Sunday, September 06 2015

How has MIPS performed YTD in 2015 ?

2015 has been one of the toughest markets for timing models, mainly because of its volatility. It does not matter to mathematical models why the market is volatile (the Fed, Greece, China, etc.).

It is difficult for timing models to make money when the indices stay flat (plus or minus 2.5% around mean line), but change direction every 3-6 days (flat market in a very tight trading range). Most models will get whipsawed if they try to trade in a market like this (e.g., trying to trade every time the market "changes direction").

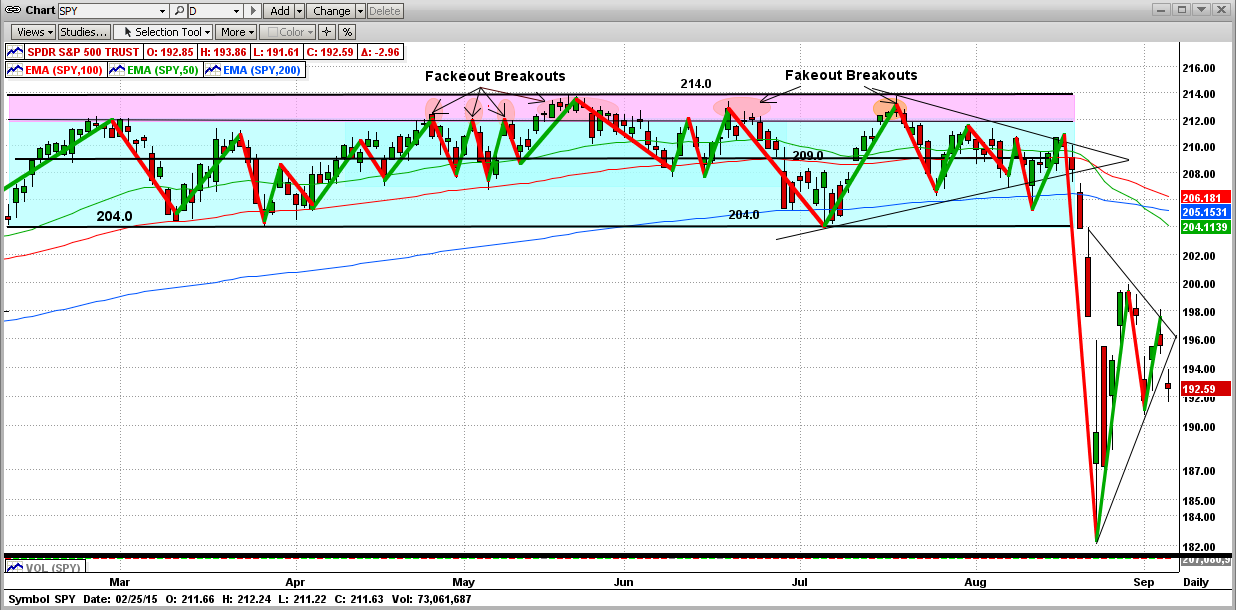

In the graph below, it can be seen that the 2015 market (aka the SPY) changed direction 28 times before it broke the flat trading pattern to the downside (starting on 8/19/15). That is a directional change (short-term trend change) every 4-6 days. Most timing models that tried to trade these "swings" got cremated. Through the end of July 2015, the MIPS models traded only 3-4 times, and was slightly ahead of its index (the SPY) at that time. And, all MIPS models issued a CASH signal on 8/18/15, the day that the "big drop" started !

