Friday, January 29 2016

We may have unravelled the "Big Guys" selling plan !!!

- (where by may have I mean likely, but not absolute)

All we really had to do to unfold this was to follow "The Bear" on 3 trips toward its goal:

1) thru the daily path,

2) thru the weekly path, and

3) thru the monthly path.

The Bear left very clear prints of where it had been and pointed out to us where it is most likely going. We don't need much of an explanation here, as the graphs below speak for themselves. Remember, the market moves in cycles and hits resistance and support levels along the way. For example, as a market travels a long way through an entire Bear market, it will meet (and need to break through) many support levels along the way. And, the support levels get harder to break through the further down they are.

So far, in the last 12 months the market has waffled back and forth for a record number of times for any prior 12-month period in market history, and has started what appears to be a big market drop. It could be a "correction" (drop of less than 20%) or a full-out "market crash" (i.e., a drop greater than 20%, and as far down as 40-60%).

The graphs below are:

Graph #1 - Daily graph,

Graph #2 - Weekly graph, and

Graph #3 - Monthly graph.

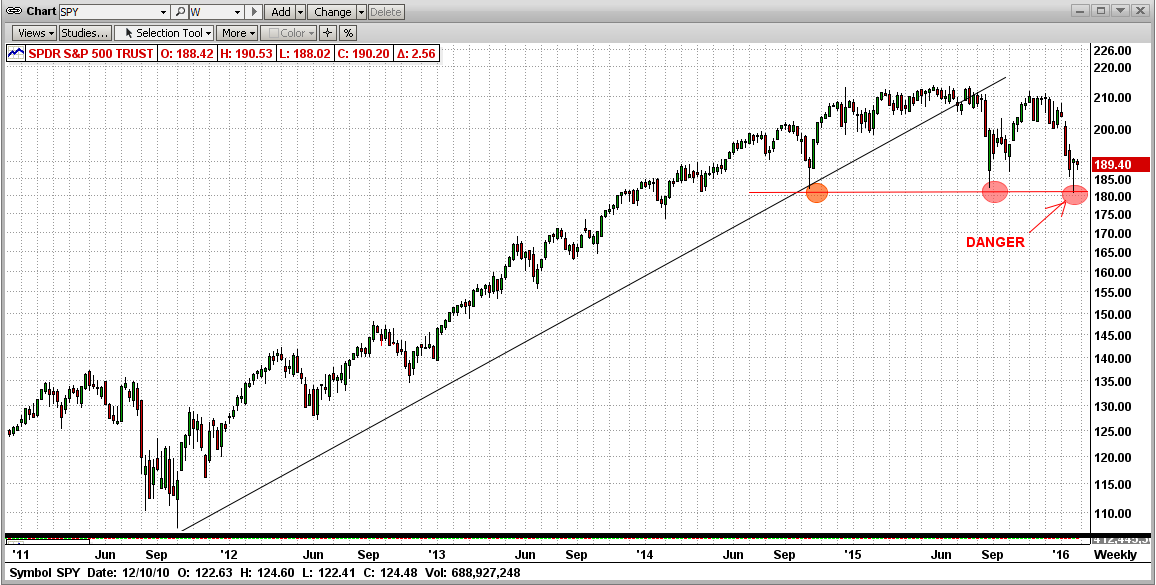

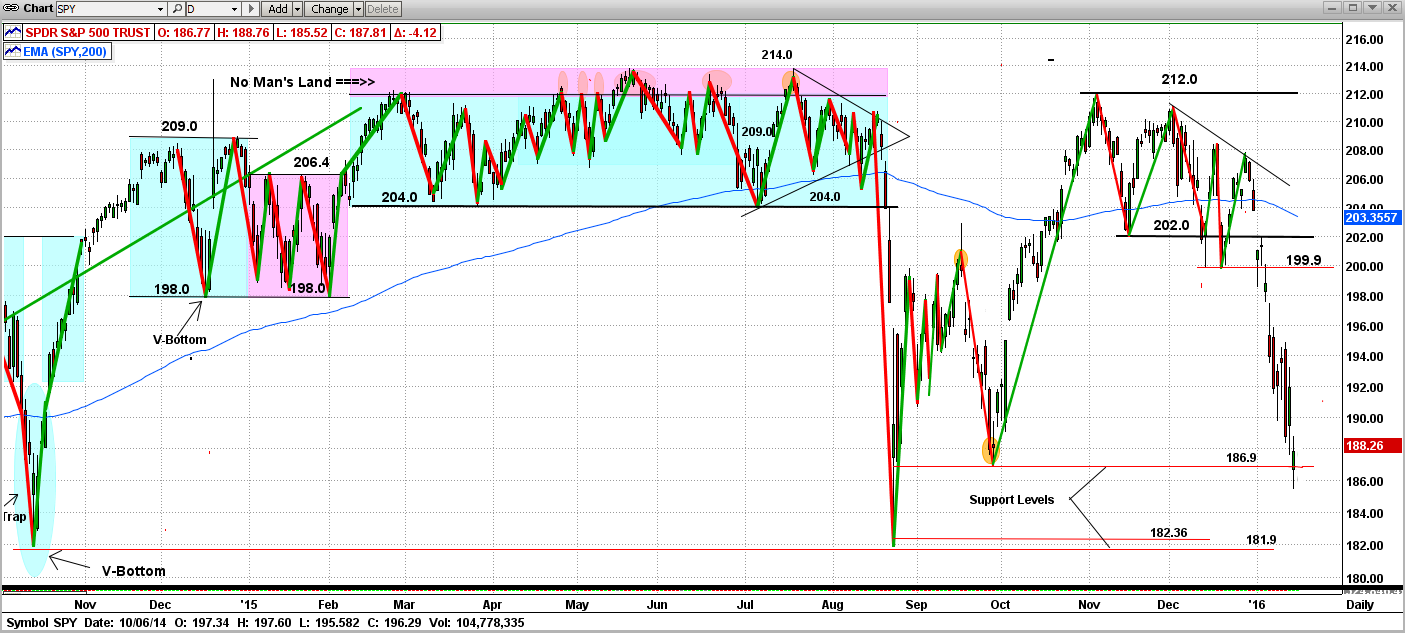

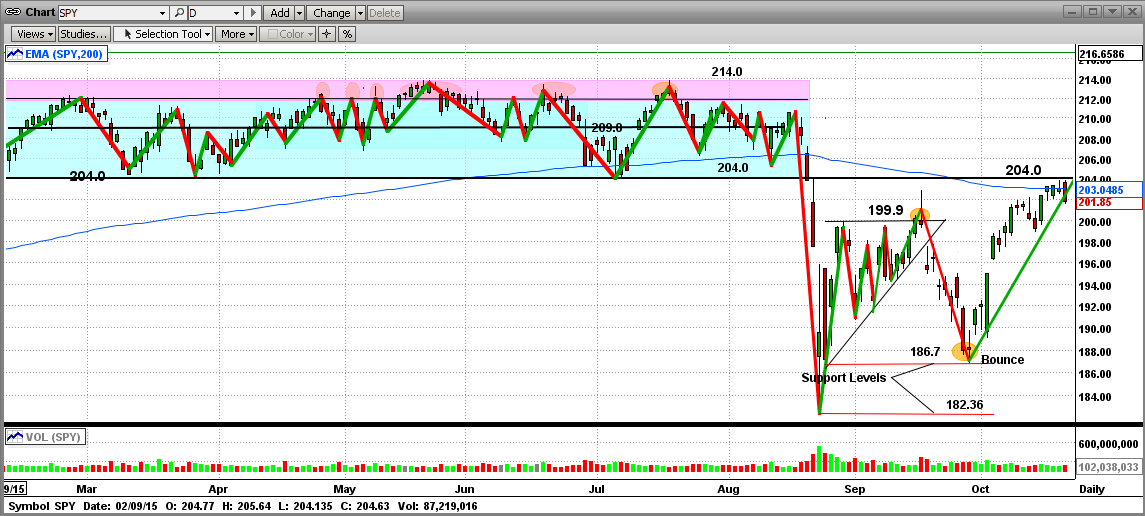

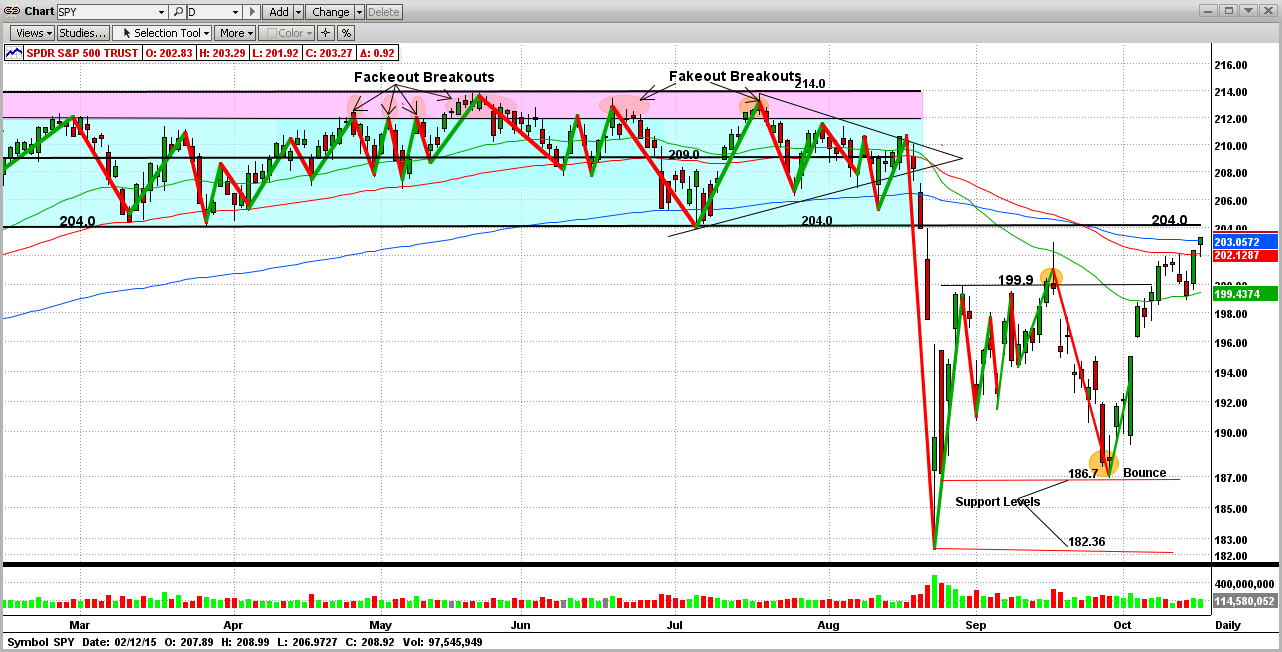

From its path in Graph #1 below, you will see that the S&P 500 (as represented by the ETF SPY), experienced an all-time high in May 2015 at 210.4 (about 2140 on the SP500 index) and has since broken key support levels on the way down at 204.0 202.0 200.0 187.0 182.0 and then it failed to break and stay below 181.0. In fact, the SPY failed to break and stay below 181.0 three times in the last 15 months (10/15/2014, 8/24/2015, and 1/20/2016).

Of course, this "Bear Path" is the work of the big guys. They try to hide their selling, but good technical analysis can expose them. The fat kats use volatility to try to "hide" their path; but again, good technical analysis can expose them. First we must make some sense out of the daily movements, and then the story gets more and more understandable as we move from the highly volatile daily graphs to the smoother, less distracting weekly and monthly graphs. In actuality, when we get to monthly graphs, the story is very obvious, clear, and telling.

