Sunday, June 23 2013

Is the Bull Dead and the "3rd Leg Down" Starting ???

- we don't think so, but what if it is?

Read on...

Everyone, and I mean everyone, with money in the stock market knows that the bull market is the result of the Fed's stimulus, the so-called Quantitative Easing (QE3). QE3 is basically the Fed printing money at an alarming rate ($85 billion per month) and buying bonds to keep interest rates artificially low to facilitate borrowing and hence to stimulate the economy. But, it is not working (see our previous email below). Of course, the stock market likes any inflow of new capital that goes into equities, even if it is not creating new jobs, etc., and the fat cats do not want it to stop (yet).

Our Beloved Ben Bernanke (BBB) put the brakes on the bull market last week. He drastically reduced the criteria under which the Fed would start throttling back on the money printing (referred to as "tapering"). BBB raised the unemployment rate criteria for the Fed to start "tapering" from 6.5% to 7.0%. Since the unemployment rate is now 7.4%, his change brought the target much closer to today's unemployment rate. Hence, it did not take long for big investors to realize that they could not count on QE3 well into 2014, but much closer to the beginning of 2014 (or even the end of 2013). So, of course, many large investors ran for the hills.

We believe that it is possible that most of the selling last week came from big, professional "traders" who see the market horizon from a few days to a few weeks, and not from the large institutional investors who have a longer-term view of the market.

The good news is that, with MIPS, we will do well either way (see below).

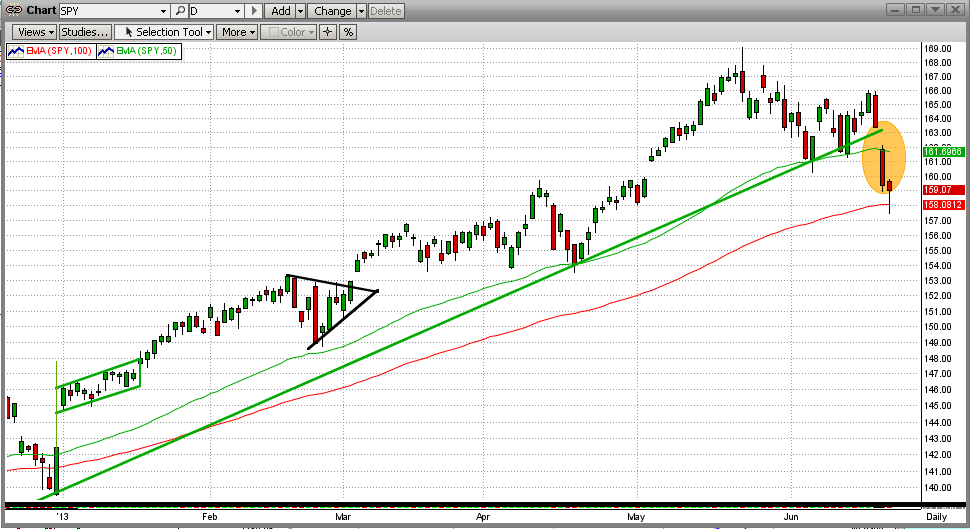

The short-term view of the market looks terrible - big sell-off last week, with a down gap on Thursday. The SPY broke its 50-day EMA, but bounced off its 100-day EMA to the upside.

So, why aren't we worried (yet)?

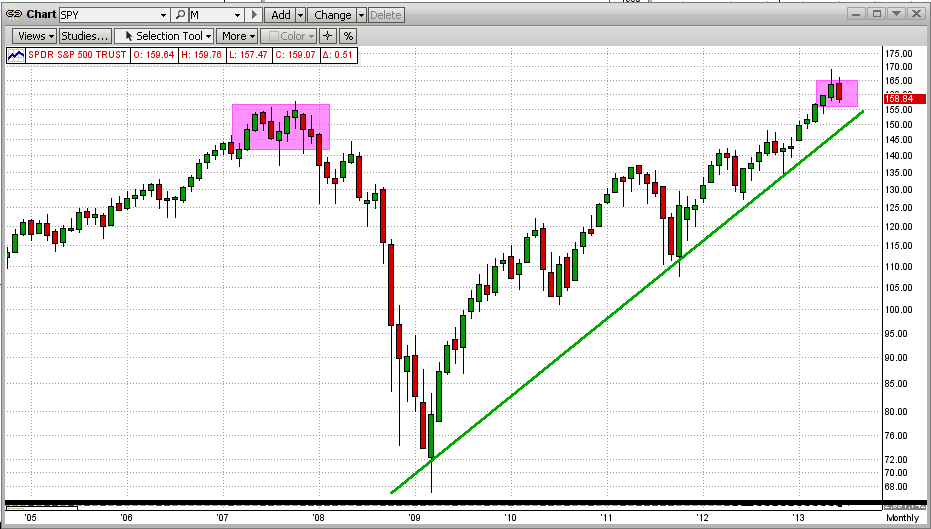

Mainly because we are intermediate-term investors and not day traders. And, a short-term drop of 3-4% does not usually signal a directional change in the stock market. Take a look at the monthly chart below. In this long-term view, the disaster on the daily chart is hardly noticeable on a monthly chart. This means that we need to wait and see.

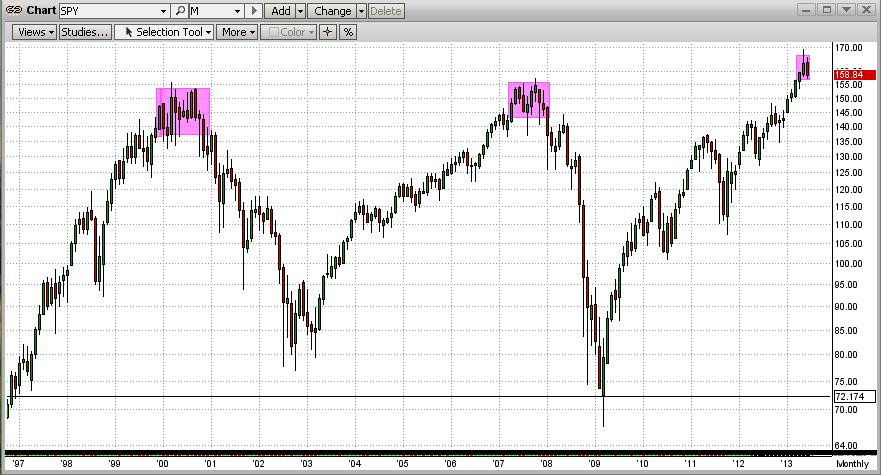

The other good news is that strong bull markets (4-5 years up) do not turn around easily or quickly. For this, let's look at the two most recent market "crashes", one in 2000 and the other in 2008. From the graph below, we can see that it took 8-10 Months for these bull markets to give up and collapse. At this time, we are only one week into a downtrend, so we have plenty time if this is the "Big One".

OK, got it. But what if is the the "Big One" ?

For that, we have to rely on MIPS. The MIPS models have been around since 2004, and the MIPS3/MF signals have been tracked by TimerTrac.com since 11/04/2005. During that time, we have had several intermediate-term downtrends and MIPS has profited from most of them (of course, MIPS beats the SPY in up markets by detecting and shorting these downtrends).

But, we have had only one really big stock market "crash" in this timeframe and that was from 4Q'07-1Q'09, when the S&P 500 dropped by over 50%. How did MIPS do in that market? For that, see the TimerTrac.com performance graph below

- see the graph below for the period of the last big market crash (mid-2007 to mid-2009)

- this graph is from TimerTrac.com using verified MIPS3/MF signals

- the "red dots" in the graph are the dates of the MIPS3/MF verified trades.

MIPS3/MF +130% SPY -40%

So, let's sleep well and wait for MIPS to tell us what to do.

Friday, June 14 2013

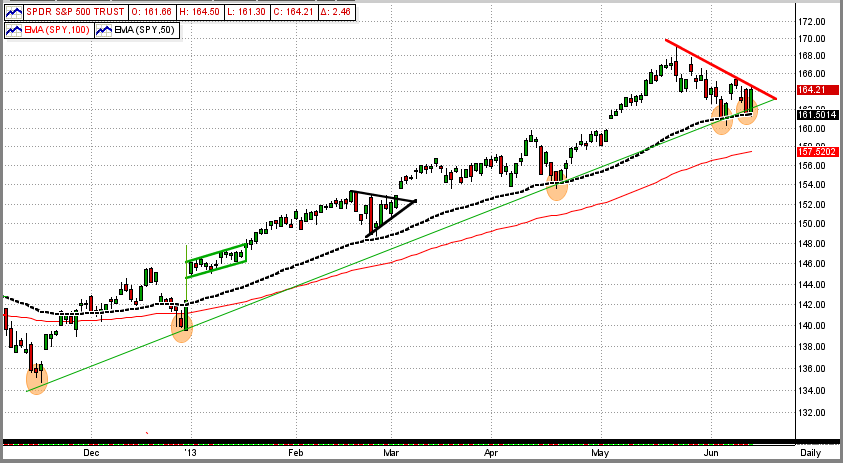

All MIPS models have been "riding the wave" since the end of Nov'12; and they have not been sucked into the "wiggles" along the way. In the graph below, see how the SPY has hit and bounced above its 50-day EMA along the way (including those in the last 7 days).

- Trendline is green; 50-EMA is dotted black; 100-EMA is red.

This stock market has been highly volatile lately, mainly out of fear that the bull run is almost over. Of course, everyone believes that they have the answer as to why the bull market is dead or why it still has legs. To answer that, however, it seems that we should first try to identify why the market has been so strong over the last 4 four years (i.e., since the the crash of 2008).

Usually, stocks increase in value from rising profits, which in turn, result from a strong economy, strong consumer spending, and good fiscal policy. And, of course, strong economies result from productivity increases, steady commodity prices, good jobs, reasonable consumer consumption, low interest rates, people living within their means, low consumer debt, etc.

Everyone has hashed and rehashed their reasons for (a) the ups in the markets (liquidity from the Fed, job creation, improving economy, the salvation of the Euro, etc.) and (b) the downs in the market (rising interest rates, not enough new jobs, slow growth, the PIIGS still weak and getting weaker, irresponsible fiscal policies in Japan, rising interest rates at home etc.).

All of this is important and variations in the above cause daily, rather minor up/down cycles in the market (mainly from big traders with a one-week horizon). But the big, long-term trend is ALL about the flow (or velocity) of money and where the money actually comes from. Remember, M1 is the "money supply" and M2 is the velocity of said money. There are good and bad MIs and M2s. A good M1 is when the money comes from companies buying raw materials and making products that are sold throughout the world to people working to produce those raw materials and to buy the finished goods. A bad M1 is when the money is coming from the Federal Government simply printing more-and-more money, like over $80 billion monthly now (which I call "Fake Money").

In my 25+ years of reading about stocks and stock markets, the most solid reason that I know of for stock market movements up and down is the accessibility and cost of money.

In poor economies and/or recoveries, governments print Fake Money to make more money available to consumers and corporations through low interest rates, entitlements, giveways, etc. Over time, of course, the more money that has been printed the less said money will be worth (declining value of the dollar) and hence the less it will buy, aka inflation.

This policy has always failed and it always will fail. It is not working here now. Japan has tried it for the last 20 years with very negative results and they are still doing it. Albert Einstein once said, "The definition of insanity is doing the same thing over and over again and expecting different results."

Here are a few examples of how the money (our money) that Ben and Japan are printing is "helping" the economy AND your stocks.

1) Individuals - Ben's buying of Treasury bonds is keeping interest rates extraordinarily low (to a fault). Individuals are buying houses now en masse with 15-year mortgages at 3%. In the next few years, home mortgages will most likely be back up to a more reasonable 6% and our government (you and I, that is) will own the debt at 3%. Thanks, Ben !!!

2) Corporations - Big companies (like IBM, GE, Exxon, etc.) are borrowing money at rates as low as 1.5% and are using said money to buy back their own stock (a lot of good that does for us). This buying pressure is pushing their stock values higher and it is lowering the number of their shares on the market. From this activity, of course, their earnings per share goes up, even if their total earnings are flat !!!

3) Big Investors - Hedge funds and ultra-wealthy billionaires are borrowing money in Japan at near zero interest rates and buying assets throughout the world. And, they "know" that they can get a better return on the borrowed money than the interest rate at which they borrowed. Hence, they are making their money using the government's money. The big guy's success depends upon the assets that they buy and the currency relationship between Japan and the other counties. In trying to navigate through all of this, they are causing tremendous volatility in all markets, including ours. Believe me, our stock market is interrelated with all major stock markets throughout the world.

The moral of this is that our markets most likely will not suffer a large drop as long as the Fed is printing and giving away your money, but it will not be a pretty outcome if they do stop in the near term. You better make money in this market because the money you will have 5-10 years from now will buy much less than it does today..

Excerpt from CNBC

Thursday, 13 Jun 2013 | 10:23 PM ET

Katie Holliday

The U.S. Federal Reserve is likely to act soon to quell investor panic over the potential tapering of its bond-buying program. Speculation is over whether or not the Fed will pullback its $85 billion a month bond-buying program that has led to volatility in global markets, particularly within Asia. Japan's Nikkei, for example, has plunged near 20 percent from its five-and-a-half year high hit on May 23.

|