It looks like the Bulls are still hanging in after the big drops in February of this year. Technically, the trend is still pointing UP (thanks to the technology sector).

Like always, there are issues on both sides of the stock market.

In summary:

1) On the positive side we have higher profits, lower unemployment, slight increase in wages, etc.

2) On the negative side, we have the potential of serious trade wars with China, Germany, Mexico, and

Canada; serious political issues here at home and with North Korea, tightening monetary policy, etc.

My broad opinion is that, if we can avoid a nuclear war with North Korea or an all-out civil war here, the positive economic fundamentals will override all else, and the market will continue up for at least the rest of 2018.

To my knowledge, we have never had a serious market “Crash” (drops of 40-60%) when our economy is experiencing higher corporate earnings and high dividends. [However, many times the market will turn south when profits are still high because the fat-kats at large banks and financial institutions start selling when they get wind of falling profits long before we know (and believe me they have plenty ways of doing so long before we do.)]

THE MARKET IN 2Q’18+

In order to better understand the market performance in the first week after 2Q/18, let’s compare the 1st quarter graph to the 2nd quarter one (see graphs below).

The first graph immediately below shows both of the big dips in 1Q’18, and support holding at the SPY’s 200-SMA. Of course, this was a crucial point for the market, as it could have gone either way from there.

SPY in 1Q’18

Moving on to one week after 2Q’18, it is obvious from the 2Q’18 graph below that the SPY bounced up off of its “strong” support level (200 SMA) three times and crossed above the upper line of the triangle pattern.

SPY in 2Q’18

Market Driven by NASDAQ stocks

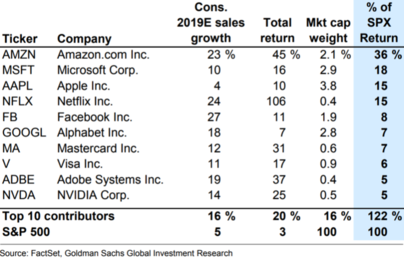

Market statistics show that over 100% of the 2nd quarter gains in the S&P 500 Index were from just ten stocks in the SPY, eight of which are from the technology sector (like the FAANNG stocks). The blue column on the right shows what % of the SPY gain the individual storks accounted for.

The performance in the QQQ emphasizes this behavior. Please note that the QQQ moved above its Jan'18 high.

QQQ in 2Q’18

From the above, one can see that the QQQ is heading back up toward it’s all time high for a second time in three months and with high momentum.

=============================

We believe that both the S&P 500 and the NASDAQ will continue up above their resistance levels and move into New High territory this quarter. But, remember, we are all going to follow recommendations from MIPS, not me.

Good Trading…

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

www.mipstiming.com

281-251-MIPS(6477)