In the past when similar patterns happened, the market has gone into full-fledged market crashes. Of course, that is just my personal analysis. But, MIPS is greatly different and is much more comprehensive. In addition to this type of analysis, MIPS uses other, much more comprehensive and reliable ways of determining which way the market is headed.

So, stay tuned and let MIPS guide us until the present plan runs its course.

- BTW, don't fear the Bear, as MIPS will take us short and we will greatly benefit from the market's

demise.

Graph #1 - Daily graph

See the 181.0 support levels at 10/15/2014, 8/24/2015 and 1/20/2016

- pink ellipses in the graph below

What I see here is strong support at 181.0

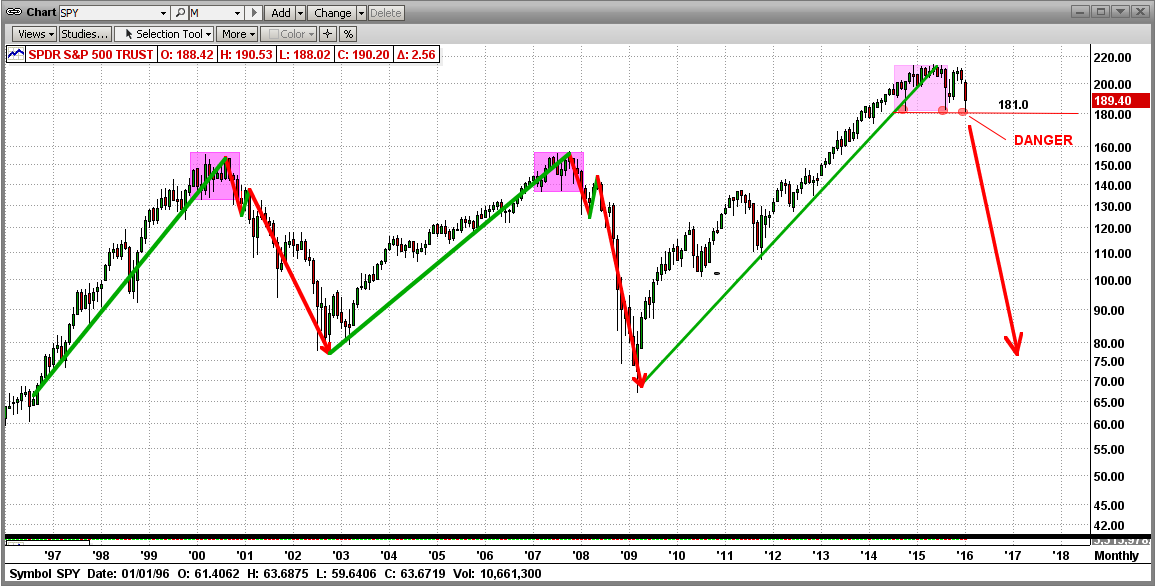

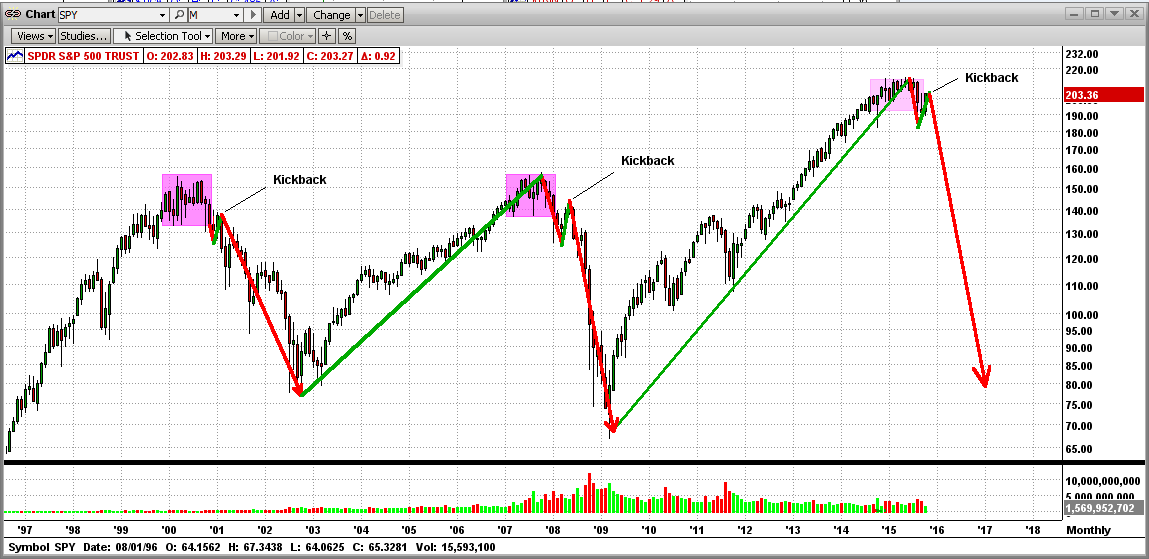

Graph #2 - Weekly graph

See the 181.0 support levels at 10/15/2014, 8/24/2015 and 1/20/2016

- pink ellipses in the graph below

What I see here is a broken trend and several strong attempts to crash (all failed at 181.0)

(Double Top ???)

Graph #3 - Monthly graph

See the 181.0 support levels at 10/15/2014, 8/24/2015 and 1/20/2016

- pink ellipses in the graph below

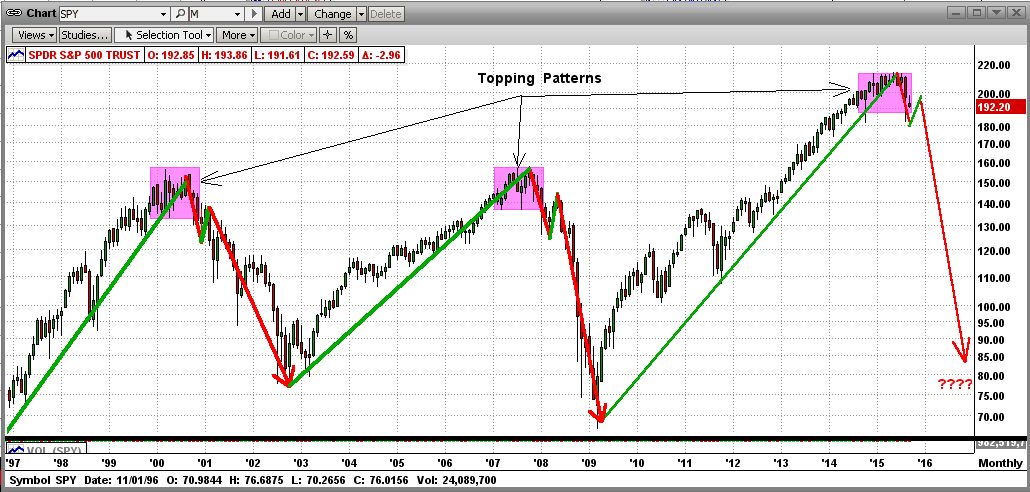

What I see here is a "topping" process that has run its course, with three attempts to break down hard, as in 2000 and 2008.

(Isn't it amazing that the volatility and waffling in all of Graph #1 is in the last three monthly bars below?)

Good trading !!!

Monday, January 18 2016

Is the Bear Upon Us?

We are smothered with "data and opinions" every day now that prove the market is heading for big trouble. This bad news is now centered around things like China's slowing economy and failing stock market (yes failing, not just falling); bad U.S. numbers on manufacturing output and retail buying; falling oil prices; fear that the Fed will reverse its course and start QE again, etc. Even if we knew for sure that all of this reported data was accurate, we would still not be able to figure out the impact on the stock market.

