All investors were shocked by how fast the recent drop became an intraday "correction", and most were also shocked by how fast the market recovered. The Nasdaq has recovered about 80% of its drop and the S&P 500 (SPY) has recovered approx 65% (see chart immediately below).

In our last Blog (When is a Market Drop a "Big Drop") http://www.mistiming.com/blogs we mentioned that we thought the main reasons for this correction were rising bond yields, inflation scares, overbought markets, traders taking profits, the "fat kats" heading for the hills, etc. Most likely, this intraday correction was started by trading from very short-term institutional traders (not investors) taking profits after such a recent strong run-up.

At any rate, the SPY experienced a dramatic "one day key reversal" on 02/09/2018, and then it bounced off of its 200-day moving average with great force and formed a very bullish "up-hammer" pattern that day. Since then, the "turn-around" has recovered approximately 2/3rds (66%) of the drop.

So, where will the market go from here ???

We all know that none of us can answer that question, so let's look at what I think are the two most probable happenings.

1) The SPY could complete the V-Bottom and continue up from there. We believe that if this happens, the market will retain its bullish conditions and will continue up for the next several months. This, of course, would result from rising corporate profits, strong economy, strong job market, etc. Note: If the SPY does break up after completing its V-Bottom, it could come back temporarily to test its breakout level.

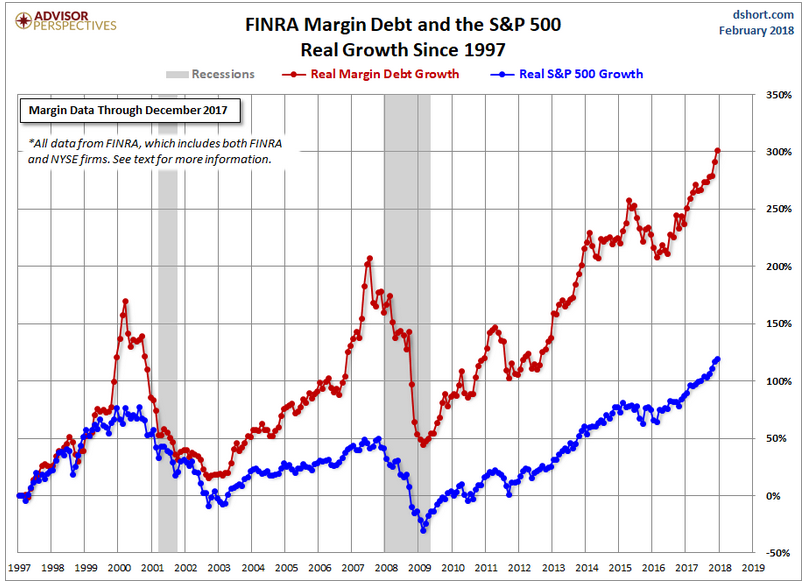

2) The SPY could go back to the all-time high where the correction started, and fall back into a full market crash. This would constitute what is called a "Double Top"; which is a proven, highly bearish pattern (1st graph below). If this actually happens in this market at this time, I believe that the major reasons would be the highly overbought market and the outrageously high margin debt at this time. In case you are not aware, the margin debt is basically the amount of money investors have "borrowed" to buy equities. When the margin debt is high, a strong pullback will force investors and traders to sell in order to pay down their debt. And, at this time, the market it is right up there with the highest levels in stock market history, and all market crashes have occurred at margin debt levels lower than it is now (see 2nd graph below). PS: This does not mean that high margin debt will indeed tank the market now, but it will be a strong catalyst somewhere along the way.

..

.

.

MARGIN DEBT

SO, WHAT DO WE DO NOW ???

If you are a relatively young person (say like under 35), you can make mistakes with your investment money now and still have a chance (at least a remote chance) to "make it back", so do whatever you want now. But, if you are over 40, or less than 15-20 years from retirement, you cannot make big mistakes now because you most likely do not have time to make it back even if you do the right things after your losses. And remember, the stock market experiences market crashes (drops of 40-65%) more often than once every decade (like in 1987, 2000, 2008 and ???). SO, TO GET THROUGH THIS ROUGH TIME, PLEASE USE MIPS OR FIND ANOTHER GOOD MODEL (OR MODELS) TO HELP YOU DECIDE WHEN TO BE INVESTED LONG OR SHORT OR BE IN CASH. And, if you do not know what to do, you can call me and I will tell you about MIPS and any other model that you may be considering.

