Sunday, May 27 2012

Many people ask us how can they beat the SPY in up markets when they are trading the SPY itself. That is, how in the heck do you beat the performance of the index fund that you are trading? Needless to say, you absolutely cannot do this with a buy and hold strategy.

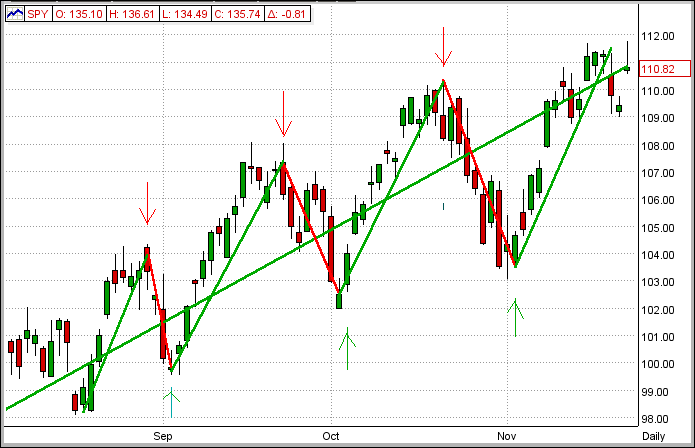

Let's assume that you are using a timing system that tracks the SPY to determine up-trends and down-trends, and that this timing system is deadly accurate. Then if you are trading SPY, the only way that this system can beat the SPY in up markets is by being short when, and if, this up market contains some intermediate downdrafts during its ascent. See the graph immediately below.

Now, if the market ascent has only small or relatively few downdrafts (as happens in many slow-growing up markets), the model will keep you long and you will simply follow the SPY upwards. So, if the SPY goes up 20% over some period of time, your money will also go up 20% in this period, but your performance will be equal to that of the SPY. In other words, even though you are making money in this market, your performance will be basically the same as that of the SPY.

[PS - This is not usually the case with fast-growing up markets since there is almost always enough volatility in these markets for MIPS to take advantage of some of its larger, inevitable downdrafts by being short.]

Of course, in down markets we don't have this problem because, when our timing model gets us into short positions in down markets, we not only make money, but our performance ratchets up as the market goes down. So, in a similar example as above, if the SPY goes down 20% in a certain period of time, since our timing model will have us short in this time period, our performance will be +20%. The net effect, of course, is that our performance would have been +20% when the SPY was -20%.

Ok, got it. But, the initial question has still not been answered.

"How Can We Beat the SPY in Up Markets"?

Independent of whether the market is going up or down (i.e., the SPY is going up or down), the simplest way to beat the SPY is to trade index funds that:

(a) correlate well with the SPY (i.e., changes direction at the same time), and

(b) have higher volatility than the SPY (goes up and down more than the SPY).

Although there are very many ETF and mutual fund indices that fit this criteria, we believe that the two best ETF candidates for this are the Russell 2000 (IWM) and the NASDAQ (QQQ).

Trading IWM and QQQ to Beat the SPY in Up Markets

- the following is a detailed analysis of this suggestion.

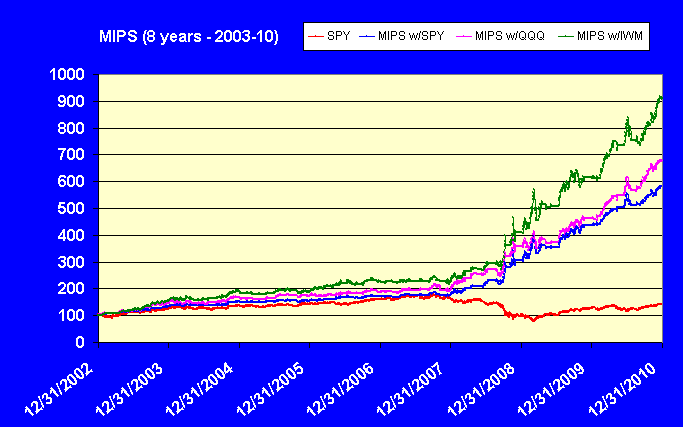

FIRST (the period of 2003-10)

On our website (www.mipstiming.com), if you click the "Performance" tab on the main menu on our homepage, and then click the "Study VI" button on the top left of the Performance page, you will see the MIPS3/MF performance from trading the SPY, QQQ, and IWM relative to buy/hold SPY in the 8-year-period of 2003-10. To save time and effort, a copy of that page is shown immediately below.

From the table/graph below, you can see that:

1) trading the SPY with MIPS3/MF signals soundly beats buy/hold SPY over the entire time period

(+481% vs +43%),

2) trading the QQQ (+574%) and the IWM (+808%) with MIPS3 signals did much better than just trading the

SPY with MIPS3 signals.

