|

As you look at the two graphs below, you will see either of:

1) Another Trading Range as in Chart #1, or

2) A New Up-Channel as in Chart #2.

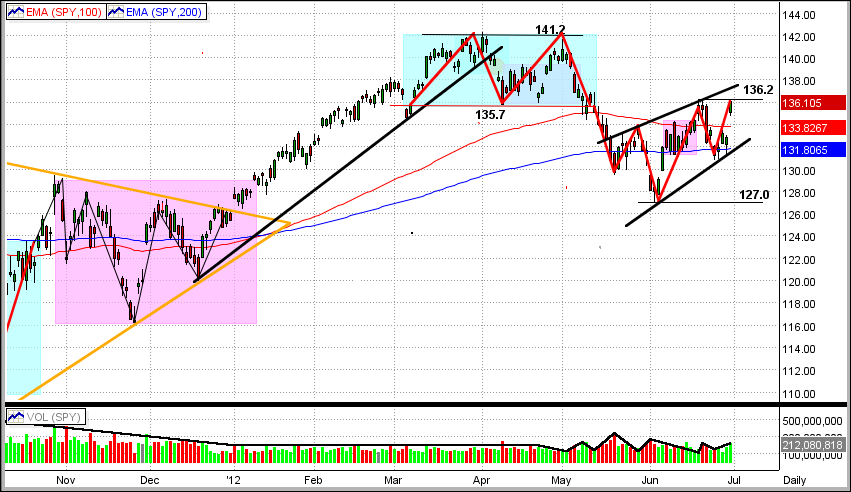

Chart #1 - Another trading range, with up-side resistance at 136.2 and downside support at 127.0

- If the SPY breaks thru 136.2 to the upside, we should have a rally

- But, if the SPY fails to break up above 136.2 over the next few days, the SPY will most likely

fall back to 127.0

Chart #1

Chart #2 - An Up-Channel, with higher highs and higher lows

- This market is definitely trending up, so the question really is: "Is this truly a new up-channel?"

- The SPY has been bouncing between 127 and 136 for all of 2012, so it's time the market finds a new trend

- The chart below seems to be indicating that its new direction will be up, but it could easily continue sideways

- So, let's let MIPS tell us what to do and when.

Chart #2

|