So, what good is this data if it cannot help us decide how it will affect the market. I am not sure about that, but I do think that there is an "indirect" way we can participate in the correct market moves. Institutional investors like Goldman Sachs, Morgan Stanley, UBS, etc. (the "fat kats") all have large staffs of hundreds of "Analysts" that analyze this data for them. Please understand that whatever actions the fat kats implement from their Analysts' recommendations are almost always 100% accurate, if you measure "accurate" by whether or not the market moves the way the analysts said it would. Well folks, if the fat kats buy, the market goes up whether or not it should; and if the fat kats sell, the market goes down whether or not if should. In other words, the price action of the market "follows the money".

This is not because the fat kats know which way the market should be going, it's because the market moves the way the fat kats push it (fat kats buying leads to up markets, and fat kats selling leads to market drops).

So, since we cannot predict the way the market will move, we seek to identify the way the fat kats are trading (buying or selling) and mimic them. MIPS capitalizes on this the by using "volume weighted data", where price action on high volume has a greater impact on the MIPS models than price action on lower volume.

[About a month ago we wrote a blog entitled "Is the Market Topping?" This was about how the fat kats "dump" their positions when the market is "topping" (i.e., turning from a bull market to a bear market). See http://www.mipstiming.com/blog/view/8682/is_the_market_topping_]

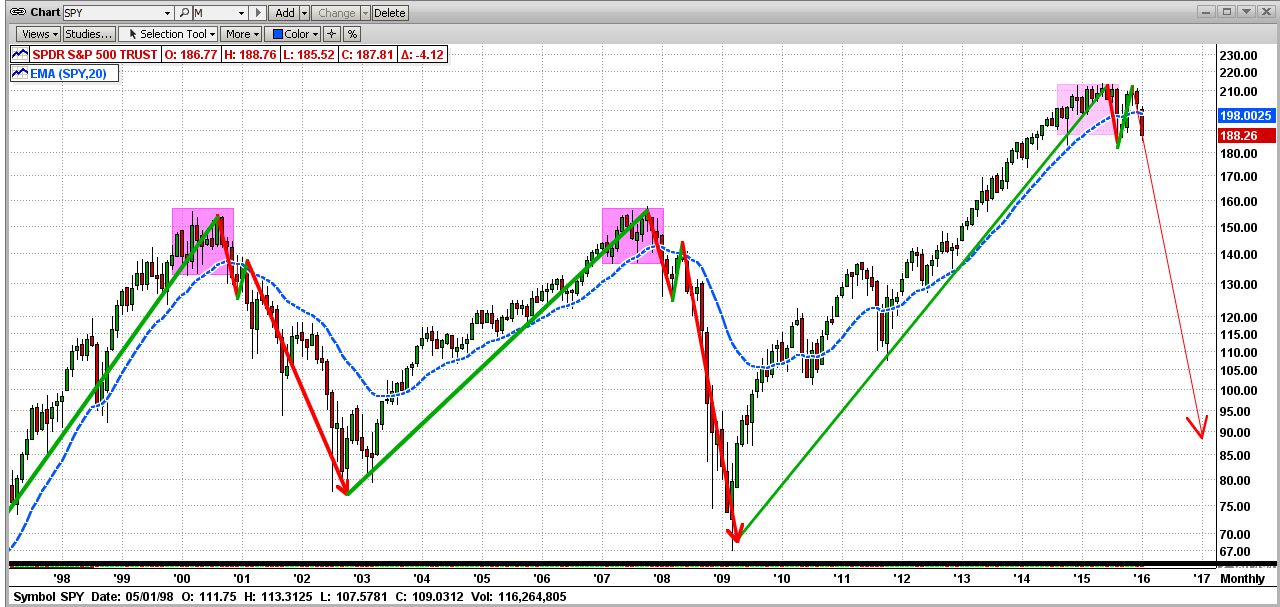

We actually thought that there was a good chance that the market was topping then, and we think so even more now. In the graph below, you can see that we have recently ALMOST completed this latest topping cycle, like the cycles from the start of previous Bear Markets (in 2000 and 2008); including two drops below the SPY's 200-day EMA (where "ALMOST" is explained below this graph).

"ALMOST"

I used the word "Almost" above because there are a couple of things that have to happen before I would "bet-the-farm" on the big crash starting now !!!

The main requirement for the big crash to happen soon is that the SPY has to break through several more very strong "Support Levels" (see graph below). As you can see, so far the SPY has broken support levels at 202.0 on 1/04/16, and 199.9 on 1/06/16. Then the SPY dropped all the way down below the even stronger support at 186.9 on 1/15/16 (Friday), but closed above that level at day end. That could signal a reversal.

To turn into a market crash, the SPY still needs to break through strong resistance at 186.9 and 182.36 and finally at 181.9. Seems like quite a task, but the lower support level at 181.9 is only about 3% from Friday's close. Even if this all happens in the next few days/weeks, the bulls could still want this market to "top" for several more months before giving in to the bears.

BTW: MIPS3 and MIPS4 went to cash on 12/30/15, and short on 1/08/16...

Stay tuned...

Saturday, January 09 2016

To successfully manage their "Nest Egg", everyone needs a good "Asset Allocation" plan. An Asset Allocation plan defines how much of your life savings you plan to allocate to real estate, commodities, equities, bonds, alternate investments (art, etc.), and cash.

This "lesson" is limited to how to go about investing your equities money (i.e., stocks, ETFs, etc.).

Needless to say, most individual investors do not do well investing in equities, especially the ones who manage their own money. Some use RIA (Registered Investment Advisor) firms, and hope for the best because they have no idea how the firm will manage their money. Still, that is a better approach than trying to trade against the pros by yourself.

This lesson is for individual investors who manage their own money (that is, buy-and-hold or trade for themselves). Please be aware that there is no real, concrete definition of a "Buy-and-Hold" strategy. For example, does it mean to pick, say, 30 stocks (as in the Dow) and hold them for retirement or for your kids/grandkids? If so, you would not have done well in the past, because most of the stocks in the Dow fifty years ago are gone.

And, the Dow has NOT been made up of the same 30 stocks for many years. When one of the Dow stocks goes bankrupt (like FW Woolworth), the Dow replaces it with another (like Walmart). Thanks. If I had a brokerage firm that would do that for me, I would buy-and-hold with them.

And, what about buying-and-holding say 10-15 mutual funds? Do you think that the fund management team is not trading in those funds. Many "turn over" 50-100% of their portfolio every year. Does buying a fund and letting the managers trade their butts off with your money in their fund make this a buy-and-hold strategy? Why is that different than you trading those stocks yourself? Does buy-and-hold mean that, if you buy a basket of stocks (as in a fund), and let someone other than yourself trade those stocks all year long (while you watch from the sidelines), that makes it a buy-and-hold strategy? But if you make those trades yourself, NOT ?

Anyway, most individual investors do trade, but it is at random and is usually the opposite of what they should be doing. I know, because I did just that myself for over 20 years. We watch Apple go up like a rocket and THEN we buy in. Shortly thereafter, Apple dives, and we switch to another stock that has been skyrocketing, like Amazon. Then we do the same thing with Amazon and Google, etc., over-and-over.

Most individual investors do the same thing with timing models as explained above for stocks. They subscribe to one model, and if it takes a relatively small "hit", they change models and continue the same process, over-and-over.

We are almost guaranteed to not do well in the stock market without two basic principles:

1) a good, specific strategy (like how, when, what to trade), and

2) the discipline to follow through with our strategy, WITHOUT emotion.

I am going to tell you how to implement something like that above and show you one way to improve on what you have been doing; in some cases by 400% or more... read on.

First, let's assume that we would be content with buy-and-hold if we could find high quality "Indices" in the world that would perform 3-4 times better than the S&P 500 (or its ETF, SPY) over say an 8-10 year period, with less than 1/3 of the drawdown of the SPY. Would that be a correct assumption? And, would you trade a little to accomplish this? If so, read on.

Let me show you what could be 3 of those types of ETFs from other countries on our planet (or something else) that performed as above. But first, let's establish the performance of our benchmark (the SPY).

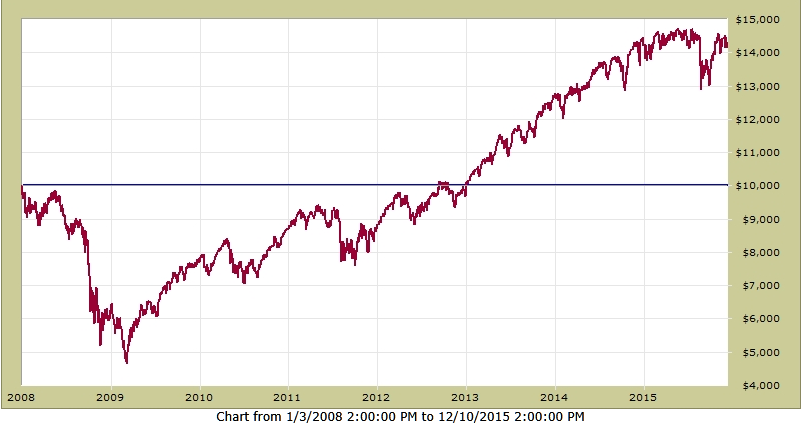

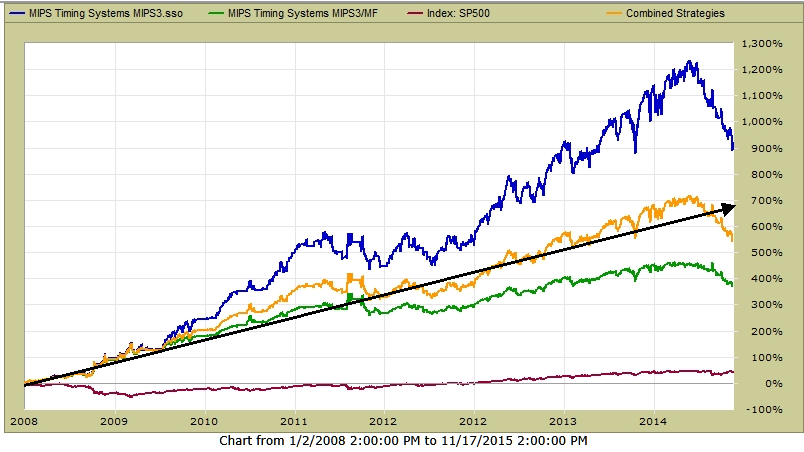

In the graph below, you will see that from 2008-2015, buying-and-holding the SPY would have:

1) grown a $100,000 investment to $143,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 4.5%

3) experienced a Maximum Drawdown = -53.5%

Could we have found other investments that would have beaten this significantly? OK, let's look at some other investments that we present herein say as "Indices" from other high-quality countries. See 3 of those below:

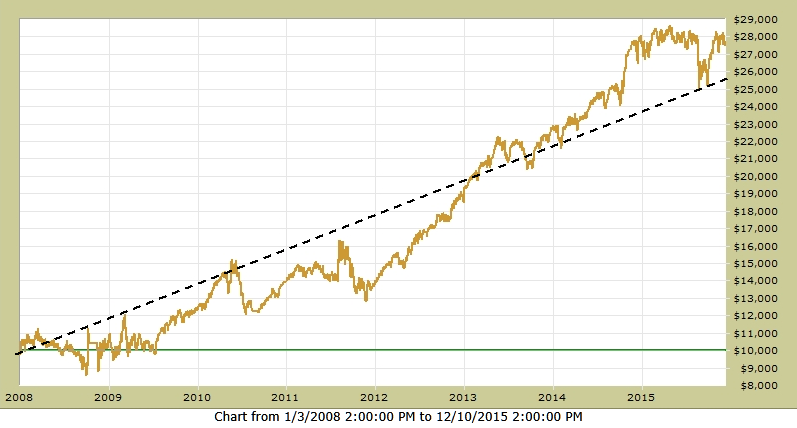

Country A - from 2008-2015, buying-and-holding the Country A Index would have:

1) grown a $100,000 investment to $240,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 13%

3) experienced a Maximum Drawdown = -28%

Country B - from 2008-2015, buying-and-holding the Country B Index would have:

1) grown a $100,000 investment to $280,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 14%

3) experienced a Maximum Drawdown = -24%

Country C - from 2008-2015, buying-and-holding the Country C Index would have:

1) grown a $100,000 investment to $450,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 21%

3) experienced a Maximum Drawdown = -19%

MIXING

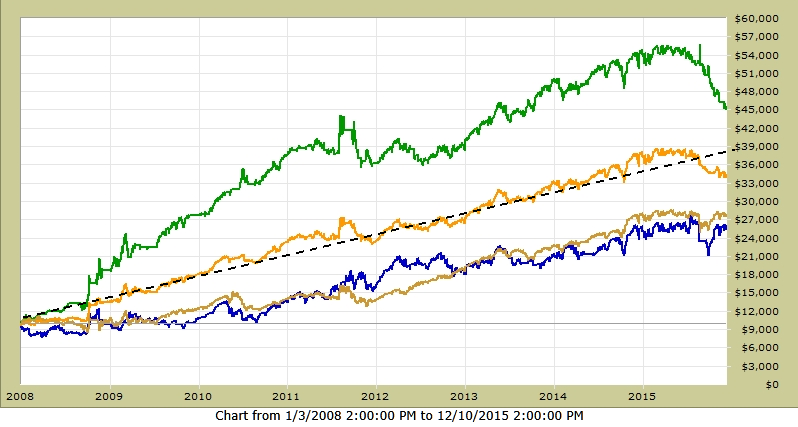

Our investment strategy would be to diversify our risk by placing a portion of our total equity money in each of these Indices. By investing 30% of our equity money in Country A; 30% in Country B; and 40% in Country C, the performance would be:

Combo - from 2008-2015, buying-and-holding the Country Indices and "mixing" as above would have:

1) grown a $100,000 investment to $350,000 (multiply right-hand scale by 10)

2) produced a compounded annual growth rate (CAGR) = 17%

3) experienced a Maximum Drawdown = -16%

Combo is Gold; Country A is Blue; Country B is Light Brown; Country C is Green

Compared to buying-and-holding the SPY, the above strategy of "mixing" good indices does MUCH better, with VERY LITTLE RISK (Max DD=-17% vs -53% from the SPY)... see below !!!

Now "The Lesson"...

First, I have some bad news and some good news !!!

The bad news is that, even though the graphs above are "verified" actual performance, they are NOT Indices from other countries (sorry, but I needed to do that to get and keep your attention).

The good news is that the results in the graphs above (that are reported as from Country Indices) are from actual good, live models like MIPS. To make my point, I used MIPS3 as Country C and picked two other models from developers that I know that have verified results on TimerTrac.com for over 10 years. I know others (like on ThetaResearch.com) that are as good or better than the other two presented herein.

My point is that many individual investors who can tolerate 40-50% drawdowns from buy/hold of good mutual funds or from a group of large-cap stocks in the US or Europe, cannot seem to tolerate even a 20% drawdown from a timing model (or better yet, a combination of 2-3 good models) even though these models have outperformed the Indices/Funds by 300-400% !!!

Caution:

Please be aware that you cannot just pick 2-3 good timing models, mix them, and expect to get similar performance and lower drawdowns from the "mix". To get lower drawdowns, the individual models CANNOT be based on the same principles (like trend-following, reversion to the mean, sector rotation, etc). When the models are based on different principles, most of the time they have their "bad periods" at different times and this "smooths" the performance. For example, if you were using 3 models and one of them had a -15% drawdown when the other two were flat, the resulting drawdown for the "mix" would only be -5%. Etc, etc, etc...

Going Forward:

I am not in a position to "recommend" other models but I can tell you what to look for. And, we have several RIAs that use the MIPS models "mixed" with 4-5 other very good models, and their results have been amazing. I can introduce you to them. Feel free to contact me !!!

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Thursday, January 07 2016

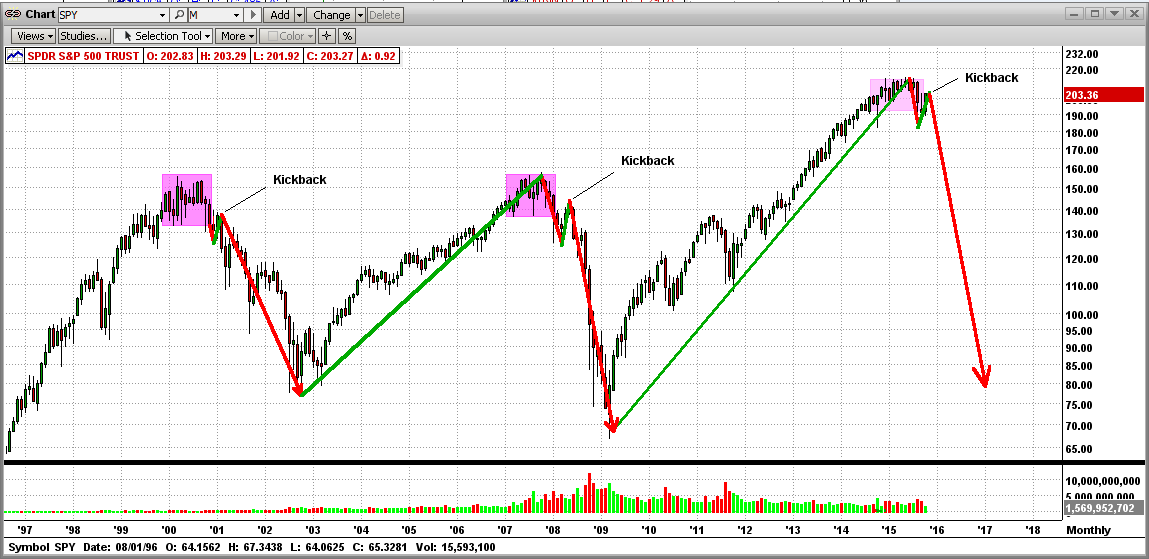

"Topping" is when the big guys are selling at a market top over a 12-15 month period; and when they have offloaded most of their huge long positions, they start shorting and driving the market through the floor.

The way this works is that an institutional investor decides to dump, say, 200 million shares of GE. Every week or so, they sell their GE position all the way down between $28 to $23/share, and they depend on the little guys to "buy on the dip" and drive the stock price back up from $23 to $28/share, over-and-over again.

The process ends when the big guys have sold most of the long positions that they wanted to unload. And, when the process does end, the market crashes (down 45-60%).

