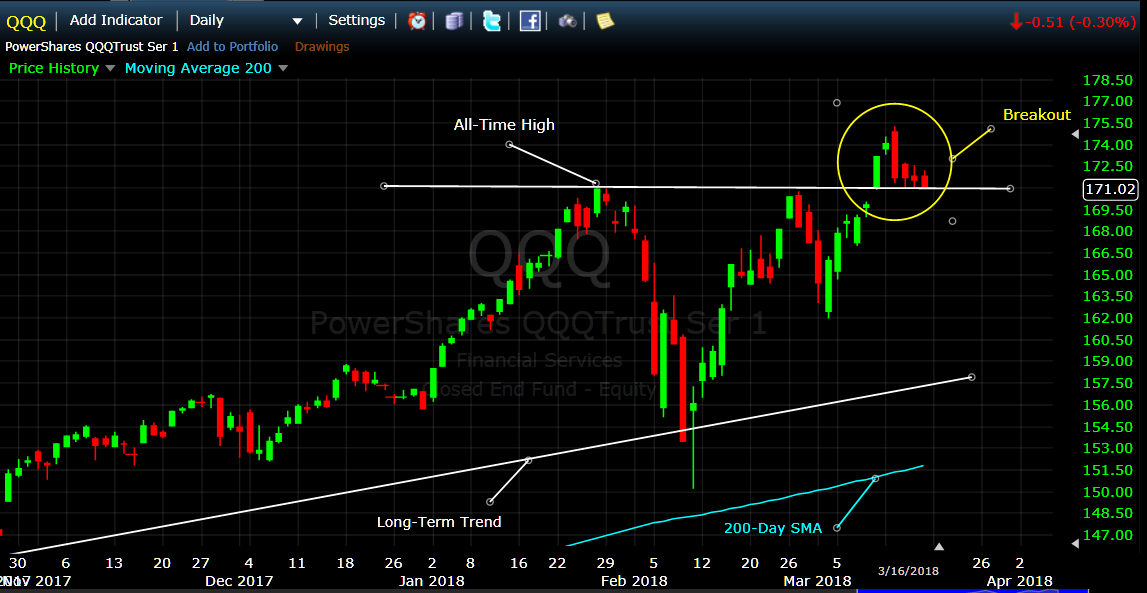

Week before last, the QQQ broke out to the upside and formed a new all-time high. The main

question then, of course, was "where does it go from here" ?

My answer then was:

"I expect the QQQ to climb higher, drop back to "test" this all-time high support level, and then

continue higher in 2018."

The first part of this was completed this week when the QQQ dropped back to test its support level at

around $171 for four straight days (see graph below). As you can see, the current support level held

steadfast at almost exactly $171 on each day.

From here, the QQQ could hold its support level and head back up for months; or of course, it could

break its all-time high support level to the downside and head back to test its previous support level at

around $150. My bet would be on the 1st option above, but I am no MIPS.

{BTW - In my opinion, the SPY will follow the same path as the QQQ.}

As far as which position we should be in going forward (long, short, cash), we need to rely on MIPS to

answer that.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

===============================================================

<<< Previous Blog >>>

03/12/2018

MIPS Members:

In our previous blog below, we pointed out that the SPY had broken out of its "triangle" pattern to the

upside, and that the Nasdaq 100 (QQQ) had climbed about 65% of the way back to its all-time high.

Since then, the QQQ has completed a "V-Bottom" pattern and has broken out above its all-time high

(see graph below).

From here, I expect the QQQ to climb higher, drop back to "test" this all-time high support level, and then

continue higher in 2018. Of course, this "climb" will be challenged by real dips, fake drops, volatility,

etc. Top management from many well-respected advisory firms see a strong possibility for this bull market

to thrive for another 2-3 years.

The challenge, of course, is to know when to get out of the market (or go short) WITHOUT chasing every

little fake dip and ending up getting whipsawed (nothing worse). The algorithms built into the Blaster

Series version of MIPS were designed to avoid getting suckered into trading every dip and ending up losing

a lot of your hard earned money. After much research, and through inputs from our MIPS family, we

have not seen nor been told about any other model on the market today that can beat MIPS in that game.

This is a time when we can either have a few more years with 20%+ gains, or a time when we give back

most or all of our gains from the last 8-10 years. Please don't "go it alone". Either use MIPS or find

another good quantitative model that did well in the market crash of 2008, and since then.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)