Sunday, January 27 2019

Some time ago, I would have been surprised at the negative inputs that MIPS is getting from "some" (small number) of its members because of the high number of trades (9 trades) that the MIPS models have issued in the last 90 days. But, I am really NOT surprised because we had almost an identical response from other members in 2017 when the MIPS models did the opposite, and had No trades for the entire year (yes, zero).

In this blog, we will attempt to explain the high number of trades from MIPS in the last 90 days; and we will refer to our previous Blog from Nov 19, 2017 to explain the lack of MIPS trades in 2017. Over the last 13 years, the MIPS models have averaged about 12 trades/year, with 20+ in some years and 0-2 in others.

Popular quantitative models are based on concepts such as:

1) Trend Following - following short, intermediate, or long-term trend lines

2) Reversion to the Mean - Reverses when the markets get over-bought or over-sold

3) Momentum - puts more trust in markets that are moving in one direction, with higher or lower movements

4) Rate of Change - highly affected by markets when the slope of the movement is growing or decaying,

5) etc, etc, etc.

MIPS

MIPS is basically a trend-following model, but has algorithms built in to recognize over-bought and over-sold markets, markets that are gaining or losing momentum, and especially markets that are moving sideways (forming a recognizable "Consolidation Pattern").

MIPS behaves differently in slow and fast moving markets, up markets, down markets, and flat/sideways markets. In 2017, the market moved as a strong up-market for the entire year, so there was no need to "trade" just to trade, at the risk of being "fooled" by small dips. So, MIPS detected that, and did not trade at all that year.

On the other hand, since 3Q'18 we have been in a flat/sideways market. This is VERY dangerous market pattern, because there are basically NO identifiable trends (flat trend), and most other indicators are in chaos also. In fact, trying to identify market direction in this type of market is like trying to figure out who is winning a battle of thousands of warriors in hand-to-hand combat !!!

In this type of market, the MIPS models are programmed to go into a "preservation of capital" mode; which essentially means that, to be "safe", the models will go into (and stay in) Cash more often. So, instead of trades being long-to-short, most will be long-to-cash-to-short (and vice-versa for short-to-long trades). With this approach in 2018, the MIPS models ended up with small gains instead of big losses from getting whipsawed like many other quantitative models.

MIPS Gains in the last 3 years

The goal of all timing models should be to keep up with (or do a little better than) the market (S&P 500) in up markets, and to beat the market (or at least not lose money) in down markets. If you want to beat the market in strong up markets, you should do so by trading with 25% (1.25x) leverage or 50% (1.5x) leverage on Long Signals. On Short Signals, you should traded with 0.5x or 1.0x leverage.

Overall, since the beginning of 2016 thru 01/15/2019, MIPS is up about 33%, while completely avoiding the big drops in the beginning of 2016 and in the last few weeks in 2019. Of course, this means if you were trading with $100,000 you would have ended up with about $33,000. Not bad since your trading advice from MIPS would have been only $39 or $59 per month for 3 years !!!

2016 - 01/15/19

MIPS - Blue Line

SPY - Red Line (big drop boxes are drops in the SPY)

Red dots show actual trades

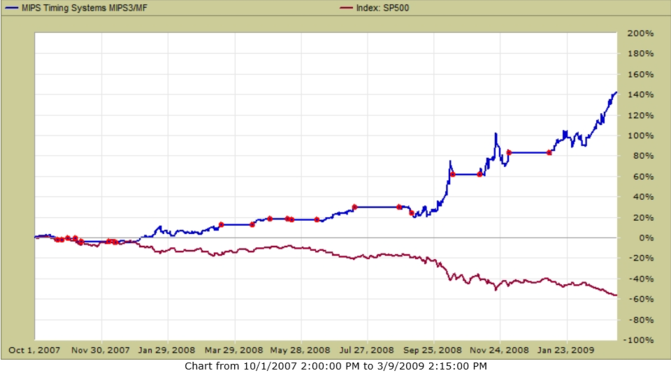

2008 - Market Crash

With good quantitative models, the "magic" comes in down markets. Notwithstanding the analysis above the graph above, the big payback comes in unanticipated years when the market crashes, as in 2008. The graph below shows what MIPS would have done for you in 2008, with no leverage.

