To successfully manage their "Nest Egg", everyone needs a good "Asset Allocation" plan. An Asset Allocation plan defines how much of your life savings you plan to allocate to real estate, commodities, equities, bonds, alternate investments (art, etc.), and cash.

This "lesson" is limited to how to go about investing your equities money (i.e., stocks, ETFs, etc.).

Needless to say, most individual investors do not do well investing in equities, especially the ones who manage their own money. Some use RIA (Registered Investment Advisor) firms, and hope for the best because they have no idea how the firm will manage their money. Still, that is a better approach than trying to trade against the pros by yourself.

This lesson is for individual investors who manage their own money (that is, buy-and-hold or trade for themselves). Please be aware that there is no real, concrete definition of a "Buy-and-Hold" strategy. For example, does it mean to pick, say, 30 stocks (as in the Dow) and hold them for retirement or for your kids/grandkids? If so, you would not have done well in the past, because most of the stocks in the Dow fifty years ago are gone.

And, the Dow has NOT been made up of the same 30 stocks for many years. When one of the Dow stocks goes bankrupt (like FW Woolworth), the Dow replaces it with another (like Walmart). Thanks. If I had a brokerage firm that would do that for me, I would buy-and-hold with them.

And, what about buying-and-holding say 10-15 mutual funds? Do you think that the fund management team is not trading in those funds. Many "turn over" 50-100% of their portfolio every year. Does buying a fund and letting the managers trade their butts off with your money in their fund make this a buy-and-hold strategy? Why is that different than you trading those stocks yourself? Does buy-and-hold mean that, if you buy a basket of stocks (as in a fund), and let someone other than yourself trade those stocks all year long (while you watch from the sidelines), that makes it a buy-and-hold strategy? But if you make those trades yourself, NOT ?

Anyway, most individual investors do trade, but it is at random and is usually the opposite of what they should be doing. I know, because I did just that myself for over 20 years. We watch Apple go up like a rocket and THEN we buy in. Shortly thereafter, Apple dives, and we switch to another stock that has been skyrocketing, like Amazon. Then we do the same thing with Amazon and Google, etc., over-and-over.

Most individual investors do the same thing with timing models as explained above for stocks. They subscribe to one model, and if it takes a relatively small "hit", they change models and continue the same process, over-and-over.

We are almost guaranteed to not do well in the stock market without two basic principles:

1) a good, specific strategy (like how, when, what to trade), and

2) the discipline to follow through with our strategy, WITHOUT emotion.

I am going to tell you how to implement something like that above and show you one way to improve on what you have been doing; in some cases by 400% or more... read on.

First, let's assume that we would be content with buy-and-hold if we could find high quality "Indices" in the world that would perform 3-4 times better than the S&P 500 (or its ETF, SPY) over say an 8-10 year period, with less than 1/3 of the drawdown of the SPY. Would that be a correct assumption? And, would you trade a little to accomplish this? If so, read on.

Let me show you what could be 3 of those types of ETFs from other countries on our planet (or something else) that performed as above. But first, let's establish the performance of our benchmark (the SPY).

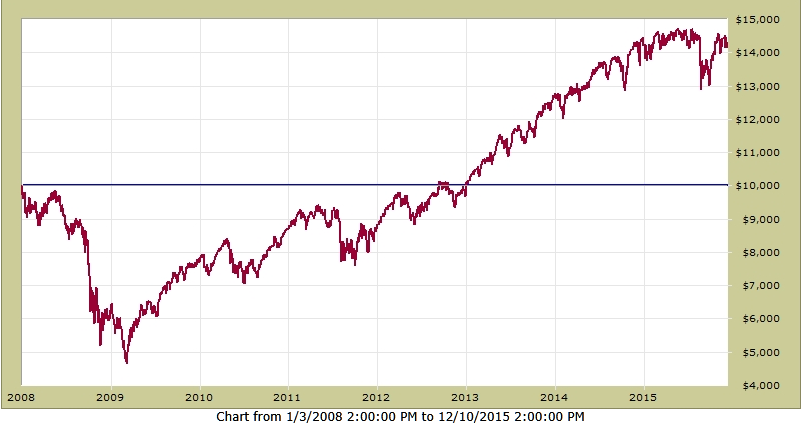

In the graph below, you will see that from 2008-2015, buying-and-holding the SPY would have:

1) grown a $100,000 investment to $143,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 4.5%

3) experienced a Maximum Drawdown = -53.5%

Could we have found other investments that would have beaten this significantly? OK, let's look at some other investments that we present herein say as "Indices" from other high-quality countries. See 3 of those below:

Country A - from 2008-2015, buying-and-holding the Country A Index would have:

1) grown a $100,000 investment to $240,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 13%