As a consequence of this, I usually trade SPY, QQQ, IWM using MIPS3/MF signals with a mix of 1/3 of each or

1/2 SPY, 1/4 QQQ, 1/4 IWM

Study VI. 2003-10 (SPY/QQQ/IWM)

· MIPS3/MF Model; Buy/Short

Buy/Hld Buy/Sht Buy/Sht Buy/Sht

SPY SPY QQQ IWM

43% 481% 574% 808%

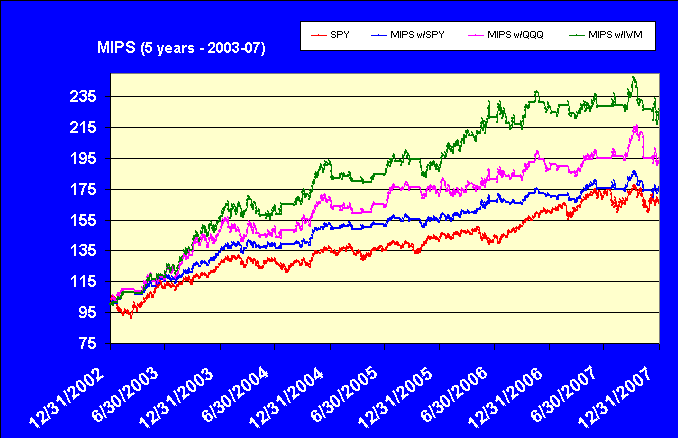

SECOND (the period of 2003-07)

To be more illustrative, we have included below an "expanded" view of the performance of MIPS3/MF trading

SPY, QQQ, IWM during the "slow-growing" up market in 2003-07

- from this graph, you can see the importance of trading ETFs other than SPY in slow up markets

SPY MIPS3 MIPS3 MIPS3

Buy/Hld w/SPY w/QQQ w/IWM

65% 75% 95% 125%

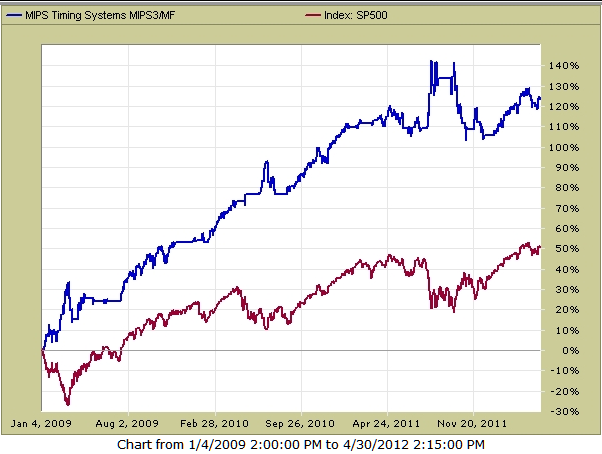

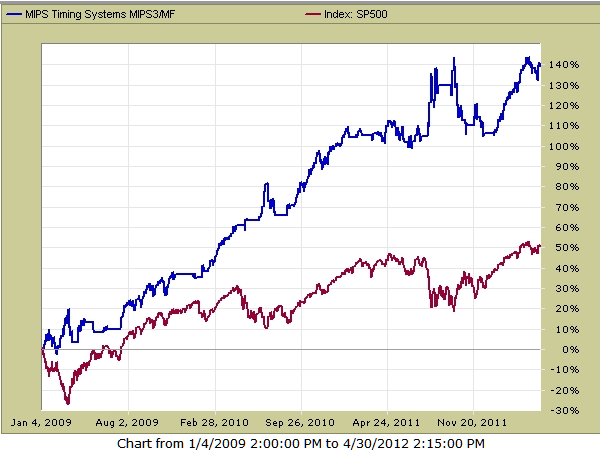

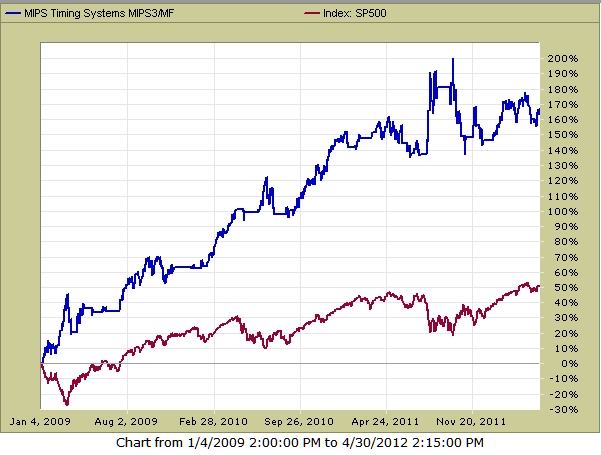

THIRD (the period of 2009-12 YTD)

The performance of MIPS3/MF trading SPY, QQQ, IWM in the very fast-growing up market in the time frame from

2009-2012 YTD is shown below (graphs from TimerTrac.com).

SPY MIPS3 MIPS3 MIPS3

Buy/Hld w/SPY w/QQQ w/IWM

50% 125% 140% 165%

Graphs for each of the above follow:

SPY (+50%) - MIPS3/MF Trading SPY (+140%)

SPY (+50%) - MIPS3/MF Trading QQQ (+140%)

SPY (+50%) - MIPS3/MF Trading IWM (+165%)

Hope this helps ...

Paul Distefano

Founder/CEO

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

|