It seems as though no one has a strong feeling for where this market will go from here. The market has hit all-time closing highs in the major indices and the retail investors (the "little guys") are rushing back into a market that they missed to the tune of over $100 billion in equities year-to-date. Other things affecting the market now are potential defaults in Greece and Cyprus, financial crises in the other PIIGS countries, interest in what the large institutional investors and retail investors will do next, interest in what the Fed will do next, etc. As always, a large number of issues/circumstances should determine the market's moves from here.

But, is this correct? One could make a strong case that the market behavior from here is not dependent upon the tens of thousands of institutional investors/traders or hundreds of millions of little guys, etc., but mainly on the actions of one man, Ben Bernanke, Chairman of the Federal Reserve.

Supposedly to stimulate the economy, Helicopter Ben has been printing tens of billions of dollars every month ($120B in 3Q'12 alone), with no end in sight. Our national debt rose by over $1 trillion last year, and we have more debt than all of the countries in the European Union combined. This will ultimately throw everything into chaos. At this time, the USA can only afford the interest payments on our national debt because Helicopter Ben is artificially keeping interest rates on mid- and long-term US Treasury bonds extremely low ("Operation Twist"). This, or course, drives bond prices up and overrides the normal reaction of bond prices to the economic outlook. Also, on the equity side, we have high quality companies borrowing money at record low interest rates to buy back their own shares, thus driving their profits in $'s/share higher due to a lower number of shares, even if their profits never changed. How long can this go on without serious consequences? By the way, what the Fed does is NOT subject to the authorization or approval of Congress or the White House (how did we let that happen?).

In his own words, Bernanke’s plan is to quit printing money only when unemployment falls to or below 6.5%. That is kind of like a family in serious debt borrowing more and more money until "things get better", even when the extra borrowing makes the “bad things" worse. How is that for "chasing your tail"? At no time in the past has any nation become more fiscally sound by taking on massive additional debt. Historically, this has only led to high inflation and/or bankruptcy.

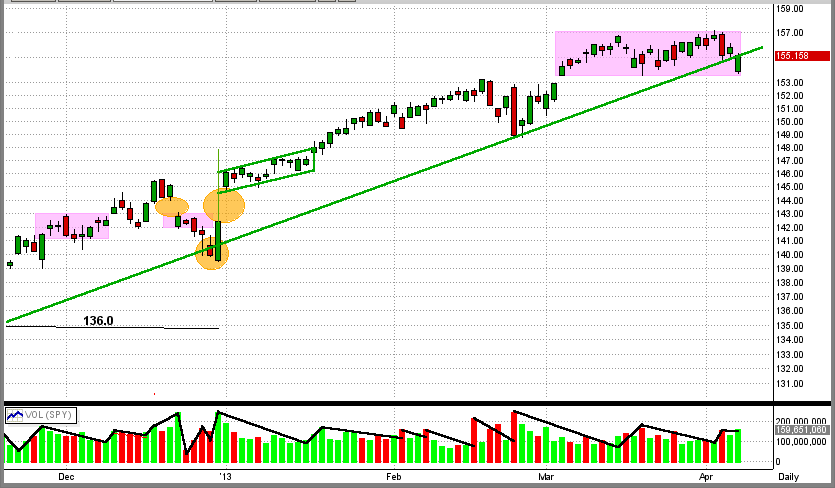

In our case, large institutional investors will not sit tight and let this go on indefinitely with no repercussions. Ultimately they will react. Thankfully, MIPS followers do not need to "call the market" themselves. MIPS will follow the market movements (mainly from the big guys by tracking volume), and will follow the new trend. In the last 4+ weeks, the SPY has moved sideways after breaking its all-time closing high. Usually, the size of market moves after breakout from a narrow trading range is somewhat correlated to the longevity of the flat trading range. This market can go higher with QE3 and little guys coming back into the market, but it is going to be an uphill battle breaking above the SPY price of $157.5/share (all-time intraday high).

See the graph below. The market (SPY) has been moving sideways for the last 20+ days (purple rectangle). The pattern of the market during this time has been a series of sizeable drops on relatively high volume (big guys), followed by a complete recovery over the next several days on low volume (little guys). Last Friday, the bears made a gallant effort to put a substantial dent in the market including a down gap on the open followed by a triple digit drop in the Dow, but the bulls spoiled the party by buying it back up to (and a little above) the intermediate-term trend line (long green line).

It’s anybody's guess from here, so we will depend upon MIPS to detect the next meaningful trend and tell us what to do.