Sunday, January 28 2018

Over the last 12 years, the MIPS models have traded an average of roughly 12-15 trades/year, depending on the model. But remember, an average of 12 trades/year over time can be 2-6 trades in some years and 15-20 trades/year in others.

When a timing model averages 12 trades/year, its Signal Life is about 30 days (one month). This is why MIPS is referred to as an Intermediate-Term trading model; whereas a model that makes 50 trades/year

with a signal life of about one week or 5 days, is a Short-Term trading model.

Good models only trade when the conditions that they are based upon change. For example, MIPS is basically a "Trend Following" model and will usually not change its Long or Short signals until the intermediate-term trend changes direction. I say "usually" because there are times when some the other indicators in MIPS (like, reversion-to-the-mean, overbought/sold, etc.) may override the trend signals.

The MIPS "Voting Tree"

MIPS is a VERY complicated, analytical model that uses over 150 indicators (some commercial, others proprietary) and a robust decision making process to ascertain if the market is climbing or diving. The math that we use includes artificial intelligence, pattern recognition, and self-developed applied mathematical algorithms (slopes, 2nd derivatives, rate-of-change, inflection points, etc.). The MIPS4 and Nitro models also use some "predictive algorithms" that anticipate changes in the markets a day or two before it happens. Gaining one day on both sides of each trade can make a significant difference in performance.

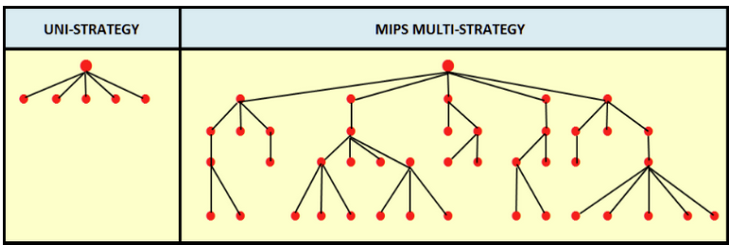

The main ingredient that we use to generate signals from our models comes mainly from the positions (Long/Short/Cash) of each and every one of our 150 Indicators. But, the process we developed does NOT simply add the positions of all of the 150 Indicators, and let the majority prevail. For example, if 77 of the Indicators are Long and 73 are short, using a Uni-Strategy voting process the consensus would be Long, but that is NOT where we stop.

The MIPS models actually use what we call a Multi-Strategy voting process, as depicted below. Please be aware that this is a simplified picture, and is less than 1/10th of the complexity used in the MIPS models. The raw 150 Indicators that we have been discussing start on the very bottom of each leg in the voting tree and they consolidate through a proprietary process that leads to a preliminary Signal decision at the very top. The indicators that are in the finals in the voting process, which we call the Super Indicators, are in the first line below the final Preliminary Signal. In the MIPS models, we use 15 Super Indicators.

These 15 Super Indicators form what we call our Core Model. We call the signals from the core models preliminary signals, and they are the base for each MIPS model. From here, algorithms that are specifically designed for each MIPS model convert the core model signals ("preliminary signals") into the final signals for each MIPS model. Going from preliminary signals to final signals for each MIPS model is a complicated, but it is a well defined process. And, it includes specific algorithms that basically define each MIPS model. Please understand that this algorithm is run on a daily basis. In less than 2-3 seconds, MIPS calculates what would take a human over 48 hours to calculate and analyze.

................................................................................. MIPS "Voting Tree"

