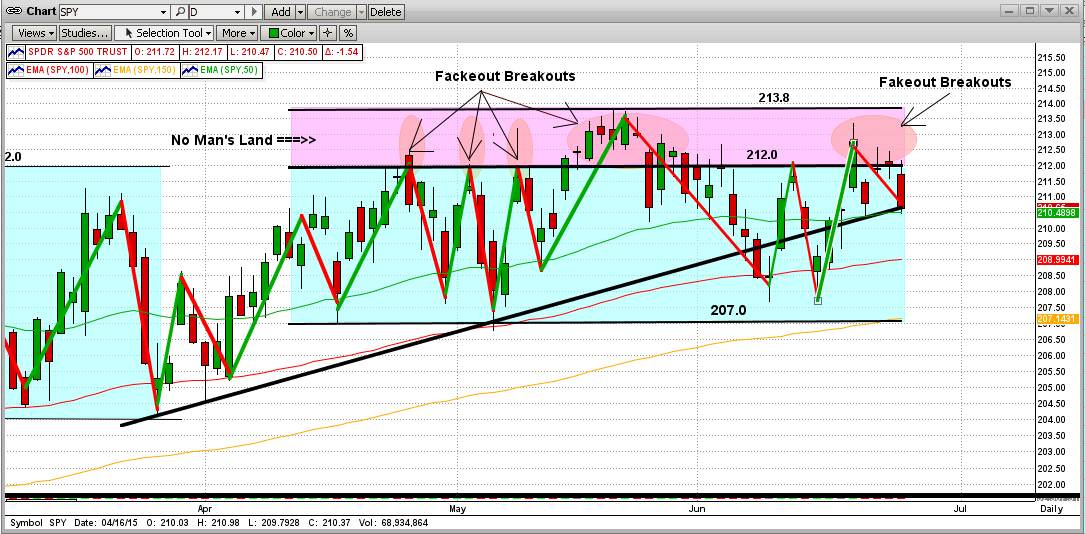

Since our previous blog (below), the "Market to Nowhere" has kept on going nowhere. The very tight trading range for the SPY in the last 6 months has changed its direction between 207.0 and 213.8 thirteen times, with no breakout above 213.8. That is a plus and minus change of only $3.4 around a mid-line of $210.4 (or 1.6%), which is not worth paying a lot of attention to from a pure performance standpoint. But, it does give a lot to think about.

As you can see in the graph immediately below, we again deemed the territory between the top two resistance levels ($212.0 and $213.8) as "No Man's Land". Every time in the 60 trading days that the Bulls have pushed the SPY into "No Man's Land" (pink area), it has gotten beaten back by the Bears. The only good news here is that this behavior cannot last forever, and is most likely coming to an end soon.

This rare kind of behavior shows extreme confusion and uncertainty as to which way this market will break out. Of course, since we cannot go sideways forever, there are only two ways the market can go, Up or Down. See our take on which way is the most likely under the graph.

UP or DOWN MARKET ???

In this market, there are compelling reasons as to why this market will continue up as in the last 6 years, but also some compelling reasons as to why it will turn down big-time. In short, the main reasons are:

Reasons for a Down Market Reasons for an Up Market

- Economy not doing well - The behavior of the Fed

- Potential higher interest rates - The behavior of the Fed

- Potential Greek default - The behavior of the Fed

- China economy slowing - The behavior of the Fed

- Oil price and energy profits - The behavior of the Fed

- Stocks overbought - No other place to invest outside of the stock market

- The market may be "topping" - Long-term, tight-range markets break up 70% of the time

- Will go where the big guys want it to - Will go where the big guys want it to go

See more about the last 2 reasons in both columns in our "previous blog" below.

Ok, I gotta say it... I think the SPY will break to the upside in the short-term, followed by a big crash in the next 4-6 months. But, as we all know, MIPS knows better than me (or you), so let's speculate as long as we want to (for fun), but follow the MIPS signals to manage our money (for gains).

And, we may not know why, but WE DO KNOW that the market will go the way the big guys want it to go. Even though the big guys don't like it, they leave a footprint when they are buying and/or selling, and MIPS knows how to track their action, and follow it.

