Sunday, May 19 2013

As most of you know, we recently released our newest model, MIPS4/MF+

- MIPS3/MF is still a very good model, but MIPS4/MF+ produces a "smoother ride" along the way.

Therefore, for individual investors, MIPS4/MF+ is the model you should use if you are going to

trade with "leverage".

- Of course, with MIPS4/MF+ signals, you do not have to trade with leverage.

- You can trade SPY or any ETF that "correlates" well with the SPY, like IWM and QQQ.

- Many of our customers trade 1/3 each of SPY, IWM, QQQ.

More aggressive investors, however, could do even better trading SSO (the "double leverage" SPY) using MIPS4/MF+ signals with some portion of their MIPS money.

Since I am "in-the-middle" of the risk tolerance crowd, I trade double leverage SSO on long signals and single leverage SH on short signals

- but, if you trade with leverage, you can choose whichever of the trading strategies below that

fits your own risk tolerance.

The following are three MIPS "Performance Reports" using MIPS4/MF+ signals in the period 2007-3/31/13:

ETFs Traded_________ ........Comp Gwth............Max DD

1) SPY long / SH short.............33.0%................. -10.63%

2) SSO long / SH short............54.1%................. -16.13%

3) SSO long / SSO short..........72.0%................. -18.14%

Hope this helps.

Thursday, May 16 2013

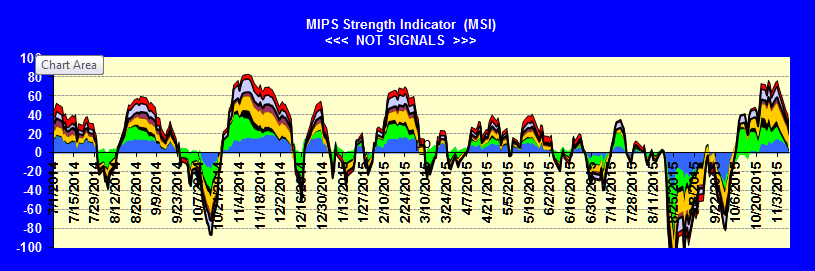

For the MIPS Members that do not remember, we do have an indicator on our website that shows roughly how MIPS sees the strength in a current market.

Market Strength Indicator

Even though it does not represent signal changes per se, we do have a graph on our homepage (1/3 down in the middle) for what we call the MIPS "Market Strength Indicator" (MSI). The MSI is a "mix" of some of our most reliable indicators. We believe that MSI does represent the "direction" of market strength (up or down), BUT IS NOT INTENDED TO BE A SIGNAL CHANGE INDICATOR. That said, the MIPS models usually do not issue a trade signal change when the MSI is really strong or really weak (but it can, with a true out-of-the-blue key reversal pattern).

We usually recommend that new MIPS users NOT join in on an existing signal if the slope of the MSI is trending against the signal (like don't go long when the MSI is trending down). Once in, however, simply follow the MIPS signals AND please DO NOT try to use the MSI as a signal change indicator.

This graph is usually updated about twice a week

Saturday, May 11 2013

As with almost everything in this world, the behavior of the stock market is made up of actions from millions of people. And, as with almost everything in this world, the stock market does kind of repeat itself. The $64,000 question is what is repeating and when?

This week I saw a talking head on CNBC discussing what was going on in the market and why, and if the current 5-year bull market would continue. Like most others, he gave a very nondescript answer. His short answer (and my interpretation of his answer) was that the action of the stock market would follow one of the options below:

1) Rational Exuberance - 60% (that is, keep going up as it should)

2) Irrational Exuberance - 30% (that is, going up faster, even though it should not)

3) Market Crash - 10% (that is, a complete reversal from today's bull market action).

This reminds me of three market behaviors of the Nasdaq in the 1990's (when Alan Greenspan coined the term "Irrational Exuberance").

Graph 1 - Rational Exuberance

This graph shows the Nasdaq from 1985-1995, when the index TRIPLED, but did so because technology was booming. This fits "Rational Exuberance" because everyone was happily making money on the high growth of companies like Microsoft, Oracle, Cisco, etc. In this 10-year period, the Nasdaq rose in value from about 250 to 775, ending with "overbought" conditions, nose-bleed P/E ratios (Cisco had a P/E ratio of over 100), etc. Then, the pundits were were crying, GET OUT!!!

Were they right?

Graph 2 - Irrational Exuberance

Of course, the pundits were right about the fundamentals, but DEAD WRONG about the Nasdaq market performance

- the proof lies in the following 5 years' performance [that is, in the time period of 1995-2999 (Graph 2)]

- this is when everyone (especially the little guys) went into panic buying ("Irrational Exuberance")

- the net result over this 5-year period was that the Nasdaq WENT UP OVER SIX-FOLD, from 775 to 5000, with

crazy things like Cisco's P/E ratio growing to over 400, Yahoo's market cap being more than the GDP of Iceland, etc

Graph 3 - Market Crash

We all know that US stock market indices went up in smoke after the year 2000, but getting out in 1995 was way too early.

