Over long periods of time, investors disagree with each other’s views of “what” will happen to the market and what the catalyst will be that causes the “what” to happen. Some of the downside catalysts have been weak economics, poor profits, global unrest, etc.

Now, most all of us agree that the ultimate “catalyst” has been, and for the next 3-6 months will continue to be, Freddy Yellen and her near zero interest rates. No doubt that the Fed’s QE and its interest rate policy is what has kept the market from dropping or even falling apart. Money coming into the markets at a very high rate (as in the last 2 years) moves markets up; and extremely low interest rates is one of the strongest forces of money movement into the markets (round robin).

Freddy Yellen is running out of excuses, but will not raise rates until December of this (election) year. Of course, the fact that this is after the presidential election is just a coincidence, because we all know that the Fed does not let politics affect its decisions. If you believe that, call me about the ocean view property that I have for sale in Arizona.

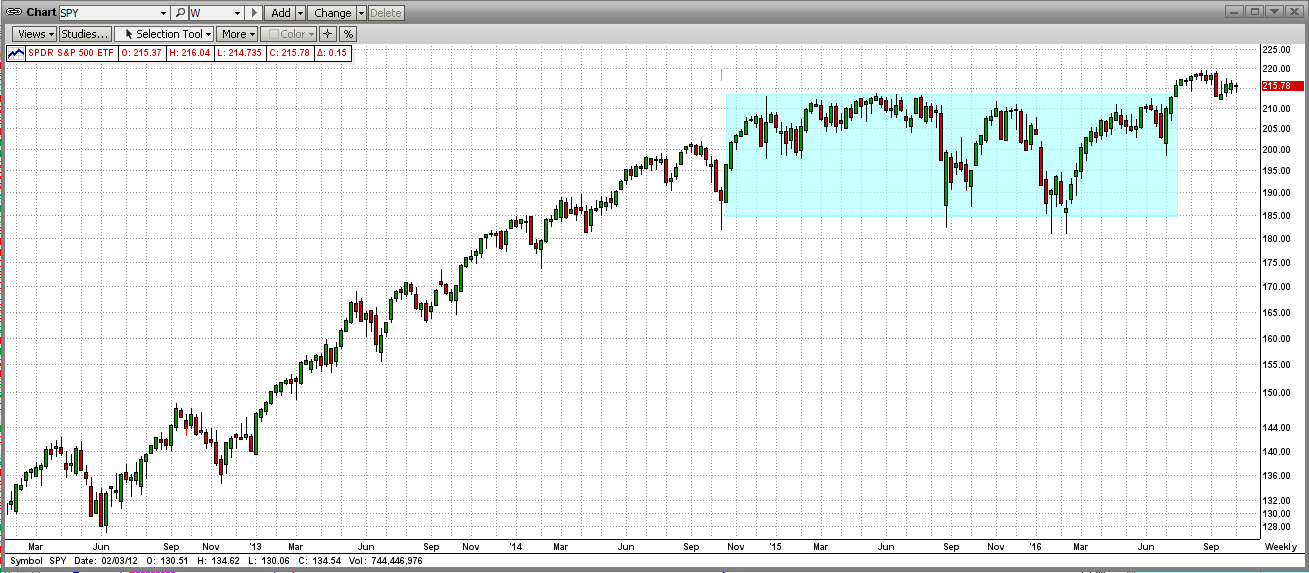

Because of the above, the market has been moving sideways for almost two years, one of the longest periods in U.S. market history. Multiple trillions have traded hands and the market has been flat for almost two years (see the graph below – weekly bars). You will notice that the “break-out” (if you want to call it that) over the last few weeks was weak and seems to be fading out.

