As most MIPS members already know, we show several possible trading profiles for our MIPS models under the "Services" tab on our main menu at www.mipstiming.com.

CONSERVATIVE TRADING

Trading the SPY long only is the most conservative trading profile for our MIPS models, and trading SPY/SH is the most conservative for long/short trading.

AGGRESSIVE TRADING

Shown below are several trading profiles that are more aggressive than simply trading SPY/SH long/short. Of course, these trading profiles are for more aggressive investors. And, since we are NOT overly aggressive , we recommend trading a "mix" of ETFs, like 1/3 each of SPY, IWM, SSO on long signals and the inverse ETFs, SH, RWM, SH* on short signals (* where SH is the single leverage inverse fund for SPY because we do not like trading double leverage on shorts). This is the trading profile #4 below (CAGR=40.3%, Max DD=-12.1%).

See Perfromnace Results for the various trading profiles below:

Note: The scale on the Y-axis is different in each graph below.

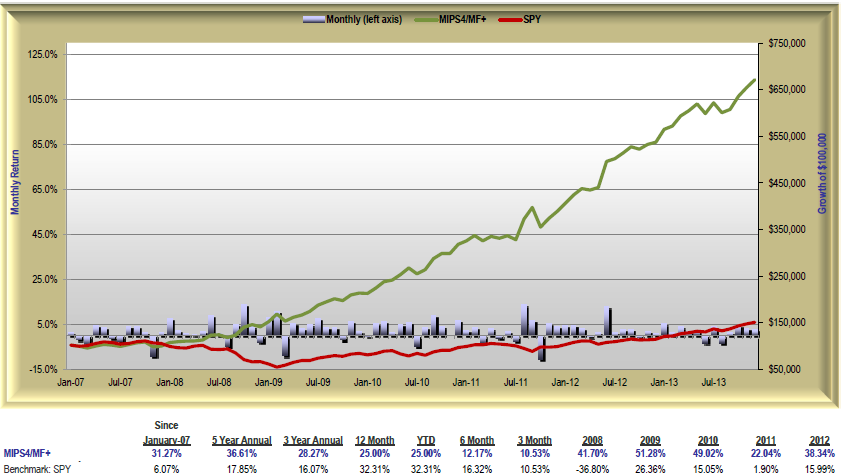

1.) MIPS4/MF+ Trading SPY/SH from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+31.3% Max Drawdown= -10.6%

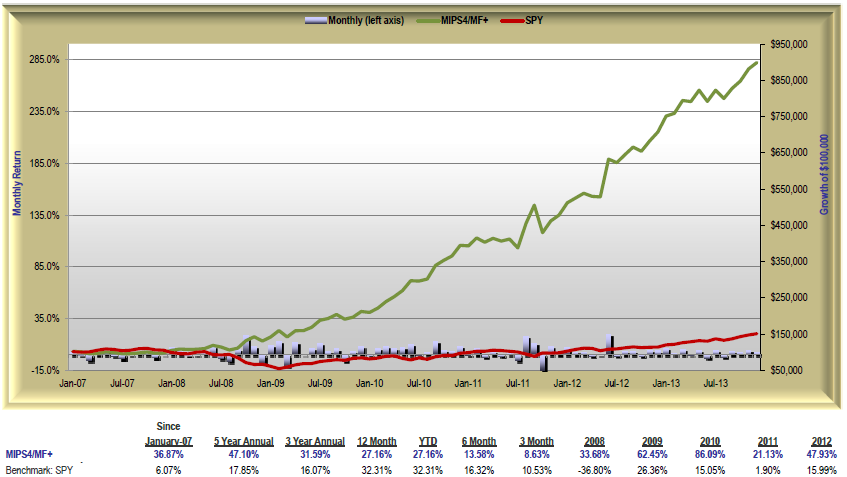

2.) MIPS4/MF+ Trading IWM/RWM from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+36.9% Max Drawdown= -15.1%

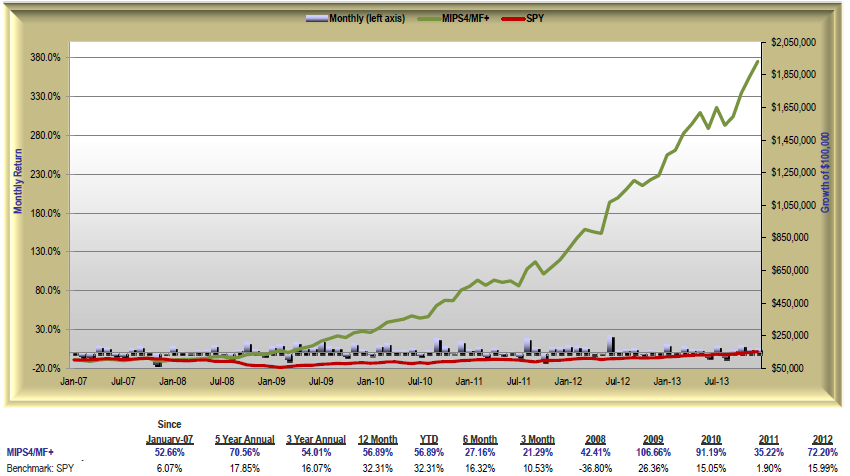

3.) MIPS4/MF+ Trading SSO/SH from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+52.7% Max Drawdown= -16.1%

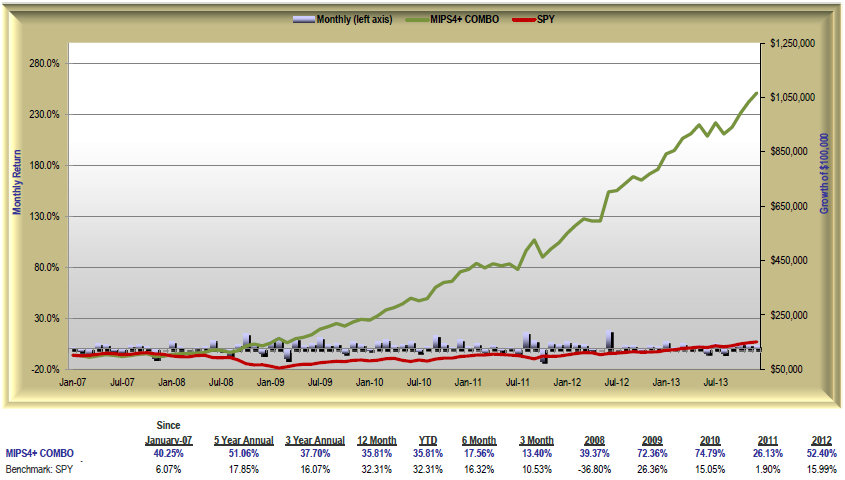

4.) MIPS4/MF+ Trading 1/3 each of SPY/SH, IWM/RWM, SSO/SH from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+40.3% Max Drawdown= -12.1%