Friday, September 22 2017

ABSOLUTELY NOT !!!

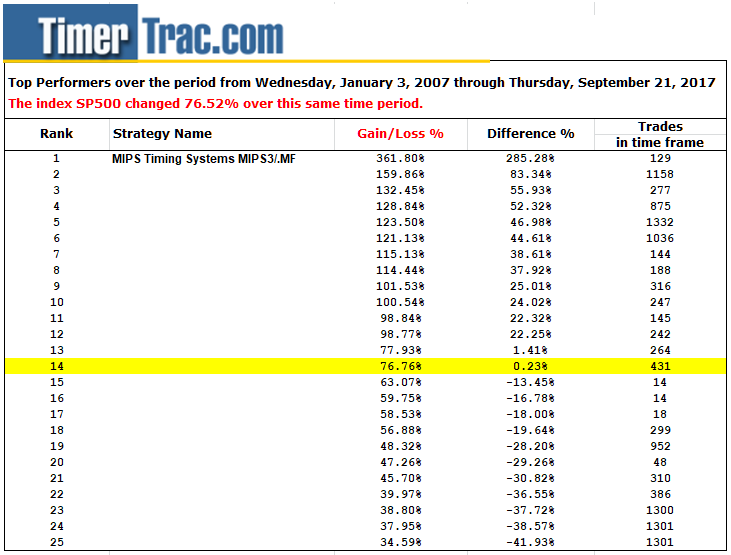

The table below shows the ranking of the top 25 models that TimerTrac.com tracked in the period of

2007 - 2017 ytd. MIPS3/MF is the #1 Ranked model out of the top 25.

Please note that the performance of these models is NOT correlated to the number of trades they issued.

For Example:

MIPS traded about 130 times in this 10-year period and was the #1 Ranked model with a gain of 362%, whereas the #25 Ranked model traded 1,300 times and was only up 35% !!!

Saturday, September 16 2017

We all know that the current up-trend in the SPY has been strong since Mar'16. There might be a slight degree of degradation at this time, but not much.

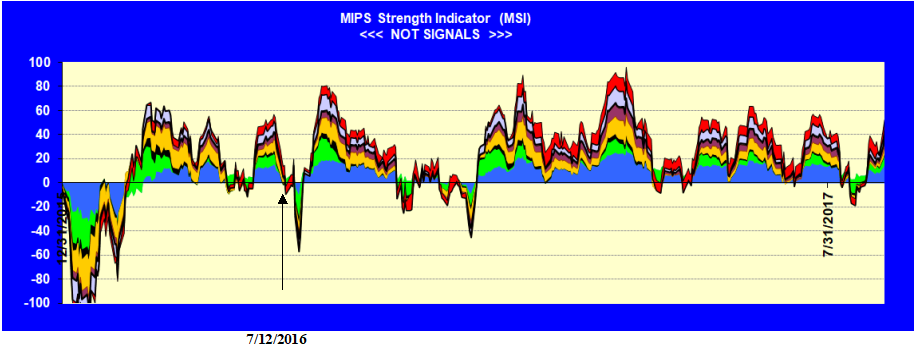

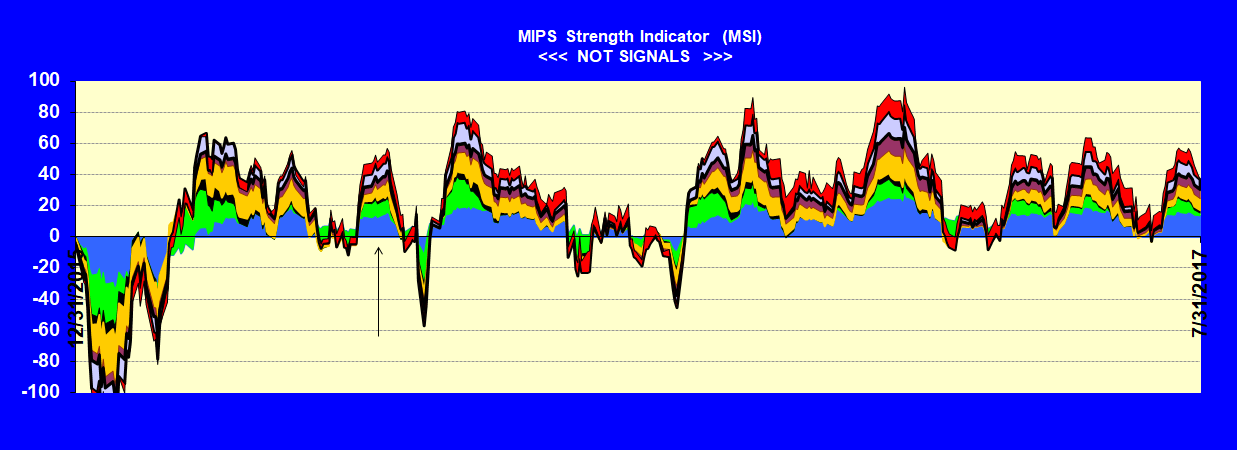

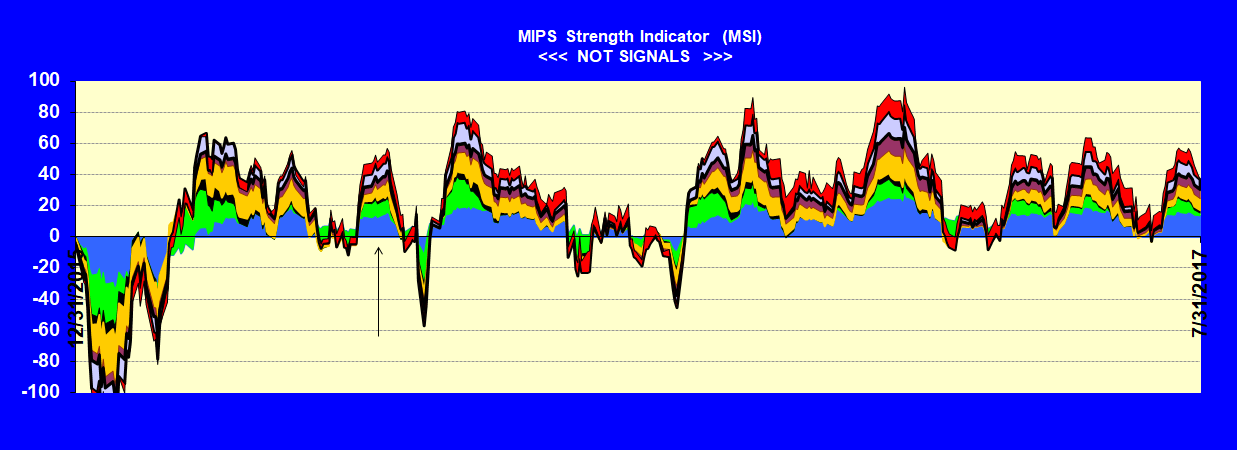

Of course, MIPS remains relatively positive

- see the MIPS Strength Indicator (MSI) immediately below.

- this is a combo of some of the best MIPS technical indicators and math algorithms.

- the black arrow from the bottom on 7/12/2017 identifies the last trade for some of the MIPS models.

Here is what today's trend looks like from a technical perspective.

Note: Almost perfect, low volatility "Up -Trending' EMAs (50-100-150-200-Day EMAs)

Monday, September 11 2017

FYI - Stocks have not been rallying for the last 10-16 months in the USA alone.