In the 2008 crash (4Q'07-1Q'09), with MIPS Signals you would have been up +140%, while with buy-and-hold you would have been down -55% (yes, LOST 55%). Again, while investing with MIPS signals your $100,000 investment in Oct'07 would have been $140,000 at the end of 1Q'09 (+40%). On the other hand, with buy-and-hold your $100,000 investment in Oct'07 would be $55,000 at the end of 1Q'09 (-45%). That's a spread of $85,000. You do the math and see if that performance would be worth $39/month !!!

2008 Crash

MIPS - Blue Line

SPY - Red Line

Red dots show actual trades

BTW, trading just the SPY and SH (or any other two ETFs), it should take only 10 minutes to make a trade. So, 12 trades/year (24 round trip) would use up a max of only about 4 hours of your time per YEAR. If you cannot or will not spend that much time managing your life savings, you should either buy-and-hold or hire a money manager (most charge a fee of about 1.5% er year, and require a minumun investment of about $100,000).

Best Wishes !!!

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston

281-251-MIPS(6477)

www.mipstiming.com

===========================================================================

<<< Previous Blog >>>

Saturday, November 18 2017

Some investors (including some MIPS members) seem to think that when there is not a position change (Signal Change) in a MIPS model for a long period of time, they are being ignored or something is wrong with the model that they are following. They can't seem to understand that a good model (like MIPS) only changes position when the market changes its behavior, and that change is detected by the model. With MIPS, this would be when the intermediate-term market "trend" changes direction. We at MIPS input data and run our models daily (in triplicate), independent of whether or not there is a change of any type.

All daily model developers (including MIPS) provide their subscribers with "Investment Positions" (Long or Short or Cash) about 250 days every year (52 weeks/year x 5 trading days/week - holidays). This is not a function of how often their models trade.

There is, however, a big difference in how these "Investment Positions" are reported amongst model developers (aka Signal Providers):

1) Some Signal Providers send out emails to subscribers with current positions every trading day, whether or not the signal has changed. Many subscribers do not like this because they get inundated with emails from their Signal Provider and many times they miss a "signal change" due to confusion or boredom.

2) Other Signal Providers only send out emails to subscribers when there is a change in position from their model. Subscribers don't like this because there can be long periods of time (weeks/months) when they don't hear from their Signal Provider, and hence they are not 100% sure that they did not miss a signal change somewhere along the way or that the Signal Provider is now inactive.

3) At MIPS (as with most other good Signal Providers), we send out

(a) A "Signal Change" email the very day that one of our models calls for a change in position

(Long-to-Short or Short-to-Cash or etc.)

(b) A "Signal Status" email every weekend showing the current position for all MIPS models.

Our subscribers like this because the "Signal Status" tells them if they are in the correct

position at that time.

The moral of this story is that MIPS runs its models each and every day, no matter what the market is doing. This includes the status and behavior of hundreds of technical indicators and mathematical equations, and thousands of calculations. it is NOT any easier to run the model when the current signal remains the same or when there is a signal change.

We report the results to you every time there is a Signal Change, with instructions on our website for you NOT to change this new position until there is another Signal Change issued by the MIPS model that you are trading with. In the meantime, we keep you up-to-date on the Signal Status for each MIPS model every weekend, in case you accidentally did not act on the latest Signal Change during the week.

