Note: In this article, the "market" is the ETF for the S&P 500 Index, the SPY

As we all know by now, the stock market has been almost flat since Jan'18 (but with a good up kick in 4Q'19). In many years, the market goes up in the 4th Quarter, mainly because mutual funds are selling their annual losers and replacing them with many of the hottest stocks of the year. The "rats" are doing this so that their year-end portfolios look like they had owned the "hotties" for most of the year.

As a mathematical model, MIPS was designed to basically "keep-up" with (or slightly beat) the market in up markets, and to beat the SPY dramatically (and make big bucks) in down markets. BTW, those that want to beat the SPY in up markets should consider at least a little leverage; like 1.25x leverage in the SPY on Long Signals (go long with 75% SPY and 25% SSO); but only 1.0x leverage on Short Signals (100% SH).

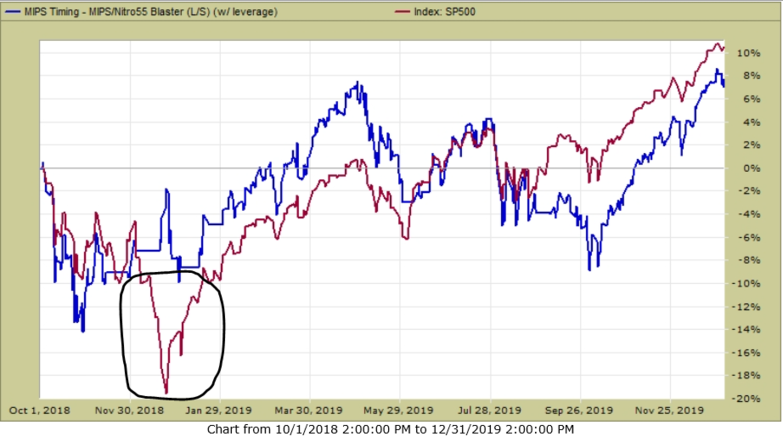

Given the above, here is how MIPS performed since Oct'18:

- please note that MIPS avoided the big dip in 4Q'18

- the models that performed the best in 2019 were the ones that lost the most in the 2018.

>From here, of course, the market can go anywhere. In general, unless a bull market gets greatly "overbought", it will continue up until corporate profits go south and we reach the next recession. Other than 10-15% "corrections", markets DO NOT drop when corporate profits are healthy.

Along the way, however, the market is disturbed by dramatic events (Brexit, international trade setbacks, etc.). The big Institutional Investors ("fat kats") like volatile markets because they buy at the bottoms and sell to the little guys at the tops. It is hard for us to predict the tops and bottoms, but it is very easy for the fat kats to do so because they basically "cause" them to milk the little guys.

Market Crashes

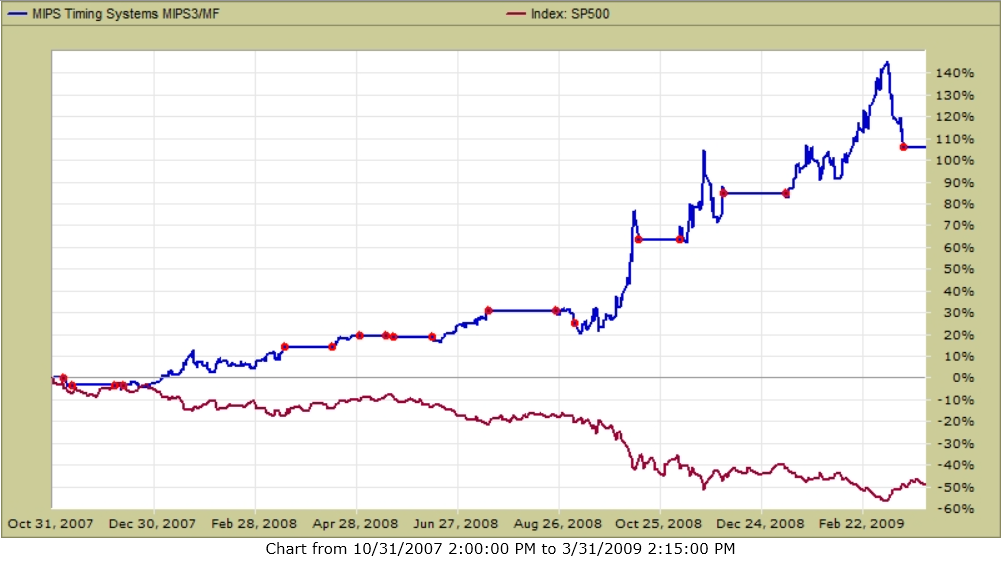

At this time it is hard to predict a market crash, as it will take a big catalyst (the Fed, Impeachment, etc.) to turn the bull. But, over time, the big crash will come. When it does, you want to be following a model that is good in market crashes and that is where MIPS is by far "the best". Below, you will see the actual MIPS3 performance in the 2008 crash (buy/sell/cash signals verified by TimerTrac.com since 11/04/2005).

MIPS - in 2008 Crash

Market Crash (4Q'07 - 1Q'09)

MIPS (blue) +108%

SPY (red) - 50%

From TimerTrac.com (red dots show trades)

PLEASE

Do not try this yourself, follow MIPS (the top ranked model on TimerTrac.com since 2007).

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

www.mipstiming.com

281-251-MIPS(6477)