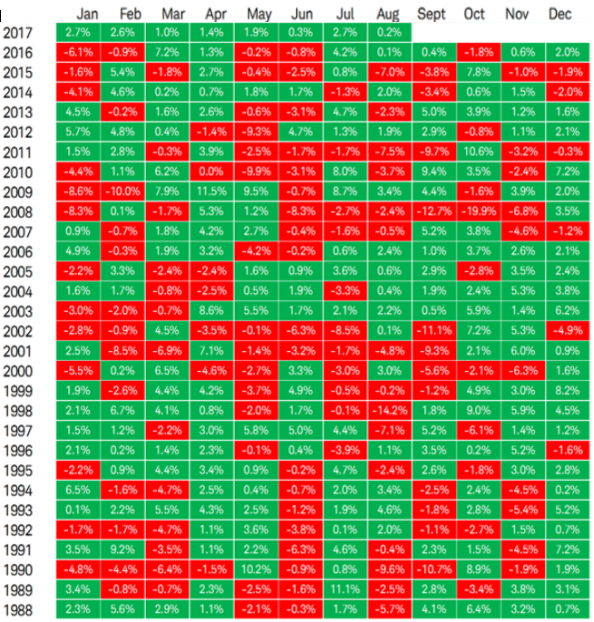

The current trend in the S&P 500 has been up for a relatively long time. But it is not alone. The MSCI All-Cap World Index (ACWI) has been up EVERY MONTH for the last ten months (and for 13 of the last 14 months). This is the first time in its 30-year history that a rally in this Index has been this perfect for so long. See the Table immediately below.

We all know that the current trend in the SPY has been strong since 3Q'16, and continues to be at this time. When a potential war with N. Korea, multiple record-breaking destructive hurricanes, a severely divided country and Congress, etc., is not enough to "turn a trend", then almost by definition, that trend must be strong.

Here is what today's trend looks like from a technical perspective.

Note: Almost perfect, low volatility "Up -Trending" EMAs (50-100-150-200-Day EMAs)

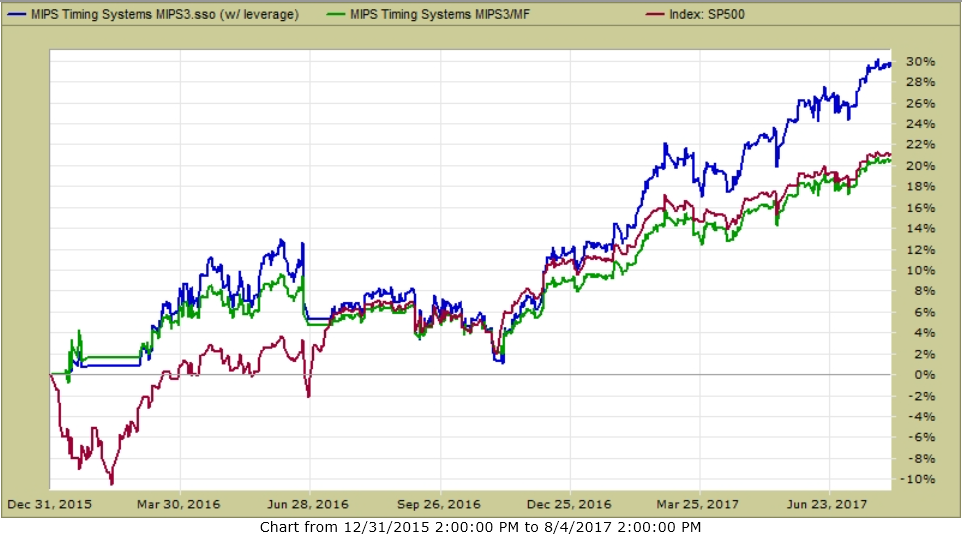

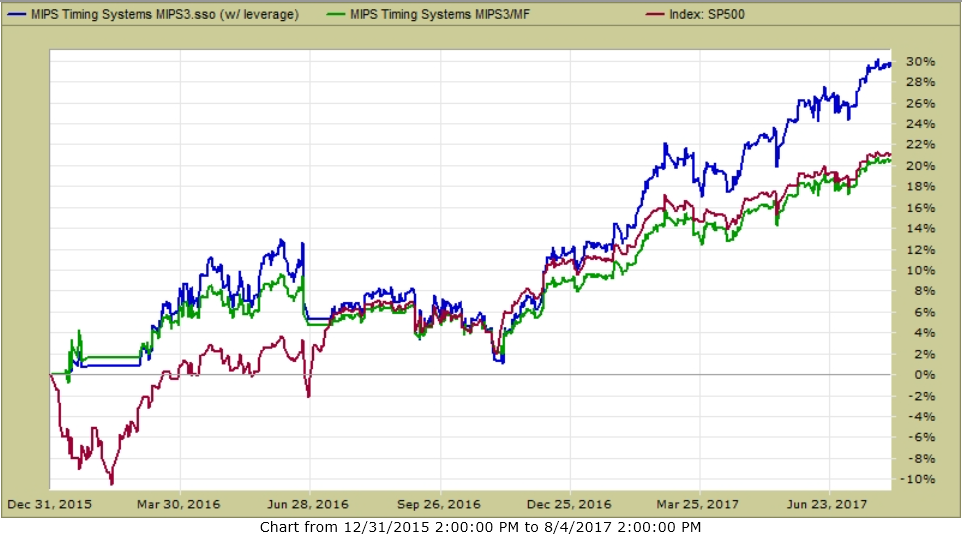

So, how has MIPS performed in the time period?

MIPS is doing a great job of not getting "sucked in" to the little dips over the last 18 months and has produced excellent results.

2016 - 170908

Blue Line - MIPS3 1.5x Long / 0.5x Short +29.5%

Green Line - MIPS3 1.0 Long / 1.0x Short +20.5%

Red Line - SPY + 2.5%

(From Timer-Trac.com)

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, August 20 2017

Some "Traders" (mainly day-traders) are panicking because the market (the SPY) has fallen 2.2% in the last few days, and they should be. "Investors", like us at MIPS however, should not be shook by a 2.2% drop following a 18.9% gain on the current signal.

BTW, the MIPS models have some degree of relativity built-in so that, under some conditions, the models will consider a 2.2% drop on a 18.9% gain worthy to analyze closely, but not enough to run for the hills. On the other hand, had the 2.2% drop occurred after only after like a 4.1% gain, the MIPS models would most likely have gone short by now.

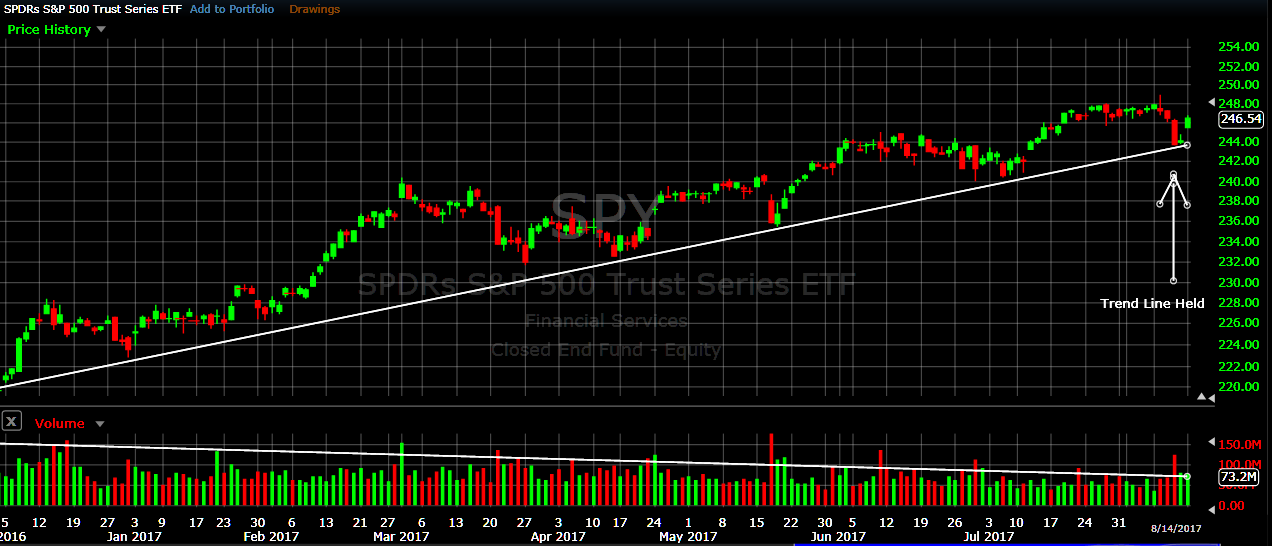

See the chart below:

1) The MIPS4 model has been long since 7/12/17 and had gained 18.9% by 8/08/17; only to

lose back 2.2% of this gain by 8/18/17 (net YTD gain of approximately +16.7%).

2) The SPY broke its trend line slightly by 8/18/17; but closed above its 90-day EMA (red line).

We all know that the market can move in any direction from here, so look out for Signal Change emails from MIPS, and check the "Current Signals" at http://www.mipstiming.com/signals_results

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Monday, August 14 2017

Remember, "The trend is your friend" !!!

The market (S&P500 ETF SPY), held its trendline last week and bounced off its trend to the upside today.

- holding above the trend is very bullish, but

- ever decreasing volume is slightly bearish.

Don't fight the Trend...

- MIPS Members can see what MIPS did at http://www.mipstiming.com/current_signals

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

=============================================================

<<< Blog from 8/06/2017 >>>

MIPS Members:

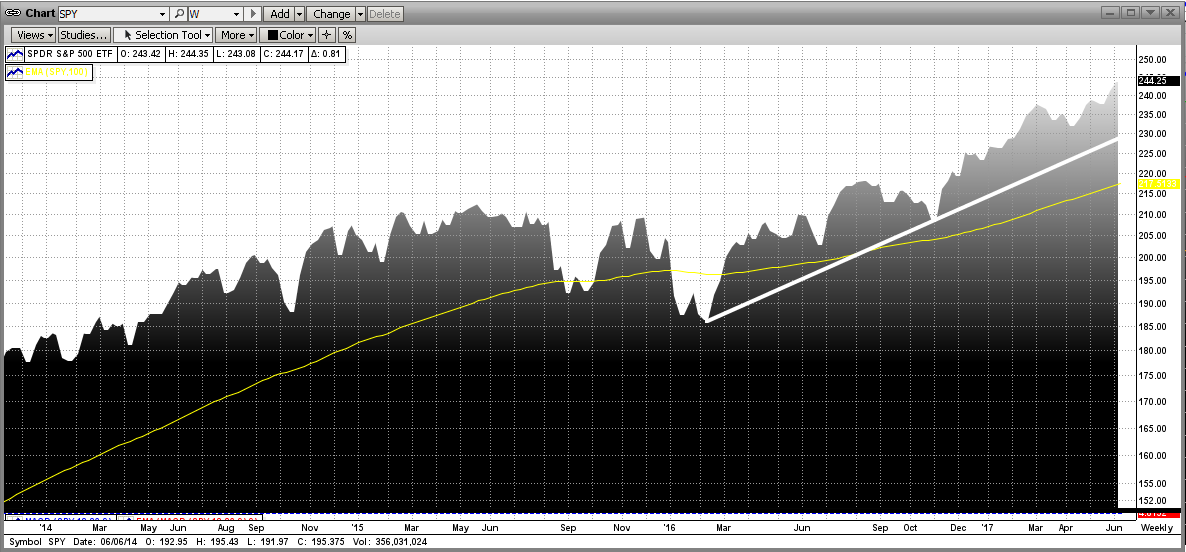

The long-term market trend is UP, and in up markets almost every investor has been told "don't fight the trend". But, of course, all trends come to an end, and that is what leads to market cycles and even market crashes. This upside trend has lasted for well over a year, with historically low volatility, and may be ready for at least a correction. See the graph below for the market (SPY) movements over the last 9 months.

It can be seen above that the market has followed a near-perfect uptrend, with higher highs and higher lows. However, the daily volume in this time period has dropped nearly 40%, and this is not a good sign from the Big Guys.

