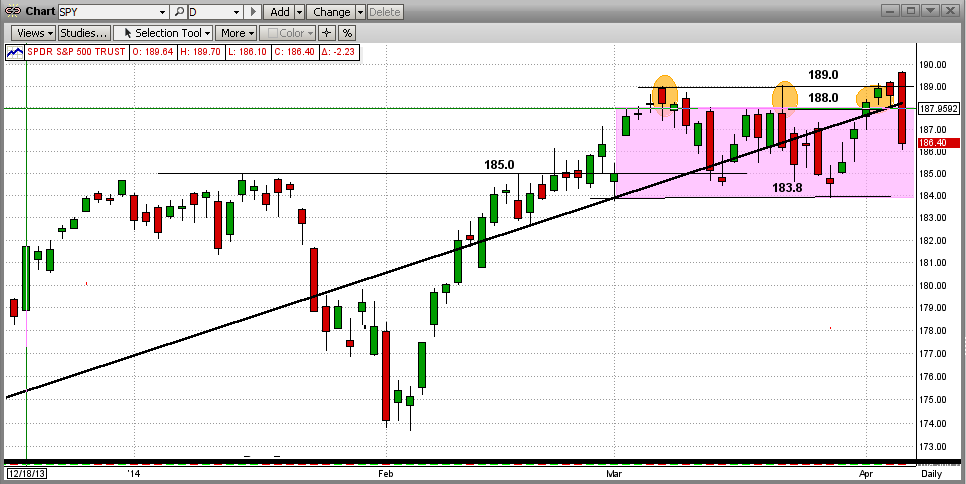

The stock market took a dive on Friday, but how bad was it? Actually, not so bad. On 4/03/2014, we sent out a blog with the title :"Hold Your Breath, We're In No-Man's Land". In this, we pointed out that the SPY had traded the range of $184-189 for the last 30+ days and had hit $189 three times, but had failed to break above that "all-time high" resistance level. You can see that in the graph immediately below. Well, it tried to do so again in the last two days, only to be "slapped" all the way back to $186.4 on the second try !!! That was about 1.7% from its high that day.

How bad was that? Well, we had comparable days like last Friday on Mar 26th, Mar 13th, and Feb 3rd, only to see the SPY come roaring back each time. So, how bad will last Friday really prove to be? And, how would you like it if this turns into a big "market crash"?

What "bad" should mean to you (or not mean to you) and what you should be (and should not be) worried about is discussed below. So, read on !!!

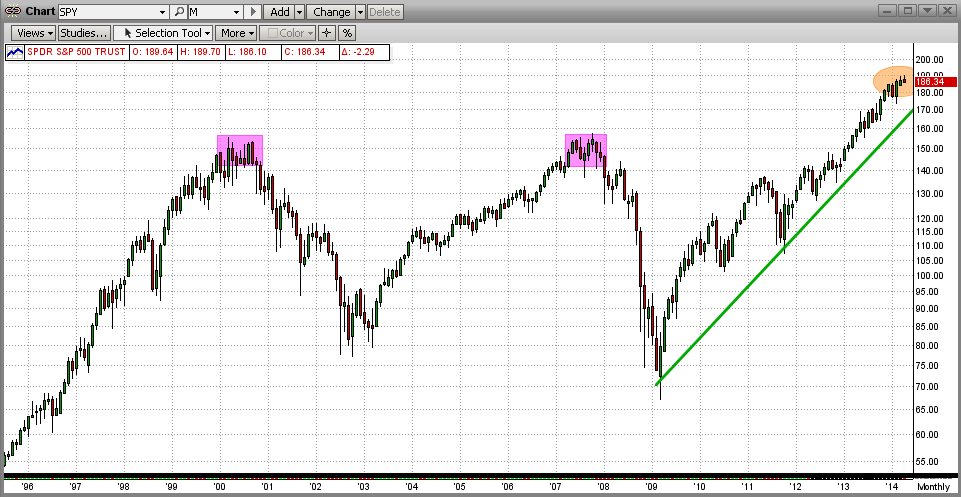

Another way to look at "How bad a day was last Friday" is to step back and look at Friday from a longer-term perspective. The graph below is the last two decades using monthly bars. From this we can see two things:

1) Looking at the last few bars (months), you can see that the market has been virtually unchanged.

2) In 2000 and 2007, it took the SPY 9-10 months each time to change direction from bull to bear markets.

Again, all of that watching and worrying for nothing !!!

PS - One of our most devoted MIPS members called Friday a collapse until she saw the graph below.

NOW FOR THE REAL POINT OF THIS BLOG.

MIPS members should NOT be worried about a market crash, they should be excited about one.

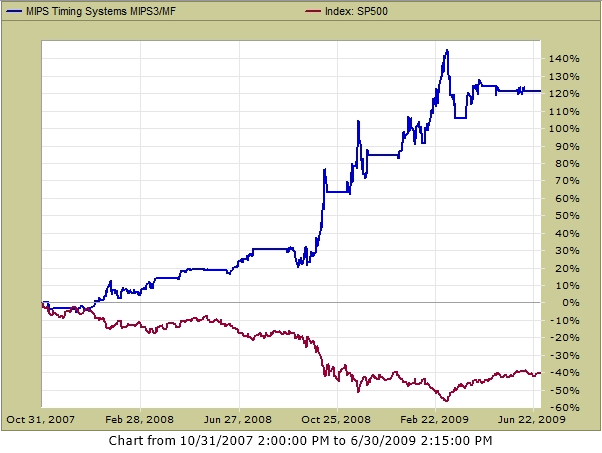

- The real reason that I am (and lots of our long-term MIPS members are) so relaxed is because of

the way that our MIPS3/MF model performed in 2008 (verified by TimerTrac.com)

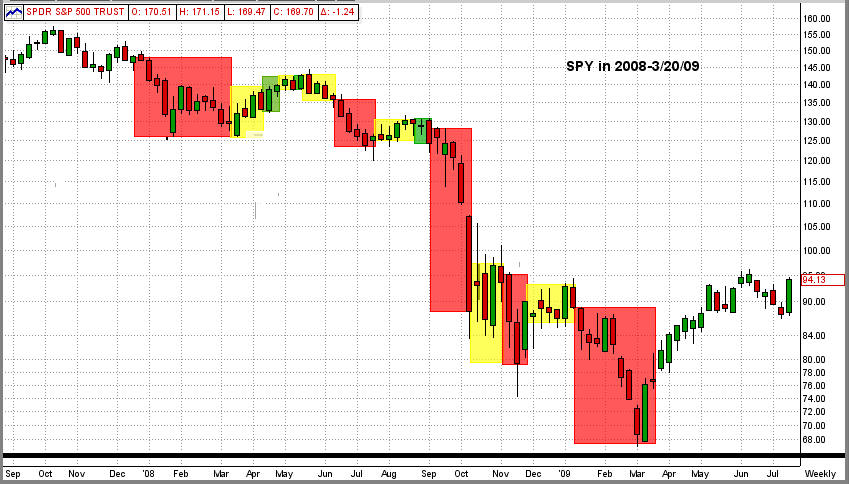

1.) MIPS Signals

Green = Long Red = Short Yellow = Cash

2.) MIPS3 Performance in 2008 (4Q'07 - 2Q'09)

FEEL BETTER NOW ???