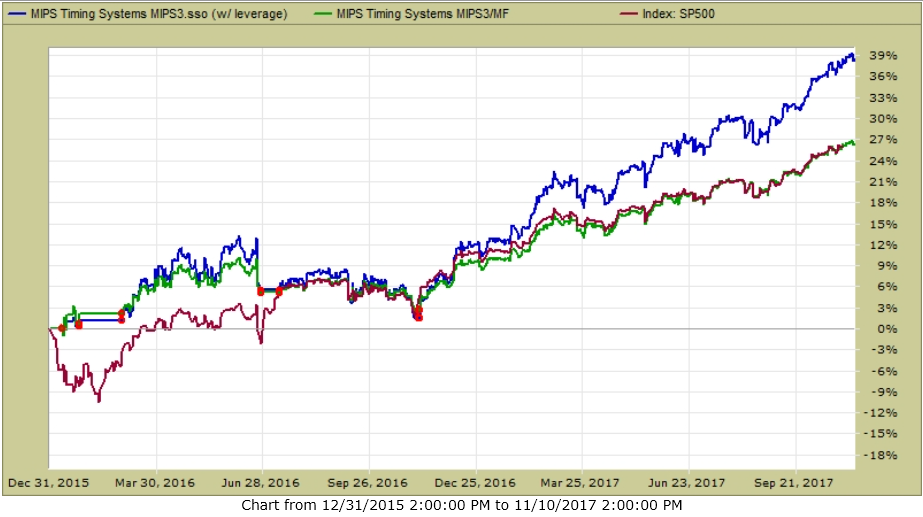

Here are the trades (red dots) and performance of the MIPS3 model since 2016

Blue Line - MIPS3 1.5x Long / 0.5x Short +39%

Green Line - MIPS3 1.0x Long / 1.0x Short +27%

Red Line - SPY........................................ +27%

Red dots show actual trades

Best Wishes...

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Tuesday, January 15 2019

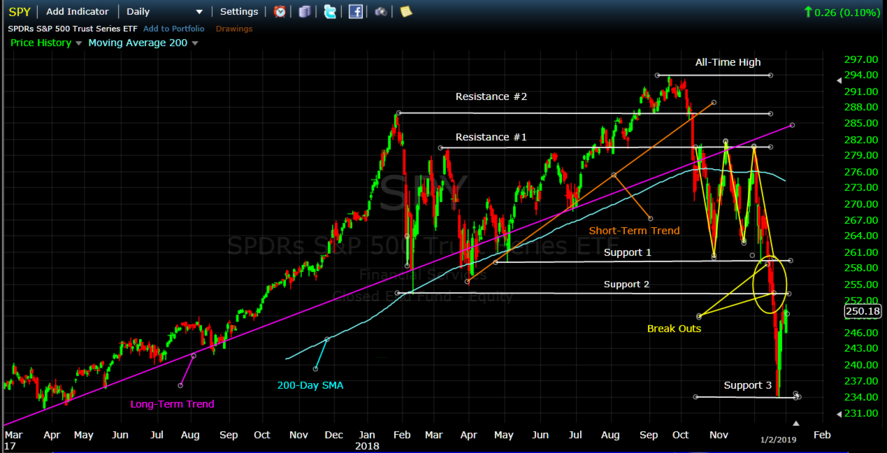

Today is a critical day in 2018-19's sideways market's short-term future. These type of sideways markets (also called "Flat Markets" or "Consolidation Patterns", etc.) usually have no direction, trend, etc. So, MIPS handles these with "Preservation of Capital" algorithms, rather than "Capital Gain" algos. In this blog, we use SPY (SP500 ETF Index) to represent "the Market".

For the SPY to go back to all time highs following a "Correction" (as in 2018), it must pass through multiple "upside resistance levels" where the market stalled on the way down. [BTW, these were called "support levels" on the way down.]

Today is what I call a "Critical Day" because the SPY is at an upside resistance level where it has "stalled" for the last five days in a row (and these attempts to cross over upside levels are not that tolerable). So, for the latest mini-rally to continue, it is very improtant that the SPY closes above its resistance level at about $259/share today or in the next few days.

See the botton right in the 2nd graph below...

COMPLETE SIDEWAYS MARKET

CRITICAL POINT TODAY

Stay tuned... MIPS had a surprise for you today... did you check your email last night or this morning?