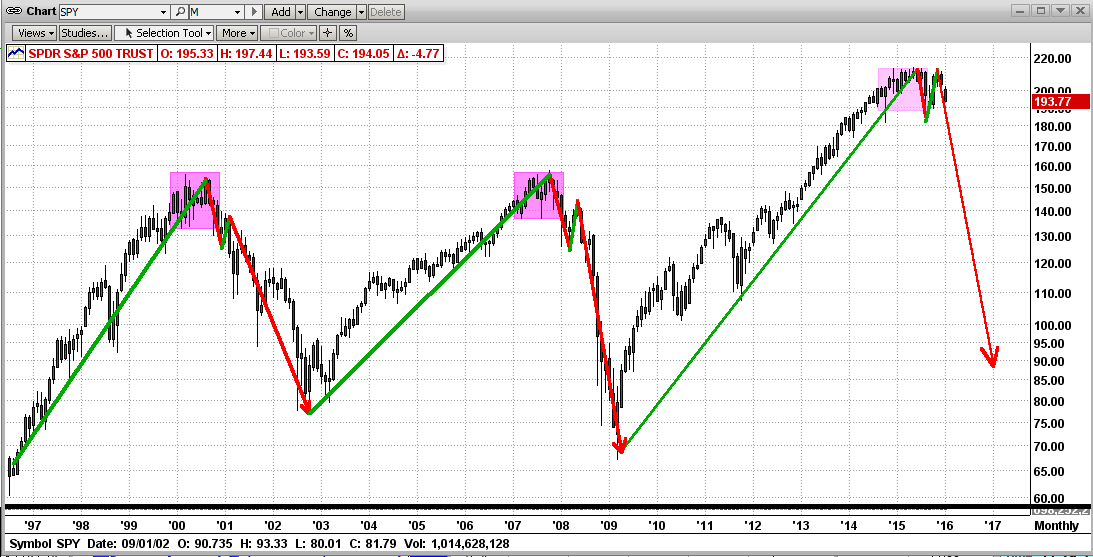

See the last two crashes below (2000 and 2008) and beware. Please see that the bars in the graph below are monthly bars, so the topping process took 12-14 months in these two years. Looks like the same is happening in 2015-16.

There is no reason to panic, mainly because once these shrinking markets start dropping, they take at least 12-18 months to run their course (i.e., for the Dow to drop like 7,500 points). We just need to wait until MIPS sees the big crash actually happening and takes us to cash and then short.

Of course, this crazy market could turn around and roar back up...

Stay tuned !!!

Saturday, December 26 2015

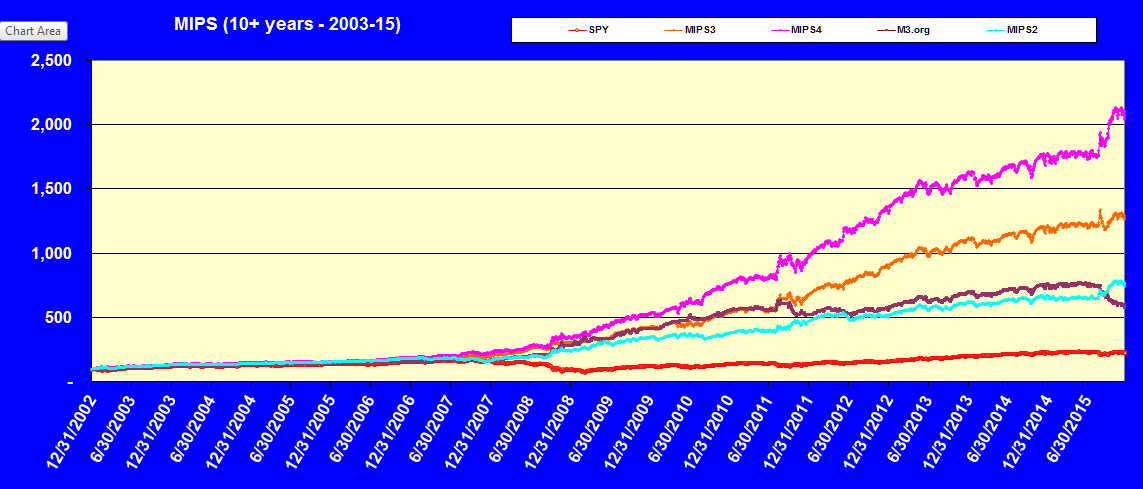

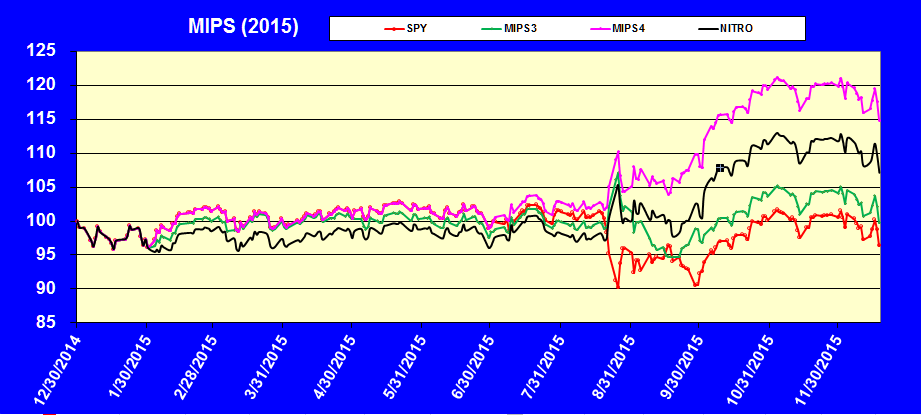

This blog is to show the improvements in performance that we have made in the MIPS models as a result of adding our new algorithms for markets with high-frequency directional changes (like every few days). Without algorithms like these, most timing models would get whipsawed in these fast changing environments (as MIPS did in 2015).

See the improvements:

(a) in 2015 in our previous email (excerpts below), and (b) for 2007-Dev'2015 in this new blog.

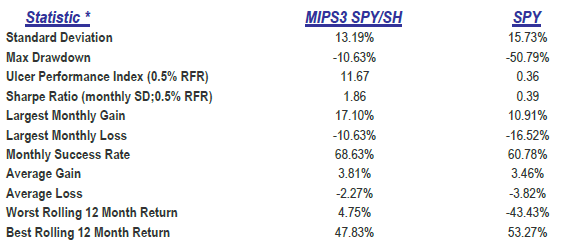

Because we have verified signals on TimerTrac.com for MIPS3, we compare MIPS3 below before and after the change in algorithms.

You will want to compare the Gold Line (after) against the Brown Line (before).

- other models are included to round out our offerings.

MIPS models updated with our new algos:

1) Brown Line = MIPS3 performance as it actually happened over the years

- Signals verified by TimerTrac.com

- Performance is from whichever version of MIPS3 that was in effect at the time of each signal

- Note the flat market in 2011 and the drawdown in 2015

The below is what the performance would have been if all revisions to the MIPS models were available

since 2003:

2) Gold Line = The latest version of MIPS3 including all new algos, backtested to 2003

3) Purple Line = The latest version of MIPS4 including all new algos, backtested to 2003

4) Blue Line = The latest version of MIPS2 including all new algos, backtested to 2003

5) Red Line = SPY performance

Remember, the new algos are for:

(a) high-frequency direction changes (b) in a flat market (c) over a relatively long period of time

- this is rare, so the new algos did not result in big differences in performance compared to the old algos,

except in 2011 and 2015

- see a comparable chart from the old models on our website at http://mipstiming.com/performance1

Statistics below are for MIPS3 trading SPY long/short from 2007-6/30/2015

- does not include results after 2Q'15

MIPS3 CAGR = 25%

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems

Houston, TX

281-251-MIPS(6477) 281-251-MIPS(6477)

=============================================================

<<< Excerpts from Blog on 12/20/2015 >>>

MIPS Members:

This blog is an attempt to explain what went wrong with the MIPS models in 2015, and how we have "fixed" the problems. Section I explains the perils of buying SH instead of shorting SPY on short signals in high volatility markets, and Section II attempts to explain the risk of trading in markets that are changing direction continuously in only a few days over long periods of time. Section III explains "drawdowns" and timing models in general.

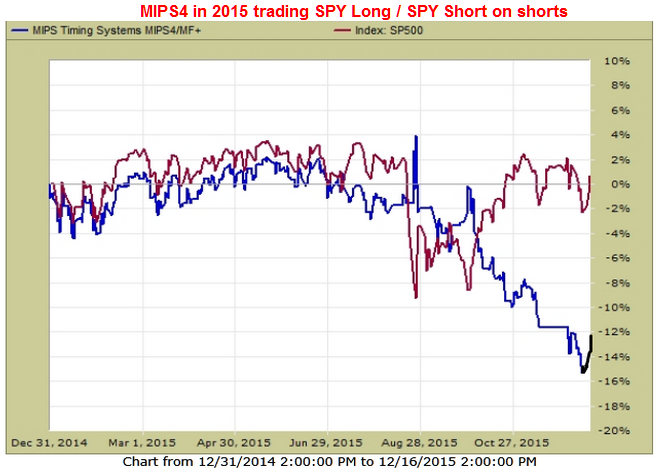

SECTION I.

This first section shows MIPS4 drawdowns in 2015 that resulted from trading SPY/SH instead of trading SPY long/short. You will see that trading SPY/SH would have increased the drawdown in 2015 by 50% (from about -12% to -18%) !!!

The "standard" MIPS models trade the S&P500 Index SPY long and short

- some people believe that buying the inverse SPY500 Index (SH) will yield the same results as shorting the SPY,

but it can be much different (as in 2015).

- with high volatility, buying SH can be much different than shorting SPY (in normal times, we buy SH on short

signals; but, in highly volatile markets, we short SPY).

- in 2015, buying SH on short signals instead of shorting SPY would have lead to a 50% bigger drop

year-to-date (-18% vs -12%)

Note:

The high performance difference between buying SH on shorts instead of shorting SPY in 2015 was rare, as most of the deviation came on 8/24/2015. On that day, the overnight percent change in the SH was almost twice that of the change in the SPY. Since MIPS4 bought SH on the open of 8/24/15 and because the market recovered a large % of the overnight drop, MIPS got clobbered that day (shorting SPY would have been much less painful).

=============================================================

SECTION II.

The rest of the bad performance from the MIPS models in 2015, of course, was the result of getting whipsawed.