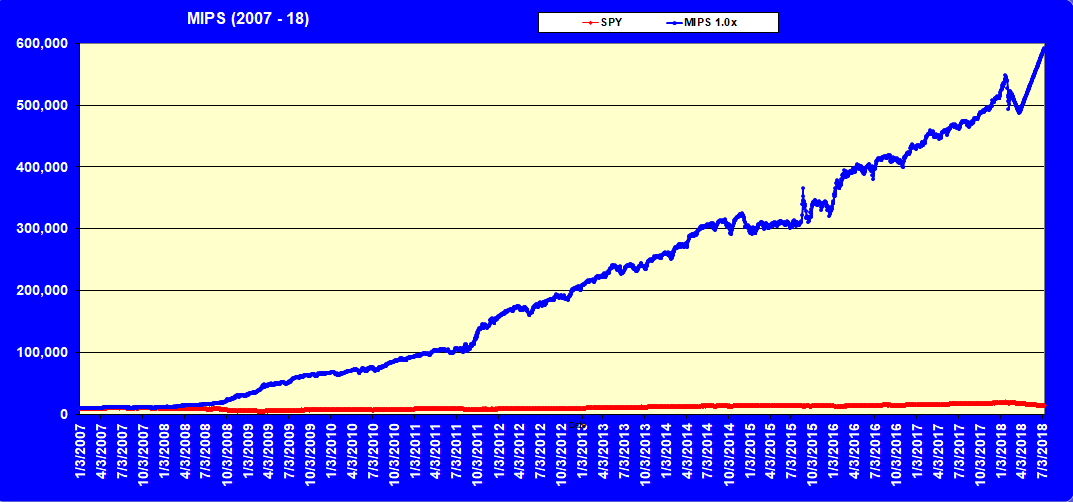

MIPS PERFORMANCE IN DOWN MARKETS, including now !!!

To help us understand what MIPS is most likely to do if the market drops 25% straight down over the next few months, we tested MIPS with many of its most reliable "predictive" algorithms to show us what the most likely outcome would be (see graph below). Results: MIPS would head down about 10% from where it is now, then climb back over 20%.

.

.

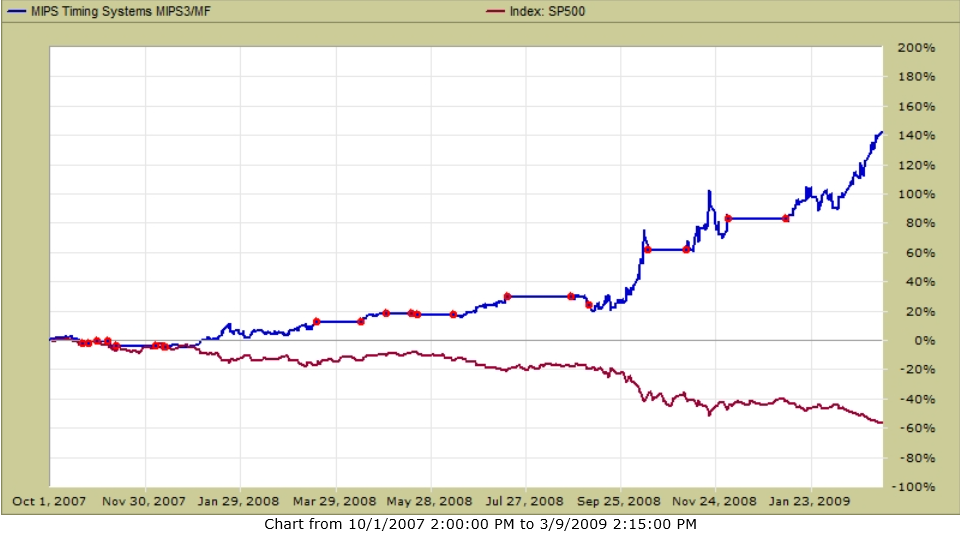

MIPS3's actual performance in 2008 (verified by TimerTrac.com)

MIPS3 +140%

SPY - 60%

PLEASE DO NOT TAKE A CHANCE NOW BY YOURSELF !!!

Best Wishes...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

281-251-MIPS(6477)