ACTUAL MIPS SIGNALS IN 2016-2017

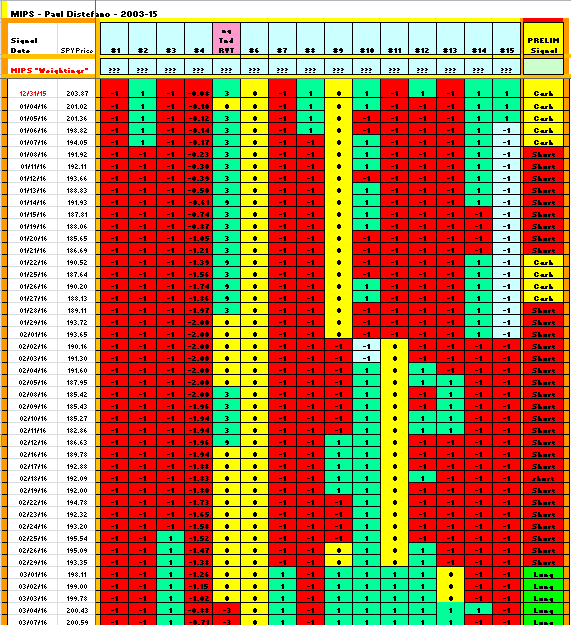

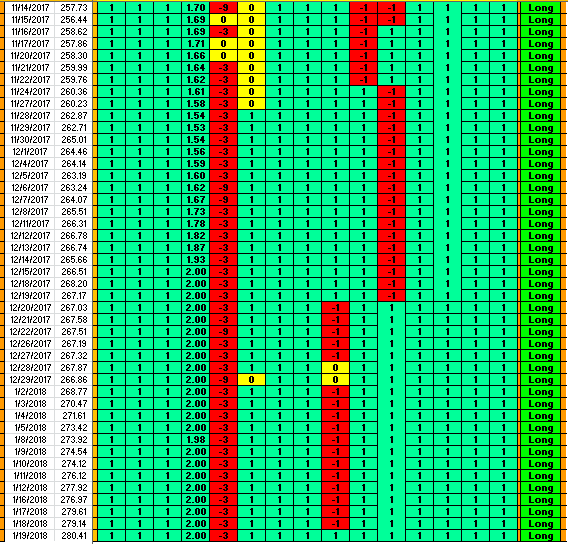

At the bottom of this Blog, you will see a sample of the daily PRELIM signals for the MIPS Core Model since December 31, 2015 (column on the far right in the table); and a table containing a "sample" of what the MIPS Super Indicators that make it to Vote Line looked like in in early 2016 and in late 2017. From this, you will see the Core Model getting stronger-and-stronger Long as we reach today's date.

The information from the MIPS core model is a major part of the final signals for all of the MIPS models. The numbers in the table at the bottom of this Blog are the foundation for the signals from all MIPS models, but are not necessarily the final word for any. At any rate, the numbers basically show the strength of all of the Super Indicators daily.

From the table at the end of this Blog, you can see that:

a) the majority of the vote-line Super Indicators were Long for the last half of 2016 and the entire

year of 2017, and

b) the "reversion-to-the-mean" indicator is getting more negative with time.

Remember, we use over 150 sub-indicators, so each of the Super Indicators on the Vote Line are the consensus of an average of 10 sub-indicators beneath them. In actuality, the Super Indicators on the Vote Line daily are fed by 3-20 sub-indicators each. Note: This is the only time that we have exposed any part of the actual guts of the MIPS core model, so please do not share it.

NEVER BEFORE

With the above in mind, all of the MIPS models have remained LONG for over 12 months (some up to 18 months). I have been developing mathematical models to time the market for almost 20 years for myself and family, and MIPS3 itself went "public" in November 2005. And, I have NEVER experienced model behavior anywhere even close to what is happening now since the 1990's (and we know how that ended).

Even though the MIPS models have been Long for over one year, three of us here at MIPS Timing Systems still input data daily, run-the models each and every day, and compare our results before we send out signal emails to our MIPS Members. We take no "breaks", nor do we spend any less effort, regardless of whether or not a model issues a new signal on any day or keeps the existing one.

The daily positions (long/short/cash) from the MIPS models depend upon the position of each and every Indicator that we use, although not on a one-to-one basis. Each Indicator earns its own weighting in the voting system, based mainly by examining its own past performance (using artificial intelligence algorithms). That notwithstanding, the MIPS models are definitely "stronger" when the majority of the Super Indicators show the same position (long/short/cash).

WHAT WOULD YOU DO?

In conjunction with the above and given the facts below, what would you do?