This "whipsawing" was a rare phenomenon that resulted from very high-frequency direction changes (every 4-7 days) over a long period of time

For example:

For the first time in its history, the SPY experienced 29 direction changes in the first 8 months of 2015 !!!

And, the Dow had a one-day 1000 point drop on 8/24/2012, one of the largest in its history (this "killed" the SH).

The things I want to point out are:

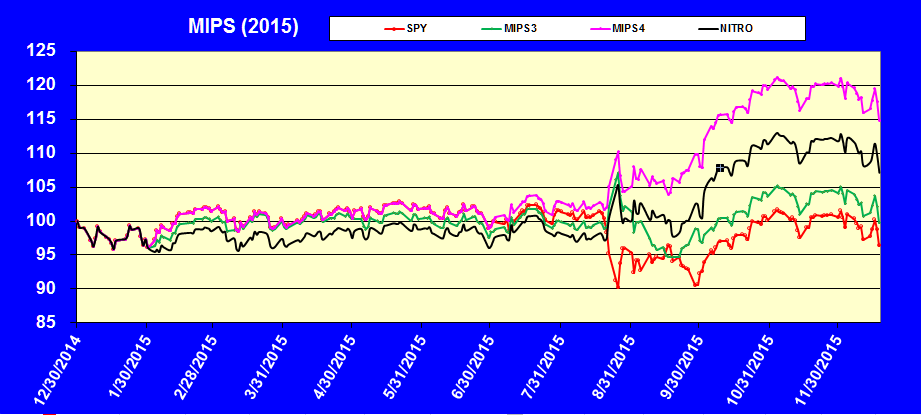

The MIPS models now have new algorithms that identify: (a) flat markets, and (2) directional changes that

are too short-term to trade.

- after our fixes for high-frequency directional changes, the MIPS models produced gains rather than nasty

drawdowns

- instead of being down between 12-18% as before, the new algorithms would have produced gains between

1% to16% for the year

- and, instead of trading an average of 17 times as with the old models, the new models traded an average of

only 10 times for the year

- this is because some of the new algorithms "stay the course" (rather than trade) under certain

identifiable conditions

2015 with the New MIPS Models

Red line = SPY Green Line = MIPS3 Black Line = MIPS/Nitro Purple Line = MIPS4

======================================================================

SECTION III

Please remember that, although 2015 was a bad year for MIPS, it DOES NOT mean that the MIPS models are not still some of the best timing models on the market today. No mathematical model is perfect and they all have "bad periods". For example, many nuclear power plants have been shut down because the control systems could not keep the plant temperature from rising; NASA has had to "intervene" hundreds of times to keep a space ship to the moon on its trajectory because the control system cannot do it correctly for 250,000 miles; etc.

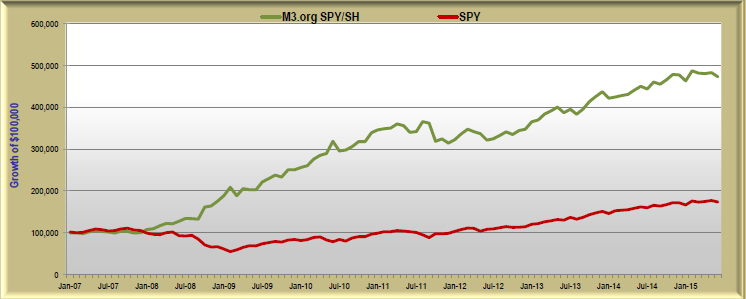

MIPS3 had a comparable bad period in 2011 and recovered nicely in 2009-2014 (see graph immediately below).

We are extremely confident that the same will happen with the MIPS models after 2015. And remember, the

current MIPS3 model is much better than the "original" M3.org model below, and MIPS4 is a much better model

than MIPS3.

MIPS3 2007-6/30/2015 CAGR = 20% Max DD = -10.6%

In our world, the Buy-and-Hold strategy has had two 50% crashes ("very large drawdowns") in the last 15 years and another one is due and coming in the next few years (or months). Both of these took rouglly 5 years to recover.

Virtually ALL of the best Timing Models on the market today that I know of, that have produced compounded annual growth rates (CAGRs) of 20% or better, have all had Max DD's of 20-25% over the last 10 years. However, most fully recovered from their drawdowns in 1-2 years.

So, what will it be ???

- Buy-and-Hold that drops 40-50% and takes 5 years to recover or

- Market Timing that drops 20-25% and takes 6-18 months to recover ???

If someone somehow could produce a model with a CAGR of 25% per year with no setbacks, this model would basically double their money every 3 years! Of course, this means if an investor started with $10,000 at age 30 (and did NOT invest any more for the rest of his/her life), with a timing model like that above, their $10,000 would have a value of about $18.5 million at age 65. And, of course, if one started with $50,000 at age 30 (with no additional investment money), they would have over $93 million at age 65. BTW, if there ever was a model this good, the developers would be able to sell it on Wall Street for at least $50-75 million. You would never see it on the retail market for $500 per year.

Because of "setbacks" as in the MIPS models in 2015, very few people will experience the above; but, they should expect to do VERY much better than buy-and-hold if they use good timing models (like the MIPS models)

Stay tuned...

Sunday, December 20 2015

This blog is an attempt to explain what went wrong with the MIPS models in 2015, and how we have "fixed" the problems. Section I explains the perils of buying SH instead of shorting SPY on short signals in high volatility markets, and Section II attempts to explain the risk of trading in markets that are changing direction continuously in only a few days over long periods of time. Section III explains "drawdowns" and timing models in general.

SECTION I.

This first section shows MIPS4 drawdowns in 2015 that resulted from trading SPY/SH instead of trading SPY long/short. You will see that trading SPY/SH would have increased the drawdown in 2015 by 50% (from about -12% to -18%) !!!

The "standard" MIPS models trade the S&P500 Index SPY long and short

- some people believe that buying the inverse SPY500 Index (SH) will yield the same results as shorting the SPY,

but it can be much different (as in 2015).

- with high volatility, buying SH can be much different than shorting SPY (in normal times, we buy SH on short

signals; but, in highly volatile markets, we short SPY).

- in 2015, buying SH on short signals instead of shorting SPY would have lead to a 50% bigger drop

year-to-date (-18% vs -12%)

Note:

The high performance difference between buying SH on shorts instead of shorting SPY in 2015 was rare, as most of the deviation came on 8/24/2015. On that day, the overnight percent change in the SH was almost twice that of the change in the SPY. Since MIPS4 bought SH on the open of 8/24/15 and because the market recovered a large % of the overnight drop, MIPS got clobbered that day (shorting SPY would have been much less painful). See Graphs #1 and #2 below.

Graph #1 is MIPS4 trading SPY on long signals and shorting SPY on short signals

(-12% for the year)

Graph #2 is MIPS4 trading SPY on long signals and buying SH on short signals

(-18% for the year)

=============================================================

SECTION II.

The rest of the bad performance from the MIPS models in 2015, of course, was the result of getting whipsawed.

This "whipsawing" was a rare phenomenon that resulted from very high-frequency direction changes (every 4-7 days) over a long period of time.

For example:

For the first time in its history, the SPY experienced 29 direction changes in the first 8 months of 2015 !!!

And, the Dow had a one-day 1000 point drop on 8/24/2012, one of the largest in its history (this "killed" the SH).

The things I want to point out are:

The MIPS models now have new algorithms that identify: (a) flat markets, and (2) directional changes that

are too short-term to trade.

- after our fixes for high-frequency directional changes, the MIPS models produced gains rather than nasty

drawdowns

- instead of being down between 12-18% as before, the new algorithms would have produced gains between

1% to16% for the year

- and, instead of trading an average of 17 times as with the old models, the new models traded an average of

only 10 times for the year

- this is because some of the new algorithms "stay the course" (rather than trade) under certain

identifiable conditions.

2015 with the New MIPS Models

Red line = SPY Green Line = MIPS3 Black Line = MIPS/Nitro Purple Line = MIPS4

======================================================================

SECTION III

Please remember that, although 2015 was a bad year for MIPS, it DOES NOT mean that the MIPS models are not still some of the best timing models on the market today. No mathematical model is perfect and they all have "bad periods". For example, many nuclear power plants have been shut down because the control systems could not keep the plant temperature from rising; NASA has had to "intervene" hundreds of times to keep a space ship to the moon on its trajectory because the control system cannot do it correctly for 250,000 miles; etc.

MIPS3 had a comparable bad period in 2011 and recovered nicely in 2009-2014 (see graph immediately below).

We are extremely confident that the same will happen with the MIPS models after 2015. And remember, the

current MIPS3 model is much better than the "original" M3.org model below, and MIPS4 is a much better model

than MIPS3.

MIPS3 2007-6/30/2015 CAGR = 20% Max DD = -10.6%

In our world, the Buy-and-Hold strategy has had two 50% drops (aka drawdowns) in the last 15 years and another one is due and coming in the next few years (or months). Virtually ALL of the best timing models on the market today that I know of, that have produced compounded annual growth rates (CAGRs) of 20% or better, have all had Max DD's of 25-30% over the last 8-10 years.

If someone somehow could produce a model with a CAGR of 24% per year with no setbacks, this model would double their money every 3 years! Of course, this means if an investor started with $10,000 at age 30 (and did NOT invest any more for the rest of his/her life), with a timing model like that above, their $10,000 would have a value of about $18.5 million at age 65. And, of course, if one started with $50,000 at age 30 (with no additional investment money), they would have over $93 million at age 65. BTW, if there ever was a model this good, the developers would be able to sell in on Wall Street for at least $50-75 million. You would never see it on the retail market for $500 per year.

Because of "setbacks" as in the MIPS models in 2015, very few people will experience the above; but, they should expect to do VERY much better than buy-and-hold if they use good timing models (like the MIPS models)

Stay tuned...

