This blog is an attempt to explain what went wrong with the MIPS models in 2015, and how we have "fixed" the problems. Section I explains the perils of buying SH instead of shorting SPY on short signals in high volatility markets, and Section II attempts to explain the risk of trading in markets that are changing direction continuously in only a few days over long periods of time. Section III explains "drawdowns" and timing models in general.

SECTION I.

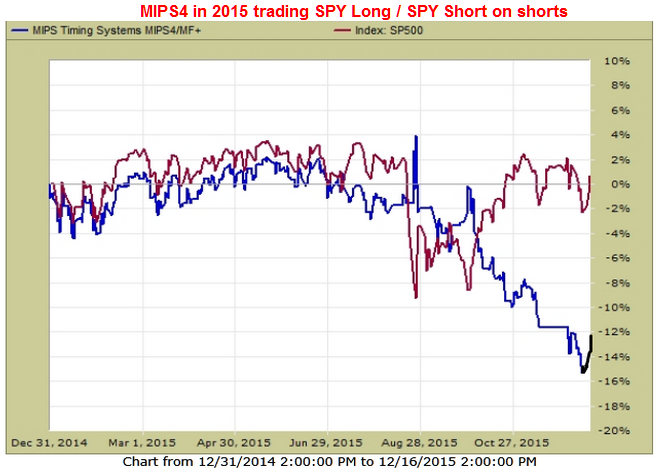

This first section shows MIPS4 drawdowns in 2015 that resulted from trading SPY/SH instead of trading SPY long/short. You will see that trading SPY/SH would have increased the drawdown in 2015 by 50% (from about -12% to -18%) !!!

The "standard" MIPS models trade the S&P500 Index SPY long and short

- some people believe that buying the inverse SPY500 Index (SH) will yield the same results as shorting the SPY,

but it can be much different (as in 2015).

- with high volatility, buying SH can be much different than shorting SPY (in normal times, we buy SH on short

signals; but, in highly volatile markets, we short SPY).

- in 2015, buying SH on short signals instead of shorting SPY would have lead to a 50% bigger drop

year-to-date (-18% vs -12%)

Note:

The high performance difference between buying SH on shorts instead of shorting SPY in 2015 was rare, as most of the deviation came on 8/24/2015. On that day, the overnight percent change in the SH was almost twice that of the change in the SPY. Since MIPS4 bought SH on the open of 8/24/15 and because the market recovered a large % of the overnight drop, MIPS got clobbered that day (shorting SPY would have been much less painful). See Graphs #1 and #2 below.

Graph #1 is MIPS4 trading SPY on long signals and shorting SPY on short signals

(-12% for the year)

Graph #2 is MIPS4 trading SPY on long signals and buying SH on short signals

(-18% for the year)

=============================================================

SECTION II.

The rest of the bad performance from the MIPS models in 2015, of course, was the result of getting whipsawed.

This "whipsawing" was a rare phenomenon that resulted from very high-frequency direction changes (every 4-7 days) over a long period of time.

For example:

For the first time in its history, the SPY experienced 29 direction changes in the first 8 months of 2015 !!!

And, the Dow had a one-day 1000 point drop on 8/24/2012, one of the largest in its history (this "killed" the SH).

The things I want to point out are:

The MIPS models now have new algorithms that identify: (a) flat markets, and (2) directional changes that

are too short-term to trade.

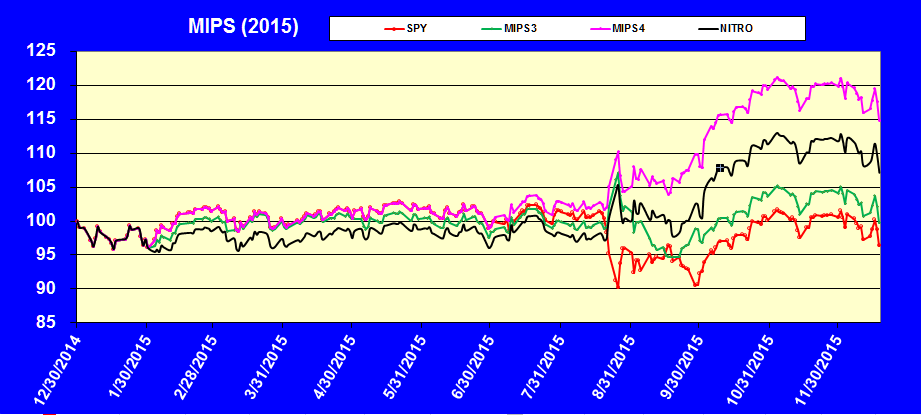

- after our fixes for high-frequency directional changes, the MIPS models produced gains rather than nasty

drawdowns

- instead of being down between 12-18% as before, the new algorithms would have produced gains between

1% to16% for the year

- and, instead of trading an average of 17 times as with the old models, the new models traded an average of

only 10 times for the year

- this is because some of the new algorithms "stay the course" (rather than trade) under certain

identifiable conditions.

2015 with the New MIPS Models

Red line = SPY Green Line = MIPS3 Black Line = MIPS/Nitro Purple Line = MIPS4

======================================================================

SECTION III

Please remember that, although 2015 was a bad year for MIPS, it DOES NOT mean that the MIPS models are not still some of the best timing models on the market today. No mathematical model is perfect and they all have "bad periods". For example, many nuclear power plants have been shut down because the control systems could not keep the plant temperature from rising; NASA has had to "intervene" hundreds of times to keep a space ship to the moon on its trajectory because the control system cannot do it correctly for 250,000 miles; etc.

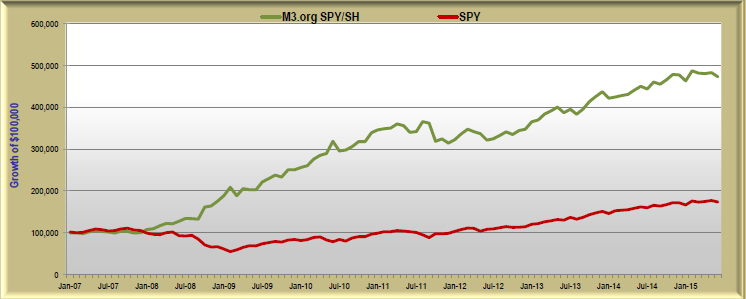

MIPS3 had a comparable bad period in 2011 and recovered nicely in 2009-2014 (see graph immediately below).

We are extremely confident that the same will happen with the MIPS models after 2015. And remember, the

current MIPS3 model is much better than the "original" M3.org model below, and MIPS4 is a much better model

than MIPS3.

MIPS3 2007-6/30/2015 CAGR = 20% Max DD = -10.6%

In our world, the Buy-and-Hold strategy has had two 50% drops (aka drawdowns) in the last 15 years and another one is due and coming in the next few years (or months). Virtually ALL of the best timing models on the market today that I know of, that have produced compounded annual growth rates (CAGRs) of 20% or better, have all had Max DD's of 25-30% over the last 8-10 years.

If someone somehow could produce a model with a CAGR of 24% per year with no setbacks, this model would double their money every 3 years! Of course, this means if an investor started with $10,000 at age 30 (and did NOT invest any more for the rest of his/her life), with a timing model like that above, their $10,000 would have a value of about $18.5 million at age 65. And, of course, if one started with $50,000 at age 30 (with no additional investment money), they would have over $93 million at age 65. BTW, if there ever was a model this good, the developers would be able to sell in on Wall Street for at least $50-75 million. You would never see it on the retail market for $500 per year.

Because of "setbacks" as in the MIPS models in 2015, very few people will experience the above; but, they should expect to do VERY much better than buy-and-hold if they use good timing models (like the MIPS models)

Stay tuned...