(a) Corporate profits from large cap stocks have been growing at a rate not seen in the last 10 years,

(b) The SPY 500 has gone almost straight up daily over the last 12-15 months with very low volatility.

Would anyone expect a good investor or a good timing model to get out of the market (or go short)?

2016-17 MIPS/NITRO PERFORMANCE

....................(Long - Short Leverage)

MIPS/Nitro (1.50x - 0.5x leverage) +58%

MIPS/Nitro (1.25x- 0.5x leverage) +49%

MIPS/Nitro (1.00x -1.0x leverage) +39%

SPY................................................. +39%

Some MIPS Members are worried because the MIPS models have been Long for over 18 months. Most of the time, worrying would be the right thing to do. Most models that do well in up markets, do poorly in down markets. And, a lot of the time, this means that these models have an up-bias and the developer is not even aware of it.

ANY GOOD MODEL MUST DO WELL IN UP AND DOWN MARKETS, and MIPS is one of them. We continually test our MIPS models with decaying market performance data to see how fast MIPS would pick up the drops; and how well (and fast) it performs at the turn-around point. On these, MIPS has an excellent batting average..

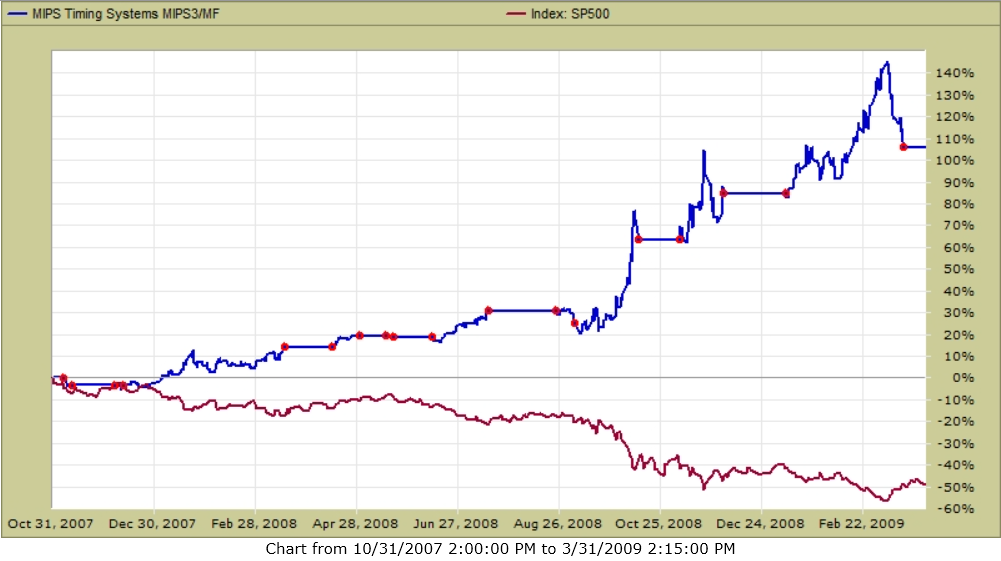

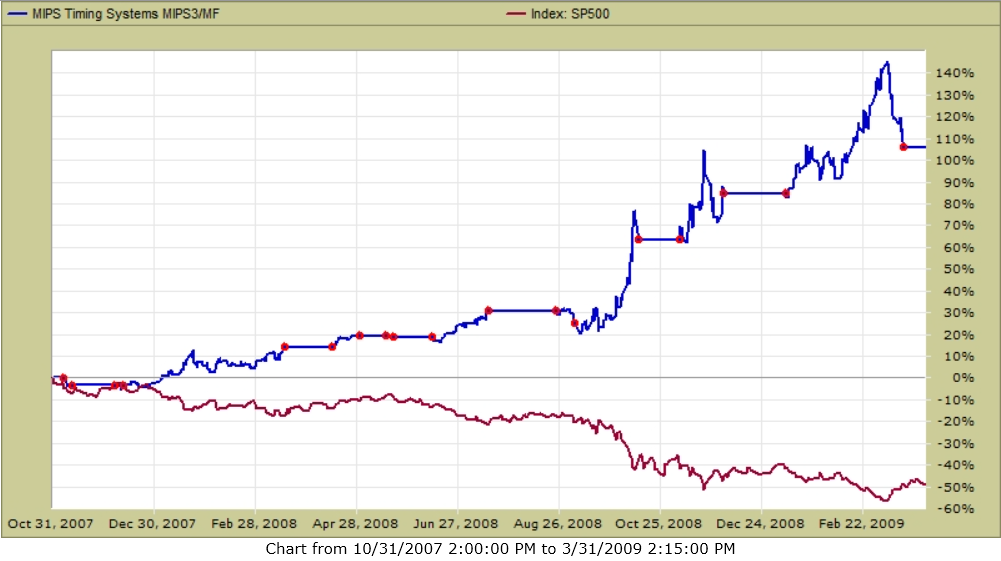

2008 MIPS3 PERFORMANCE

Thankfully, we do not have to guess how MIPS would have done in a market crash like 2008, because MIPS3 was LIVE in 2008 and was being tracked by TimerTrac.com. MIPS3's 2008 performance is shown below (hard to beat):

MIPS3 in 2008 (red dots designate trade dates)

MIPS +108% SPY -50%

==============================================================================

The MIPS Models' Super Indicators and "Core Model" Signals

EARLY 2016

.

.

.

LATE 2017 (and now)

Good Trading...

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

www.mipstiming.com

Sunday, January 07 2018

There is one (and maybe only one) economic fundamental condition that dictates, with almost 100% accuracy, if the market is going to move up or down in the intermediate-term future (months). That one fundamental condition is CORPORATE EARNINGS (of course, markets move up on increasing profits and it moves down on declining profits).