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

281-251-MIPS(6477)

www.mipstiming.com

pdistefano@mipstiming.com

Wednesday, January 09 2019

2018 was an unusually volatile market with all hell breaking loose in the 4th quarter. If we need an explanation, the catalysts would again be the Fed raising interest rates, tariffs, trade agreements with China, Mexico and Canada, domestic and international political unrest, etc. And, it is indeed odd that this happened when the economy is still in relatively good shape. For example, in December 77% more new non-farm jobs were created versus the prior period. If the economy had any impact on the market, it would be because the troublemakers made up any and all excuses to scare investors into thinking that the economy is weakening, thus causing a sell off. Then the fat kats come back in and buy at prices much lower than what would have been possible before.

That said, the market is beginning to look like it is entering a “topping" pattern that we have seen before in each and every major market crash in the last 20+ years. In 2015, the Global Central Bank interventions prevented or postponed a crash. Crashes don’t normally happen suddenly and quickly; they usually waffle in a tight trading range (like plus to minus 6 to 7%), and then they drop like a rock. Is that what is happening now? I don’t know, but we should find out in a relatively short period of time from here.

.

The 4th Quarter was a Disaster !!!

Meet the monster…

The market volatility type in 4Q'18 is one of the most difficult for quantitative models.

Some of the major problems weree:

1) Trendless - a flat or sideways market has no trend. The slope of the trend is near zero, so any small

deviation from the trend could seem to signal a "direction change", and this can lead to a series of

“whipsaws”.

2) Oversold and overbought conditions do not register nearly as often as the market changes direction

quickly.

3) Reversion to the mean signals could trigger at tops in sideways patterns that happen in an up market,

but they rarely trigger on market bottoms in these type markets.

4) Since most models available to large individual investors and RIAs are based on daily data (instead

of like minute-by-minute or second-by-second data), it can take a few days for models to issue a new

buy/sell/cash signal. And, when sideways markets are changing direction every few days (high-

frequency-directional-changes), the market can change direction a day or two after each trade is

executed, time after time. We all know what that leads to, and it is NOT pretty.

MIPS Performance in 2018…

Actually, MIPS performed OK in 2018 (like, did not lose money in a down market). MIPS was up about +1%, while the S&P 500 was down about -7%. Many other quantitative models took a beating in 2018.

From TimerTrac.com MIPS +1% Standard & Poors 500 -7%

Red dots represent "trades"...

Here Comes 2019…

2019 is starting off with a Bang...

.

China remains a headache but it is not overbearing. And, our economy remains strong.

There are billions of dollars flowing back into the market so far in Jan’19. The market got a boost from the Fed after Chairman Powell said the Feb will be “flexible and patient" regarding rate hikes in 2019. Last Friday, earnings reports showed 312,000 new jobs created in December versus 155,000 created in November, and 180,000 “expected” in December. Can’t beat that !!!

In 4Q’18, Corporate earnings growth has average 15.4%, with Corporate revenue growth of 6.2%. Average hourly wages rose 0.4%, the largest gain in 4 months. The year-over-year wages growth is about 3.1%.

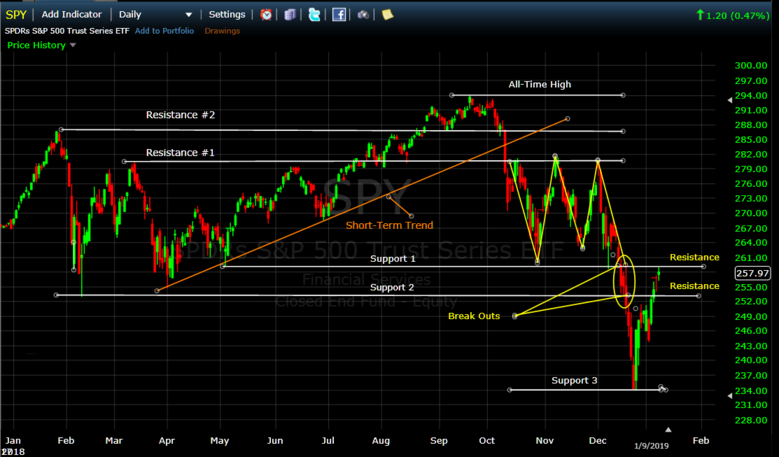

After a strong recovery in the last four days in Dec’18 and in the first six days in Jan’19, the SPY has “recaptured” a little over 50% of the “drop” that started in early Dec’18. See graph and text below...

