Wednesday, July 25 2018

In our previous Blog (shown below), we pointed out that this market could be getting way "over-bought", but we pointed out that our economics are very good now and that usually leads to "new highs". Since then, corporate profits have continued to grow (strongly), Trump's tariffs and associated deals seem to be getting acceptance in the EU, etc. In other words, many important "things" seem to be doing well. SEE PROOF BELOW.

SPY - Breakout above Resistance

QQQ - New Highs

The danger, of course, is that if any one of the major issues at stake worldwide today (N. Korea, China's retaliating tariffs, Europe rejecting our newest tariffs without a counter-deal, a breakdown in profit growth (especially from hi-flyers, like the FAANNG stocks), could be devestating.

For Example

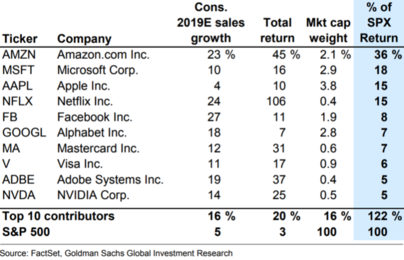

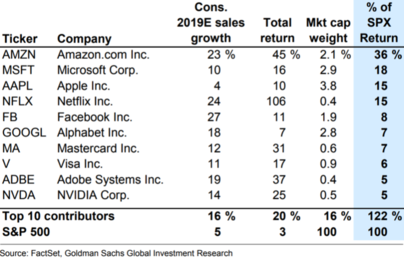

See the participation of FAANNG stocks in the SP500 Index (Facebook, Apple, Amazon, Netflix, Nivida, Google).

Market statistics show that 122% of the 2nd quarter gains in the S&P 500 Index resulted from the performance of just ten stocks, eight of which are from the technology sector. The blue column on the right below shows what % of the SP500 gain each individual stock accounted for (e.g., AMZN's growth accounted for 36% of the S&P 500 growth).

So, without any major set-backs from any of the issues above, all US indices should continue to grow with good strength; but even a slight setback could derail this extended bull market.

The "derail" part is where MIPS comes in and will tell us if any "upset" that happens is strong enough to change the direction of this extended bull market, or just strong enough to result in another rather small setback. Stay tuned...

Be careful, and feel free to call anytime between 10am-10pm CDT (six days/week).

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

support@mipstiming.com

================================================================================

<<< Previous MIPS Blog >>>

MIPS Members:

There are a lot of things going on now that could be a "catalyst" for a big market crash or correction (tariffs. Brexit, worldwide geopolitical unrest, 2018 mid-year elections, inflation, overbought stocks, etc.). On the bullish side, US companies are stiil experiencing growing gains in corporate profits, high employment numbers, etc.).

Overall, however, some very knowledgeable financial experts think that a big market drop is inevitable soon.

- For example, read the following two of very many articles that are being posted at an alarming

rate now:

https://www.marketwatch.com/story/the-stock-market-is-days-away-from-setting-a-bearish-record-2018-06-28?siteid=yhoof2&yptr=yahoo

http://www.businessinsider.com/jim-rogers-worst-crash-lifetime-coming-2017-6

Also, at least look at the following graph. This is why many investors believe that the stock market is grossly "overbought" after its recovery in March, 2009.

We have to at least admit that this is a scary period.

But, we are not alone. We have MIPS to tell us what to do, and MIPS reacts well in down markets.