In fact, the market starts its move up or down before us little guys even have a clue as to which way profits are moving. The reason for this, of course, is because the largest institutional investors know in advance (at least 60-90 days) if their "clients" (the largest companies in America) are going to announce increasing or decreasing profits at the end of the current quarter. The fat kats also know the "outlook" for the future long before we do. They should know, because in most cases the fat kats are helping these large companies (their clients) to prepare these numbers for release at the end of the current quarter. Of course, the fat kats would not use that knowledge to their advantage over the little guys like us, right? Yeah, right!!!

We all know now that corporate profits are stronger than what they have been in the last 10 years. Most of us anticipated this with Trump's election, and traded accordingly. Since then, every quarter has been better than the previous quarter, and the outlook for 2018 is pointing in the same direction.

The MIPS models use hundreds of market indicators, mathematical equations, and artificial intelligence feedback to track the market and to decide the direction of the intermediate-term trend and the signal for each day. And, we follow the trend daily. Remember, "do not bet against the trend". In this market, as MIPS has correctly reported, the trend has been Long for over one year...

The MIPS models are still highly positive, but this does not mean that we could not have a smallish correction on the way to higher levels in the market (like from some of MIPS "reversion to the mean" algorithms). Stay tuned daily...

IMPORTANT... please read...

I am writing this for five reasons:

I.) to explain how and why a MIPS trading signal (which gets to our subscribers in a “Signal Change” email)

can last for a really long time (so-called “signal life”),

II.) to clarify how MIPS issues new signals and how we make our subscribers aware of the “Signal Status” for

each MIPS model EVERY DAY,

III) to show that more (unnecessary) trading usually yields worse results,

IV) to show the MIPS performance over the last 12 months, with and without leverage, and

V.) to show how MIPS3 performed in 2008

-------------------------------

I.) All good timing models have a foundation upon which they determine if investors should be in a Long, Short, or Cash position. Some of the underlying “foundations” of these models are trend following, reversion to the mean, momentum, relative strength, rate of change, etc. In general, the MIPS models are Trend Following models. But, believe it or not, they contain some of all of the above foundations (the MIPS models contain up to 165 standard technical indicators, artificial intelligence, pattern recognition, and applied math algorithms).