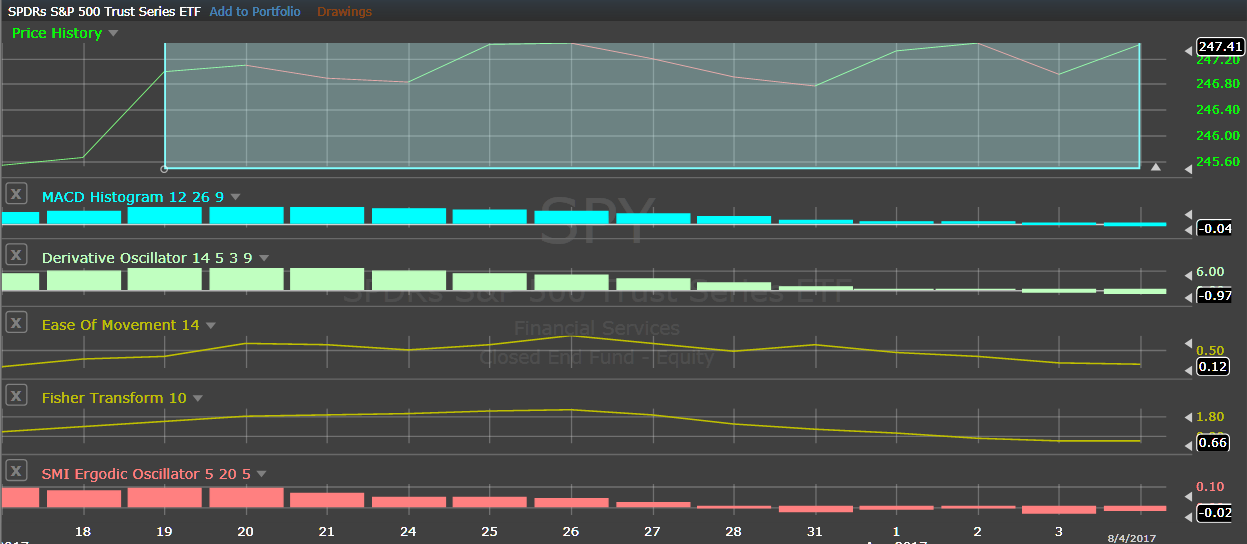

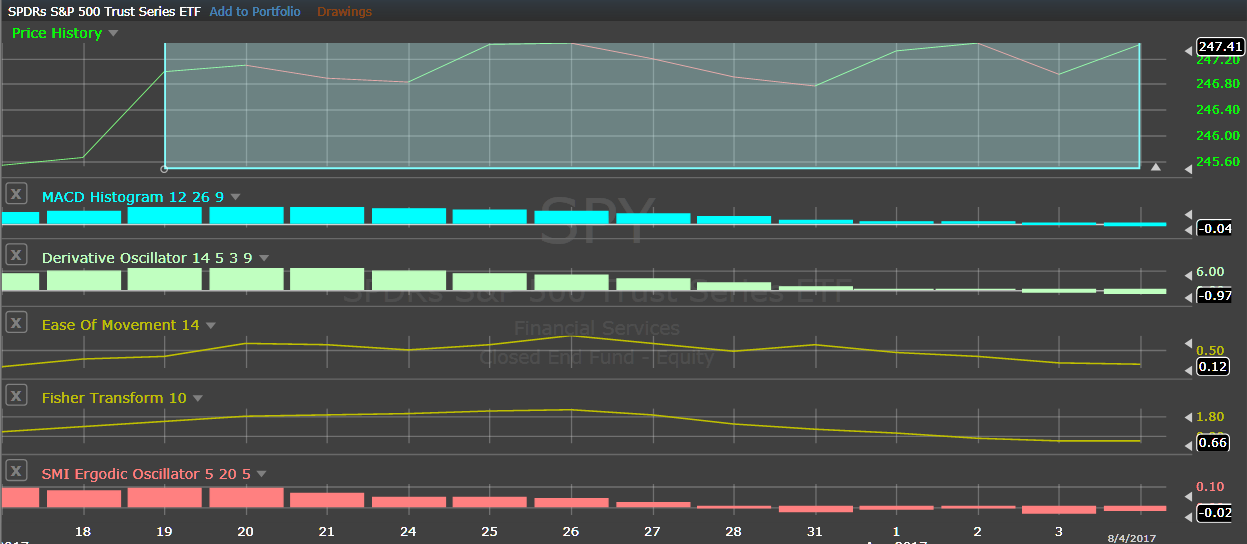

MIPS xRay View

And, in the last couple of weeks, the market seems to be flattening-out. For this, let's "zoom-in" and go into our xRay view to see an example of what's going on under the skin in a certain part of the MIPS models (see graph immediately below).

When we take the volatility out of the price action of the SPY over the last two weeks as done above, we see that the market closes have indeed been VERY flat. From this, one might expect that the indicators in the MIPS models are also flat (like not moving up or down). In actuality, you can see that ALL of the five indicators above are decaying from positive to negative (or close to zero). This could indicate that the uptrend is decaying. Of course, this is a VERY small part of a MIPS model (5 out of over 150 indicators and lots of math), and other parts of the models are signaling that the market still has steam. For example, see the MIPS Market Strength Indicator (MSI) below.

MIPS Market Strength Indicator (MSI)

The MSI graph below shows the relative strength of 8 of our best indicators. These are showing a neutral to positive view of the market direction at this time, and never went seriously negative since early 2016.

.

MIPS3 Performance 2016-2017 YTD

All of the MIPS models are still Long, and the performance since 2016 has been very good.

Of course, we will continue with the Long signal from MIPS until MIPS changes its mind.

MIPS3 - 2016 - 08/04/2017

(Trading SPY Long / Short)

Blue Line 1.5x Long / 0.5x Short +30.0%

Green Line 1.0 x Long / 1.0x Short +20.5%

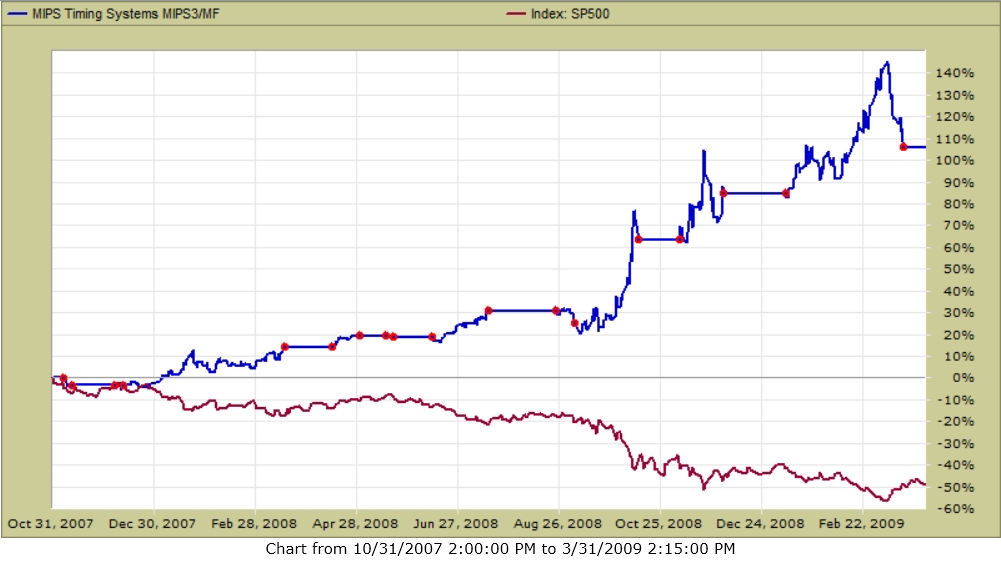

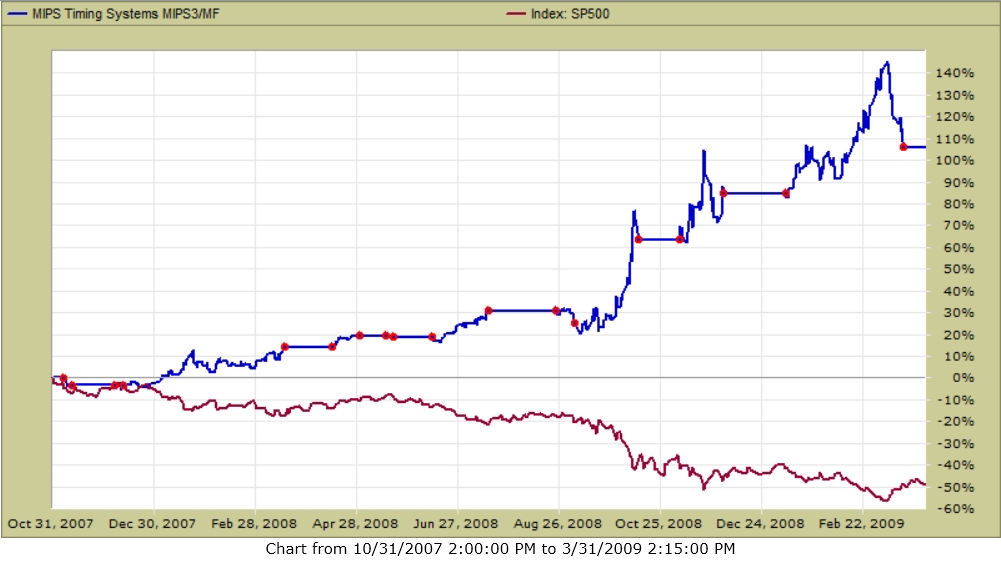

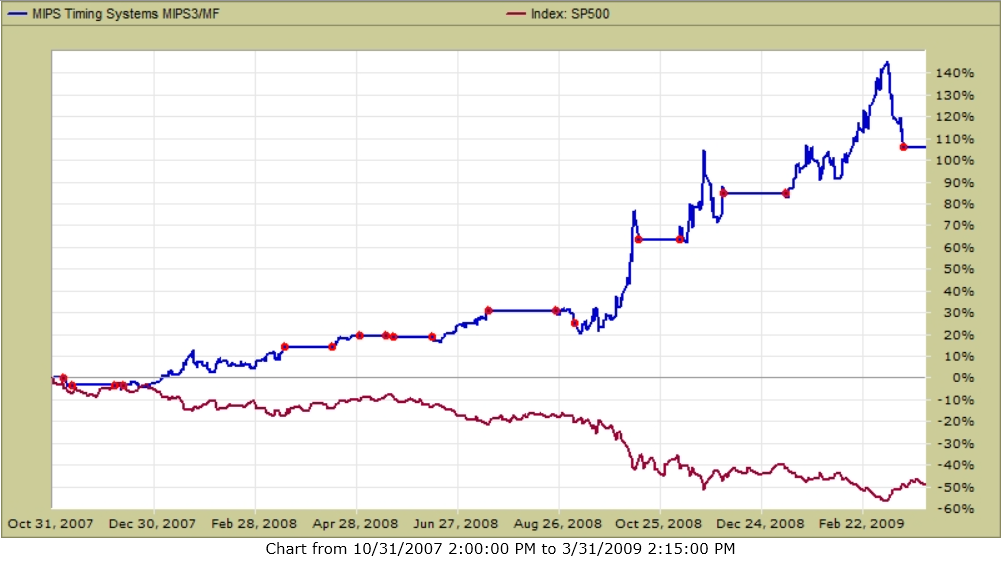

MIPS3 in 2008

And, don't forget how MIPS3 did between Oct'07 and Mar'09 (see graph below).

