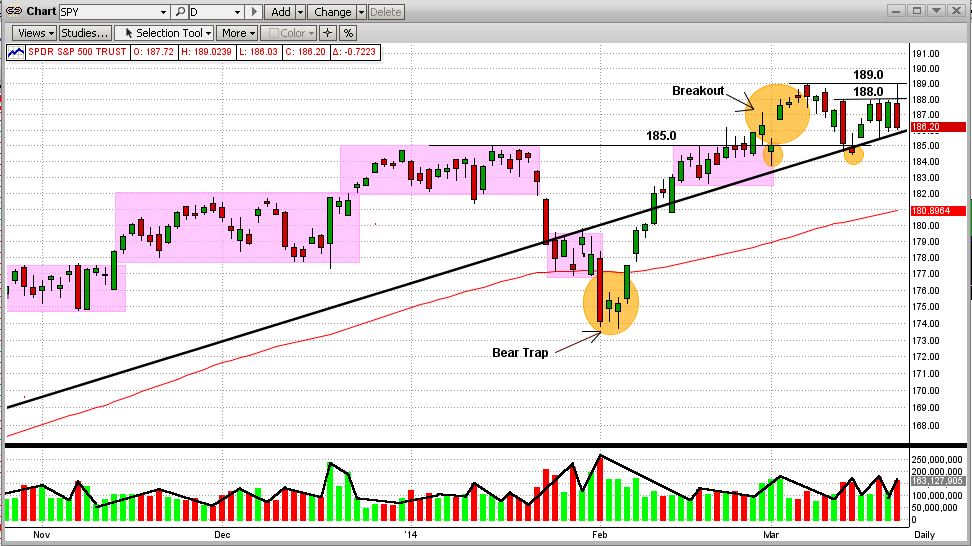

In our previous blog (immediately below), we showed that the SPY was having trouble breaking above its all-time high of $189/share.

Many times the stock market seems to follow the simple rule that after it tries something 3 times, it's time to move on and try something different (triple bottoms, head and shoulders tops, etc.). It seems like we are there again.

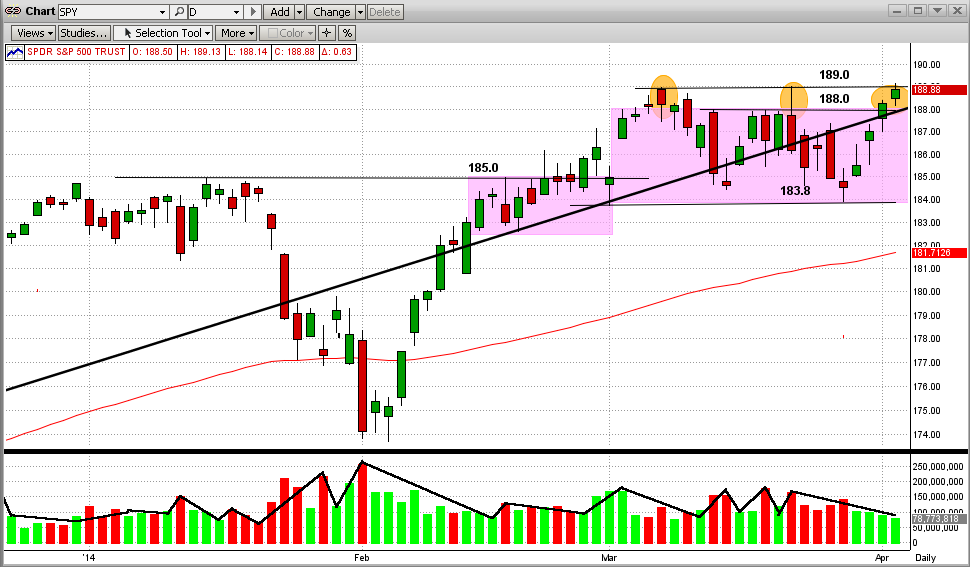

Better hold your breath as we seem to be in another "no-man's land". For the last 30+ days the highs/lows for the SPY were between about $184-189/share (plus/minus 1.3%). Looking closely at the graph immediately below, you can see that most of that time the SPY was actually between $184-188/share, breaking above $188 only three times. The first two times this happened, the SPY rose only to $189/share and was "slapped" all the way back to $184/share(actually to $183.8).

