8-19-2014

This blog is all about the latest short-term trend in the market, which started on 5/22/2014 with a breakout of the SPY after a 2-1/2 month sideways/flat market (remember "No Man's Land" in the purple box below). Of course, this is the tail end (so far) of a strong intermediate-term uptrend that started almost 2 years ago in Nov 2012 (black line). See the graph below.

Legend:

Green Curved Line = 50-Day EMA

Red Curved Line = 100-Day EMA

Black Line = Intermediate-Term Trend Line

Green Lines - Short-Term Trend Lines

Purple Box = Sideways/Flat Trading Pattern

Orange Circles = Significant Points

We are most interested in the pattern that started developing at the beginning of June 2014. This has evolved into what is called an "up channel". Swing trades will trade this as follows: Buy when the SPY hits the bottom channel line and Sell when it hits the upper channel line. Some very experienced swing traders can make money at this, but most amateurs get crushed (surprise, surprise). Most of the time, trading these patterns leads to getting whipsawed badly. For most investors, it is best to ride the uptrend by staying long (or short in downtrends).

The market (the SPY) traded in this range almost to perfection until the 3rd week in July when it failed to "hit" the upper trendline, and then it fell 4.3% over the next 2 weeks (from about 199-190). Also, during that fall, the SPY broke both its 50-Day EMA and 100-Day EMA. Of course, this caused many traders to go short, only to get whipsawed with a quick reversal a couple of days later. MIPS dodged this "Bear Trap" and stayed long. At the close today, MIPS was under its all-time high price by only 1/3 of 1% !!!.

For the uptrend to be re-established, the SPY will need to climb above its all-time high of $199.1 (on 7/21/2014). If it does we, along with 200 million other investors in the US stock markets from all over the world, will make more money on this uptrend (even better if you have a percent of your money in double leverage, like the SSO). Better yet, if the market does tank, we (along with a relatively few individual investors that "short" like the hedge fund managers do) will make lots of money. So, don't be afraid of the "Big One". Hope for and embrace it !!!

Sleep Well !!!

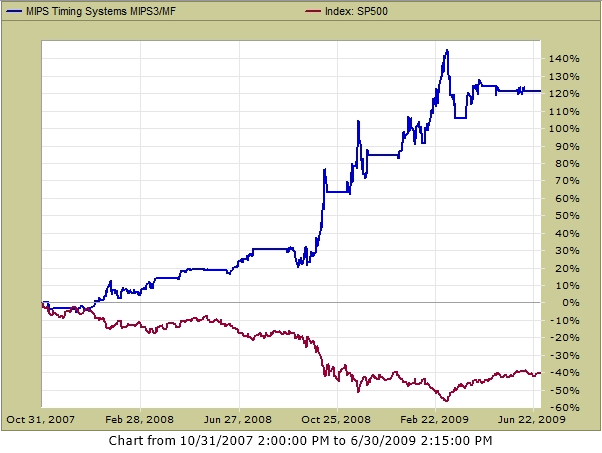

Remember what MIPS did in 2008?

- If not, see below

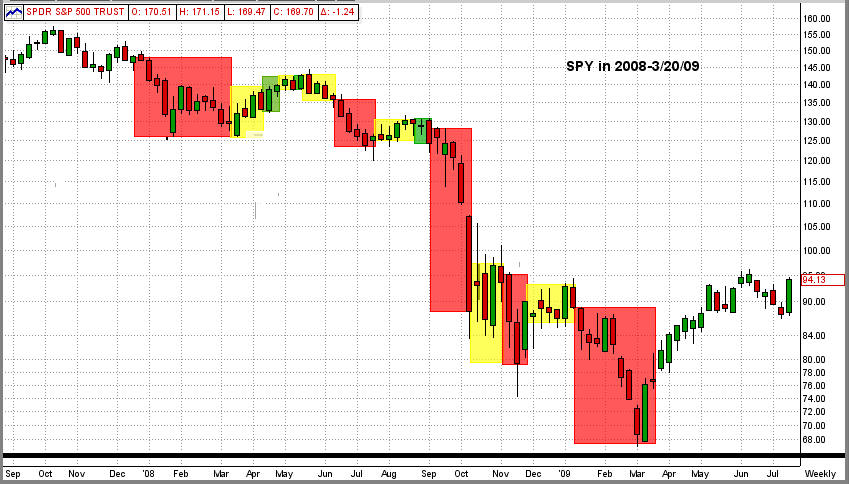

Red=Shorts, Green=Longs, Yellow=Cash

MIPS in 2008 (from TImerTrac.com)

- look forward to repeating something similar to that below