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

===============================================================

<<< Previous Blog >>>

MIPS Members:

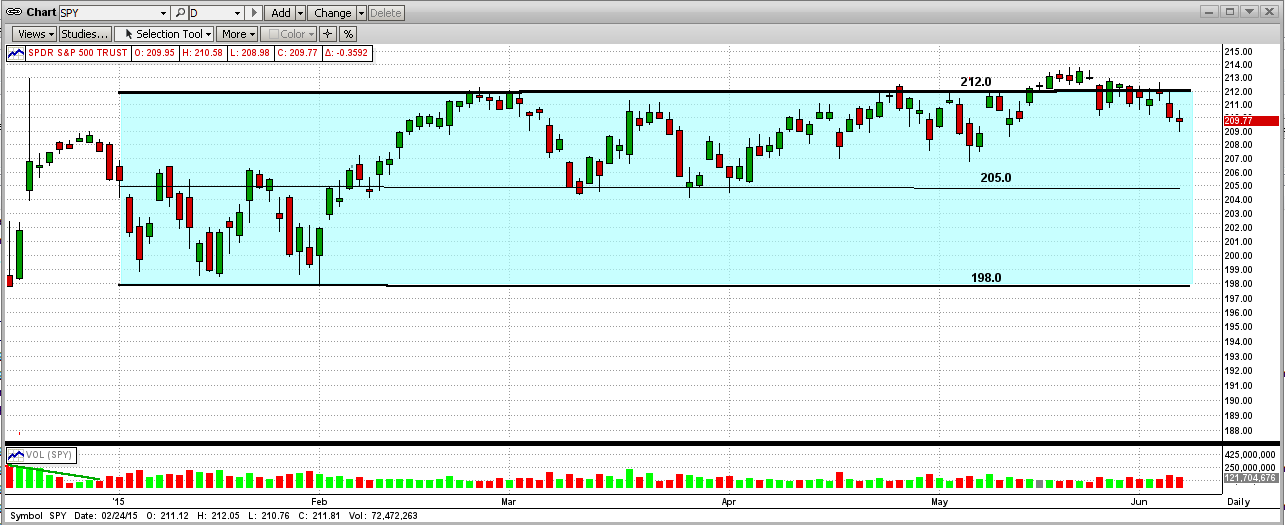

As you know by now, the market's "march to nowhere" continues. As said on CNBC, "The biggest story in the stock market this year has been, well, no story at all." And, according to technical analyst Jonathan Krinsky (MKM Partners), "The Dow hasn't done this in over 100 years."

What has the Dow not done in its history going back to the 1890's? The Dow has never traded in a narrow trading range of less than 6.2% for the first 6 months of any year. We are about 3 weeks short of that record time now, and the Dow's max top-to-bottom range has been about 6.2%. That's a plus-or-minus deviation of 3.1% around its mean-line in 6 months !!!

Yes, multiple trillions of dollars have been traded in this time frame with almost no real gains/losses in the indices. Needless to say, that shows a lot of uncertainty. See the graph for the SPY below (with a couple of "fakeout" breakouts).

No one has any idea where this market will go from here, and there are two good cases.

- you need to follow this market daily.