In the last couple of days, we see a "here we go again" movement. The SPY is back to $189/share again, and it did stick its nose slightly above that level for a short period of time today. If it gets slapped back again at this level, then $183.8 becomes the next support level (and then, it ain't pretty after that). On the other side, we are at the verge of the SPY breaking above its all-time high. Knowing that the S&P 500 closed above its all-time high today is very comforting.

But, when we remember that MIPS makes money in up and down markets, we really should not care which way the market moves from here. We have MIPS to tell us what to do, and when!!!

<<< Previous Blog >>>

MIPS Members:

The SPY proved today that the market's "Stone Wall" that has prevented it from surpassing its all-time high is still there.

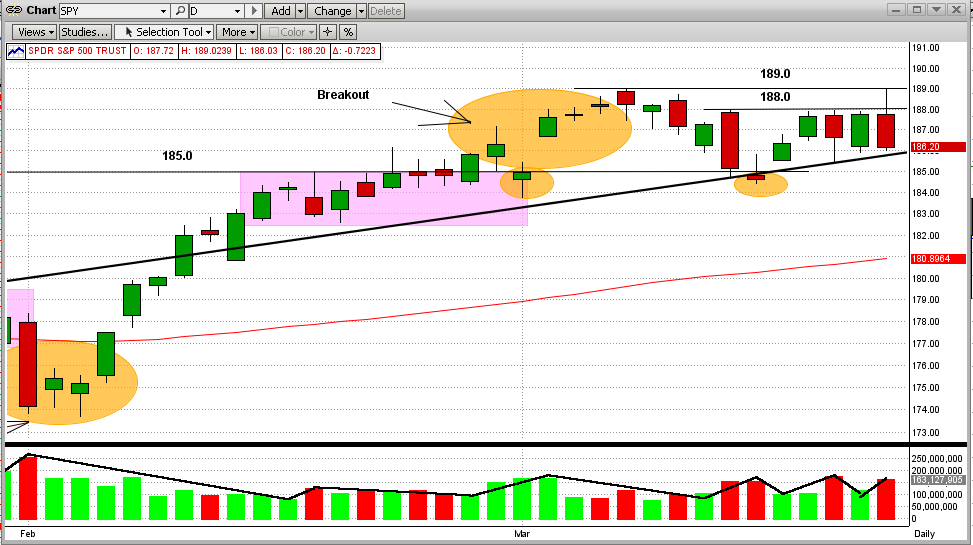

To see this plainly, please look at Graph #1 below:

1) The SPY hit its all-time high at $189 on 3/07/2014.

2) Then it trickled down for a few days followed by a big drop on 3/13/2014.

3) The SPY bounced back on the intersection of its trendline and support level at $185.

4) This uptick met an abrupt halt at $188, exactly where the big drop started several days before.

5) Since then, the SPY has tried and failed 3 more times to break above this "Stone Wall" at $188.

6) In fact, early today the SPY did pierce this level and climbed all the way to the all-time high level at $189,

only to be slapped all the way back down to the low of the day at $186.2 (see the 2nd Graph below).

7) The volume on down days was higher than on up days (bearish, but certainly not conclusive).

These movements in the SPY are more pronounced in Graph #2 below

Graph #1

In Graph #2 below, the SPY now appears to be in an "Reverse Pennant" or "Widening Wedge" pattern, either or both of which could prove to be bearish. As we all know by now, there are plenty of reasons why this market should have had a correction by now and really only one big reason why it should continue to climb higher. However, the one big reason (the Fed) is starting to lose traction.

It's anybody's guess where the market will move from here. But MIPS does not guess, it calculates all the likely options and chooses the one with the highest probably. And, it almost always beats my guesses.

Graph #2