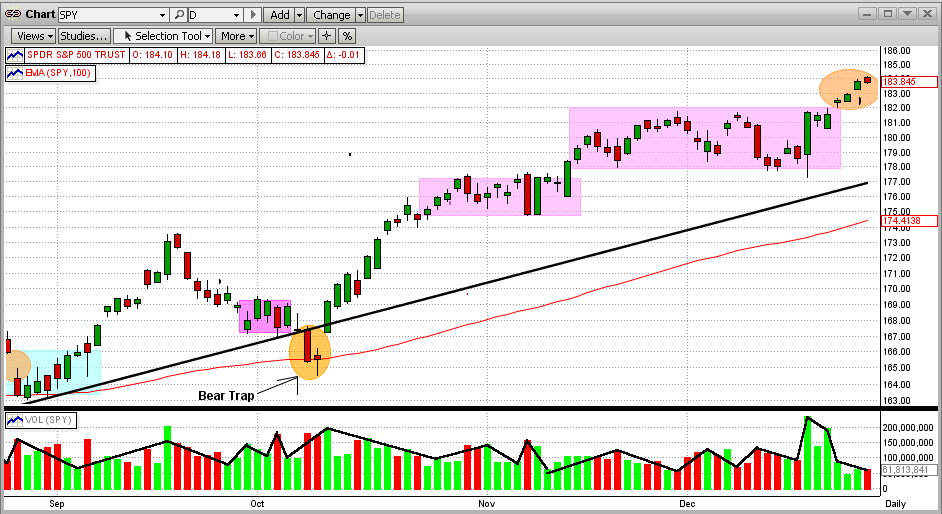

In our previous blog below from 12/22/13, we showed how the SPY had climbed quickly back to the top of its flat/sideways trading pattern on high volume. From this one could conclude that we should have expected a "breakout" to the upside this past week. As can be seen in the graph immediately below, we did get an upside breakout this past week, but not what we would call a really strong breakout. This is mainly because of its low volume. The odds are for this breakout to pick up steam and head higher, but it could very easily turn out to be a "bull trap" that turns lower in the short term. It is exactly these kinds of situations when we need for MIPS to tell us what to do.

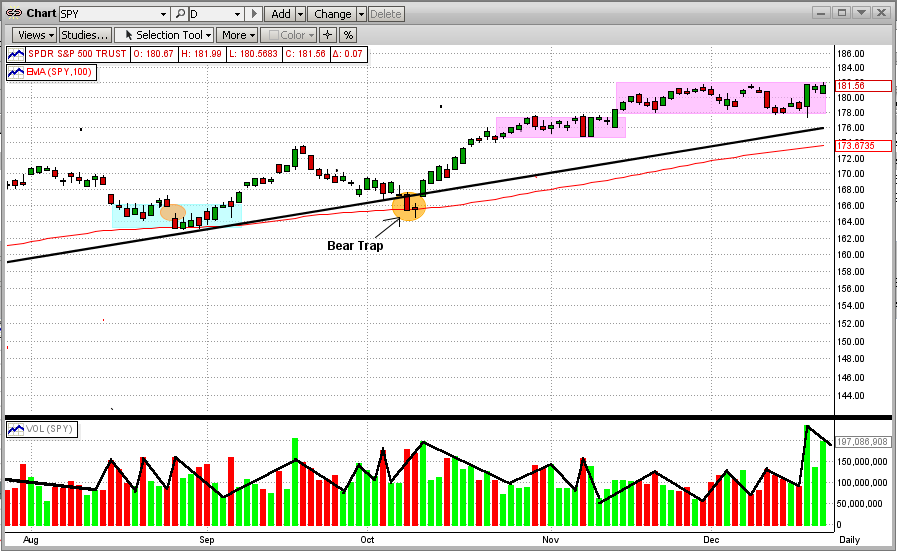

Blog from 12/22/2013

In our previous blog below (from 12/16/13), we told our MIPS members to basically ignore the 5-consecutive-day drop in the SPY that occurred in the previous week (see the last graph below). The reasons for this were: (a) the entire drop was just a little over 2% and (b) the market was just completing a drop from the top to the bottom of a relatively flat/sideways 15-day trading pattern.

Then this last week, the SPY basically reversed it movement and simply went back to the top of the trading pattern (see graph immediately below). No breakout. So, is this week's move up any different than last week's move down? In many cases, the answer would be no. But, there are some compelling reasons for believing that the recent move up was indeed more telling than the previous move down, even though there was no breakout. One reason is that the trading pattern is now over 20 days old, and sideways trading patterns usually do not last much longer than that. But the BIG reason to think that this move up is different from the prior moves is that the move up was on volume almost two time higher than the volume for the prior 30 days. Thus, one can conclude that the move up was the result of the big guys buying. That's huge!!!

The real story will most likely unfold within the next week or two, so let's stay long and wait for MIPS to tell us what to do next.