As you all know by now, the SPY hit an all-time high on 11/03/14 after a strong "V-Bottom" pattern following the big 4-week drop that started on 9/19/14. From this, one may think that we are in for a large number of "new highs" for months to come. Not so fast !!!

For that to happen, the SPY must clearly and strongly stay above its previous new high at 201.9. This could take several weeks like it did in the 3-month period in late April'14 to mid-May'14 (see the graph we called "No Man's Land" in our blog from 5/12/14 below). This was a long, sideways trading patten that took over 50 trading days of sideways trading before the SPY broke to the upside. This could happen again, but it does not have to.

There is tremendous "resistance" when the market approaches a new high after a big dip like the one we just had. Almost everyone in the market wants to "get out at the top" before a big dip. And, when they don't get out at the top and the market falls, most investors are kicking themselves and promising themselves that if the market goes back up to or near its last top, they are going to bail out!!! So, there is a tremendous amount of built up selling pressure at or near the last high, and, hence, it takes a tremendous amount of buying demand to push the market up through all of the looming sell orders. That is why the market can move sideways for so long at or near a strong resistance level.

From the viewpoint of the bears, if the market tries and cannot substantially rise above the "new high" resistance level after say 4-5 tries, the market will most likely drop all the way back to its most recent "support" level (which in this case is the bottom of the V-Bottom at about 191.6. (That's a long way down, but this would indicate a possible "correction" rather than an all-out market "crash").

Even though the market can move any way from here, my vote is up. But, my vote will not buy much. We need to sit back and relax (as if that is possible) and wait for MIPS to tell us what to do.

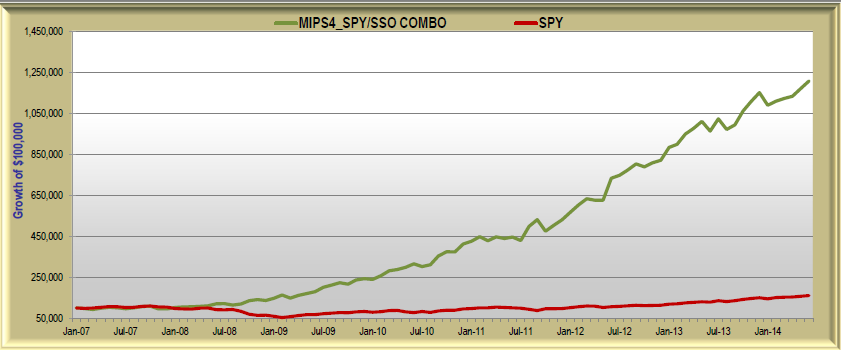

MIPS4/MF trading 1/2 each of SPY/SH and SSO/SH since 2007 (verified since 4/20/2013, backtested prior).

SPY CAGR = 6.6% MIPS CAGR = +39.4% Max DD = -12.2%