The challenge going forward is for the SPY to break above the second Resistance levels on the right hand side of the graph above. On Monday (Jan 7th) the SPY broke above its first Resistance level at 253.1; and then it stalled right on the second Resistance at 259.1 today (Jan 9th). It is highly likely that the SPY may stall at this level for a few days or even drop back below it.

On the other hand, if the SPY breaks above 259.1, it would most likely move up significantly to test its higher resistance levels shown above (or even move into new high territory). Although not expected at this time, the SPY could of course, just as easily head back down to test the support levels below today’s price. That could result in a drop to 234.1, or lower. And, it if breaks that level, we will head for the hills (that is, go Short and make money).

Stay tuned. It’s anybody’s guess, but MIPS is watching…

Good Trading…

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

www.mipstiming.com

281-251-MIPS(6477)

Thursday, January 03 2019

It is important that you understand why most of the MIPS models have recently (last 2 months) been issuing many more trade signals than they would under "normal" times. [And, no... there is nothing happening that the MIPS models cannot handle, as has been the case with many other models in 2018.]

Remember, between the twelve years of 2007-2018, the MIPS3, MIPS4, and MIPS/Nitro models have traded an average of 12-15 trades/year; with some years trading 4-5 times and others trading 15-20 times.

The MIPS models are known for being able to avoid getting whipsawed in flat/sideways markets that can last 10-15 months. Our models do this mainly by either keeping the position that it had going into the flat market (long, short, or cash) or simply by going to cash often. That is mainly why the MIPS models traded only twice in the first 10 months of 2018. From the graph below, in these 10 months, you will see some "wobbling" in the 1st quarter (where MIPS only traded twice) and then a rather strong "Short-Term" trend line (brown line in graph) from the end of March to the middle of September (where MIPS stayed Long). So, during this time, the MIPS models were mostly Long, and traded only twice.

However, from the middle of October to the middle of December, the SPY went sideways again in something like a pattern-within-a-pattern (see the yellow trend lines between Resistance 1 and Support 1 forming a "W" Pattern). After the SPY broke out of the bottom of this pattern, as is the case most of the time after a market "breaks out" of a flat pattern, all hell breaks loose and high volatility becomes the norm. [See yellow "Break-Outs" to the downside near the bottom right in the graph below.]

This is where MIPS (and most other quantitative models) have their most trouble. In situations like this, MIPS goes into a "kind of" defensive mode, and seeks to limit losses. When there is any doubt of a sustained market direction, MIPS may simply go to Cash. And, to avoid getting whipsawed, the MIPS models internally build a "no-man-zone" around a potential trigger point. And, instead of the MIPS trade signals going from say Long-to-Short, the models will go to Cash in the "no-man-zone", with the result being trades like Long-to-Cash-to-Short (instead of just Long-to-Short). Of course, the same thing happens on potential Short-to-Long trades.

FYI- The MIPS models issued 10 trades in 2018, two in the first quarter and eight in the 4th quarter. This is not the norm as the modes trade as the trend trades (or to limit losses).

With these type of tactics built in, the MIPS models managed to provide gains of 1-3% in 2018, depending on the model; whereas the SPY benchmark lost around 6.5%.

While some models did better, other well-known and well-respected models lost between 6-15% for the year.

BTW, the drop from the top in September to the bottom in December was about 20%, and some people had to drink with that on New Year's Eve !!!

Happy New Year !!!

Paul Disetefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

www.mipstiming.com

Support@mipstiming.com

|