Press ? for keyboard shortcuts.

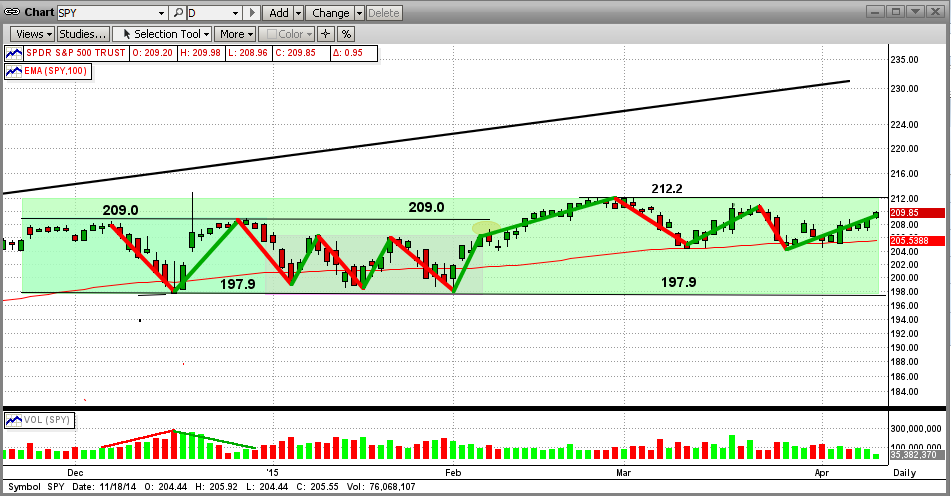

Talk about "A Market Going Nowhere, Fast" - you have just witnessed one. For the last FIVE MONTHS, the SPY has traded in a rather tight trading range of plus-and-minus 3.5% around the mid-line of a price range between 197.9 and 212.2 (see graph below). And, the SPY has experienced 12 short-term trend changes in this time period (if you can call them that). Even more remarkable is that, with all of these "wild" changes, the SPY on 3/31/15 was only 0.43% higher than it was on 12/31/14.

This has been a VERY volatile market. For example, the Dow experienced 16 days of triple-digit moves in March alone (that's 16 triple-digit days out of 22 trading days, or 73% of the days). These 16 triple-digit days accounted for 3,149 "swing" points for the Dow, and yet it closed less than 2% higher for the month.

The stock market continually experiences flat or sideways markets (aka "consolidation patterns"), but they rarely last 5 months. This one is long in the tooth. The stats show that: (a) most of the time the market breaks out of the pattern in the direction from which it came in (up in our case) and (b) the longer the time frame of the sideways pattern, the bigger the following breakout move is.

Obviously, this market has no short-term trend or direction now (other than flat-as-a-pancake), but the long-term trend is still up. The next few days are vital. In order for the bulls to keep running, the SPY must break above the strong resistance at 212.2 (its all-time high) with some degree of strength. If that does not happen in a relatively short period of time, the bears may get rejuvenated and may finally push this market down big, at least a "correction" if not the "big one".

One positive aspect of a long-term sideways pattern is that MIPS usually gets set to "trigger" faster after being "flat" for over 100 days (think of what that does to 20-50-100 day EMAs). Because of moves like this (or lack thereof), a small change can look big to MIPS after months of plus-and-minus 3%.

Until further notice, we are still bullish, mainly because the long-term trend is still up. No matter what, we will be waiting for the MIPS models to provide our future guidance (as usual). Stay tuned...