Tuesday, January 29 2013

This blog post is all about "Is This Market Rally Going Higher?"

- it is not about whether or not this market should go higher, and that is a big difference.

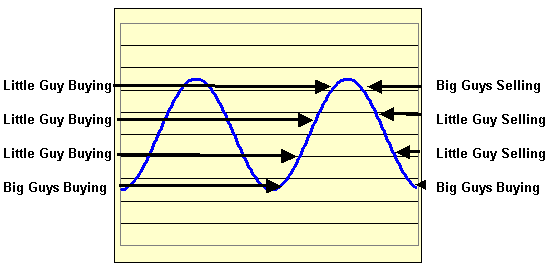

Almost any news can change the short-term direction (days/weeks) of the market, but only strong buying or selling volume can keep a trend going intermediate-to-long-term (like weeks/months). The four cycles in the long-term ups-and-downs in the market are something like that below:

The steps in recovering from a bear market are (see the steps on the left side of the graph above):

1) the big guys buy at the market bottom (remember, they cause the bottom, not call it)

2) aggressive little guys who sold low, then sell their bonds and get back into equities when they

are still low

3) average little guys who sold about halfway down, also move money from bonds and get back

in the market

4) conservative little guys (who swore off the market), cave in and buy near the top (again and

again).

The steps after a long up market (like now) are shown below (also see the steps on the right above):

1) after the little guys have 80+ percent of their assets invested in equities, the big guys start a

stampede down

- we are not there yet, because the little guys have plenty of buying power tied up in bonds

- the SPY now is about $150.7/share and the all-time high from Oct'08 is about $157.5/share

- we believe that the big guys will let the little guys push the market to the all-time high (and

maybe higher)

- the big guys, of course, will be trying to start "panic buying" from the little guys near the top

- in reality, the big guys are not calling the market top, they are causing it

2) after the SPY makes new highs and the market gets even more "overbought", the big guys will

"dump"

3) the big guys' heavy selling will cause a big downside jolt in the market and the little guys will run

for the sidelines

4) as the first wave of little guys sell the market lower, more little guys will sell in stages all the way

to a new bottom.

In essence, we do not believe that the big guys will let this market "crash" until the SPY has "tested" its all time high at $157.5/share This might not happen until we have a small pullback, but we do think it will happen. And, we think there is a good chance that the little guys will push it that high, OR higher. But, we also believe that a big drop is possible (even likely) after that.

Either way, MIPS will catch the new trend and get us on the right track !!!

Thursday, January 24 2013

The title of this email was borrowed from an article on CNBC. And, remember my blog post from last week? ("Tipping Point for the Market in 1Q'13!") Well, it's all about that. The market (SPY) has gone up almost every day since the beginning of the year. And, the SPY broke its "up pennant" pattern decisively on 1/18/13. It seems to be headed for the SPY all-time high of $157/share (or about $1,570 on the S&P 500), made on 10/11/2007. Of course, we can expect extreme resistance at $150 and above, as the bulls and bears fight it out.

The SPY crossed $150 today, but was beaten back by the bears right around the $150 mark (and almost created the dreaded "one-day key reversal pattern"). Some say the bulls are determined to move the SPY up to test the all-time high and others say the market is way "over bought" and overdue to fall back. See excerpts of what CNBC says below the graph.

Thursday, 24 Jan 2013 | 10:36 AM ET

The Standard & Poor's 500 crossed the last big, round number between here and a record high, a destination considered inevitable by some Wall Street pros. Early Thursday trading saw the S&P 500 briefly pass through 1,500, just 65 points shy of its 1,565 record set in 2007.

Dan Greenhaus, BTIG; and Scott Sperling, THL Partners, discuss the market's recent rally and provide an outlook on private equity. While many traders usually dismiss the big, round numbers as having little meaning from a fundamental or technical standpoint, eclipsing this mark could be different.

"It's psychological more than anything," said Justin Wiggs, vice president of trading at Stifel Nicolaus. "If we stay above 1,500 it could bring some incremental dollars off the sidelines." The move past 1,500 comes as investors have been showing more confidence in stocks, finally taking some of the $2.7 trillion lying dormant in low-yielding money market funds and pumping it into equities. Stock-based mutual funds saw $9.3 billion of inflows last week and $23.6 billion over the past two weeks, according to the Investment Company Institute.