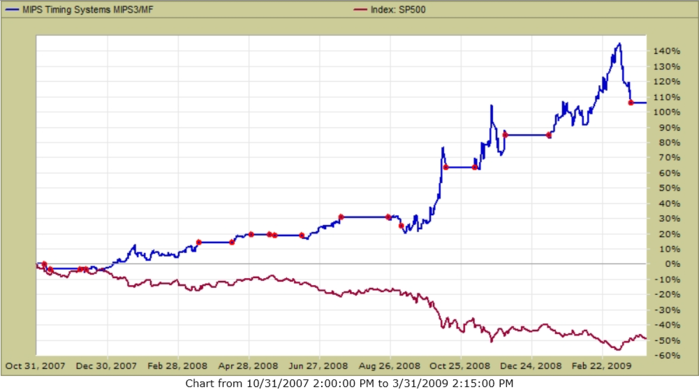

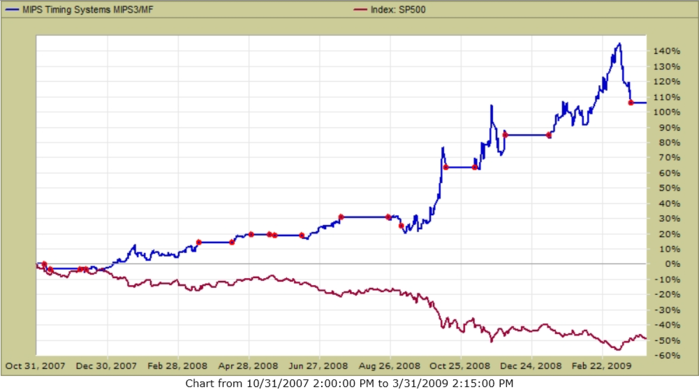

See the MIPS actual trades and performance in the period of the "2008 Crash" (Dec'07 - Mar'09):

Be careful, and feel free to call anytime between 10am-10pm CDT (six days/week).

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

support@mipstiming.com

Monday, July 16 2018

There are a lot of things going on now that could be a "catalyst" for a big market crash or correction (tariffs. Brexit, worldwide geopolitical unrest, 2018 mid-year elections, inflation, overbought stocks, etc.). On the bullish side, US companies are stiil experiencing growing gains in corporate profits, high employment numbers, etc.).

Overall, however, some very knowledgeable financial experts think that a big market drop is inevitable soon.

- For example, read the following two of very many articles that are being posted at an alarming

rate now:

https://www.marketwatch.com/story/the-stock-market-is-days-away-from-setting-a-bearish-record-2018-06-28?siteid=yhoof2&yptr=yahoo

http://www.businessinsider.com/jim-rogers-worst-crash-lifetime-coming-2017-6

Also, at least look at the following graph. This is why many investors believe that the stock market is grossly "overbought" after its recovery in March, 2009.

We have to at least admit that this is a scary period.

But, we are not alone. We have MIPS to tell us what to do, and MIPS reacts well in down markets.

See the MIPS actual trades and performance in the period of the "2008 Crash" (Dec'07 - Mar'09):

Be careful, and feel free to call anytime between 10am-10pm CDT (six days/week).

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

support@mipstiming.com

Sunday, July 08 2018

It looks like the Bulls are still hanging in after the big drops in February of this year. Technically, the trend is still pointing UP (thanks to the technology sector).

Like always, there are issues on both sides of the stock market.

In summary:

1) On the positive side we have higher profits, lower unemployment, slight increase in wages, etc.

2) On the negative side, we have the potential of serious trade wars with China, Germany, Mexico, and

Canada; serious political issues here at home and with North Korea, tightening monetary policy, etc.

My broad opinion is that, if we can avoid a nuclear war with North Korea or an all-out civil war here, the positive economic fundamentals will override all else, and the market will continue up for at least the rest of 2018.

To my knowledge, we have never had a serious market “Crash” (drops of 40-60%) when our economy is experiencing higher corporate earnings and high dividends. [However, many times the market will turn south when profits are still high because the fat-kats at large banks and financial institutions start selling when they get wind of falling profits long before we know (and believe me they have plenty ways of doing so long before we do.)]

THE MARKET IN 2Q’18+

In order to better understand the market performance in the first week after 2Q/18, let’s compare the 1st quarter graph to the 2nd quarter one (see graphs below).

The first graph immediately below shows both of the big dips in 1Q’18, and support holding at the SPY’s 200-SMA. Of course, this was a crucial point for the market, as it could have gone either way from there.

SPY in 1Q’18

Moving on to one week after 2Q’18, it is obvious from the 2Q’18 graph below that the SPY bounced up off of its “strong” support level (200 SMA) three times and crossed above the upper line of the triangle pattern.

SPY in 2Q’18

Market Driven by NASDAQ stocks

Market statistics show that over 100% of the 2nd quarter gains in the S&P 500 Index were from just ten stocks in the SPY, eight of which are from the technology sector (like the FAANNG stocks). The blue column on the right shows what % of the SPY gain the individual storks accounted for.