OUR POINT IS THAT SINCE THE MARKET DID RECENTLY BREAK TO THE UPSIDE AND SET NEW ALL-TIME HIGHS, AND IF THE BIG GUYS GET THEIR WAY, THE LITTLE GUYS CAN PUSH THIS MARKET WAY HIGHER THAN IT SHOULD GO (like 1995-2000), AND THEN THE BIG GUYS WILL DUMP BIG-TIME (like 2000).

BUT, IF THE LITTLE GUYS ARE NOT ABLE TO KEEP THE SPY ABOVE ITS CURRENT RESISTANCE LEVELS, THE BIG GUYS WILL MOST LIKELY SELL DOWN. OF COURSE, THIS CAN RESULT IN (1) A RELATIVELY SMALL DIP WITH A CONTINUED UPTREND OR (2) A BIG MARKET CRASH (like 2000).

We certainly can't predict what will happen from here, and that is why we developed and follow the MIPS models. If and when this market makes a major change, MIPS will most likely miss a minor part of the change, but will find and follow the resulting trend. And, MIPS should ignore minor changes to prevent getting whipsawed.

Wednesday, May 01 2013

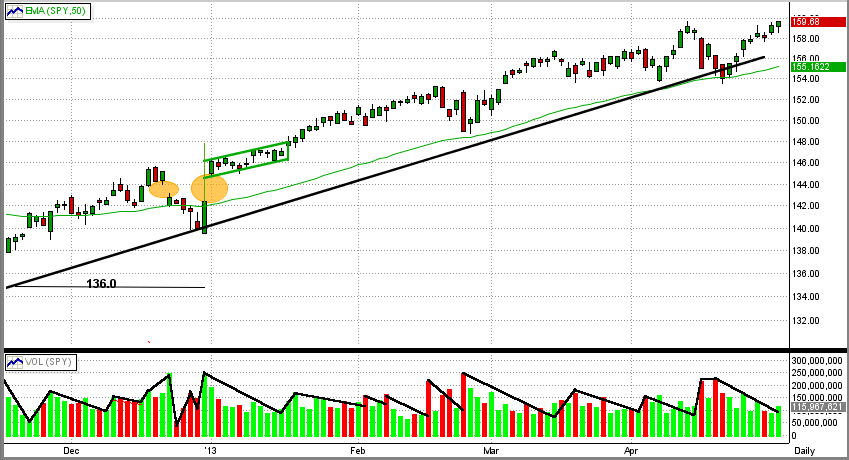

Are we tied to a market that will continue a smooth ride up for some time to come? Sure feels that way. Ole Ben keeps printing money, the little guys (retail investors) keep buying the market back up after every dip that results from the big guys' selling, the economy is holding its own, the market is moving in a near-perfect immediate-term trend and MIPS is following it to perfection, etc. See Graph #1 immediately below.

Graph #1

So, what could go wrong? There are many fundamental values that could could derail the market, but that is outside of the scope of this blog (and you can read about that all over the Internet).

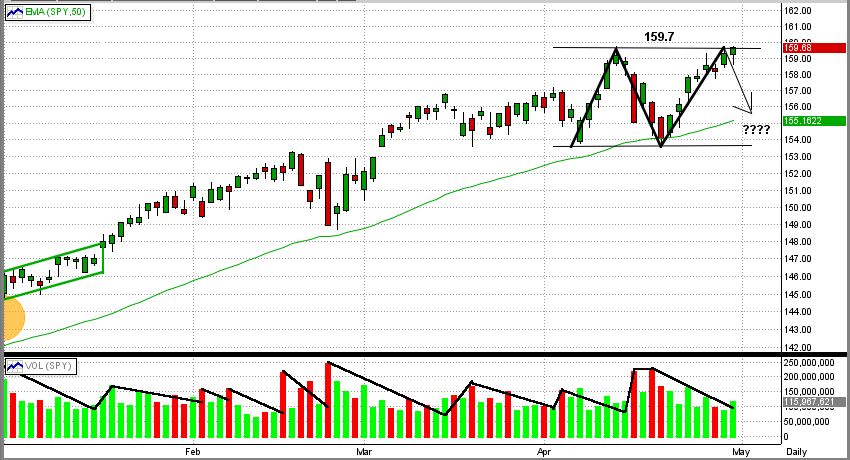

From a purely technical standpoint, two things are very dangerous.

1) The first is the 13-year Triple Top that we discussed in the previous email below (see the very last graph).

2) The second is closer to home. In Graph #2 below, you can see the potential formation of a near-term perfect

double top. If the SPY fails at breaking 159.7 to the upside and heads down, this could represent (a) a dreaded

sideways pattern at best, and (b) a double top worst case.

Graph #2

As always, let's wait for MIPS to tell us what do do.

|