In mid-February, the market (the SPY) broke out of its sideways trading pattern ("No-Man's-Land") and headed to what one might have thought was a new uptrend. As always, however, the market had its own view on what it was going to do, and it does as it wants. As we all know, starting on March 1st, the market stalled and waffled for a few days.

Then, the SPY got slapped back into No-Man's-Land, with a big drop on 3/06/2015. Ironically, the catalyst for this big drop was "too good" economic news, after a surprisingly good new jobs report and shrinking unemployment. Of course, good economic news should be good for the market, and it ultimately will be. But, this was mitigated away by "fear" of the Fed raising interest rates in June or September, which "overcame" the good economic news because it "MIGHT" affect the Fed's actions months from now. From my experience, these "knee-jerk" reactions to what might happen bad in the future that could trump positive results that have already happened, usually fizzles out within a few days. And this is exactly what happened today (3/12/15). I must add that today's positive move was also aided by the "cooling off" of recent gains in the value in the dollar.

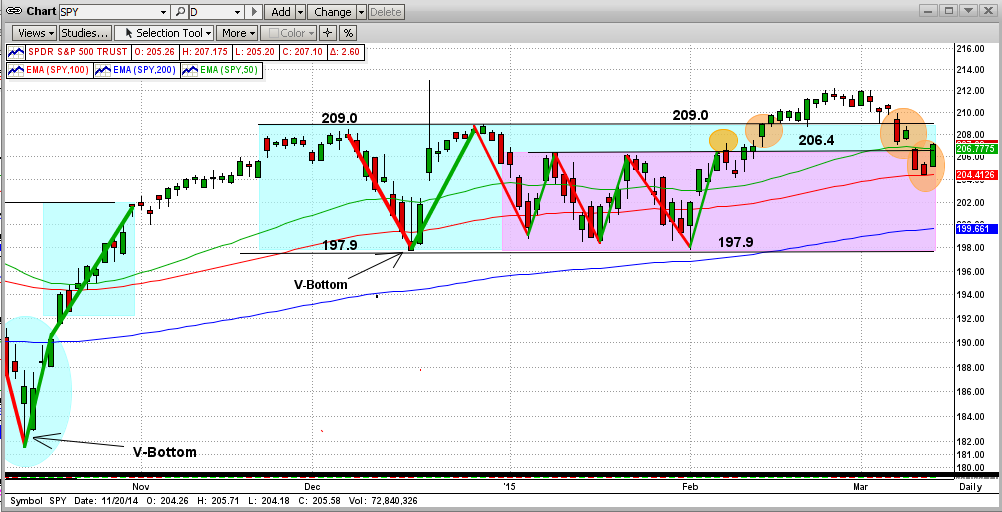

In the graph below (right-most orange circle), you will see that the SPY "held its ground" and bounced off of its 200-day EMA at $204.4 on 3/11/15; and then it climbed all the way back above its 50-day EMA to close at $207.1 today (3/12/15). I personally believe the market will go up from here, at least to again test the upside resistance at $209 on the SPY. What happens after that is anybody's guess, but MIPS will be watching closely for us. Stay tuned...

Hope this helps !!!

<<< Previous Blog >>>

From the graph immediately below at today's close, you will see that the advancing forces (the Bulls) made their way up across the battlefield (pink space) from 197.9 to the beginning of No-Man's-Land at 206.4, with little or no resistance.

Then, they carried on through the "moat" around the castle (blue space) in No-Man's-Land in short order, with few set-backs. But, the Bears "stalled" them at the castle wall today, right at the 209.0 level (see the right-most orange circle in the graph). BTW, the 209.0 resistance level is the SPY's all-time-high, and hence, could provide ultra-resistance.

The last time the market charged the castle's wall, the upside resistance was at 189.0 (2nd graph below). it took nine charges to break out of No-Man's-Land, and it did so to the upside.

In order for the Bulls to feel comfortable now, any break to the upside from here needs to be dramatic. Otherwise, we may experience a Bear provided trip back down to 197.9, or lower (no free ride).

Let's keep watching, but let's wait for MIPS to tell us what to do next !!!

- Stay tuned...