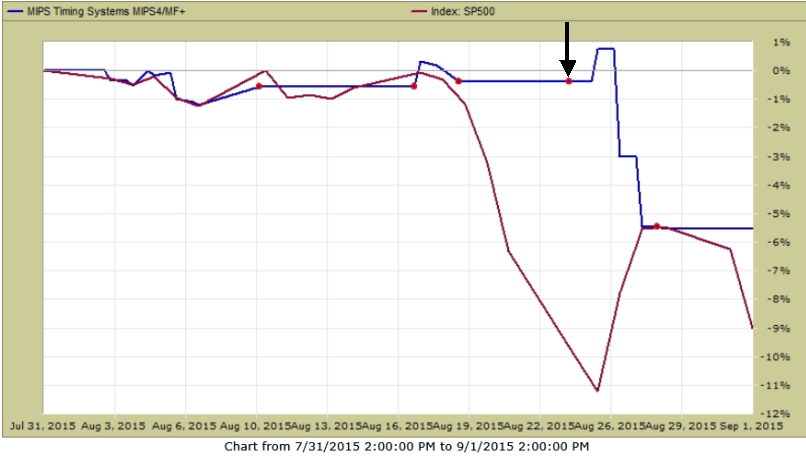

MIPS in August 2015

ONE BAD DAY

So far, so good. MIPS issued a Cash signal on 8/18/15. On that day, the SPY closed at 210.0 and it opened the next morning (8/19/15) at 209.1. By issuing a Cash signal on 8/18/15, MIPS avoided a lot of "damage" until 8/21/15 came along. On 8/20/15, the SPY closed at 204.0 while MIPS was still in Cash, so up until that time we had avoided a drop of about 2.4%.

But then, starting on 8/21/15, all hell broke loose. In two trading days (Friday and Monday), the market experienced extreme volatility and dropped dramatically. On Monday of 8/24/15, the SPY hit an intraday low of 182.4, a drop of 10.6% in two trading days from the 8/20/15 close. That extremely large two-day drop resulted mainly from the one-day drop of 15.2 points in the SPY from the close on 8/21/15 (Friday) to the intraday low on 8/24/15 (Monday). This is roughly equivalent to about 150 points in the S&P 500 Index, and a near 1200 point drop in the Dow). This day was one of the largest one-day drops in the history of the US stock markets. Wow, that really was ONE BAD DAY !!!

MIPS issued a short signal on 8/21/15, which of course was executed on the open of 8/24/15 at 187.5. This was near the low and when the SPY was ready to "rebound" from the dramatic drop. After MIPS issued a cash signal on 8/27/15 (three trading days later), this one trade had lost about 6%. In effect, we "shorted" very near the bottom - ONE BAD TRADE !!!

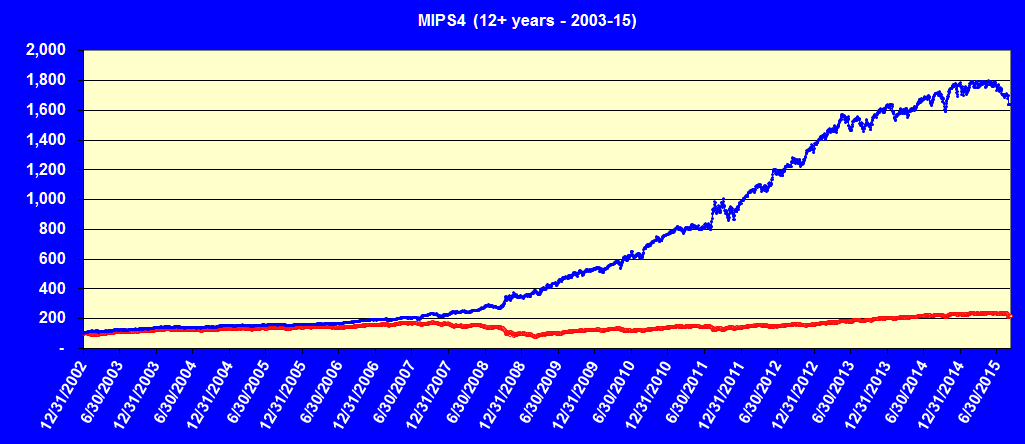

For a model like MIPS4 that compounds with a CAGR of approximately 25-30%, this is like a "blip", so don't worry (see the MIPS4 growth graph at the bottom of this blog).

