Press ? for keyboard shortcuts.

As you know, the MIPS models trade an "average" of about 12 times/year. Of course, this means that the models can trade as many as 16-20 times in some years (like 2008-2009-2010) or as few as 2-4 times in other years (like 2013-2014). This is not by design, it depends upon the number of trend changes (and the volatility) in a given year.

At any rate, we have many MIPS members now who like to trade more often with the MIPS signals. On our website, we have always offered traditional trading ideas under the "services" tab in our main menu. This includes trading ETFs like the SPY, IWM, QQQ, etc., on long signals and their shorts or inverse funds on short signals. We recommend that our traders include a large percentage of SPY in any of their trading profiles because this is what MIPS is based upon. But, a little of the others (up to 50%) is OK. And, for more aggressive investors, we also approve of using some leverage. Our favorite is being long 1.5x SPY on long signals and being short 1.0x SPY on short signals (we do this by investing 50% in SPY and 50% in SSO on long signals, and 100% SH on short signals).

MIPS models (MIPS1, MIPS2, MIPS3 and MIPS4)

Our "Services" section covers the above in detail, and it explains the pros and cons of trading with any of the MIPS trading models. Basically, we highly recommend MIPS4 because it is our newest, best model trading ETF funds on the "next day's Open". But, if you must trade on the "next day's Close" (as in many 401K accounts), we recommend that you use MIPS3. You would only use MIPS2 if you can can't trade (or do not want to trade) over about 6 times/year. Use MIPS1 only if you can trade only 1-2 times/year (not recommended, but still better than buy-and-hold).

FOR AGGRESSIVE TRADERS THAT WANT TO TRADE MORE OFTEN and do not mind some extra effort on their part, we have added a new section to our "Services" page called "AGGRESSIVE TRADING" (this has been added as a blue "button" on the top left of our "Services" page www.mipstiming.com/services ).

Or, YOU CAN READ EXCERPTS OF IT HERE...

STRATEGIC and HIGHER-FREQUENCY TRADING

Even though we DO NOT recommend the strategies below for the average investor, active investors and day traders have shared with us what they have done to produce great results, either by taking more risk or working harder to prepare for higher frequency trades. IN ALL CASES THEY ARE RELYING ON THE MIPS MODELS TO PROVIDE THEM WITH THE DIRECTION OF THE MARKET (and it has done so correctly 65--70% of the time in the last 9 years). Many times, these investors are managing only a portion of their MIPS money with the strategies below, and the rest with the recommended MIPS trading profiles in the "Services" section.

Higher Frequency Trading For Long/Short Investors:

1) Aggressive investors trade more leverage than 1.5x SPY. They may trade:

a) Double leverage (2x) long/short.

b) Triple leverage (3x) long/short (not recommended).

c) Double (2x) or triple (3x) leverage long and single leverage (1x) short.

2) Use the MIPS trends to trade options, futures, etc., "on the money", and renew them until the current trend changes

direction.

3) Follow the trend with MIPS, and rotate "high momentum" individual stocks:

a) Use a "stock screener" (Morningstar, VectorVest, Omni-Trader, etc.) to identify the best 5-10 top performing stocks,

buy them on long signals, and rotate them every day or week or month, depending on how often you want to trade.

b) Ditto the above to short the worst 5-10 performing stocks on short signals, and rotate them every day or week or

month.

4) Ditto #2 immediately above, but with "high momentum" ETFs instead of with individual stocks.

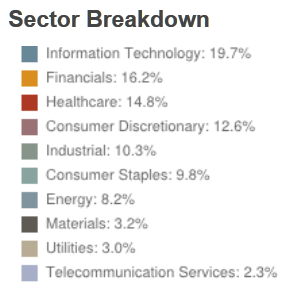

5) Trade the "hottest sectors" in the S&P 500 (instead of all sectors, which are included in the Index and the SPY):

a) On long signals, buy the top performing 3-4 S&P 500 Sectors (like maybe technology, health care, financials, etc.),

and rotate them every week or month.

b) on short signals, short the worst performing 3-4 S&P 500 Sectors (like maybe energy, industrial, materials), and

rotate them every week or month.

6) Most of us know Pareto's Principle as the 80-20% Rule. It implies that, in general, 80% of the effects come

from 20% of the causes (Google it). For the stock market, Marty Chenard from www.stocktiming.com coined

the 70-20-10% Rule. He proposed that 70% of your success in trading depends upon your trades being

"in sync" with market movements/trends (long in up markets, etc.); 20% depends upon you being in the right

sectors at the right time; and the remaining 10% depends upon the stocks that you buy in these sectors.

To implement this methodology, we propose that you follow the steps below:

i.) MIPS - the first part of your success should come from MIPS correctly identifying up/down trends

(you want to be long on uptrends; short on downtrends; and in cash on flat/sideways trends).

ii.) Hot Sectors in #5 above - The second part should come from your picks of the top 2-3 Hot Sectors as described, and

iii) High Momentum Stocks/ETFs in #3 or #4 above - The last part should come from trading the top 2-3 "High Momentum"

stocks or ETFs in each sector from ii.) above.

Of course, in down markets, you would do the inverse (look for the worst sectors, stocks, ETFs).

--------------------

Many of the above strategies can greatly increase the number of trades with MIPS signals without violating the trend. If MIPS identifies the trends correctly (which it has done very well in the last 9 years), and if MIPS members are willing to put in the extra effort, they could possibly make more $'s with the above trading strategies than by simply holding 1-3 positions (long or short) the entire signal life of every trade.

We do not track or report the performance of any of the above strategies.