Sunday, December 06 2015

We take drawdowns very seriously...

- in fact, we have comprehensive stats on drawdowns for all of the MIPS models

- we "track" them ourselves AND through 3rd party "tracking" companies (like TimerTrac.com, etc.)

- remember, our new algos were designed to both: (a) increase performance and (b) limit drawdowns.

A few things to look for in Max Drawdowns with all timing models are:

1) how severe is the Max DD ?

2) how many times per year do large DD's occur (and, what is the Average DD) ?

3) what is the "Average Recovery Time" ("ART") for the Max DD in the model ?

- Definition: Average Recovery Time = Max DD divided by the model's CAGR.

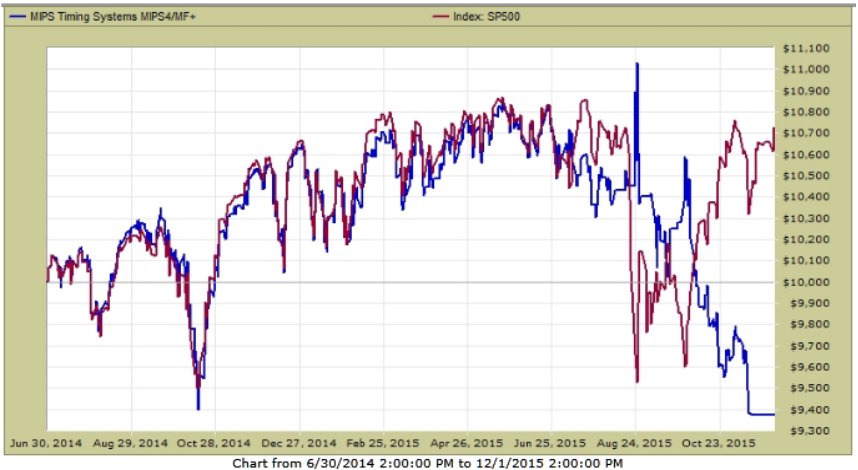

For answers to the above questions for MIPS4 trading SPY/SH, please refer to the two graphs below:

1) In Graph #1, you can see that the MAX DD between 2007-Jun'15 was 10.6%, but Graph #2 shows

a 13.8% Max DD in 2014-2015.

2) At the bottom of Graph #1, you can see that MIPS4 only had one DD greater than 10% in the

8.5 years between 2007-Jun'15, and the Average DD between 2007-Jun'15 was less than 5%,

- but, MIPS4 did have a 13.8% DD between 2014-2015 (see graph 2).

3) The "Average Recovery Time" for the Max DD of 10.6% in Graph #1 is 4.2 months; and the "ART"

for the 13.8% Max DD in Graph #2 is 5.4 months.

Graph #1 - By StatsReports (Eric Stats)

CAGR = 30.5% Max DD = 10.6% Average Recovery Time = 4.2 months

Graph #2 - By TimerTrac.com

Max DD = $9,380 / $10,880 = -13.8%

Not real pretty, but rather amazing for a model that has compounded out at over 30% (CAGR=30.5%, with no leverage), and made big $'s in 2008 (its younger brother, MIPS3, was verified up over 60% in 2008) !!!

So, stay tuned to MIPS !!!

- and enjoy the expected, long-overdue market crash in 2016...

Monday, November 30 2015

It would be foolish for us to say anything other than "our MIPS models have not performed well in 2015" !

- but, we have gone through these types of markets before (like 2011) and have experienced really good gains

from the MIPS models before and after those times.

In 2015, one of our worst nightmares came to light, and that is an extended, flat market that changed direction

every few days. Trend following models can "break down" in these types of markets. We experienced a similar

market in 2011, so we developed and built into the MIPS models several new algorithms that would "take the place" of trend following algorithms in these types of markets, and we really thought that we had solved the "entire" flat-market problem.

Then, along came 2015, where the Indices (Dow, SP500, etc.) set records for:

(a) the duration of a tight, flat trading range,

(b) the number of directional changes in 8 months of any year in the Dow's history,

(c) the market changing direction over-and-over in very few days (like 3-6 days) for months on end, and

(d) one of the largest one-day drops for the Dow in the last 50 years.

Needless to say, our "flat market" algorithms from 2011 were not enough to prevent getting whipsawed in 2015.

So, we have recently gone back to the drawing board and developed new proprietary algorithms that:

(a) track and calculate the "frequency" of the directional changes, and

(b) when the directional change frequency is only a few days several times back-to-back, the models will

"shut down" (go to cash) until the volatility dies down.

We have started using a preliminary version of the final release at these new algorithms at this time.

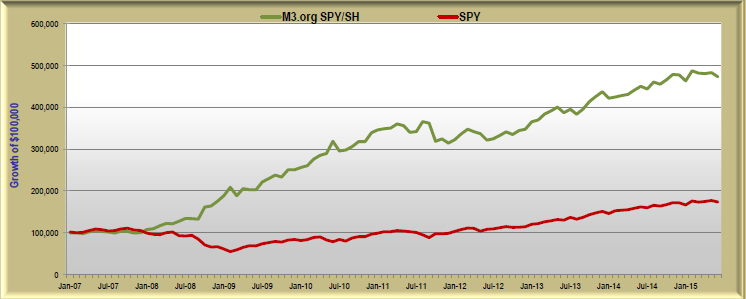

OUR PERFORMANCE BETWEEN 2008-2015

The goals that most intermediate-term model developers follow are to:

1) Do as well or better than the Index they are following (in our case the S&P500) in up markets and beat the market soundly in down markets. Of course, in up markets, the only ways to beat the markett (i.e., to beat the index you are trading) are to:

- identify and trade "intermediate-term" opportunities (trade-able dips, 20% "corrections", etc.), and/or to

- trade with some leverage (e.g., 1.33x leverage by trading 2/3 SPY and 1/3 SSO on long signals)

- we do not use leverage on shorts, so we either short the SPY (recommended) or buy the inverse SH.

2) Beat the market soundly in down markets ("crashes"). Our minimum goal is that we "gain" at least 1/2 of the total percentage that the market "loses" in a crash (e.g., market down 50%, MIPS up at least 25%).

- all of the MIPS models did way better than that in 2008.

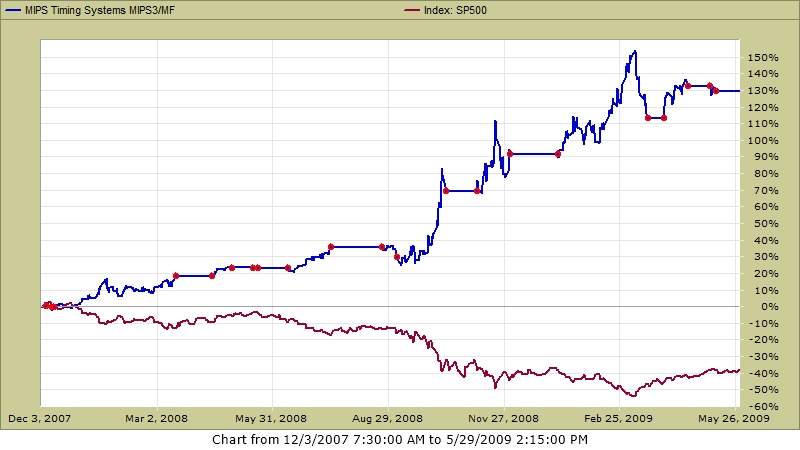

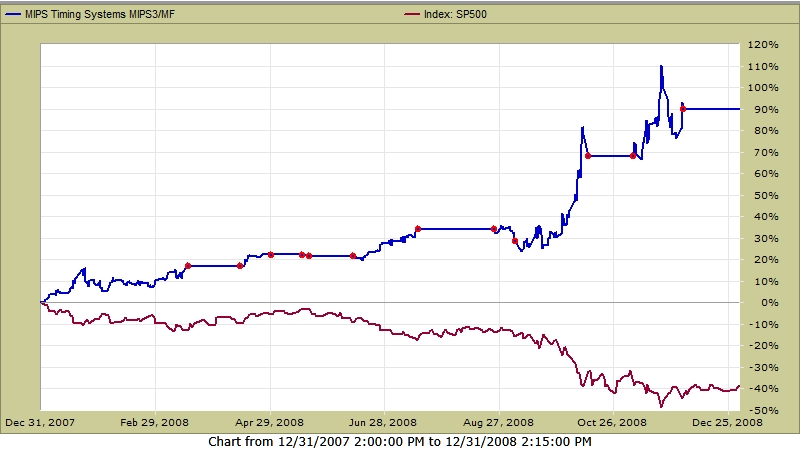

- MIPS3 was live then and its "gains" were verified by TimerTrac.com (see the Graph #2 below).

BTW, everyone that has been in the market for 10-20+ years would have had unbelievable performance if they had somehow just "avoided" every market crash, and started their up-trend ("recovery") where these markets "peaked" rather than where they "bottomed" (i.e., no losses in the crash). A good timing system would do even better by just "keeping up" in up markets and making some money during market crashes. It is not difficult to calculate how much money you would have if you just "avoided" the two market crashes since 2000; and, of course, you would have made even more if you had been short at the right times in the "big falls" (as MIPS3 did in Graph #2 below).

Note: When we show performance results from the "MIPS models" we normally use MIPS3/MF because that model has been in use and verified by TimerTrac.com since 11/04/2005. But, please be aware that MIPS4 is a much better model than MIPS3, but it does not have as long a verified track record as MIPS3

- in 2007-mid'2015, MIPS3 was up about 380% and MIPS4 was up 880%, when the SPY was up only 90%.

Exactly what does TimerTrac.com say about the MIPS3 performance since since 2008...