Please remember, whether a timing model did well on this one-day drop or not is basically pure luck. One bad day can happen at any time, and no timing model can consistently predict any one day's price action to the day. In this case, it stands out because the one-day change was so dramatic. This one-bad-day was going to happen whether MIPS (or any other model) was long, short, or cash. Good timing models recover, like MIPS did in 2011 and should do again in 2015. After a flat 2011, MIPS3 was up 9% in 2012 and 23.3% in 2013.

MIPS4 in August 2015

(Red dots are Trades dates)

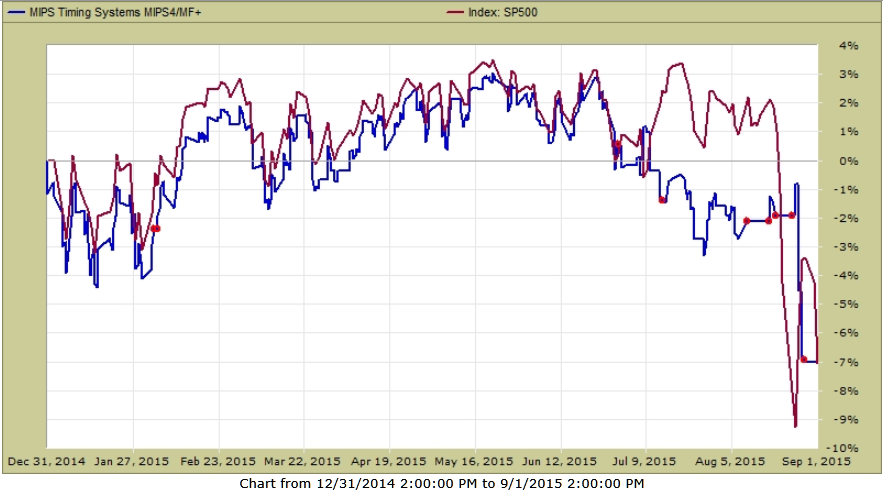

MIPS YTD in 2015

The graph from TimerTrac.com below shows the MIPS4 performance YTD thru August, 2015 (you can see the "one-bad-day" in the graph).

As discussed above and can be seen in the graph below, MIPS was hanging in there until late August, when MIPS was down only 2%, while the SPY was down 9%. Then the one-bad-day came along and upset the cart.

Now, through August 2015, MIPS and the SPY are both down about 7%. So even after all of the hoopla and "bad luck", MIPS has not done any worse than buying and holding the SPY.

MIPS4 YTD in 2015

(Red dots are trade dates)