The performance in the QQQ emphasizes this behavior. Please note that the QQQ moved above its Jan'18 high.

QQQ in 2Q’18

From the above, one can see that the QQQ is heading back up toward it’s all time high for a second time in three months and with high momentum.

=============================

We believe that both the S&P 500 and the NASDAQ will continue up above their resistance levels and move into New High territory this quarter. But, remember, we are all going to follow recommendations from MIPS, not me.

Good Trading…

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

www.mipstiming.com

281-251-MIPS(6477)

Wednesday, June 13 2018

In a recent email we asked our MIPS members (and followers) for their opinions regarding the direction of

the SPY from 4/23/18 through 5/31/18.

The four Categories (explained and illustrated below) were that the SPY woold:

A) complete the W-Pattern and make new highs, or

B) at or near the new high level, turn around and head back down, or

C) hit the top of the Triangle line, turn around and head back down, or

D) stall before reaching the top of the Triangle pattern, and head back down.

After stretching the rules a little, Category C turned out to be the winner (the SPY went up a little past the top

line in the triangle, and dropped back a little). We will be sending a one month refund (or a one month free trail)

to the first 10 members (or followers) who bet on Category C.

Since the time period for this first survey was so short, we have decided to "Extend" the survey until the

end of August, with the same rules. Therefore, as can be seen in the graph below, since the SPY did not

go down immediately in April (Category D) nor stop near the top of the upper triangle line and head down

in May (Category C), the only members/followers who are eligible for the the Extended Survey are those

from Categories A and B.

I'm betting on Category C, but am glad that we have MIPS and don't need to "guess" what to do next...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, May 27 2018

Most "things" are looking good, so it seems to me that we will have more upside coming next week:

- lots of good "stuff" in the economic world,

- good fundamentals in stocks and bonds,

- good technical analytics (see breakouts below) and

- good geopolitical info (Turmp/N.Korea summit meeting, etc)

That is just my opinion, so thanks that we have MIPS to tell us what to do next !!!

-----------------------------------------------------------------------------------------------

Index graphs through Friday 5/25/18 ...

DOW / DIA

SP 500 / SPY

NASDAQ / QQQ

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Friday, May 11 2018

Last week all markets made good moves up... Will that continue?

- please be aware that this behavior could reverse itself with NO warning...

- let's not guess, but wait for MIPS to tell us what to do next !!!

Today's graphs compared to last Friday's close (in 5/04/18 email below):

DOW / DIA

SP 500 / SPY

NASDAQ / QQQ

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

=================================================================

From 5/04/18

MIPS Members:

We never really know which way the market is heading in the near-term future (like in the next few weeks/months). But, there are some "patterns" that tell us where to start looking.

In this blog, we are concentrating on "triangle patterns" (aka TP). Like other patterns, TP comes into play after the market has made a long-term run, and has run out of steam. Because the bulls/bears are not willing to make a stand one way or the other, the TP acts like most other "Consolidation" pattern (sideways, but with defined, squeezing limits up and down). See below...

The good news is that, most of the time, the market makes future big moves in the direction that the market breaks out of the pattern. And, my experience shows that the market usually breaks out in the direction that it was moving before the pattern was formed (and, this time it was moving up) !!!

- Warning: that is just my opinion and has nothing to do with MIPS.

Graphs of the current state of the Dow (DIA), the SPY, and the Nasdaq (QQQ) are shown below.

Status:

1) DIA - hitting the tops and bottoms to near perfection - with the upside looking stronger

2) SPY - following the pattern and struggling to move to the upside, and

3) QQQ - has already broken out to the upside.

DOW / DIA

SP500/ SPY

NASDAQ / QQQ

Good Trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

support@mipstiming.com

www.mipstiming.com

Sunday, May 06 2018

We never really know which way the market is heading in the near-term future (like in the next few weeks/months). But, there are some "patterns" that tell us where to start looking.

In this blog, we are concentrating on "triangle patterns" (aka TP). Like other patterns, TP comes into play after the market has made a long-term run, and has run out of steam. Because the bulls/bears are not willing to make a stand one way or the other, the TP acts like most other "Consolidation" pattern (sideways, but with defined, squeezing limits up and down). See below...