MIPS’ strength lies in its ability to determine when the market has “turned over” from up-to-down or from down-to-up (mathematically called “Inflection Points”).

We all know that the market basically moves in “cycles”; from short-term (days to weeks), to intermediate-term (weeks to months), and to long-term cycles (months to years). And, an intermediate-term cycle basically ignores short-term cycles and a long-term cycle ignores both short-term and intermediate-term cycles.

MIPS tracks intermediate-term cycles. “Cycles” in the stock market move from tops-to-bottoms, and then turn around and move from bottoms-to-tops. An up-trend is a series of higher highs and higher lows, and the up-trendline is a line along the bottoms (and the inverse for a down-trendline). See graph below.

A good trend following model will rarely change position unless the market breaks the trendline with force, and which has the support of a strong majority of the other technical algorithms confirming a market breach in the current direction.

With enough strength in a strong up-market, an intermediate-term cycle can turn into a long-term cycle. As can be seen in the graph below, in the last 12 months the market has moved up on what could be called a “near-perfect” up-trend, AND all of the MIPS models have remained LONG during this entire period (a new record of time for a MIPS “signal life”).

Remember, a good timing model not only needs to know when to trade, but it also needs to know when NOT to trade.

BTW:

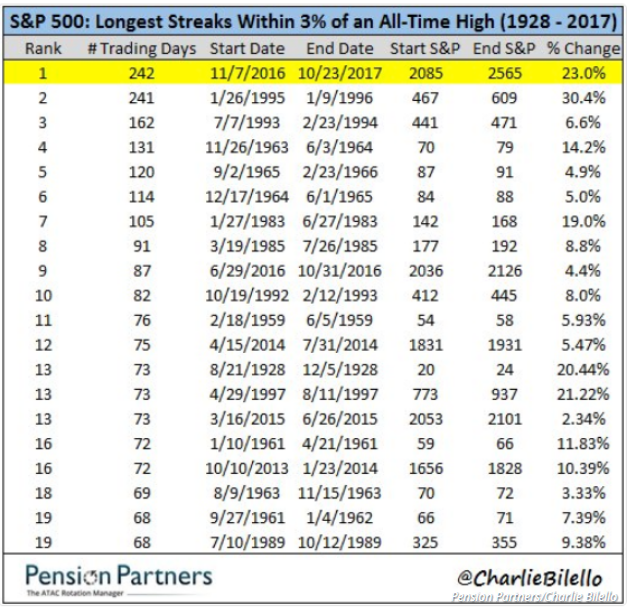

The S&P 500 just set an all-time record for the number of consecutive days when the S&P 500 did not have a 3% loss. As of today’s date (10/30/2017) that would be very close to one year (247 trading days) !!! Of course, this usually means that it is very difficult for most timing models to “trade the dips”. It would be better to stay long with some leverage (like 1.5x leverage).

.

-------------------------------

II.) Moving on to Section II in this Blog, the MIPS models send out “Signal Change” emails every time that any one or more of the models instructs MIPS subscribers to “change” position (like from Long-to-Short, or from Short-to-Cash, etc). Of course, at MIPS we “run the models” EVERY DAY (in triplicate) to determine if any of the MIPS signals have changed. If so, we send out a "Signal Change" email after the close that day. If not, we send "Signal Status" emails to our subscribers every weekend. This way, if a subscriber missed a Signal Change email or forgot to trade it, they will be aware over the weekend that they missed a Signal Change.

A few market timers send out daily Signal Status emails. But we (along with most others), do not do so mainly because most of our subscribers and RIA customers do not want to be inundated with emails from MIPS unless there is a Signal Change (remember, there are about 240-250 trading days each year). Unfortunately, because we do not send out daily emails, some subscribers feel as if we are not paying attention to MIPS or the markets, which of course, is dead wrong.

-------------------------------

III) Regarding trading frequency, no one should change a winning position (execute another trade) unless the trend that the model is tracking has changed direction (in other works, “Don’t Fight The Trend”). And remember when you make a trade (like buy) you will ultimately need to reverse that trade (like sell or short). So, on each new trade, you must be correct on when to buy AND when to sell. A good example of this can be displayed by showing the performance of most of the timing models that were tracked by TimerTrac.com over the last 12 months (see Table below).