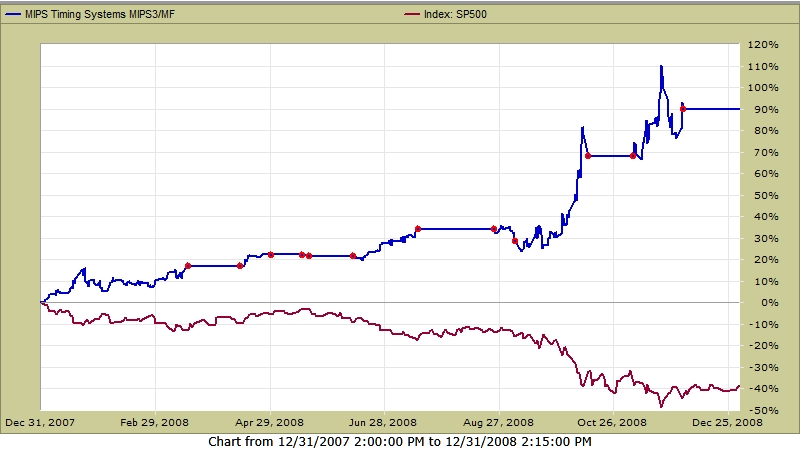

MIPS3 in 2008

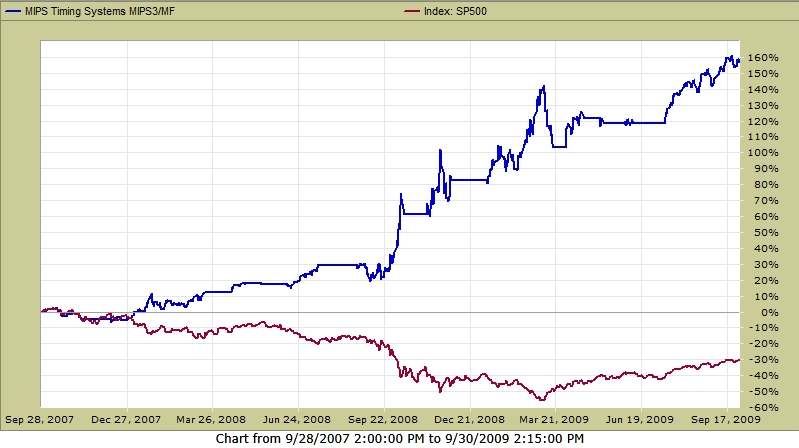

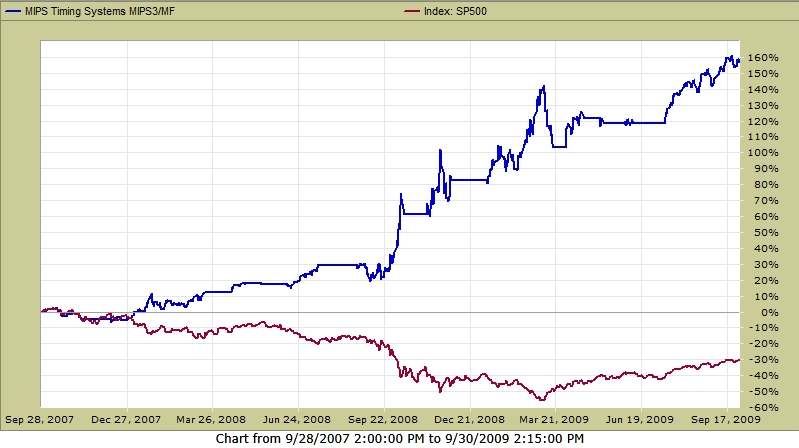

Whether this drop is a correction or the beginning of a market crash, we have plenty of time to make money, After backtesting in 1987 and 2003, and observing MIPS live in 2008, we feel 99% sure that MIPS will make us money in down markets. See MIPS3's "actual performance" graph in 2008 as "verified" by TimerTrac.com immediatelybelow:

MIPS3 in 2008

(Red dots are trade dates)

MIPS4's Long-Term Performance (2003-2015 ytd)

o When looked at from a "Long-Term View", the ONE BAD DAY goes away !!!

- So, don't let one-bad-day scare you away...

Stay tuned…

Sunday, August 09 2015

MIPS Members:

Since the markets (as measured by the S&P 500 and/or the Dow) have been moving sideways for over 7 months now, lots of people are saying, "This market makes no sense at all." Are they right?

Maybe or maybe not. It is very difficult to get to where you want to be if you really do not know exactly where you are now; or if you do know where you are now, but you do not have a clue as to how to get where you want to be from where you are now. The current stock market fits both of these situations.

What is confusing is that many investors do not not know how to determine where the market is now and where it might go from here. To show you what we mean, we will look at the current market from several slightly different viewpoints:

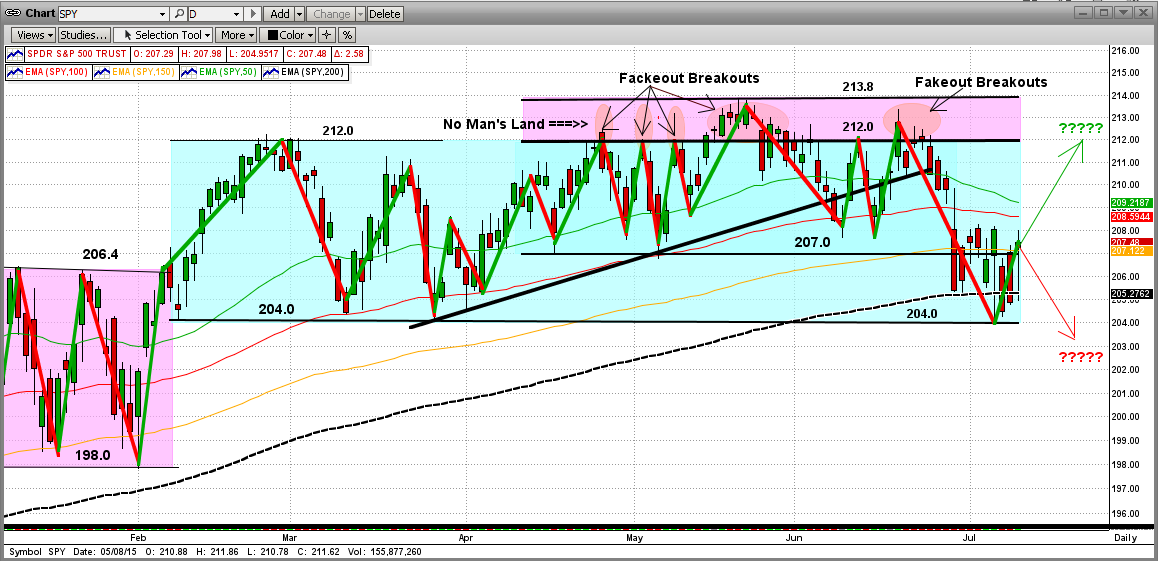

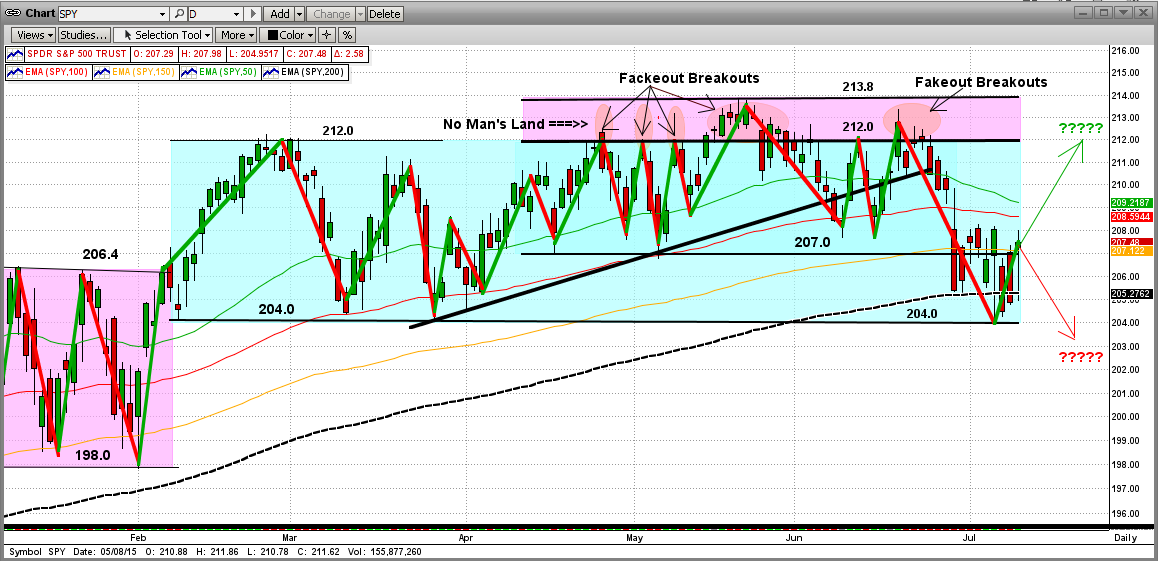

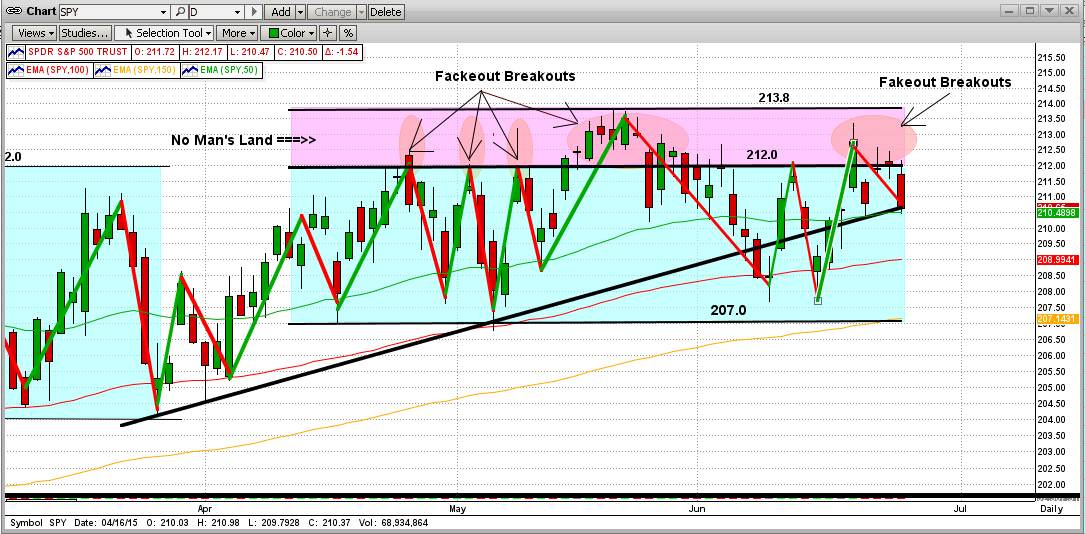