THE BULL's CASE

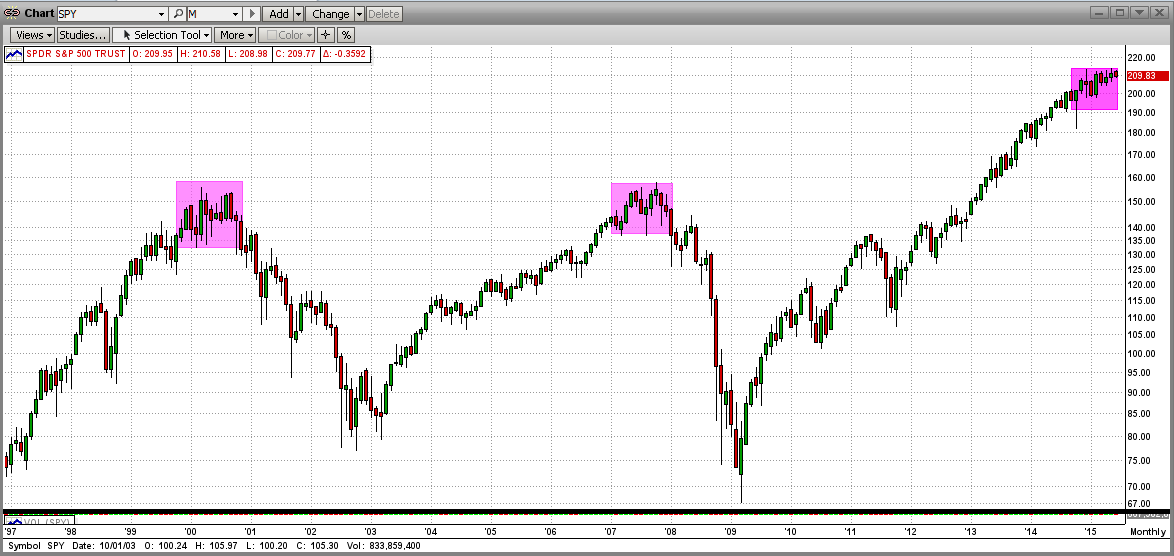

According to technical analyst Jonathan Krinsky, the Dow has traded in a narrow trading range of 10% (as opposed to 6% now) in the first 6 months of any given year 19 times since 1896. Of these 19 times, almost 70% or the time (13 out of 19), the market ended up higher for the remainder of the year. We have 3 weeks left to go in the 1st 6 months of this year. This market may still have steam, and the little guys could push it much higher with euphoric buying.

THE BEAR's CASE

There is a good chance that all of this "flatness" is NOT all about uncertainty, but is part of a "rollover" of this 6.5 year bull market into a full-fledged bear market. Of course, all rollovers are caused by the big guys selling at the top of a bull market (like now), or buying at the bottom of a bear market (like in 2009). At a top, the big guys sell the market down, and the little guys buy the dips right back up to the tops. A "topping" market takes the form of a "rollover" (instead of an immediate "reversal") because it takes the big guys at least 12 months to dump the major part of their portfolios; and then they let the little guys ride it down all the way to the bottom for the umpteenth time. SEE THE GRAPH IMMEDIATELY BELOW. If this indeed what is going on, we only have a few months left, so watch closely.

OUR ADVANTAGE

We can't "go this alone" and try to pick the time that this market is going to crash. We are not smart enough and we do not think fast enough to even come close. We are not going to out-think the mathematics that make up good models and go through even one thousandth of the conditions that the computer can analyze in milliseconds.

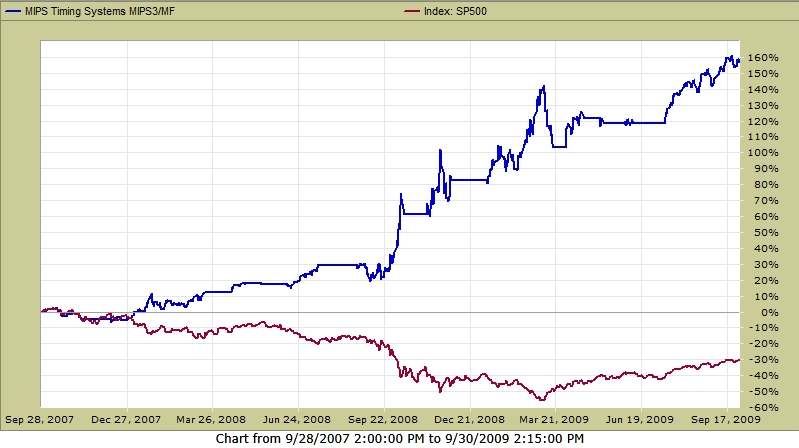

For example, study the graph below (from TimerTrac.com with verified signals) to see how MIPS3 actually traded the SPY in 2008. Who would you bet on: yourself, or MIPS, or some other model that you have not seen successfully handle a market crash? I know how I would answer that question. Stay tuned !!!