The table below from TimerTrac.com over the last 12 months shows (a) the performance (Gain/Loss %) with no leverage, and (b) the number of trades from over 75 of the models that it tracks. The MIPS models are at (or near the top), with only 2 trades from MIPS3 and no new trades from MIPS4 and Nitro.

Average:

Over the last 12 months

- the MIPS models averaged a gain/loss of 21.2%, with a average of 1 trade each.

- other models with over 80 trades averaged a gain/loss of -13.3%, with an average 117 trades each.

PS – Of course, this does NOT mean that models that trade less perform better…

Long-Term trading

Since Nov’05, the MIPS models have averaged 12-15 trades/year, with the lower ones being 2-4 trades/year and the high end being 16-20 trades/year. In the 18 months of the last market crash (Oct’07 – Mar’09) MIPS3 issued 18 trades.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Top Performers over the period from Monday, October 31, 2016 through Friday, October 27, 2017

|

|

The index SP500 gained 21.38% over this same time period.

|

|

|

|

|

|

|

|

|

|

Rank

|

Strategy Name

|

Gain/Loss %

|

Difference %

|

Trades

|

|

1

|

|

21.40%

|

0.01%

|

6

|

|

2

|

MIPS Timing Systems MIPS/Nitro

|

21.38%

|

0.00%

|

0

|

|

2

|

MIPS Timing Systems MIPS4.sso

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

2

|

|

21.38%

|

0.00%

|

0

|

|

3

|

|

21.38%

|

0.00%

|

6

|

|

4

|

MIPS Timing Systems MIPS3/MF

|

20.93%

|

-0.46%

|

2

|

|

5

|

|

20.79%

|

-0.59%

|

31

|

|

6

|

|

20.47%

|

-0.91%

|

2

|

|

7

|

|

18.99%

|

-2.39%

|

17

|

|

8

|

|

18.37%

|

-3.02%

|

94

|

|

9

|

|

18.05%

|

-3.33%

|

99

|

|

10

|

|

18.01%

|

-3.38%

|

7

|

|

11

|

|

17.77%

|

-3.61%

|

7

|

|

12

|

|

17.63%

|

-3.75%

|

6

|

|

13

|

|

17.53%

|

-3.85%

|

14

|

|

14

|

|

17.36%

|

-4.02%

|

8

|

|

15

|

|

17.08%

|

-4.30%

|

7

|

|

16

|

|

15.95%

|

-5.43%

|

3

|

|

17

|

|

15.43%

|

-5.95%

|

5

|

|

18

|

|

15.29%

|

-6.09%

|

15

|

|

19

|

|

14.76%

|

-6.62%

|

23

|