The good news is that, most of the time, the market makes future big moves in the direction that the market breaks out of the pattern. And, my experience shows that the market usually breaks out in the direction that it was moving before the pattern was formed (and, this time it was moving up) !!!

- Warning: that is just my opinion and has nothing to do with MIPS.

Graphs of the current state of the Dow (DIA), the SPY, and the Nasdaq (QQQ) are shown below.

Status:

1) DIA - hitting the tops and bottoms to near perfection - with the upside looking stronger

2) SPY - following the pattern and struggling to move to the upside, and

3) QQQ - has already broken out to the upside.

DOW / DIA

SP500/ SPY

NASDAQ / QQQ

Good Trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

support@mipstiming.com

www.mipstiming.com

Monday, April 23 2018

The "votes" are in from our recent "Survey", where the possibilities for the SPY from Apr 15th to the end

of May 2018 are (see graph below):

A) complete the W-Pattern and make new highs, or

B) at or near the new high level, turn around and head back down, or

C) hit the top of the Triangle line, turn around and head back down, or

D) stall before reaching the top of the Triangle pattern, and head back down.

The final results are:

A) 42%

B) 13%

C) 30%

D) 15%

From above:

o 42% of MIPS followers are VERY optimistic and see the SPY breaking above and making new highs, but

o 30% feel that the SPY will go up from Apr 15th but will fail to reach its all-time high; and then drop way

back down.

I am glad the we have MIPS and don't have to "guess" what to do next...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

==============================================================

April 15, 2018

MIPS Members:

We are all very much aware that the unstoppable bull run since March 2009 was punched straight in the nose at the end of January 2018 and the S&P 500 went tumbling down about -10%. Good things for the market, like corporate earnings, new jobs, and lower unemployment have been offset by new tariffs, trade wars, real wars, the Fed, rising interest rates and fears of increasing inflation.

At any rate, since the end of January 2018, the SPY has waffled down and up several times forming either a "W-Pattern" as in the yellow lines below (similar to a double bottom) or a "Triangle Pattern" as in the white lines below.

The possibilities for the SPY from today to the end of May 2018 are:

A) complete the W-Pattern and make new highs, or

B) at or near the new high level, turn around and head back down, or

C) hit the top of the Triangle line, turn around and head back down, or

D) stall before reaching the top of the Triangle pattern, and head back down.

We are asking for your opinion, and will offer a one month free MIPS monthly subscription ($39 refund) to the first 10 responders that call the correct or closest outcome (A,B, C, or D) that happens by the end of May 2018.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, April 15 2018

We are all very much aware that the unstoppable bull run since March 2009 was punched straight in the nose at the end of January 2018 and the S&P 500 went tumbling down about -10%. Good things for the market, like corporate earnings, new jobs, and lower unemployment have been offset by new tariffs, trade wars, real wars, the Fed, rising interest rates and fears of increasing inflation.

At any rate, since the end of January 2018, the SPY has waffled down and up several times forming either a "W-Pattern" as in the yellow lines below (similar to a double bottom) or a "Triangle Pattern" as in the white lines below.

The possibilities for the SPY from today to the end of May 2018 are:

A) complete the W-Pattern and make new highs, or

B) at or near the new high level, turn around and head back down, or

C) hit the top of the Triangle line, turn around and head back down, or

D) stall before reaching the top of the Triangle pattern, and head back down.

We are asking for your opinion, and will offer a one month free MIPS monthly subscription ($39 refund) to the first 10 responders that call the correct or closest outcome (A,B, C, or D) that happens by the end of May 2018.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Wednesday, April 11 2018

The MIPS3, MIPS4, and MIPS/Nitro models issued two “signal changes” (trades) in just three days last week, after being in a Long signal position for over 15 months. Lots of MIPS members have asked us for an explanation.

The MIPS models are very complex models that use more of our own proprietary mathematical algorithms (applied math, pattern recognition, artificial intelligence, etc.) than simple tactical indicators. In total, however, “votes” from over 150+ technical indicators and market behavior algorithms decide in which direction “the market” is moving (for us, “the market” is the S&P 500 Index, or SPY).

