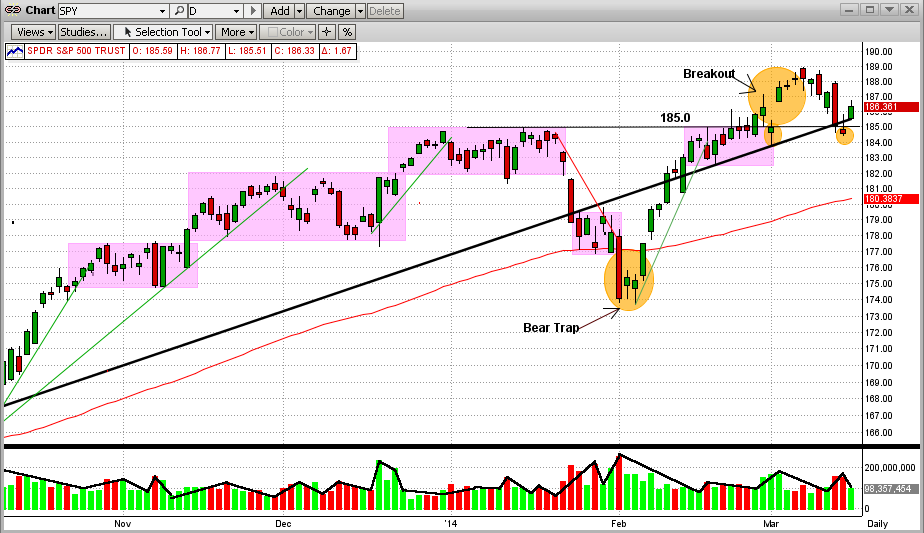

In our blog from March 4, 2014 below, we stated that we believed that the market (the SPY) had confirmed its breakout above its previous all-time high (and strong resistance level) of $185 per share on 2/27/2014. Of course, on that day its upside "resistance" at $185 immediately became its downside "support" level.

In that blog, we also went on to say that: "Most likely, the SPY will come back down to test this new $185 support level and the SPY must 'hold the line' there for this 'breakout' to be real and lasting."

And, that is exactly what the SPY did last week. As can be seen in the graph immediately below, after the SPY reached new highs, it dropped back down over 6 days and actually closed a little below its strong support at $185 (which now looks like a typical "bear trap"). Today the SPY rallied and closed at $186.33/share, thus technically again confirming the previous breakout. Now, the new upside resistance for the SPY is at about $188/share and the new downside support is at about $184.5/share. The next support level is the 50-day EMA, which is now at $183.4/share. It is important to notice that:

1) the two "pullbacks" in the last few weeks did not break the SPY's long-term trendline,

2) since MIPS does not follow "wiggles", the MIPS models did not get sucked into costly short calls, and

3) the volume on today's uptick was on healthy, but not high, volume.

All things considered, and from a purely technical standpoint, the market appears to be poised for more upside. But, there are many reasons why the market could pull back sharply (like the situation in the Ukraine, amongst may others). So, instead of trying to "guess" with our hard earned money which way the market will go from here, let's let MIPS do the heavy lifting and tell us what to do.

Paul Distefano, PhD

CEO/Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

<<< Previous Blog >>>

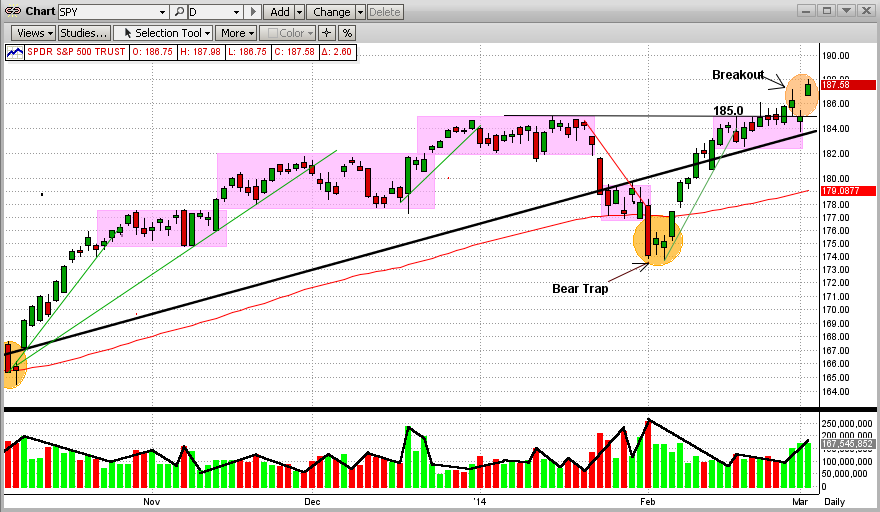

3/04/2014

MIPS Members:

In our previous Blog below, we showed a breakout of the SPY above its all-time high level of $185 on 2/27/2014 (Thursday) and a confirmation of this breakout on Friday. After a single day of dealing with Putin's ego on Monday (SPY back down to close a fraction below $185), the SPY bounced back up today to $187.85 (new high). And, it was very comforting to see higher volume on the up days (see graph immediately below).

All of this is good news for the bulls. The market should push even higher in the short-term (weeks/months). For this to actually happen, however, we need to see continuing higher levels for the SPY from here or at least several solid days above $185. Most likely, the SPY will come back down to test this new $185 support level and the SPY must "hold the line" there for this "breakout" to be real and lasting.

Still, its anybody's guess. To our benefit, we have MIPS to tell us what to do (all MIPS models are still long).