|

20

|

|

14.63%

|

-6.75%

|

3

|

|

21

|

|

14.37%

|

-7.01%

|

132

|

|

22

|

|

13.81%

|

-7.58%

|

132

|

|

22

|

|

13.81%

|

-7.58%

|

132

|

|

23

|

|

13.75%

|

-7.63%

|

24

|

|

24

|

|

13.08%

|

-8.30%

|

52

|

|

25

|

|

12.91%

|

-8.47%

|

49

|

|

26

|

|

12.71%

|

-8.67%

|

3

|

|

27

|

|

12.27%

|

-9.11%

|

42

|

|

28

|

|

12.16%

|

-9.22%

|

16

|

|

29

|

|

11.90%

|

-9.48%

|

12

|

|

30

|

|

11.64%

|

-9.74%

|

35

|

|

30

|

|

11.64%

|

-9.74%

|

35

|

|

30

|

|

11.64%

|

-9.74%

|

35

|

|

30

|

|

11.64%

|

-9.74%

|

35

|

|

30

|

|

11.64%

|

-9.74%

|

35

|

|

30

|

|

11.64%

|

-9.74%

|

35

|

|

31

|

|

11.41%

|

-9.97%

|

12

|

|

32

|

|

11.40%

|

-9.98%

|

16

|

|

33

|

|

11.32%

|

-10.07%

|

56

|

|

34

|

|

11.23%

|

-10.15%

|

50

|

|

35

|

|

11.16%

|

-10.22%

|

55

|

|

36

|

|

10.89%

|

-10.49%

|

10

|

|

37

|

|

10.71%

|

-10.67%

|

63

|

|

38

|

|

10.69%

|

-10.69%

|

81

|

|

39

|

|

10.66%

|

-10.72%

|

24

|

|

40

|

|

9.37%

|

-12.02%

|

17

|

|

41

|

|

8.83%

|

-12.55%

|

59

|

|

42

|

|

8.33%

|

-13.05%

|

90

|

|

43

|

|

8.00%

|

-13.38%

|

12

|

|

44

|

|

7.59%

|

-13.79%

|

4

|

|

45

|

|

7.32%

|

-14.07%

|

22

|

|

46

|

|

7.20%

|

-14.19%

|

10

|

|

47

|

|

7.10%

|

-14.28%

|

55

|

|

48

|

|

6.93%

|

-14.45%

|

7

|

|

49

|

|

6.88%

|

-14.50%

|

9

|

|

50

|

|

6.81%

|

-14.57%

|

21

|

|

51

|

|

6.60%

|

-14.78%

|

240

|

|

52

|

|

6.01%

|

-15.37%

|

43

|

|

53

|

|

5.75%

|

-15.63%

|

9

|

|

54

|

|

5.70%

|

-15.68%

|

152

|

|

55

|

|

5.69%

|

-15.69%

|

15

|

|

56

|

|

4.89%

|

-16.50%

|

49

|

|

57

|

|

4.88%

|

-16.50%

|

12

|

|

58

|

|

4.80%

|

-16.58%

|

10

|

|

59

|

|

4.64%

|

-16.74%

|

2

|

|

60

|

|

4.56%

|

-16.82%

|

12

|

|

61

|

|

4.31%

|

-17.07%

|

96

|

|

62

|

|

3.84%

|

-17.54%

|

234

|

|

63

|

|

3.59%

|

-17.79%

|

18

|

|

64

|

|

3.21%

|

