Saturday, December 22 2012

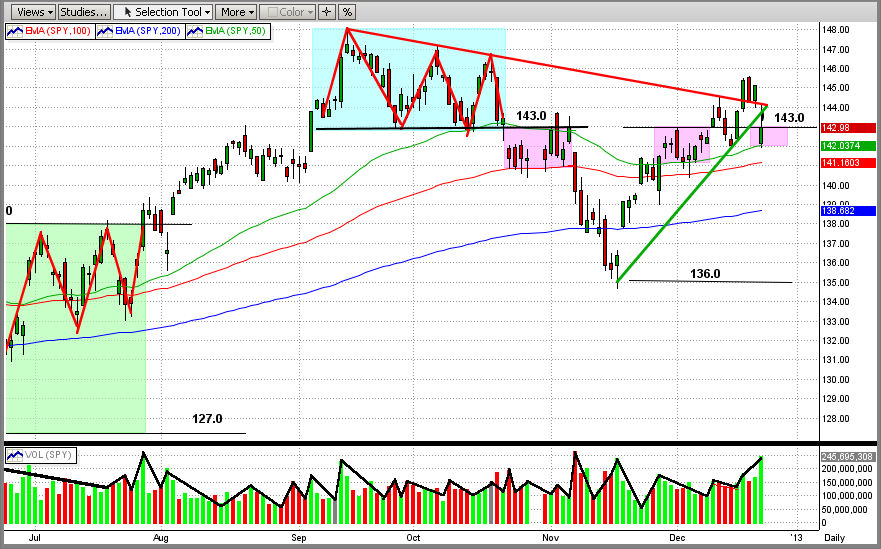

Responding to the bad news from John Boehner that he was calling off the vote in the House on the GOP's "Plan B" to avoid going over the "Fiscal Cliff", the SPY (and all other USA markets) fell substantially Friday. The SPY opened on Friday at $142.17 (approx $1421.7 on the SP500), which accounted for the downside "gap" of -$1.93 (or 1.34%) from Thursday's close of $144.10. Then, the SPY gained back $0.62 to close at $142.79, for a total loss of-$1.31 from Thursday's close (see the graph below). This $1.31 drop equates to approximately -$13 on the SP500 (or almost -1%).

An interesting phenomenon has developed in the market around $143/share (neckline of the triple top).

1) In late Oct/Nov, the SPY bounced between $143 and the top of the 100-day EMA for 2 weeks, and

then fell almost 5% to $136 (left-most pink box).

2) Then again in late Nov/early Dec, after bouncing off of its support at 136, the SPY came all the way

back and traded between $143 and the top of its 50-day EMA for 8 trading days, before it broke out

to the upside (middle pink box).

3) Unfortunately, the upside move did not last long, as the SPY again fell back to between $143 and

50-day EMA. This is where we stand now (right-most pink box).

4) If the SPY does not again challenge the $143 resistance and goes down from here, we would of course,

face an immediate correction.

5) On the other hand, another attempt by the SPY to break $143 to the upside would be its 3rd attempt.

We believe that, if the SPY does break above $143 on this 3rd attempt, the upside move will last a while.

But, if the SPY fails to break above $143, the immediate future could be very worrisome, or worse.

Of course, what happens to the US stock markets in the short-term (weeks) will most likely depend upon:

(a) what our "heroes" in Congress decide to do about our country's financial future (taxes, spending, debt),

if they can decide on anything at all, or

(b) if they will continue to prove that they are incompetent and can't get anything done, thus letting our

country fall over the "Fiscal Cliff" into a financial abyss.

[Sorry for my nasty tone in the above paragraph, but I am fed up with our congressional "leaders" on both sides.]

But remember, we can follow the above with interest but without having to decide which way the markets will go (or why), because we can rely on MIPS to tell us what to do, and when.

The above has nothing to do with the MIPS models, and are simply observations and/or opinions of the author.

|