This bull market move is now facing its most daunting situation since 2009. We are fast approaching a point of "Stone Wall" resistance. This "Stone Wall", of course, is the all-time, intraday high for the SPY at $157.5/share on 10/11/07 (about $1565 on the S&P 500).

What makes this so "daunting" is that $157.5/share on the SPY now would complete a very precise, almost perfect 13-year "Triple-Top". See

Graph #1 below (scary). If the SPY fails to break through this level to the upside (after a couple or three times), the results could be devastating.

Graph #1

On the other hand, if the SPY does break through to the upside and stays above or goes higher, this could lead to panic buying (or according to Greenspan, "Irrational Exuberance").

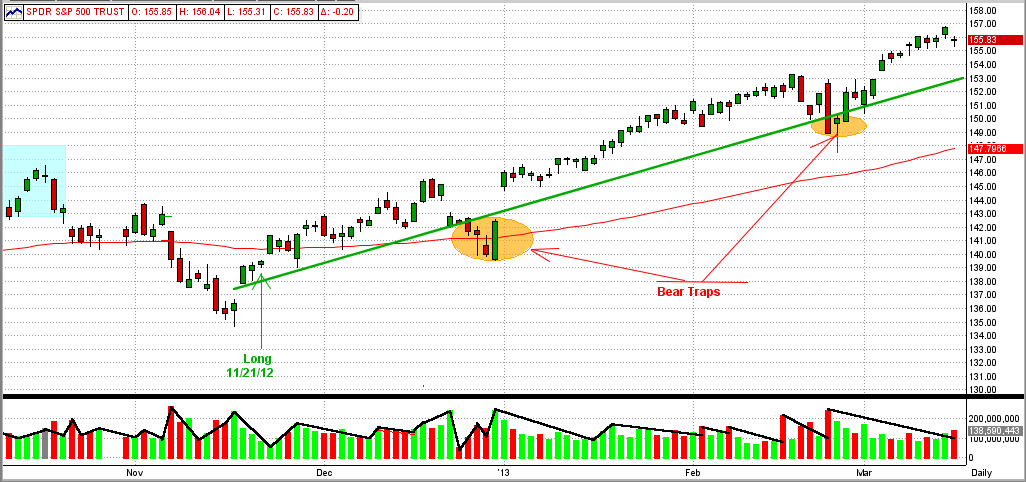

For the last few months, the big guys have been selling on high volume and the little guys have been "buying the market" back up. See the volume numbers in

Graph #2 below. Other than a couple of pretty weak "bear market traps" (which the MIPS models ignored) this market has been in a very obvious up-trend, and all of the MIPS models have been long since 11/21/12.

Graph #2

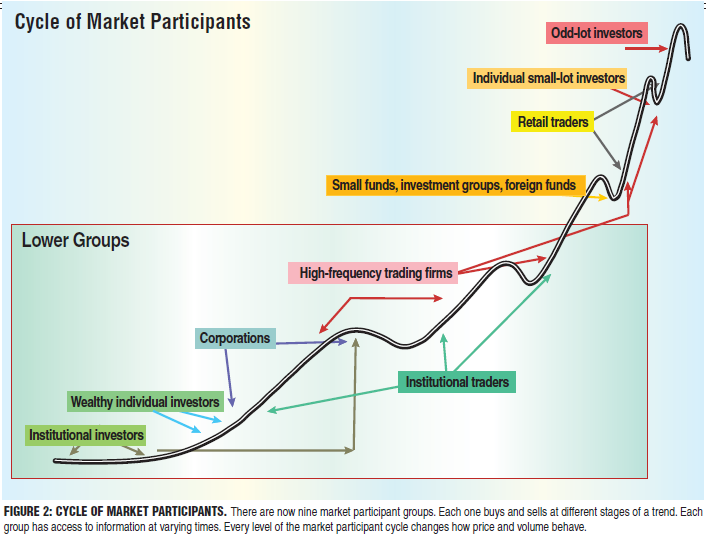

The little guy, big guy behavior

The little guy, big guy behavior above is a little nerve-racking, but remember that the little guys can come in en masse at market tops, and push it a lot higher (a la the NASDAQ in the late 1991's). See

Graph #3 below.

Graph #3 (from Traders.com)

Good Trading !!!