-18.17%

|

14

|

|

65

|

|

3.17%

|

-18.22%

|

3

|

|

65

|

|

3.17%

|

-18.22%

|

3

|

|

65

|

|

3.17%

|

-18.22%

|

3

|

|

65

|

|

3.17%

|

-18.22%

|

3

|

|

66

|

|

2.35%

|

-19.03%

|

19

|

|

67

|

|

2.19%

|

-19.19%

|

23

|

|

68

|

|

0.00%

|

-21.38%

|

0

|

|

68

|

|

0.00%

|

-21.38%

|

0

|

|

68

|

|

0.00%

|

-21.38%

|

0

|

|

68

|

|

0.00%

|

-21.38%

|

0

|

|

68

|

|

0.00%

|

-21.38%

|

0

|

|

68

|

|

0.00%

|

-21.38%

|

0

|

|

68

|

|

0.00%

|

-21.38%

|

0

|

|

69

|

|

-0.53%

|

-21.91%

|

2

|

|

70

|

|

-0.81%

|

-22.20%

|

2

|

|

71

|

|

-0.85%

|

-22.24%

|

120

|

|

72

|

|

-1.65%

|

-23.04%

|

87

|

|

72

|

|

-1.65%

|

-23.04%

|

87

|

|

73

|

|

-2.78%

|

-24.16%

|

12

|

|

74

|

|

-3.60%

|

-24.98%

|

13

|

|

75

|

|

-5.60%

|

-26.98%

|

1

|

|

76

|

|

-15.28%

|

-36.66%

|

32

|

---------------------------------

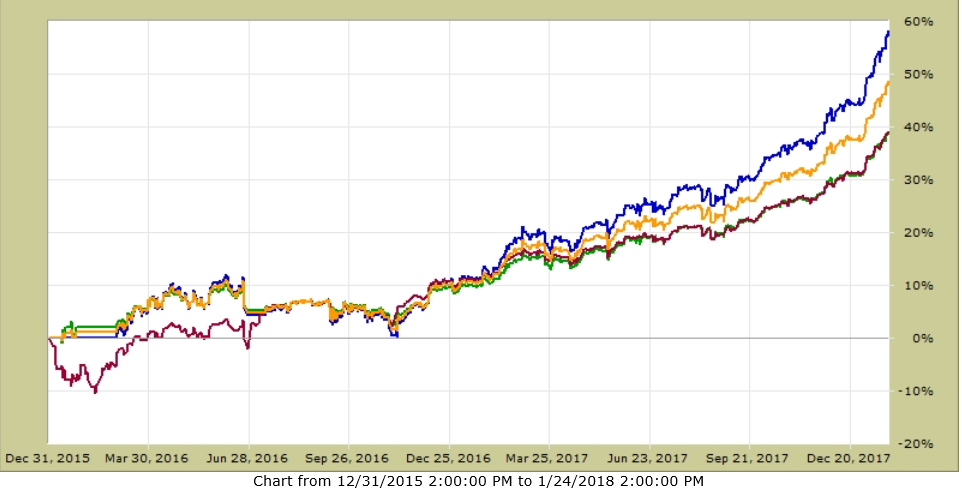

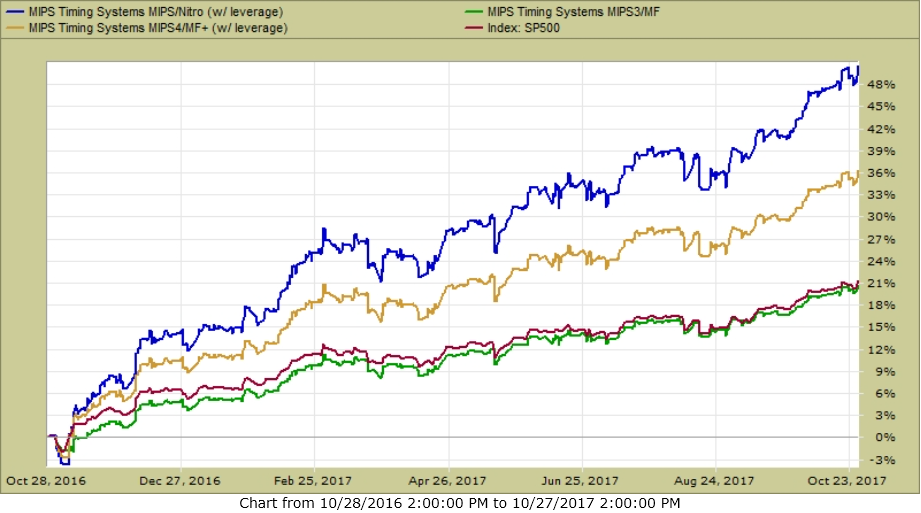

IV) MIPS performance over the last 12 months (from TimerTrac.com)

- MIPS/Nitro with 2x leverage (blue line) + 50%

- MIPS4 with 1.5x leverage (gold line) + 36%

- MIPS3 with no leverage (green line) +21%

- SPY (red line) +21%

.

-----------------------------------

V.) How did MIPS perform in 2008

The graph below is:

(a) to prove that MIPS not only performs well in up markets, but also

(b) to show how fast MIPS3 actually responded to the market crash in 2008.

- MIPS3 issued its first short signal in 4Q’07 (verified by TimerTrac.com),

MIPS3 – 4Q’07 thru 1Q’09

- MIPS3 - blue line +106%

- SPY - red line -48%

Red dots indicate actual signals …

. .

In summary, it seems that many “investors” get such a big “kick” out of trading, they lose track of the objective of making money. Many will not tolerate a lower frequency trading model, but seem to love higher frequency trading models that do not perform nearly as well as MIPS. You tell me why…

.

--------------------------------

Best Wishes…

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

|