Please refer to the graphs below from TimerTrac.com (with 1.0x, 1.33x, and 1.5x leverage), where:

Graph #1 - MIPS3 in 2008-Nov'15 trading 1.33x leverage on Long signals and 1.0x on Shorts (Gold line)

- Note that the Green line in the graph is with 1.0s (no leverage)

Sure we have had somewhat bad periods in 2011 and 2015, but MIPS3 recovered after 2011, and should after 2015

- even with its not-so-good 2015, MIPS3 is still ranked #1 by TimerTrac.com from 2008-2015, and it is way ahead

of the 2nd ranked model.

GRAPH #1 2008-15 SPY = +124% MIPS3 w/1.0 leverage +380% MIPS3 w/1.33x leverage = +550%

Graph #2 - MIPS3 in 2008 -May'09

- trading the 2008 market crash , with no leverage

- red "dots" on graph show "trades"

SPY = -40% (yes, -40%) MIPS3 = +130%

Going Forward into 2016 ...

We still believe that this market could be "topping" now, thereby signaling a big crash before the end of 2016.

- this is why every individual investor needs a tried-and-proven timing model to help them avoid a 50% market crash.

- see the graph below to see the "topping" processes in the 2000 and 2008 market crashes (not the "kickbacks").

Stay Tuned...

Hope this helps...

Sunday, October 18 2015

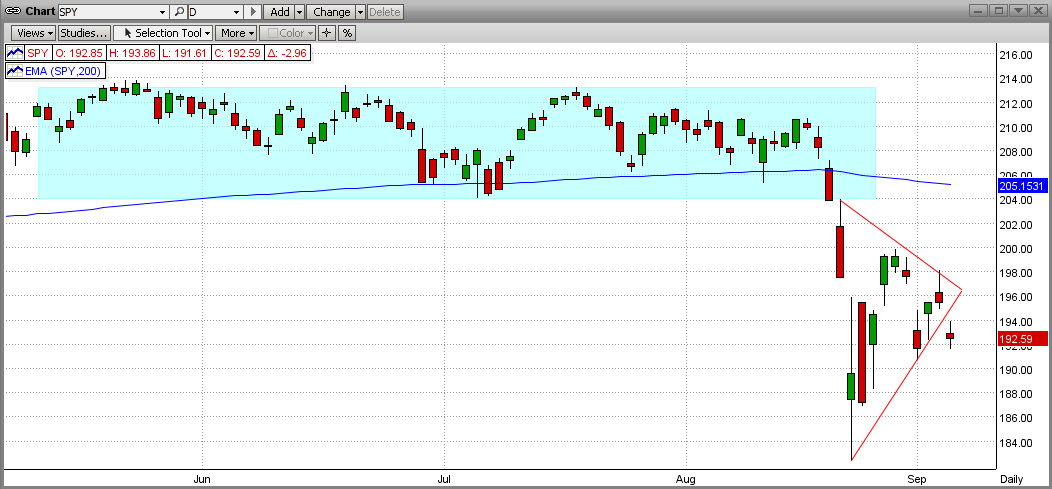

As you all know, MIPS has held steady on its recent short signal, but most do not know why. There are two overwhelming reasons for this:

I.) After the big drop, the market has since bounced back and is going to test its most recent "support" level; which, of course, is now a strong "resistance" level at 2040 on the S&P 500 Index. Nothing new here, as the market almost ALWAYS goes back to test its "breaking points". MIPS most likely will not change its position until the SPY finishes its "shoot out" at 204.0.

Graph I - Critical Point for the SPY now - New massive "Resistance" at 204.0; which was the OLD major

"Support" level for the 9 months of Mar-Oct 2015

- this recent rally in the SPY went through the 50-EMA (green), the 100-EMA (red), and the

200-EMA (blue) like they were water

- it will be facing 204.0 soon

- this will be a CRITICAL TEST (if the SPY breaks above this, the bears will have to "give up").

II.) The second thing that MIPS is choking on is the "topping patterns" in 2000, 2008, and 2015. Almost all pattern recognition algorithms recognize the recent behavior of the SPY as a "topping pattern", which is where the big guys dump for 10-12 months to lighten their positions in anticipation of a big drop. Of course, this is easy for them to do because they "cause" big drops whenever they decide to. Only the little guys suffer in the following several years. And, the market DOES NOT have to always come back quickly (look at the Dow in the 1930's and the Japanese stock market since 1990).

Graph II - Long-Term View

- almost identical "topping patterns"

- market looks ripe for the next "Big One" (big drop, that is)

- and notice the "kickbacks" in the big drops in 2000 and 2008 (like what is happening now)

- it still looks a little early for the 'big one", but it can happen at any time

- but, of course, the market can continue to rally higher from here

Stay tuned...

Monday, September 07 2015

Many MIPS members are asking us if we think that this market in 2015 is headed for "A Crash or A Correction". My answer, of course, is that nobody knows for sure.

From an economic viewpoint, things look "bleak". The US economy is not in good shape (barely growing at all); the Fed is getting ready to mess things up again; China is in deep trouble as its growth rate is slowing dramatically and its stock market is about to collapse; Japan is stagnant; Greece is still waffling; etc.

From the view of technical analysis, things are just as bad! Different charts show different outcomes (more below). And, even if all of the charts in the world agreed today, that DOES NOT mean that they can predict the direction of the market next week or longer.

What this equates to is that the only hope we have to determine the intermediate-term direction of the market is a good mechanical, mathematical timing model that can interpret the near-term directional changes in market trends as they develop (not daily, and not for 6 months from now, but more like the weekly/monthly trend). And, of course, that is what the MIPS models do, and do well.

Back to technical analysis of the market price movements and charts... Of course, technical analysis would not still be around if it did not as least show us the "probable" moves of the market and when certain directions are highly possible. However, many times there are contradictory views, and that is where I think we are now. See a brief explanation of this below.

The Case For a Market Crash

Without going through the details, many chartists think that the market is in a "Topping Pattern", where the big guys (institutional investors) are dumping heavily to prepare for a big market crash (one that they are basically causing). That happened both in 2000 and 2008 (and probably preceding all market crashes).

The chart below is what is driving this belief of most chartists today. See the graph immediately below. Does the market behavior today look very close (i.e., almost identical) to the markets in 2000 and 2008, when the fat kats took away 40-55% of our hard-earned money in two big crashes? If so, why not just go to cash now and wait out the drop? Read on...

The Case for a Market Correction

We do not have to simply bet on this "big drop" now, and possibly be wrong and lose big $bucks$. It is possible that the markets now may NOT be heading toward a "Crash" (like in 2000 and 2009), but merely to a "Correction" (like in 2011). The "chartist" evidence for a Correction below is almost as compelling as the evidence for a Crash, as above

The Market in 2015

The Market in 2011

Compare the last two graphs above (2015 vs 2011). Do they look similar (or almost dead on)? Did the market in 2011 lead to a full blown market "Crash" as it did in 2000 and 2008? Read on...

The Market After 2011

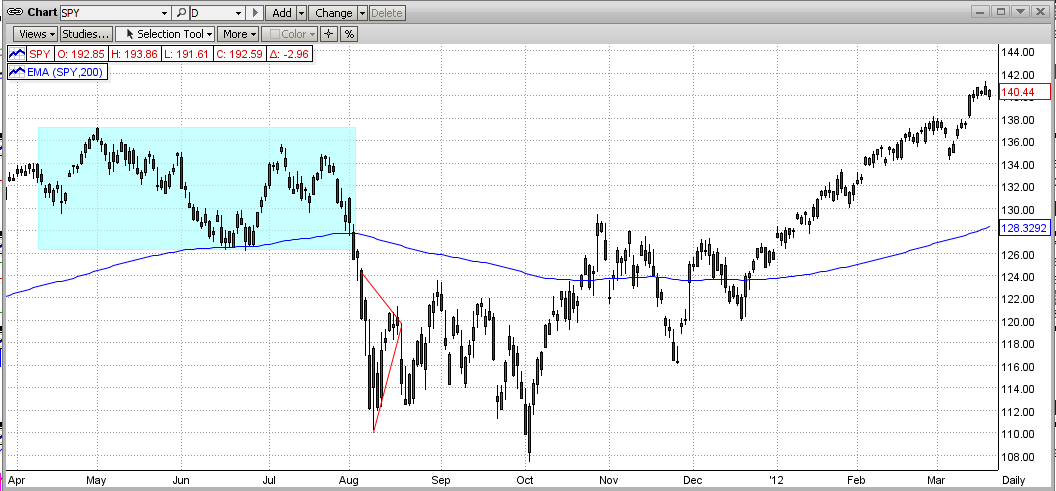

Sorry, the drop in 2011 did not lead to a 40-50% "Crash", as you can see below in 2011-early 2012. The 2011 market suffered through a Correction and recovered to new highs over the next 3 years, before "flattening out" again in 2015. See graph immediately below.

So, you see that trying to predict the market behavior beyond the scope of what you can see now is very dangerous. It's better to wait for MIPS to "drive us" in the right direction. After each "topping" process the market drops, and then seems to waffle for a relatively short while (like weeks) before it "breaks", and heads back up or continues down. This is a critical "trend change", and that is where MIPS shines (and what it is developed to do).

MIPS in 2008

it is easy for a market developer (like me) to "claim" that their model will do well in any type of market (like in a big bear market), but our MIPS3 model was "live" in 2008 and "tracked" by TimerTrac.com. And, remember, MIPS3 is also the "core" of all of our newer models, like MIPS4 and MIPS/Nitro.

So, see the graph below for how MIPS3 did in 2008... MIPS +90% SPY -40%.

(The red dots are trades.)

|