SPY -50% MIPS3 +108%

CONCLUSION:

MIPS's position is that the market still has an upward bias, and we expect more growth from this market. But, MIPS is seeing some aspects of a neutral or decaying trend. From the above, you can see that MIPS is doing whatever it needs do to to ascertain when the market is going south, and then getting us out. This is the time when you make big bucks using good timing models, like MIPS3 and MIPS4.

Stay tuned...

Best Wishes !!!

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, August 06 2017

The long-term market trend is UP, and in up markets almost every investor has been told "don't fight the trend". But, of course, all trends come to an end, and that is what leads to market cycles and even market crashes. This upside trend has lasted for well over a year, with historically low volatility, and may be ready for at least a correction. See the graph below for the market (SPY) movements over the last 9 months.

It can be seen above that the market has followed a near-perfect uptrend, with higher highs and higher lows. However, the daily volume in this time period has dropped nearly 40%, and this is not a good sign from the Big Guys.

MIPS xRay View

And, in the last couple of weeks, the market seems to be flattening-out. For this, let's "zoom-in" and go into our xRay view to see an example of what's going on under the skin in a certain part of the MIPS models (see graph immediately below).

When we take the volatility out of the price action of the SPY over the last two weeks as done above, we see that the market closes have indeed been VERY flat. From this, one might expect that the indicators in the MIPS models are also flat (like not moving up or down). In actuality, you can see that ALL of the five indicators above are decaying from positive to negative (or close to zero). This could indicate that the uptrend is decaying. Of course, this is a VERY small part of a MIPS model (5 out of over 150 indicators and lots of math), and other parts of the models are signaling that the market still has steam. For example, see the MIPS Market Strength Indicator (MSI) below.

MIPS Market Strength Indicator (MSI)

The MSI graph below shows the relative strength of 8 of our best indicators. These are showing a neutral to positive view of the market direction at this time, and never went seriously negative since early 2016.

.

MIPS3 Performance 2016-2017 YTD

All of the MIPS models are still Long, and the performance since 2016 has been very good.

Of course, we will continue with the Long signal from MIPS until MIPS changes its mind.

MIPS3 - 2016 - 08/04/2017

(Trading SPY Long / Short)

Blue Line 1.5x Long / 0.5x Short +30.0%

Green Line 1.0 x Long / 1.0x Short +20.5%

MIPS3 in 2008

And, don't forget how MIPS3 did between Oct'07 and Mar'09 (see graph below).

SPY -50% MIPS3 +108%

CONCLUSION:

MIPS's position is that the market still has an upward bias, and we expect more growth from this market. But, MIPS is seeing some aspects of a neutral or decaying trend. From the above, you can see that MIPS is doing whatever it needs do to to ascertain when the market is going south, and then getting us out. This is the time when you make big bucks using good timing models, like MIPS3 and MIPS4.

Stay tuned...

Best Wishes !!!

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Monday, July 17 2017

Nothing moves the stock market in a more predictable fashion than corporate earnings. At this time, investors are betting on the Trump agenda (lower taxes, better intenational trade deals, less giveaways, less regulations, etc.) to greatly increase corporate profits. Hence, the big run-up in the markets since the presidential election in Nov'16.

Although there are many obstacles along the way, the bet is still that most of the above will become "law", and this will result in higher corporate profits in 2017 and/or 2018. Because the fat kats basically have insider informantion, stock prices always lead profit direction, both up and down.

To that end, the markets (Dow and S&P 500) both closed at all-time new highs on Friday, June 14th. Furthermore, the S&P 500 has not experienced even a -5% drawdown all year. From a seasonality standpoint, during the last 90 years, in 84% of the years that the market was up at least 8% in the first 1/2 of the year, it was followed by 4-5% gains in the 2nd half.

See below...

THE OTHER SIDE...

Regardless of the above, there is ample reason to believe that the market is ripe for a correction. Since 1950, the market has experienced at least a -5% drawdown in 91% of the years.

And there are indeed some real and far fetched possible reasons (failed Trump agenda, war with North Korea, Trump trouble with Russian collusion in the election, etc.) where the market could experience a real crash (-55% drop).

By and large, MIPS may or may not identify a -5% drop, but would almost certainly identify a "market crash" of 30-50% or more. In backtesting in 1987 and 2000, MIPS identified the drops and did not lose money in either crash. In actual trading in 2008 - 2009 (verified by TimerTrac.com), MIPS not only identified the -55% drop, but made over 100% to the upside!!!

MIPS3 during Oct 31, 2007 - March 31, 2009

Blue Line - MIPS +110%

Red Line - SPY - 50%

Red Dots indicate trade dates (from TimerTrac.com)

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS (6477)

Sunday, July 02 2017

MIPS Members / Followers:

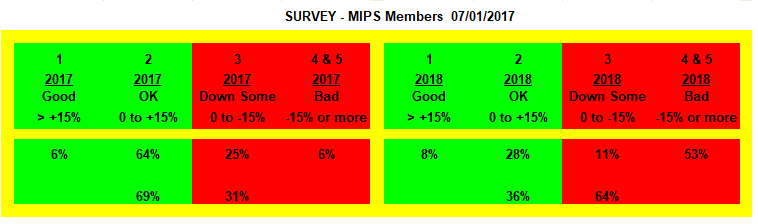

We sent out our 2017 Blog/Survey on 6/28/2017 (see "Previous Blog" below), and the results have come in. Thanks to our loyal members, we had good participation.

As we all know (and what we pointed out in the Blog below), is that Bull Markets happen when the "Things" that are happening in the world (or at least in the USA) are good for corporate earnings (like the Fed's easing in 2008-2014, the Trump agenda in 2016, etc). Conversely, Bear Markets happen when "Things" that are anti-that above (like overbought markets, Trump's agenda failing, war with North Korea, etc.) come into play.

In the Survey we asked our members to provide us with their opinion of where the stock market would be at the end of:

(a) the next six months of 2017 and

(b) the first 6 months of 2018.

The categories that we defined were:

#1) Grow greater than +15%

#2) Grow between 0% and +15%

#3) Fall between 0% and -15%

#4) Fall between -15% and -30%

#5) Fall more than -30%

A summary of the SURVEY "votes" is shown below:

As can be seen above, in 2017 over two-thirds (69%) of our members think that the market will be somewhat bullish thru year-end; whereas in 2018 the consensus flipped to where almost two-thirds (64%) of our members are "bearish" by the end of the first six months. More dramatic is that only 6% felt like the market would undergo a significant drop by Dec'17; but 53% predicted a big drop by June'18. As probably known by most, the most common concern in the next 12 months is the timing of Trump's agenda.

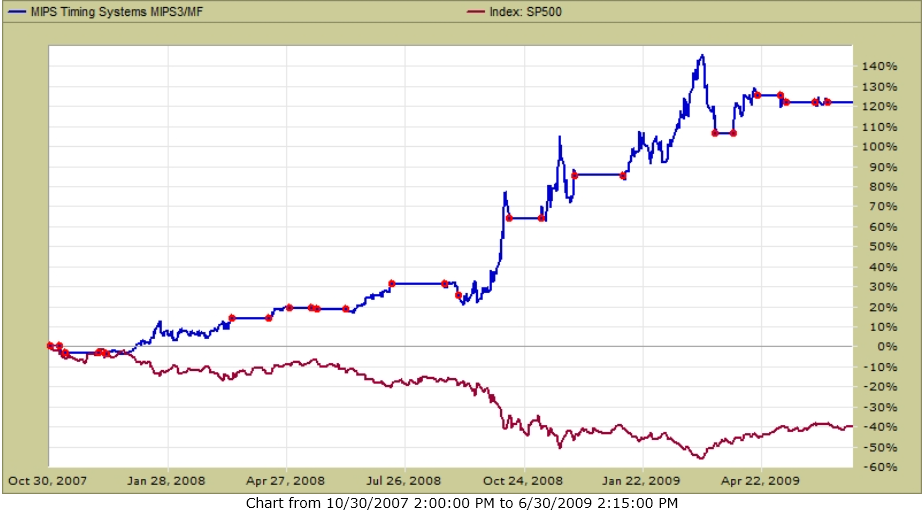

MIPS IN DOWN MARKETS !!!

Interesting numbers, but MIPS members should "hope for" a big drop sometime in this 12-month period. Why? Because MIPS is designed to make money in down markets as well as in up markets (actually better in down markets).

Need proof?

The graph below shows the actual performance of our MIPS3 model between Oct 2007 - June 2009

- trading SPY long/short (no leverage)

- results "verified" by TimerTrac.com

From TimerTrac.com...

"Red dots" are actual trades

- MIPS3 is the Blue Line

- SPY is the Red Line

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

support@mipstiming.com

=============================================================

<<< Previous Blag >>>

6/28/2017

MIPS - Back Away to see the market in "Full View" - SURVEY

MIPS Members / Followers:

- please take 2 minutes and complete the SURVEY at the end of this email...

I am sure that all of you have heard the expression "Sometimes we can't see the forest for the trees". Of course, this implies that in a thick forest one can only see 20-30 feet in any direction, and hence they have no idea what there is beyond that. So, if a stranger was in the middle of a forest in a horrific fire, they would most likely think that this fire could consume many homes and even some small towns. Hence, they would probably do everything that they could to alert the authorities in the area.

However, if the person was in a "forest" that was only 50 yards wide in each direction, surrounded by 100's of acres of just grass/weeds, then this forest fire would not be a threat to anyone except the stranger in the fire. Of course, another person in a small plane could immediately see the small size of the "forest" and completely understand that the fire was really no big deal.

Along this line, many people get bogged down in the very latest movements in the market without understanding how the market got where it is and what the underlying factors/movements mean. With this only info, they have almost no significant data to help them understand where the market is going from here and when.

Like many other things in life (like the guy in the small plane above), sometimes we have to back away and take a look at what we are analyzing from a longer-term view.

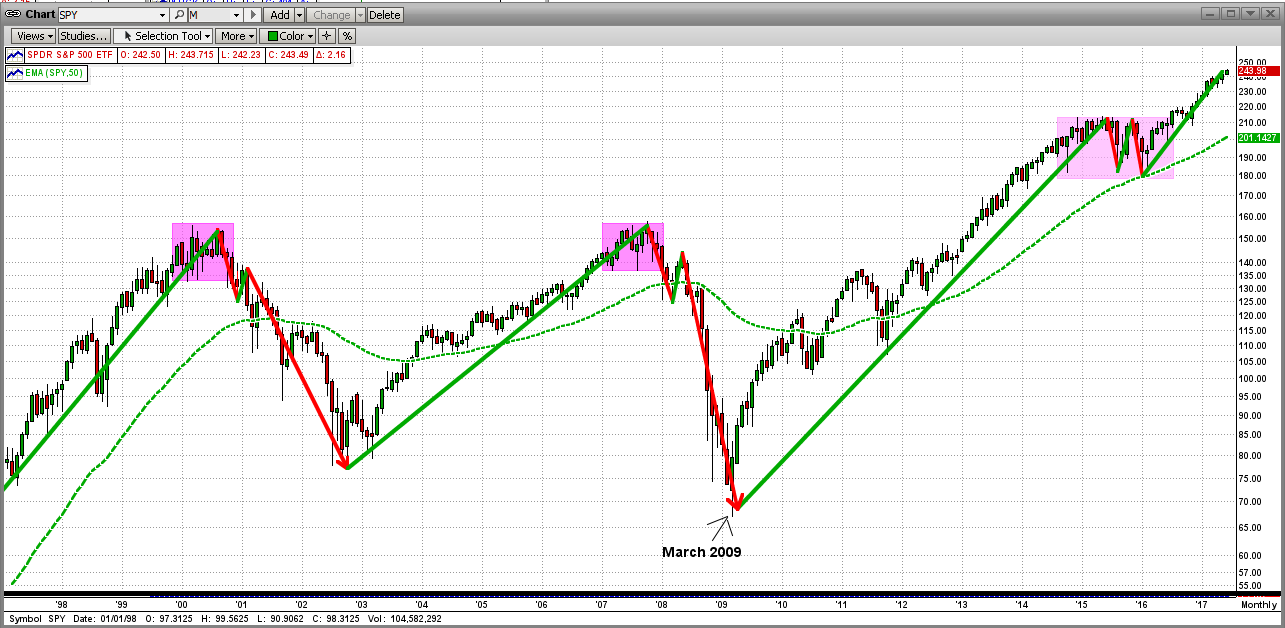

In the two graphs below:

- Graph #1 is a daily graph for the last four months (Mar-June 2017), and

- Graph #2 is monthly graph going all the way back to 1997

GRAPH #1

In the graph immediately below, the straight black line is the long-term trend line, and

the gray, green, red, orange and blue lines are EMAs:

- the grey line is the 18-day EMA,

- the green line is the 50-day EMA,

- the red line is the 100-day EMA,

- the orange line is the 150-day EMA, and

- the blue line is the 200-day EMA

What we can see from this is:

(a) The trend is going up "slowly", but may be getting weaker (market below trend in late-June)

(b) The moving averages:

- are moving almost perfectly "in sync" with each other,

- are keeping their individual "slopes", and

- are not getting weaker or converging with each another.

(c) The two observations above are bullish, but the market appears to be flattening out (bearish)

Read on...