OFFENSIVE SIGNALS

Please understand that we run the MIPS models each and every day from scratch. When a MIPS model indicates, with a strong degree of confidence, that the direction of the market has changed, it will issue a “signal change” and this goes out in an email to MIPS members (and is updated on the MIPS website immediately thereafter). Of course, if the model does not identify a new change in the market direction with high confidence that day, it will keep the same position (Long, Short, or Cash). And, this can go on as long as the market keeps growing (or declining) as in the last 15+ months. In all of the above cases, we call these signals “Offensive Signals”, and over 80-90% of our signals are Offensive (see Defensive Signals below).

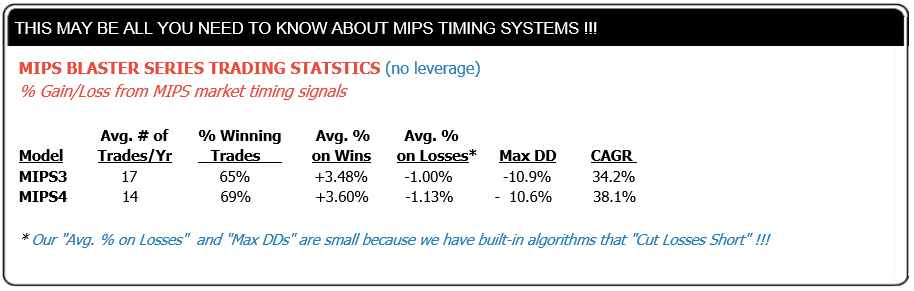

Now, things get interesting (and pseudo confidential for all recipients). To understand this Blog from here on, please take a second to “study” the table below (from the Home page on our website).

DEFENSIVE SIGNALS

MIPS3 has been tracked and its signals have been verified since Nov 2005. MIPS4 is a more recent model and is slightly better than MIPS3. So, let’s concentrate on MIPS4 for this blog. BTW, the results in the table above result from the MIPS models with the Blaster Series algorithms.

What is obvious in the above table is that, on average, the MIPS4 models traded a little over one time per month, the trades were winners almost 70% of the time, the CAGR was almost 40%, and the maximum drawdown was just a little over -10%.

The stats above are all great, but there is “one thing” that all MIPS members should be aware of and be happy about. I am sorry to say that we have been publishing this chart for years, and we have gotten very few questions about one important entity in it. If one digs a little deeper, they would realize that this “one thing” that makes such a huge improvement in performance is that the average GAIN on winning trades is +3.5%, but the average LOSS on losing trades is only -1.1%. That is pretty good proof that a timing model that is programmed to automatically “cut its losses short” is working with darn near perfection.

This is NOT a Coincidence!!!

The much lower average LOSS above does not “just happen”, but rather it results from highly effective “stops” that we designed and built into the MIPS models. The MIPS very low average LOSS is only about 1/3 of the size of its average GAIN. If we had done nothing in the MIPS models to cut LOSSES, instead of the average loss being -1.1% as it is now, it is highly likely that the average loss would be close to the opposite of the average gain (or about -3.5%). The reason that we defined our “stops” with quotation marks is that our “stops” are NOT derived simply from a designated loss from the last actual initial trade or from a trailing high. Our "stops" are designed so that, as a MIPS model “learns” about its most recent bad performance (e.g., it losses 3-4 days in a row, or it losses 4 days out of 5, and many more), other algorithms take over and either reverse the current signal or takes the model to a Cash position.

We have many of these proprietary “stops” built into all MIPS models, and they can either take a new Long or Short signal that is not working well to Cash, or they can take a Cash signal that is being left behind in performance to a new Long or Short position !!!

The MIPS models are more likely to issue both offensive and defensive signals quickly in relatively flat, horizontal market patterns than in markets with a strong up or down trend with low volatility; but it can happen at any time. The Defensive signal algorithms In our MIPS models work exceptionally well, and this is one reason why our average losses are so low.

LAST WEEK and 2018 YTD

The MIPS3, MIPS4, MIPS/Nitro models that had been long for over 15 months issued two trade signals last week (a Cash signal on 4/3/18 and a Long signal on 4/5/18). Since 4/2/18, all of the MIPS models are up approximately +1.5% as of the close on 4/10/18; but the MIPS models are down -4.6% for the year.

Good Trading !!!

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

|