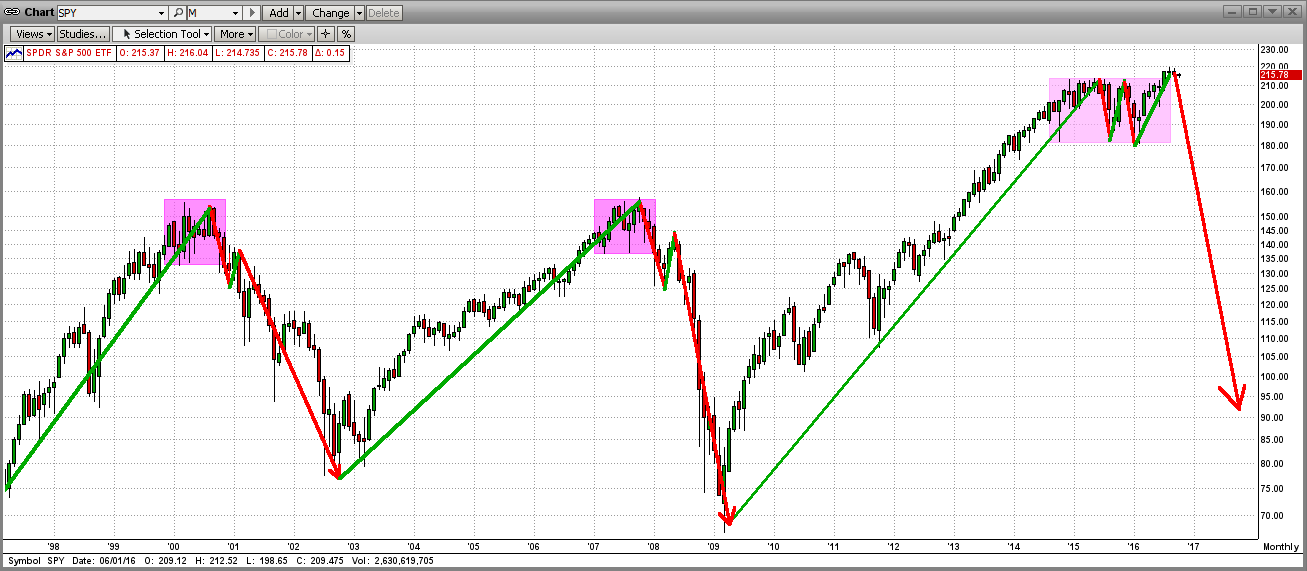

In the past, markets that have been flat at their recent highs for 1-2 years have been in a “topping” pattern, that is, forming a top. The “toppings” in 1999 and 2007 lasted 10-12 months and the topping in 2015-16 has been forming for almost 20 months (see graph below, with monthly bars). Does this mean that the market is ready for the “big drop”? Maybe, but maybe not… read on…

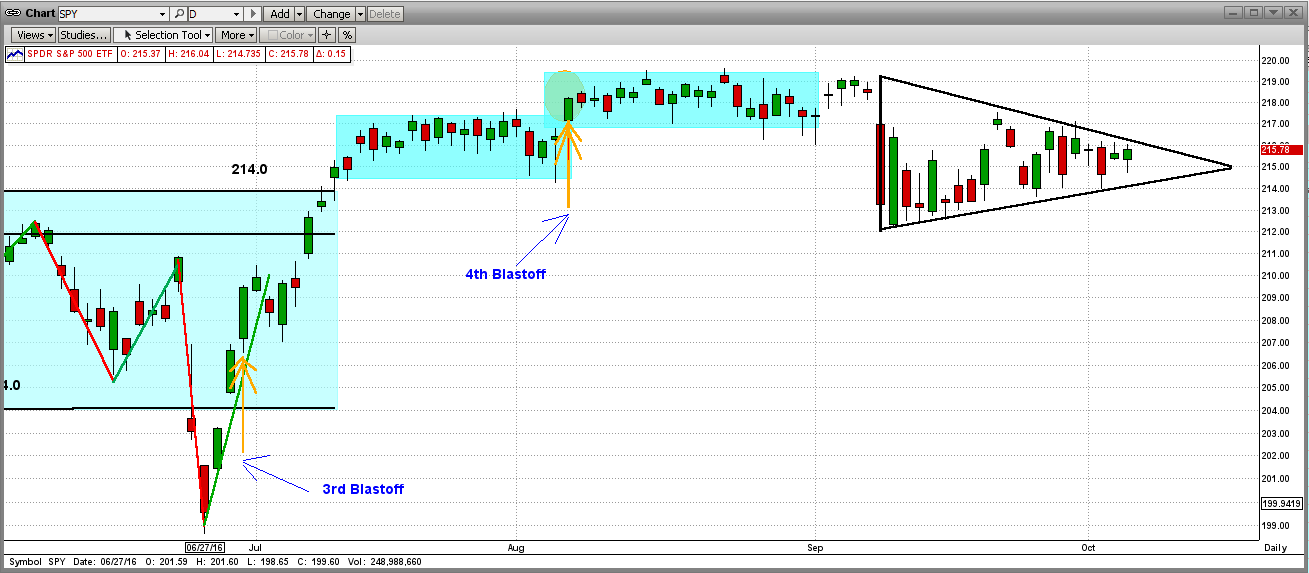

The last stand in the topping process may be happening now. See the “triangle pattern” in the graph below (daily bars). Even though it appears or feels that the market is ready for a dive, any good news for the Fed (like some bad economic or jobs data), could get this market back into the upside breakout mode.

For the last few weeks we have been in this trading triangle, and now this one is coming to an end. In the majority of times, a big market move happens in same the direction as that of the breakout from the triangle pattern itself. Time will tell, and we believe that that time is now upon us. Stay alert…

At the very beginning of this year, we released new versions of our MIPS models (Blaster series) that contain new algorithms that greatly reduce the probability of the models getting whipsawed in flat markets. Instead of trying (and failing) to find new trends in flat “trendless” markets, the models will stop trading in flat markets, and either keep the same signal or go to cash until the market starts moving in a definitive direction again.

This was a major project (9 months) that will undoubtedly provide much better results for the users of our models. The performances of the MIPS models YTD are approximate in sync with the performance of the SPY.