3) experienced a Maximum Drawdown = -28%

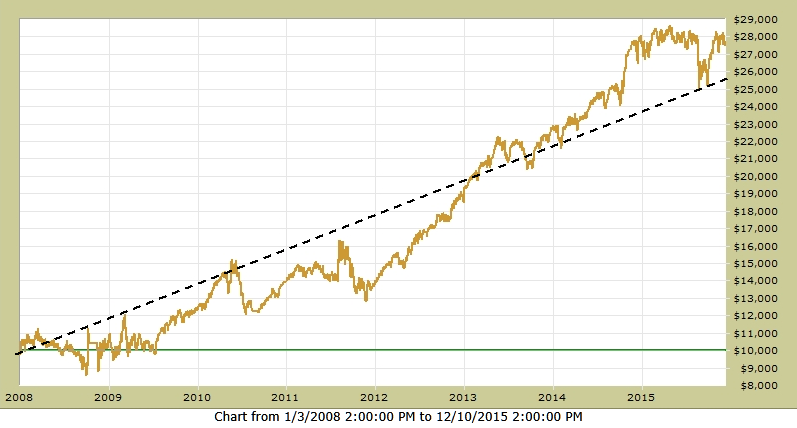

Country B - from 2008-2015, buying-and-holding the Country B Index would have:

1) grown a $100,000 investment to $280,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 14%

3) experienced a Maximum Drawdown = -24%

Country C - from 2008-2015, buying-and-holding the Country C Index would have:

1) grown a $100,000 investment to $450,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 21%

3) experienced a Maximum Drawdown = -19%

MIXING

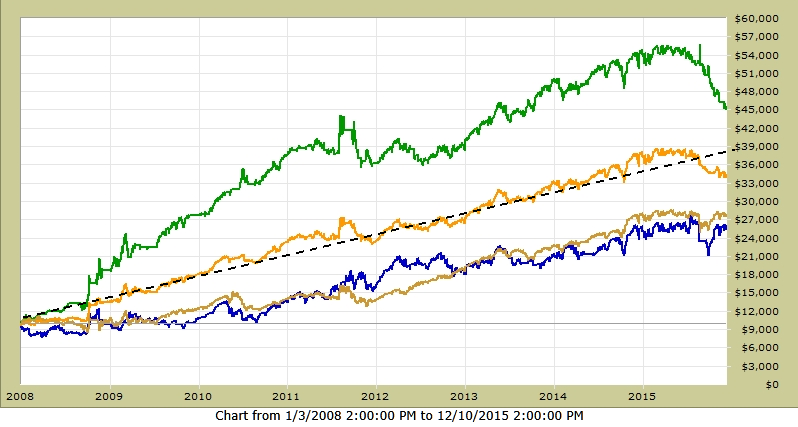

Our investment strategy would be to diversify our risk by placing a portion of our total equity money in each of these Indices. By investing 30% of our equity money in Country A; 30% in Country B; and 40% in Country C, the performance would be:

Combo - from 2008-2015, buying-and-holding the Country Indices and "mixing" as above would have:

1) grown a $100,000 investment to $350,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 17%

3) experienced a Maximum Drawdown = -16%

Combo is Gold; Country A is Blue; Country B is Light Brown; Country C is Green

Compared to buying-and-holding the SPY, the above strategy of "mixing" good indices does MUCH better, with VERY LITTLE RISK (Max DD=-17% vs -53% from the SPY)... see below !!!

Now "The Lesson"...

First, I have some bad news and some good news !!!

The bad news is that, even though the graphs above are "verified" actual performance, they are NOT Indices from other countries (sorry, but I needed to do that to get and keep your attention).

The good news is that the results in the graphs above (that are reported as from Country Indices) are from actual good, live models like MIPS. To make my point, I used MIPS3 as Country C and picked two other models from developers that I know that have verified results on TimerTrac.com for over 10 years. I know others (like on ThetaResearch.com) that are as good or better than the other two presented herein.

My point is that many individual investors who can tolerate 40-50% drawdowns from buy/hold of good mutual funds or from a group of large-cap stocks in the US or Europe, cannot seem to tolerate even a 20% drawdown from a timing model (or better yet, a combination of 2-3 good models) even though these models have outperformed the Indices/Funds by 300-400% !!!

Caution:

Please be aware that you cannot just pick 2-3 good timing models, mix them, and expect to get similar performance and lower drawdowns from the "mix". To get lower drawdowns, the individual models CANNOT be based on the same principles (like trend-following, reversion to the mean, sector rotation, etc). When the models are based on different principles, most of the time they have their "bad periods" at different times and this "smooths" the performance. For example, if you were using 3 models and one of them had a -15% drawdown when the other two were flat, the resulting drawdown for the "mix" would only be -5%. Etc, etc, etc...

Going Forward:

I am not in a position to "recommend" other models but I can tell you what to look for. And, we have several RIAs that use the MIPS models "mixed" with 4-5 other very good models, and their results have been amazing. I can introduce you to them. Feel free to contact me !!!

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC