Sunday, May 15 2016

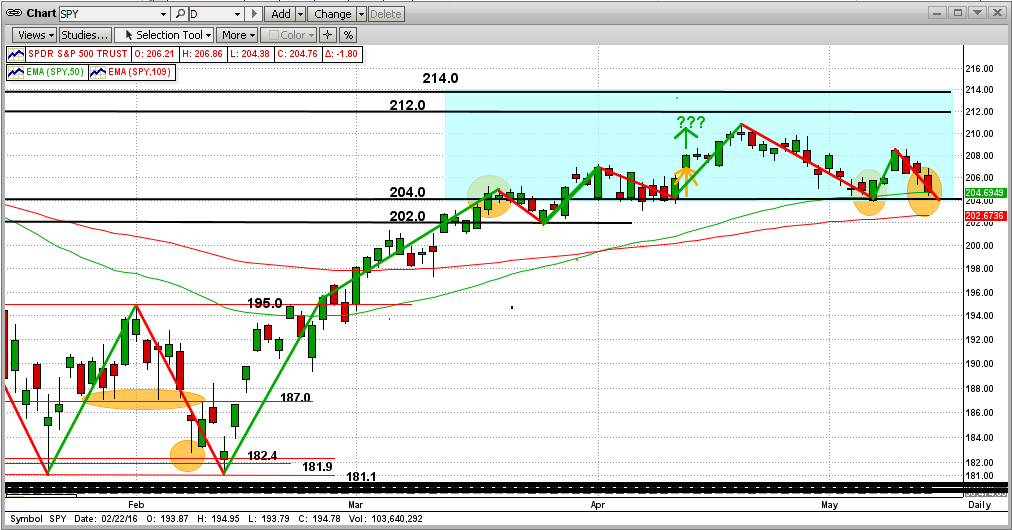

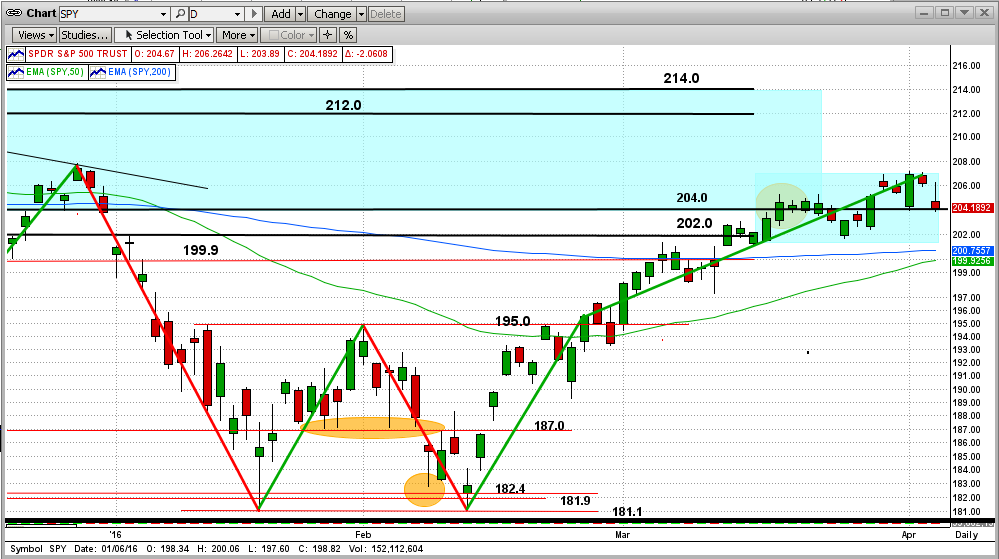

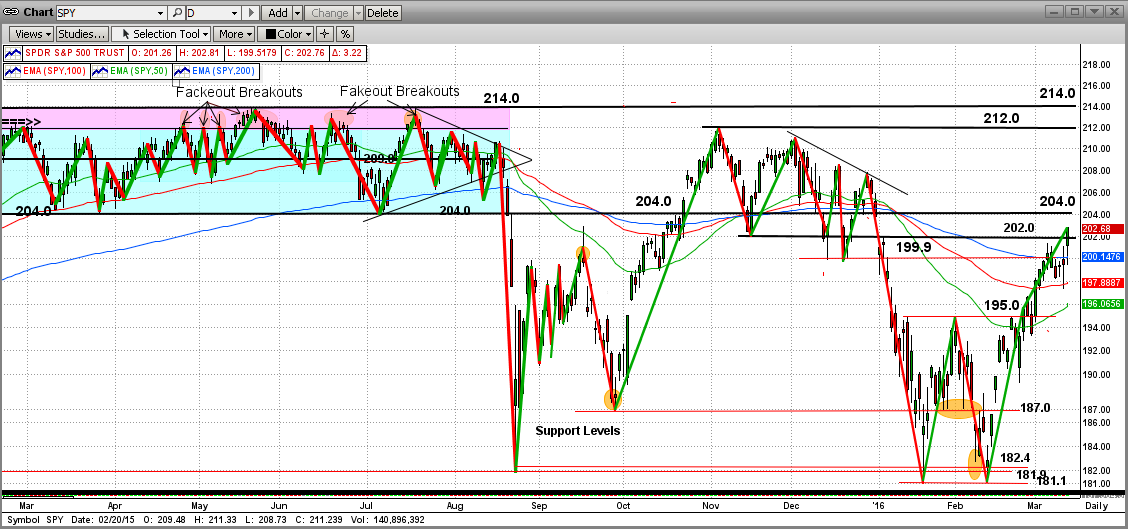

We are all wondering where this market will go from here. On Friday of last week, the SPY closed very near a critical point - almost right on the 204.0 support level and dead-on the 50-day EMA (green line in graph below). Of course, in the short-term, the market can move either way from here. We will rely on MIPS to tell us how to trade this market now.

LONG TERM...

At this time, after a 7-year Bull Market, it is interesting and prudent to start analyzing the longer-term outlook. Consider this ...

There are thousands of things that make the stock market move up and down all day long (daily cycles). And, there are others that affect what the market does on a longer-term basis; such as on daily-weekly cycles (short-term), monthly-quarterly cycles (intermediate-term), and annual cycles (long-term).

"Things" that affect short and intermediate-term cycles, (fundamental and technical) are overwhelming, such as:

- natural disasters (earthquakes, tsunamies, etc.)

- terrorist attacks

- foreign crisis (Greece, China, etc.)

- tech leader failure (Apple, Amazon, etc.)

- economic growth

- consumer prices

- inflation

- stock values (extreme P/E ratios)

- companies earnings/profits

- Fed Action

- interest rates

- quantitative easing

- dangerously low oil prices

- sentiment

- etc., etc., etc.

Short/Intermediate Term

The above are impossible to predict, but the impact on the market from "all of the above" combined can be measured and analyzed on an intermediate-term basis. That is what MIPS does for us. MIPS uses applied mathematics, pattern recognition, artificial intelligence, and common sense to tell us if the intermediate-term trend is moving up or down. Furthermore, each decision is analyzed in light of what MIPS sees the "big guys" doing (that is, institutional investors, like Morgan Stanley, Goldman Sachs, etc.). MIPS does this by "weighting" market changes by trading volume, using our proprietary "volume-weighted data". Basically, this means that market changes on high volume have a greater impact on decision than market changes on low volume. Of course, since high volume can only come from the big guys, we are basically tracking what the big guys are doing (high volume is like their "foot prints" in the sand).

Long-Term

The long-term trend should be a little easier to predict because of one single indicator. This indicator is NOT a technical indicator. Rather, it is a core fundamental fact which always shows which way the market should/will be moving. I say "should" because it sometimes takes a while to "sink in" (lag); and I say "will" because the market WILL ultimately follow this indicator.

Of course, this is not something that I made up or discovered. Big, smart investors like Warren Buffett have followed this fundamental indicator throughout their entire careers. It's not a new one either, as it was emphasized in Benjamin Graham's book "The Intelligent Investor" in 1949. This non-magical indicator is companies' PROFITS.

Ultimately, the long-term trend in stock prices is driven almost 100% by profits, but sometimes with a few months lag. [I believe that stock prices start moving up or dropping a few months before profits move up or down because the fat kats (CEOs, top management, board members, institutional investors, etc.) know in advance what direction their companies' quarterly profits will be, and they (and their family/friends) take action long before the profits are released to the public.]

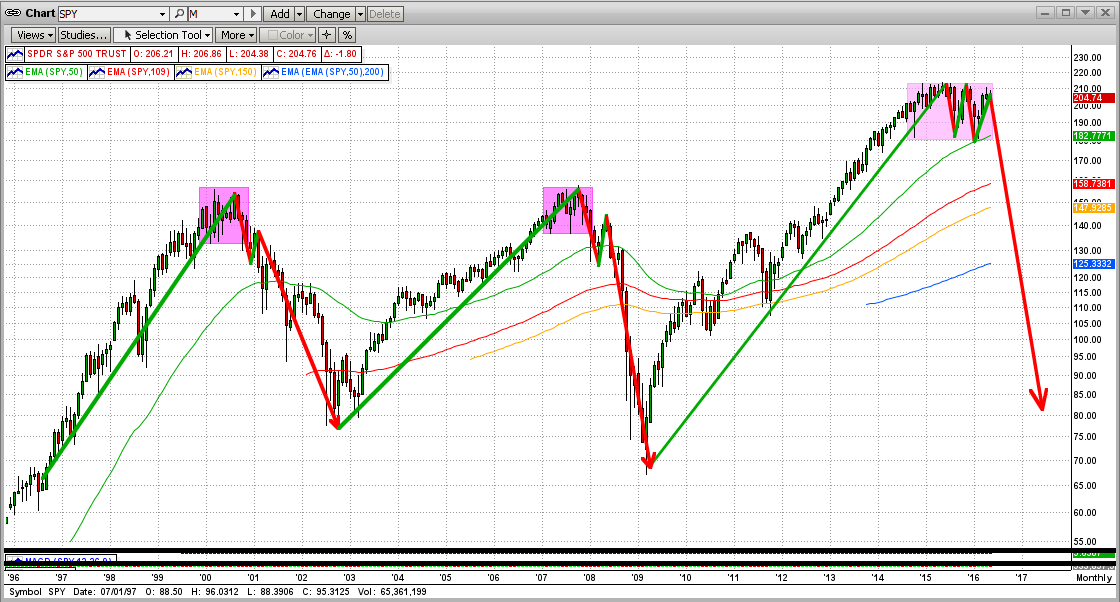

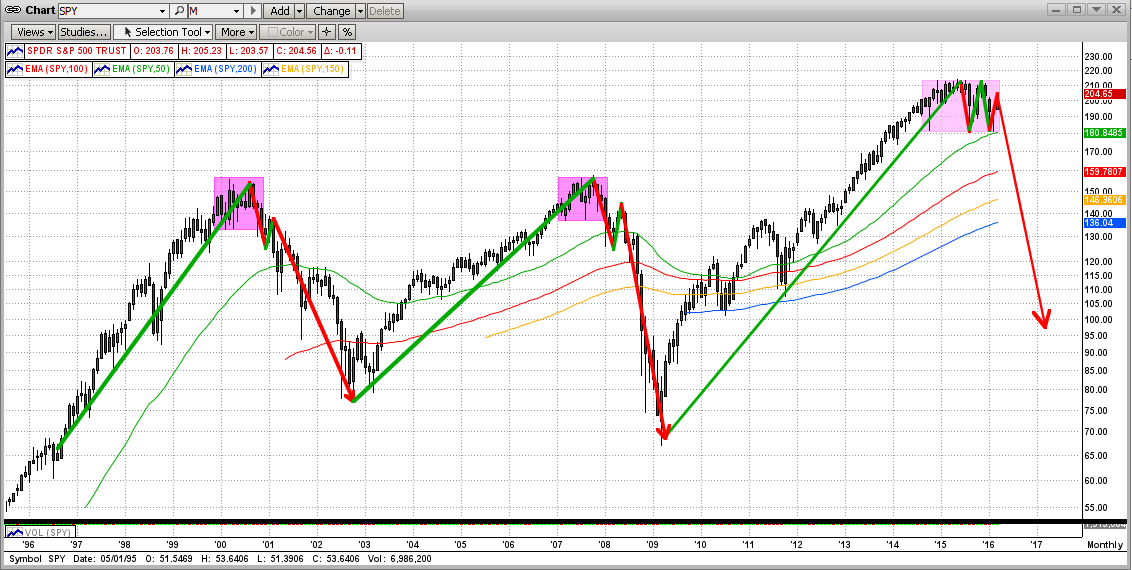

See the graph below (from StockCharts.com and www.RealInvestmentAdvice.com)

BEWARE

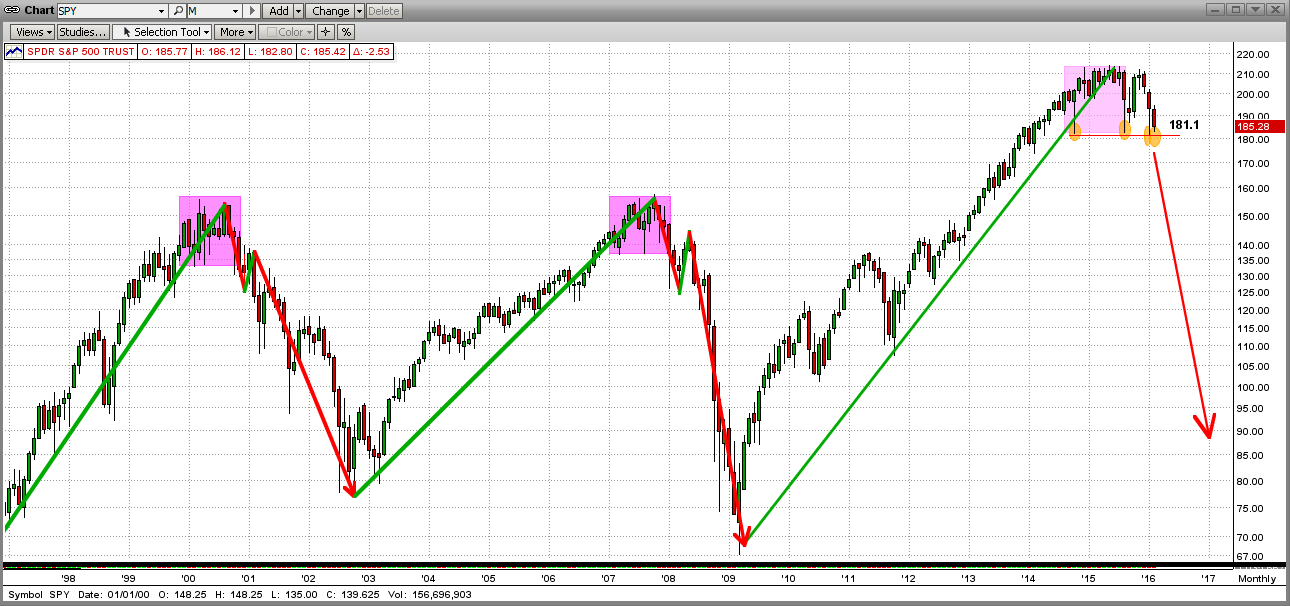

In the graph above, you can see that PROFITS "peaked" at the end of 2015, and have been DROPPING for over 1 year now. I believe that the Fed, and only the Fed, has been keeping stock prices high throughout 2015 with quantitative easing and extremely low interest rates. This is not good and cannot continue to happen forever. When the Fed's "tricks" no longer have a positive impact on stock prices, and if the US economy does not improved significantly, we will most likely have a drop in the stock market like in 2000 and 2008 (see graph below).

Good trading ...

Sunday, May 08 2016

MIPS Members:

Just as it appeared that the Bulls had broken out to the upside on 4/13/2016 to win the "Resistance Battle" of the SPY at 204.0, the Bears came back strong. The Bulls carried the SPY up to the 211.0 level, but the Bears pushed them back again to test 204.0.

The Bulls fought hard and held above the very strong 204 Resistance Level, which happened to also be the 50-Day EMA. This was a VERY bullish day !

Does this mean the market will be up from here? Absolutely not. It does mean, however, that the Bulls did find the strength to momentarily resist the downward push from the Bears when the market hit the ultra-critical 204.0 resistance.

This market could go either way from here (lots of good reasons now for both directions).

Let's wait for MIPS to tell us what to do !!!

Wednesday, April 13 2016

Did we see the Bulls blast out to the upside today ?

- New run to at least to 212.0 or 214.0 ???

Monday, April 04 2016

Where do we go from here?

The SPY is sitting close to 204, up from about 181. The Bears want to push the SPY back down to 181, but the Bulls want it to continue up to the all-time-high resistance level at 214. When the SPY hit 204, it was like hitting a triple-reinforced brick wall (with lots of waffling around since then). "The Battle of 204" will turn out to be quite a battle.

Lots of people are simply peeking over the fence (watching) to see what might happen next, but MIPS is "in the gears" analyzing (calculating) what is most likely to happen next. I'm betting on MIPS !!!

PEEKING...

MIPS'ing...

Sunday, April 03 2016

Rightfully so, many MIPS members are concerned about curve fitting, data mining, etc., in timing models on the market today (and, or course, in the MIPS models themselves). I can tell you point blank that we do not curve fit in the development of the MIPS models. I can also say with a high degree of certainly that any engineer with an advanced degree from a good school who has written software for control systems (say for nuclear power plants, space rockets, fighter jets, commercial aircraft, etc.), where failure is expensive or disastrous, knows the difference between curve fitting and the development of new algorithms to improve their software's performance.

I say "rightfully so" above, because many (or most) model developers do curve fit in the "development" of their models (if you want to call it "development"). The problem is that "curve fitting" is not really "development". It is merely forcing a bad model to look good using a certain set of data. And yes, done correctly, that model may produce good results after curve fitting with a certain set of data, but will almost certainly fail with any other set of data. I can also tell you that I know several model "developers" that curve fit in some form or fashion in their models, and they don't even know that they are doing so.

In reality, there can be a fine line between:

(1) curve fitting an existing model to perform better or

(2) introducing new algorithms to make a revised model perform better than its predecessor.

Let's see if I can come up with an example of this. In many cases, trying to come up with an example to explain something is more complicated than describing the original.

Allow me to try to explain fixing a fighter jet's control system software to better adhere to the design specs as to how fast the jet should climb in relation to how far back the pilot pulls "the stick". In any decent software of this type, the formula would be based on the physical fact that, because of the curvature of the top of the wing compared to the flat bottom, the air traveling over the top of the wing goes faster than that along the bottom, and hence the air pressure on the top of the wing is lower than that on the bottom. This pressure difference, of course, is what "pushes" the jet up into the lower pressure zone. This is why the wing is designed and built the way it is.

Now, let's say the fighter jet isn't working the way is should and two teams set out to fix it. Team #1 applies curve fitting and team #2 chooses to redesign.

Team #1

Curve fitting in this case could be "developers" tweaking certain parameters in the existing formula to force the jet to climb at a certain rate depending upon the speed of the jet. They may make this one jet perform better, but their "design" will likely fail for all others.

Team #2

Real development in this control system software would be where the design engineers that developed the formulas for how fast the wind over the wing should travel, realize that these formulas were developed for Mach1 speeds, but the current jets travel at Mach3. They also know that, at Mach3, the faster wind speed heats up the air going over the wing more than Mach1, and this hotter air get "lighter" (lower pressure). So, lighter air on the top makes the pressure from the bottom more effective, and the jet moves up faster.

Therefore, rather than one-time random "adjustments" which are also unexplainable from Team #1 (the curve fitters), the "real" design engineers in Team #2 introduced new mathematical algorithms that take the speed of the jet into consideration and adjust accordingly and automatically, and the software then works again at all speeds.

The main difference between these two approaches, of course, is that, when the software controlling of the jet needs to be improved:

Team #1 members "need and use" the raw data to adjust/develop their model, whereas

Team #2 members introduce new mathematical algorithms to closer resemble the performance of the jet itself (and they use the data

only to "prove" that the new algorithms/equations did improve the performance of the jet in the way in which it was designed).

Is this understandable?

Saturday, April 02 2016

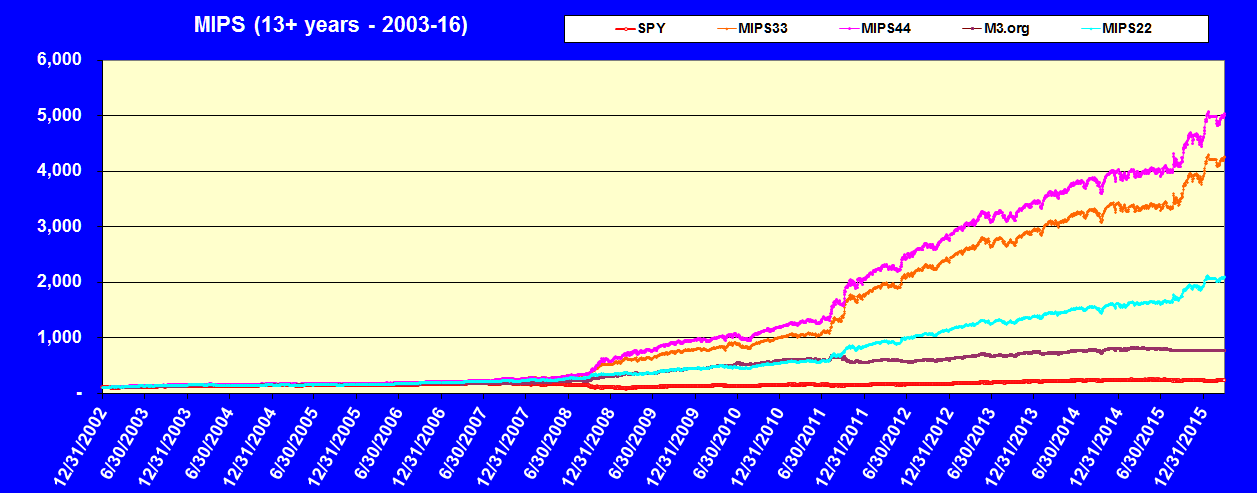

GREAT NEWS FOR MIPS MEMBERS !!!

We have spent the last 15 months developing what has turned out to be some of the very best models on the market today. We call this version of our models the "Blaster Series". Even though we added many new algorithms that would make our models better, the main contribution is how we now handle "flat markets" (aka, sideways trading patterns, consolidation patterns, etc.). Call them what you will, but they wreak havoc on all types of timing models; partially because they are "trendless" and partially because these types of markets can change direction so frequently (every few days), that timing models available on the market today usually get whipsawed when trying to follow these patterns.

Therefore, we added new code in our MIPS models to successfully deal with:

(a) low volatility markets that "wiggle" either in a flat or very slow growing/degrading trend (2005),

(b) high volatility markets that shoot up/down in big cycles, and end up where they started (2011),

(c) high volatility markets that trade in a "very tight trading range" of plus/minus 3-5% and change

direction very frequently (like every 4-7 days, as in the first 8 months of 2015).

The results are a developer's dream:

Our tests of the new models show that, compared to the performance when we started developing this new series,

1) the CAGR of the Blaster models are 30-50% higher,

2) the Maximum Drawdowns have been reduced by about 35%, and

3) the average number of annual trades are about the same as, or a little less than, before.

Nomenclature:

Below are the names that we will use going forward to distinguish between the new MIPS "Blaster Series" models and the names of the prior models from which they came.

Pre-Blaster Models Blaster Models

MIPS1 No new model

MIPS2 MIPS22

MIPS3 MIPS33

MIPS4 MIPS44

MIPS/Nitro MIPS/Nitro5

Blaster Performance:

Tuesday, March 22 2016

Many of our MIPS followers (including me) are asking if we will see new highs on the S&P 500 in the near future. We believe there is a good chance of that happening, but we are at a very critial point now.

As you can see in the graph below, the SPY broke through the top of an obvious double bottom at 195.0 (SP500 1950) in early March 2016, and then climbed rapidly to the bottom of the 12-month flat channel from 2015 at 204.0 (SP500 2040). The "area" between SPY 204.0 and 214.0 is what we have been calling "No Man's Land". The SPY broke through 204.0 with force (orange elispe), and has "stagnated" close to there for the last 3 trading days. It is very bullish that the SPY has been able to close above 204.0 every day after either opening or dropping below 204.0 intraday. Good "bounce-backs" for the bulls !!![Looks like someone hanging on to the top of a fence for their life, and it may be so for some of their investing lives.]

It will be very difficult for the bulls to push the SPY all of the way through "no man's land", up to strong resistance levels at 212.0 and 214.0 (SP500 2120 and 2140). The SPY all time high is at 213.5 (SP500 2135). And, of course, it will be even harder for the bulls to push the SPY through that level. Even if that does happen, none of this is really good for us unless the SPY keeps going up from there or we get out before the fall back. Read on...

Alternate:

If the bulls cannot push through SPY 213.5, we may be back to the topping process and the possibility of a big drop from near the all-time high. See below.

We will wait for MIPS to tell us how to trade this market...

Sunday, March 13 2016

With the recent price action in the stock market, one may ask if we are in a "New Bull Run" or a "Bear Market Rally" ?

If we look at the S&P 500 Index (or the SPY) over the last 12 months, this market does not look like it is going anywhere, except maybe up and down over-and-over again. Or, maybe even down, if not for the recent rally. The question is, "is this recent rally for real" or just a natural kick-back from a big drop (bear market rally)?

But, as active investors, we do not have the luxury to sit back and "only" analyze the market activity over the last year. We need to know where this market is going from here, now !!!

Read on...

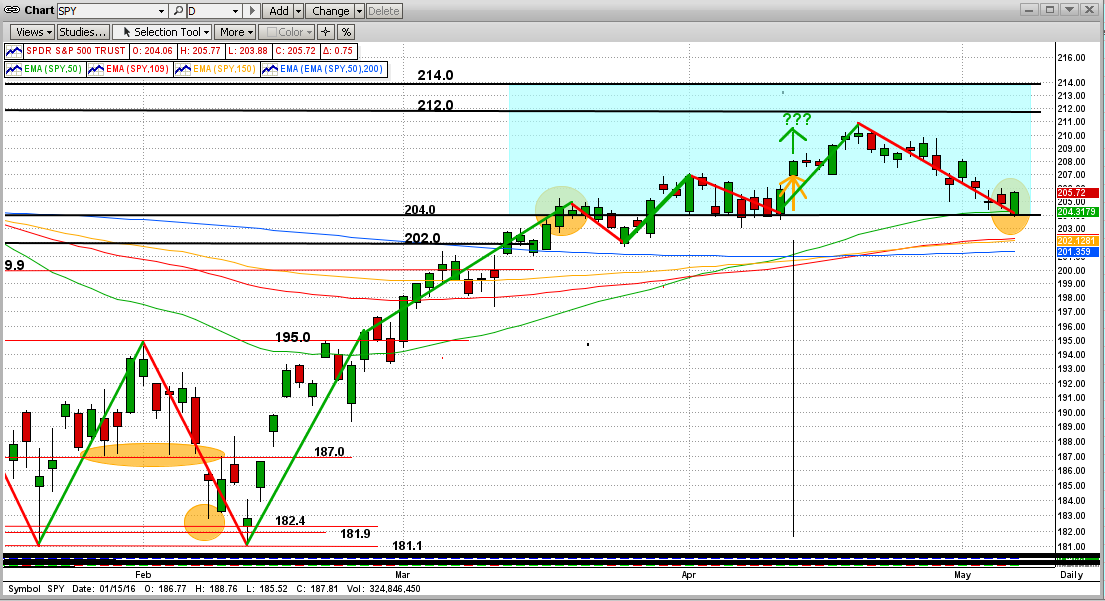

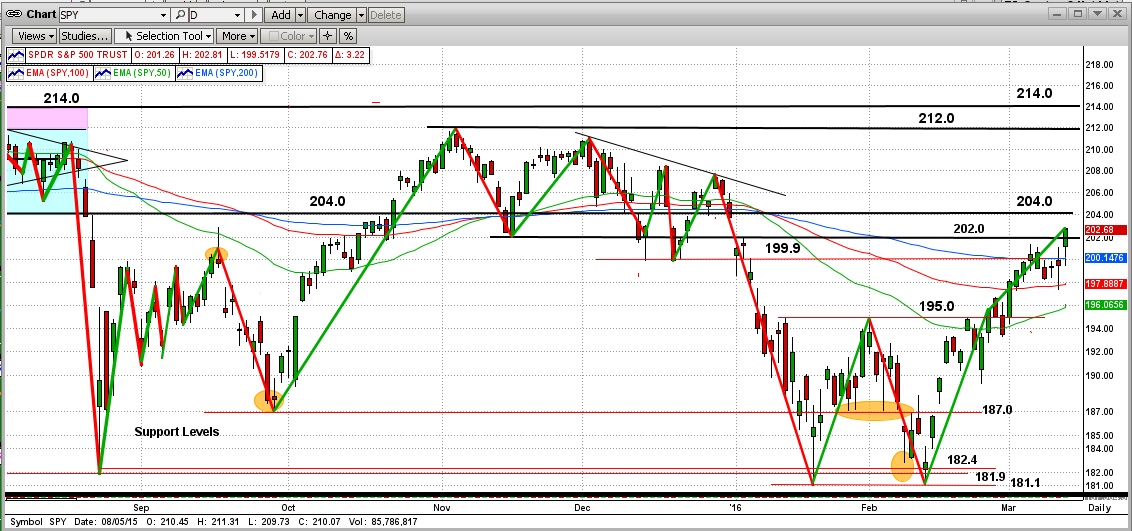

In the graph below, you can see that after several drops and kick-backs, the SPY hit and bounced off of its strong support at the SPY level of 181.0 (SP500 1810) in mid-February of 2016.

Even though there were a few other hurdles along the way up, we (and everyone else on the planet) knew that the SPY would face its toughest upside resistance at the top of the double bottom pattern at 195.0 (SP500 1950). Needless to say now, the SPY broke through 195.0 with force at the beginning of Mar'16. That was really bullish !!!

So, where does this leave us? Since its breakout at 195.0 (SP500 1950), the SPY has managed to break through 202.0 and head for the nasty tight-trading "channel" where it "lived" for all of the first 8 months of 2015. This "channel" is between SPY 204.0 and 214.0 (SP500 2040-2140). If the SP500 actually hits 2140 (SPY 214.0), it will be at an all-time high, and then the sky is the limit.

But, since there are no guarantees, this market could easily fail in its attempt to reach a new all-time high, and head back down and turn into a real "market crash". Please understand that "this risk is not gone". We will leave that analysis up to MIPS. Stay tuned...

Monday, February 22 2016

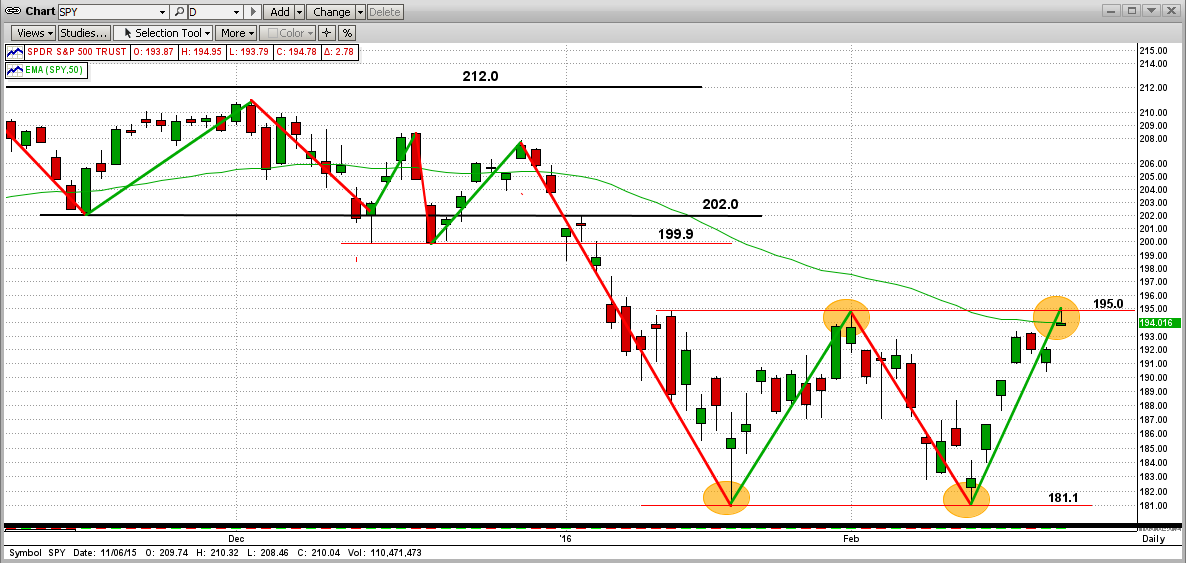

Today, and over the last two months, the market (SPY) has formed an almost perfect "W" trading pattern (Google "M and W" trading patterns for more info). Some analysts call the M patterns double tops and W patterns double bottoms.

I agree with that at times, but not most of the time. Most times, I have seen the market break out of the M&W pattern in the direction that it went in (i.e., if it formed the pattern on a down trend, it usually came out to the downside, and vice versa.)

Also, we have seen these patterns repeat themselves for months, in which case I look at them as pure "sideways trading patterns" or "consolidation patterns" (up and down over-and-over in a tight range, as the market did for the first 8 months of this year). These are dangerous patterns and MIPS now has new algorithms to handle this or run to the sidelines and wait it out (i.e., minimize whipsaw).

But, now the SPY has formed a new W pattern and this time its anybody's guess. See the graph immediately below. The W pattern hit the bottom of its pattern twice at exactly 181.1 (1811 on the S&P 500 index) and got kicked back up both times by the bulls; and recently it hit the top of the pattern at 195.0 (1950 on the S&P 500) for the 2nd time and got slapped back below a little by the bears (for now). So far, this spells strong downside support at 181.1 and possibly strong upside resistance at 195.0. Read on below ...

The next 2-3 trading days are crucial !!!

From here, if the SPY moves above 195.0 with force (and/or stays above it for a few days), we can look for the SPY to rally up to the next strong resistant levels at 202 or even 212. But, if it fails to break (and hold) above 195.0, we think the market (SPY) will drop back to test its support level at 181.1 (1811 on the S&P500). Then, if it breaks below 181.1, there is no strong support until way, way down (like in a real "crash"). My guess is that we may have a small rally from here, followed by a break to the downside below 181.1 sometime in the next 3-6 months. Follow MIPS, not me !

We are trusting MIPS to tell us what to do next, and I believe that MIPS will decide that shortly.

Stay tuned...

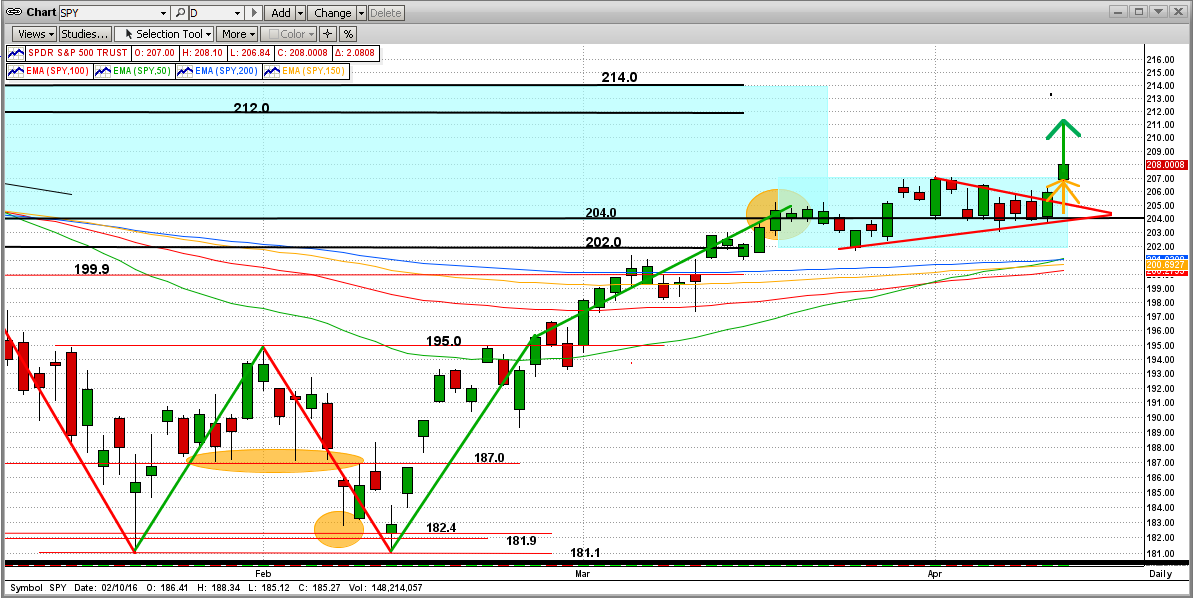

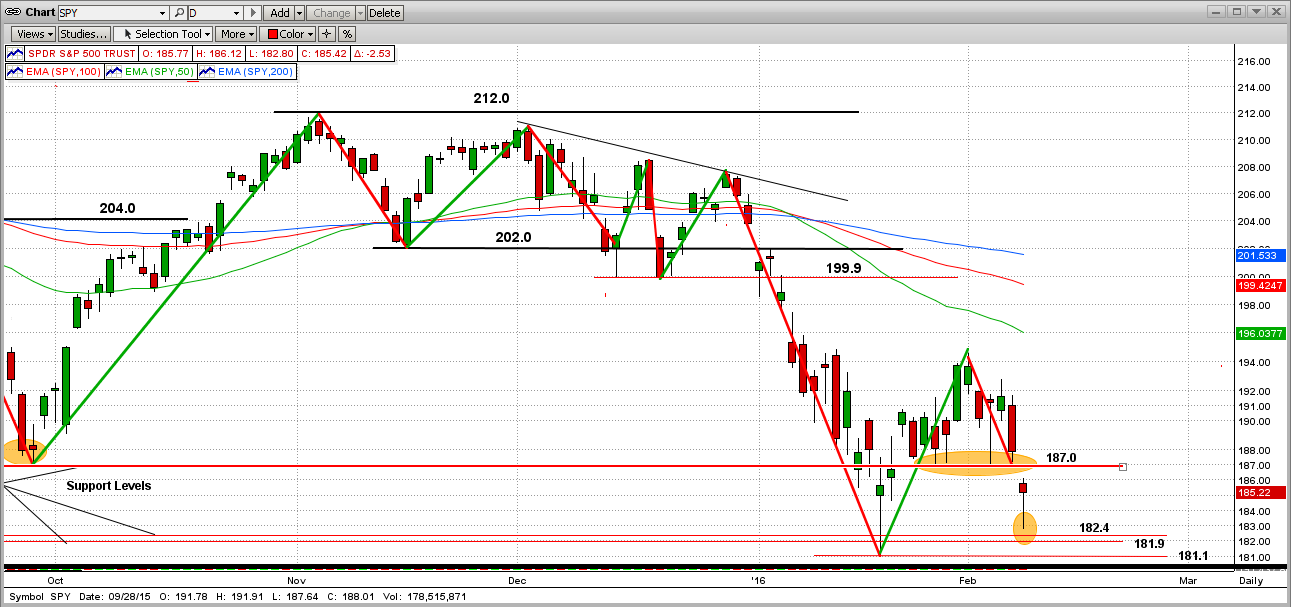

Monday, February 08 2016

Please review our previous email below from 1/27/2016 (Beware the Bear !!!), or you may have trouble understanding this one.

In the previous email, we included a:

#1 daily graph,

#2 weekly graph, and

#3 monthly graph

in order to show how the SPY has been breaking all support to the downside starting at a high of 214.0 in 2015 (approx 2140 on the S&P 500). Today, the SPY broke to the downside through a very important support level at 187.0 that it had touched, and bounced back up from, 4 times in the last 8 trading days !!!

Today's breakthrough started with force (S&P500 down 50 points), but the SPY bounced back up after touching the next very important support level at about 182.4 (not a good sign for the Bears). In fact, this could be interpreted as a "one-day key reversal"; where the SPY could change direction and head back up from here for a while. Read on...

Or, maybe the bears will get aggressive and charge ("test") the last strong support level at 181.1. If the SPY does break below 181.1 with force (after 4 tries now) and stays below for a few days, this could be the start of the big drop we have been keeping you aware of. This, of course, would not be pretty for most investors, but MIPS is on the verge of a going short now, and would quickly identify and short the big drop. If this does happen, the graph below shows what the SPY could look like over the next few weeks/months.

Stay tuned !!!

|