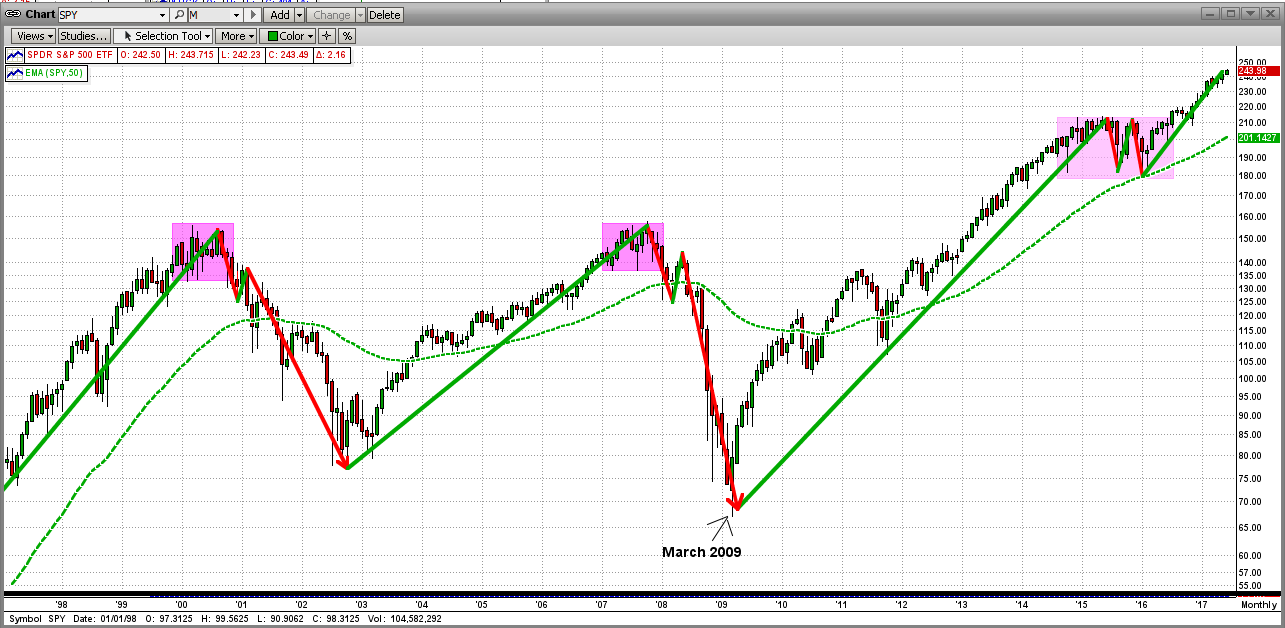

GRAPH #2

There is not enough in the above to make me feel comfortable, so lets "back away" and look at the market from a longer-term view. The view below covers almost 20 years (1997-June'07) and, of course, it contains the big market crashes in 2000 and 2008.

Read on...

As you may know, real bear markets do not just happen immediately and out of the clear-blue sky. Two things are usually required: bad economic fundamentals and a "catalyst" to bring it about (like the Lehman Brothers failure, etc). Bear markets do not happen when the economy is booming. Stock prices go in the same directon as profits, period. That is, stock prices rise with increasing profits and stock prices fall with decreasing profits.

But stock prices "lead" in this relationship, as the very largest investment firms (Goldman Sachs, Morgan Stanley, etc) start selling before bad earnings numbers are realized and announced to the world of investors. Did you ever wonder how these big guys (aka Fat Kats) know when American companies are going to announce lower earnings (yeah, what a surprise). Maybe, just maybe, it is because these big American companies are their customers and somehow the fat kats figure it out (haha) at our expense.

At any rate, in Graph #2 above, it can be seen that what I call "topping" takes 9-15 months to complete a "turn-over", and then a catalyst comes along and takes the bottom out. The toppings in 2000 and 2008 were almost identical, and it appeared that the topping in 2015 (fake) would occur again. But it did not, thanks to the Presidential election; which sort of acted like an "anti-catalyst". This was because of the strong probability that Trump would strengthen the economy (lowering taxes, infrastructure spending, renegotiating or leaving foreign agreements, etc.). Now, if that fails, this "anit-catalyst" could become the catalyst for a big drop.

Of course, anything could happen from here...

- and that is why we need MIPS...

- MIPS is 1,000 times more complex and accurate than the simple analysis herein.

SURVEY

- WHAT DO YOU THINK???

We are asking all MIPS Members and followers to submit their opinions in an email reply, and we will share the results with all.

What is your opinion regarding market performance (S&P 500) in the next 12 months?

- please send us your best guesses for 12/31/2017 and 6/30/2018

------------------------------------------------Pick one for each year

Performance.......................................Dec 2017....June 2018

#1) Grow greater than +15%

#2) Grow between 0% and +15% x

#3) Fall between 0% and -15%

#4) Fall between -15% and -30% x

#5) Fall more than -30%

Example Answer................................. #2 for Dec'17 #4 for June'18

Thanks

Best Wishes...

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

support@mipstiming.com

Wednesday, June 28 2017

MIPS Members / Followers:

- please take 2 minutes and complete the SURVEY at the end of this email...

I am sure that all of you have heard the expression "Sometimes we can't see the forest for the trees". Of course, this implies that in a thick forest one can only see 20-30 feet in any direction, and hence they have no idea what there is beyond that. So, if a stranger was in the middle of a forest in a horrific fire, they would most likely think that this fire could consume many homes and even some small towns. Hence, they would probably do everything that they could to alert the authorities in the area.

However, if the person was in a "forest" that was only 50 yards wide in each direction, surrounded by 100's of acres of just grass/weeds, then this forest fire would not be a threat to anyone except the stranger in the fire. Of course, another person in a small plane could immediately see the small size of the "forest" and completely understand that the fire was really no big deal.

Along this line, many people get bogged down in the very latest movements in the market without understanding how the market got where it is and what the underlying factors/movements mean. With this only info, they have almost no significant data to help them understand where the market is going from here and when.

Like many other things in life (like the guy in the small plane above), sometimes we have to back away and take a look at what we are analyzing from a longer-term view.

In the two graphs below:

- Graph #1 is a daily graph for the last four months (Mar-June 2017), and

- Graph #2 is monthly graph going all the way back to 1997

GRAPH #1

In the graph immediately below, the straight black line is the long-term trend line, and

the gray, green, red, orange and blue lines are EMAs:

- the grey line is the 18-day EMA,

- the green line is the 50-day EMA,

- the red line is the 100-day EMA,

- the orange line is the 150-day EMA, and

- the blue line is the 200-day EMA

What we can see from this is:

(a) The trend is going up "slowly", but may be getting weaker (market below trend in late-June)

(b) The moving averages:

- are moving almost perfectly "in sync" with each other,

- are keeping their individual "slopes", and

- are not getting weaker or converging with each another.

(c) The two observations above are bullish, but the market appears to be flattening out (bearish)

Read on...

GRAPH #2

There is not enough in the above to make me feel comfortable, so lets "back away" and look at the market from a longer-term view. The view below covers almost 20 years (1997-June'07) and, of course, it contains the big market crashes in 2000 and 2008.

Read on...

As you may know, real bear markets do not just happen immediately and out of the clear-blue sky. Two things are usually required: bad economic fundamentals and a "catalyst" to bring it about (like the Lehman Brothers failure, etc). Bear markets do not happen when the economy is booming. Stock prices go in the same directon as profits, period. That is, stock prices rise with increasing profits and stock prices fall with decreasing profits.

But stock prices "lead" in this relationship, as the very largest investment firms (Goldman Sachs, Morgan Stanley, etc) start selling before bad earnings numbers are realized and announced to the world of investors. Did you ever wonder how these big guys (aka Fat Kats) know when American companies are going to announce lower earnings (yeah, what a surprise). Maybe, just maybe, it is because these big American companies are their customers and somehow the fat kats figure it out (haha) at our expense.

At any rate, in Graph #2 above, it can be seen that what I call "topping" takes 9-15 months to complete a "turn-over", and then a catalyst comes along and takes the bottom out. The toppings in 2000 and 2008 were almost identical, and it appeared that the topping in 2015 (fake) would occur again. But it did not, thanks to the Presidential election; which sort of acted like an "anti-catalyst". This was because of the strong probability that Trump would strengthen the economy (lowering taxes, infrastructure spending, renegotiating or leaving foreign agreements, etc.). Now, if that fails, this "anit-catalyst" could become the catalyst for a big drop.