The 1,500 billboard could become just a signpost along the way if current chart patterns hold up. "We're already confirmed to go maybe not exactly to the all-time high but pretty darned close," said Abigail Doolittle, technical strategist at Seaport Group in New York. That trading behavior has been significant within the context of the Federal Reserve's liquidity programs. The central bank has pumped nearly $3 trillion through its government debt-buying program known as quantitative easing, or QE.

Doolittle has issued bearish calls in the past and still believes the long-term picture of the stock market is troubling, but sees Federal Reserve liquidity driving the market now. "It's going to be interesting to see how this plays out. It's unbelievable that the Fed has been able to pull this off," she said. "I applaud them because it hasn't collapsed yet, but I'll be shocked if there's not some severe market action to the downside, very similar to 2000 and 2007."

While the round number are often dismissed, they can prove formidable barriers. The S&P 500 struggled for three months in 2012 to clear 1,400, but once it did the average zoomed higher. "If it was the first time we were hitting the big, round number it could represent resistance. We've already been through there a couple times," said Mark Arbeter, chief technical strategist at S&P Capital IQ. "The completion of some chart formations suggests we could have measured moves back up towards the all-time highs in the first quarter."

"This is a very frustrating market," said Kathy Boyle, president of Chapin Hill Advisors. "It's times like this when I feel like throwing in the towel. That's when I feel like I should stick to my guns."

"end..."

Thursday, January 17 2013

It looks like we are at a "Tipping Point" in the market for 1Q'13. Let's look at the performance of the SPY since 12/31/12. We received an overdue Christmas present on 12/31/12, as the SPY roared up over 2% on that day. On the first trading day of this year (1/02/13), the SPY "gapped up" and closed even higher on this day's close at 146.06. Overall, these two trading days accounted for a total gain of about 4.7%, with high volume on both days!!! Thanks for the good start, big guys.

Since then, the SPY has formed a classic "up flag" pattern, but on low volume (the big guys letting the little guys push the market even higher). Today we almost saw an impressive break of the SPY to the upside of this pattern, but instead the SPY closed at or near the top of this pattern's upper range at $148.0/share. By the way, this is above the 4-year high for the SPY of $146.99/share on 1/02/08. If we break out of this pattern decisively to the upside, we believe that we will see new all-time highs for the SPY (and other indices) in the first half of 2013.

[My opinion, and my opinion only, is that the big guys (Goldman Sachs, etc.) will let the little guys (those of us with less than $20 million) push the market to all-time highs. And, just about when all of the little guys have 80-90% of their portfolios in equities, the big guys will sell the market down big-time. BTW, I developed MIPS to help me trade with quantitative analysis rather than with my opinions, and MIPS has been very, very successful on that issue.]

Wednesday, January 09 2013

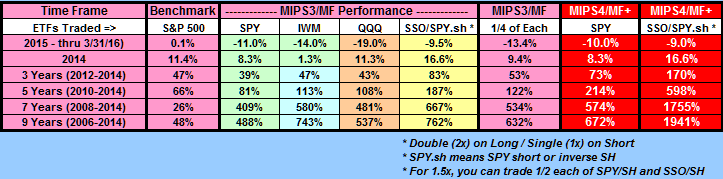

Our flagship MIPS3/MF model did NOT do really well in 2012. Our portfolio managed by MIPS3/MF trading

SPY long and short was up about 8.5% for the year (9% counting dividends earned and commissions

paid), versus about 13% growth for the SPY. So, what can we do to perform better?

Here are three ways to do better using the MIPS3/MF model (at least they have been better over the last 7 years).

Improvement #1 - Trade Multiple ETFs

As most of you know, our MIPS models are tracking the ETF for the S&P500 Index (SPY), because we

believe that the S&P500 is a very good representation of "the market". For this reason and this reason

only, we report our performance of MIPS models trading the SPY.

However, as you most likely know, MIPS members are not restricted to trading just the SPY. In fact, as

you can read under the "Services" tab on our homepage, MIPS members can trade any ETF that

"correlates" well with the SPY (or any mix thereof). Most of he ETFs that represents the major USA

indices (SPY, MDY, IWM, QQQ), fill this bill. See the definition of "correlates" at Investopedia.com:

http://www.investopedia.com/terms/c/correlation.asp#axzz2HRqpl6YI )

Therefore, if so desired, MIPS investors can trade the following:

I.) Conservative investors trading SPY long and short (or buying SH on shorts).

II.) Aggressive investors buying 1/3 each of SPY, IWM, QQQ on long signals, but only

shorting the SPY on short signals (or buying SH).

III.) More Aggressive investors buying 1/3 each of SPY, IWM, QQQ long and either shorting

these ETFs or buying their corresponding inverse ETFs on short signals (SH, RWM, PSQ).

BTW, I usually apply profile "II" or "III" above to my trading.

So, in the last 3 years 2010-2011-2012 (certainly not the best time for MIPS3/MF), when the SPY with

buy/hold was up 28%, MIPS3/MF trading just SPY (using profile "I") was up 42% (not at all bad). But,

trading with profile "III" in this time period, MIPS3/MF would have been up a whopping 58% (tons better

than the 28% with buy/hold, and also better than 42% from trading just the SPY with MIPS3/MF).

If we look at the last 7 years (longer-term view), the SPY was up 14%, and the trading profile "III" with

MIPS3/MF would have been up 379% (verified by TimerTrac.com) !!!

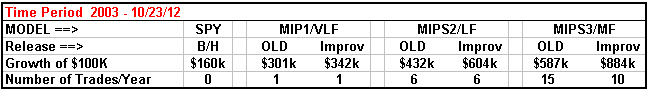

Improvement #2 - New "Improv" Release

This one is on the house. The performance of the current MIPS models are some of the very best in

the industry. However, as most of you know, we at MIPS are continually trying to make our models

even better.

To that end, we recently updated some of the algorithms in our models to respond more effectively

in flat or sideways market (like the markets in 2011-12), and hence these MIPS models will do a lot better

in these types of markets in the future. This, of course, will improve the overall results of all MIPS models

going forward.

Please note that these are NOT NEW models, they are simply the old models with relatively simple

but very effective revisions. When we develop a completely different model, the name of the new

model, or course, will definitely be different from that of any existing models (as in MIPS3/MF versus

MIPS2/LF).

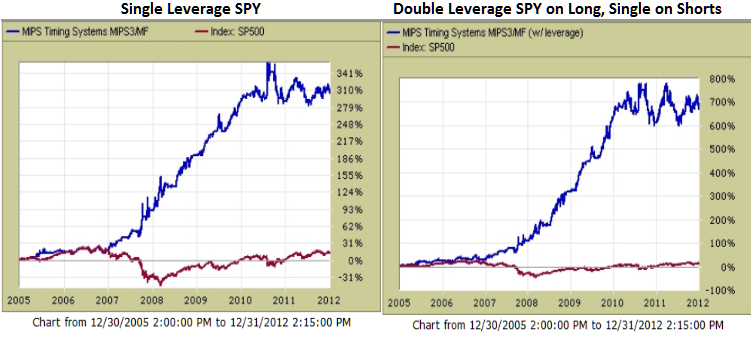

Improvement #3 - Trading Leveraged ETFs

Investors who are willing to take more risk would most likely do better with the MIPS3/MF model trading

"double leveraged" ETFs. I personally do not like to trade leveraged ETFs on every trade. Sometimes

I do use double leveraged SPY on long signals, but I use single leveraged SPY on short signals. The

results of using MIPS3/MF signals with this trading strategy are shown below (from TimerTrac.com).

In the 7-year period of 2006-12, MIPS3/MF trading single leveraged SPY was up 314% (left graph); but trading

double leveraged SPY on long signals and single leveraged SPY on short signals would have produced gains of

about 700% (right graph). Please pay close attention to the vertical axis in both graphs below.

|