Today, and over the last two months, the market (SPY) has formed an almost perfect "W" trading pattern (Google "M and W" trading patterns for more info). Some analysts call the M patterns double tops and W patterns double bottoms.

I agree with that at times, but not most of the time. Most times, I have seen the market break out of the M&W pattern in the direction that it went in (i.e., if it formed the pattern on a down trend, it usually came out to the downside, and vice versa.)

Also, we have seen these patterns repeat themselves for months, in which case I look at them as pure "sideways trading patterns" or "consolidation patterns" (up and down over-and-over in a tight range, as the market did for the first 8 months of this year). These are dangerous patterns and MIPS now has new algorithms to handle this or run to the sidelines and wait it out (i.e., minimize whipsaw).

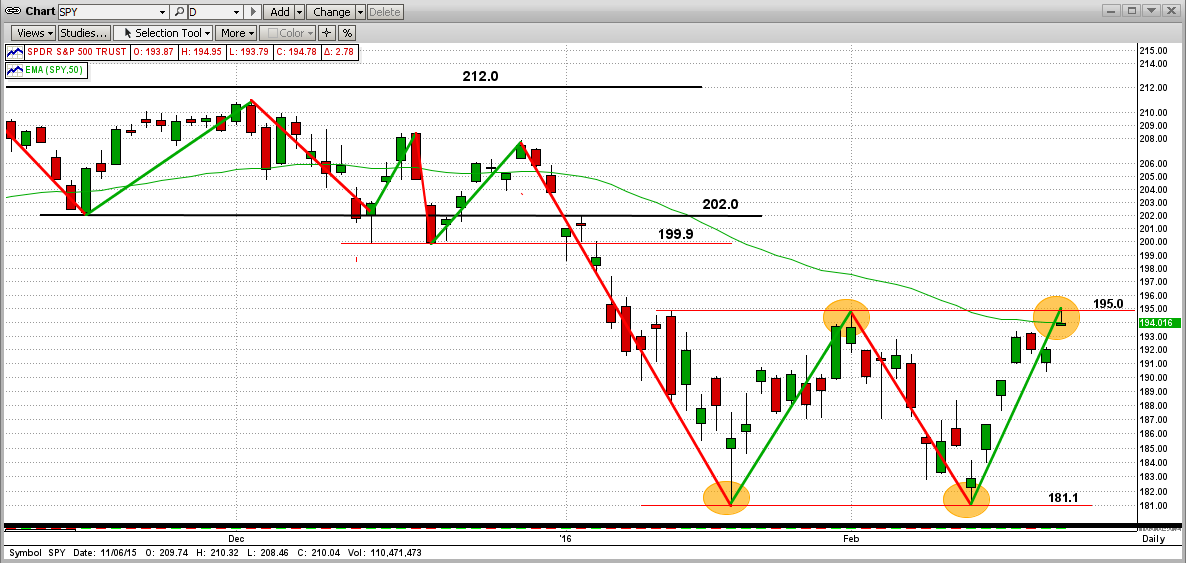

But, now the SPY has formed a new W pattern and this time its anybody's guess. See the graph immediately below. The W pattern hit the bottom of its pattern twice at exactly 181.1 (1811 on the S&P 500 index) and got kicked back up both times by the bulls; and recently it hit the top of the pattern at 195.0 (1950 on the S&P 500) for the 2nd time and got slapped back below a little by the bears (for now). So far, this spells strong downside support at 181.1 and possibly strong upside resistance at 195.0. Read on below ...

The next 2-3 trading days are crucial !!!

From here, if the SPY moves above 195.0 with force (and/or stays above it for a few days), we can look for the SPY to rally up to the next strong resistant levels at 202 or even 212. But, if it fails to break (and hold) above 195.0, we think the market (SPY) will drop back to test its support level at 181.1 (1811 on the S&P500). Then, if it breaks below 181.1, there is no strong support until way, way down (like in a real "crash"). My guess is that we may have a small rally from here, followed by a break to the downside below 181.1 sometime in the next 3-6 months. Follow MIPS, not me !

We are trusting MIPS to tell us what to do next, and I believe that MIPS will decide that shortly.

Stay tuned...