Of course, anything could happen from here...

- and that is why we need MIPS...

- MIPS is 1,000 times more complex and accurate than the simple analysis herein.

SURVEY

- WHAT DO YOU THINK???

We are asking all MIPS Members and followers to submit their opinions in an email reply, and we will share the results with all.

What is your opinion regarding market performance (S&P 500) in the next 18 months?

- please send us your best guesses for 12/31/2017 and 6/30/2018

------------------------------------------------Pick one for each year

Performance.......................................Dec 2017....June 2018

#1) Grow greater than +15%

#2) Grow between 0% and +15% x

#3) Fall between 0% and -15%

#4) Fall between -15% and -30% x

#5) Fall more than -30%

Example Answer................................. #2 for Dec'17 #4 for June'18

Thanks

Best Wishes...

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

support@mipstiming.com

Sunday, June 04 2017

It seems like all investors are getting very jittery about the recent market rally. And, it seems like some MIPS members are crying for a signal change. Why, because somehow they think if you trade a lot, you will do better. In most cases (like now), the opposite is true. There is no reason for a timing model to turn "investors" (who want to ride the trend) into "traders" (who want to attempt to make money on every blip in the market and end up getting whipsawed).

That is especially true at this time, when the "trend" is up-up-up !!! - See graph below...

- BE HAPPY THAT YOUR MIPS TIMING MODEL IS KEEPING YOU LONG NOW !!!

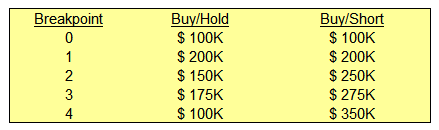

COMPOUNDING EFFECT OF LONG/SHORT TRADING IN DOWN MARKETS !!!

Good timing models should keep you Long in up markets and Short or Cash in down markets.

PLEASE remember that, if you trade an index fund (like SPY) and the market goes up for 8 or 10 or 15 months, and your model keeps you Long, your performance will be equal to (or close to equal) that of the index. One way to "better this" is to trade with a little leverage on Long signals (like 1.25x of 1.5x) and with no leverage on Short signals.

If you have a good stock market timing model (like MIPS) to tell you when to buy or short, and if you change your trading strategy from buy/hold to buy/short, you will most likely GREATLY improve your long-term investment performance. The reason, of course, is that you will be Long in up markets (making money) and Short in down markets (making money). In other words, you should make money in both up and down markets. Even though that might sound like "magic" to the average investor, the fat cats have been enjoying this type of trading (and the resulting performance) for over 100 years. They call it "Hedging".

OK, so how does buy/short actually work? Well, first you need a good stock market timing system (like MIPS3 or MIPS4) to tell you when the stock market is headed up and when it is headed down. Then, you simply need to be in long positions when the stock market is going up; and either out of the market or in short positions when the stock market is going down (simply following the MIPS Signals). That is a relatively safe market trading strategy if your timing model is a good one.

Hypothetical

Show me !!!

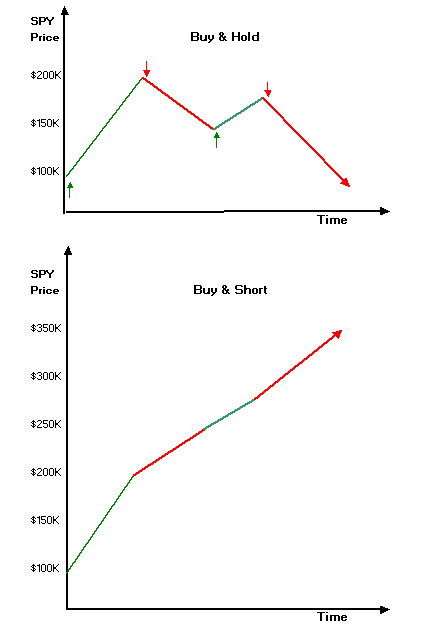

OK, let's look at a sample chart of stock market movements and how you would make money with the buy/short strategy. Below is how the buy/short strategy would work in a perfect world. Of course, stock market timing systems like MIPS are not perfect, but they are much, much better that going it alone.

Sample Market Performance (like in 2000-2010)

In the graphs immediately below, buy/hold & buy/short strategies would have resulted in the values at each breakpoint of those in the tables immediately below. You can see that at every breakpoint, the SPY value with buy/short "ratchets" up by being long when the market is going up, AND by being short when the market is headed down. BTW, in this hypo-example, buy/short would have grown to $350K instead of basically ending up "flat" (no gain).

------------------------------------------------------------------------------------------------------------------------------

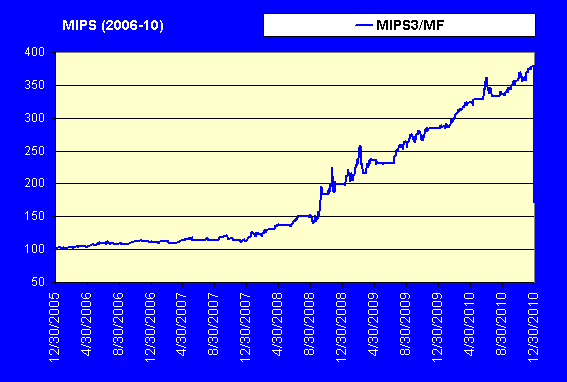

REAL MARKET Performance With MIPS3 (trading in 2006-2010)

Real Life Performance Using the MIPS3 Long/Short Strategy

Does the hypothetical "Buy & Short" graph above seem unbelievable? Do you doubt that this could happen in real life? It not only can, it did happen in 2000 and in 2008 (and it will happen again). For a real-life view of how MIPS performed in 2008, let's look at the period between 2006 and 2010 (using MIPS3 verified signals for this time frame from TimerTrac.com).

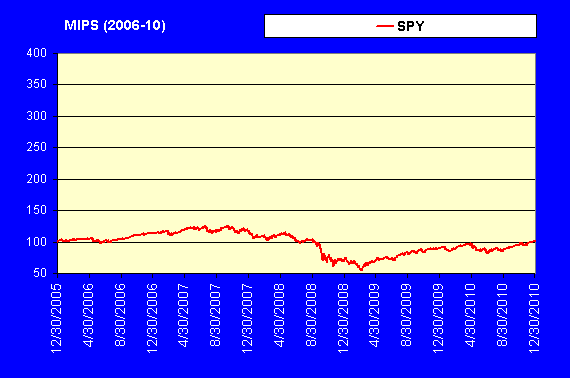

Buy/Hold SPY (1st Graph Below)

In this time period, the SPY

- started with $100,000,

- grew by about 27% to $127,000,

- took a nose-dive in 2008 of over 50% to $60,000,

- and grew back to where it started ($100,000) by the edd of 2010.

Big deal, 5 years and you would have ended up where you started (ie, you would not have made a penny).

Buy/Short SPY (with MIPS3) (2nd Graph Below)

The numbers in the 2nd chart below are real numbers trading with the MIPS3 buy/short strategy, using signals verified by TimerTrac.com. During the period between 12/30/2005 thru 12/31/2010, your portfolio that started at $100,000 would have grown steadily (almost no dips) over this five year period to $379,000 at the end (for a GAIN of 279%) !!! AND THAT IS REAL !!!

THE MORAL OF THE STORY IS:

Trading long/short effectively means that you invest with the market when it is going up and you invest AGAINST the market when it is going down (making money in down markets). Trading buy/hold means that you invest with the market when it is going up AND also with the market when it is going down (losing money in down markets)

Best Wishes !!!

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

www.mipstiming.com

support@mipstiming.com

|