1) Short-Term movements in the markets (SPY) - Indeterminate

- Daily movements over the last 6 months...

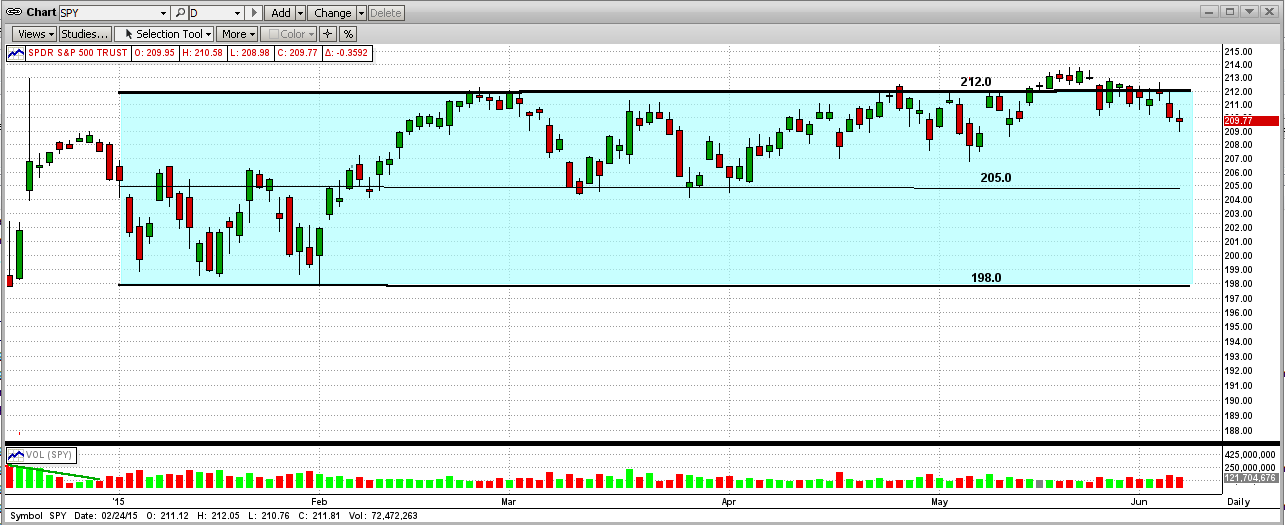

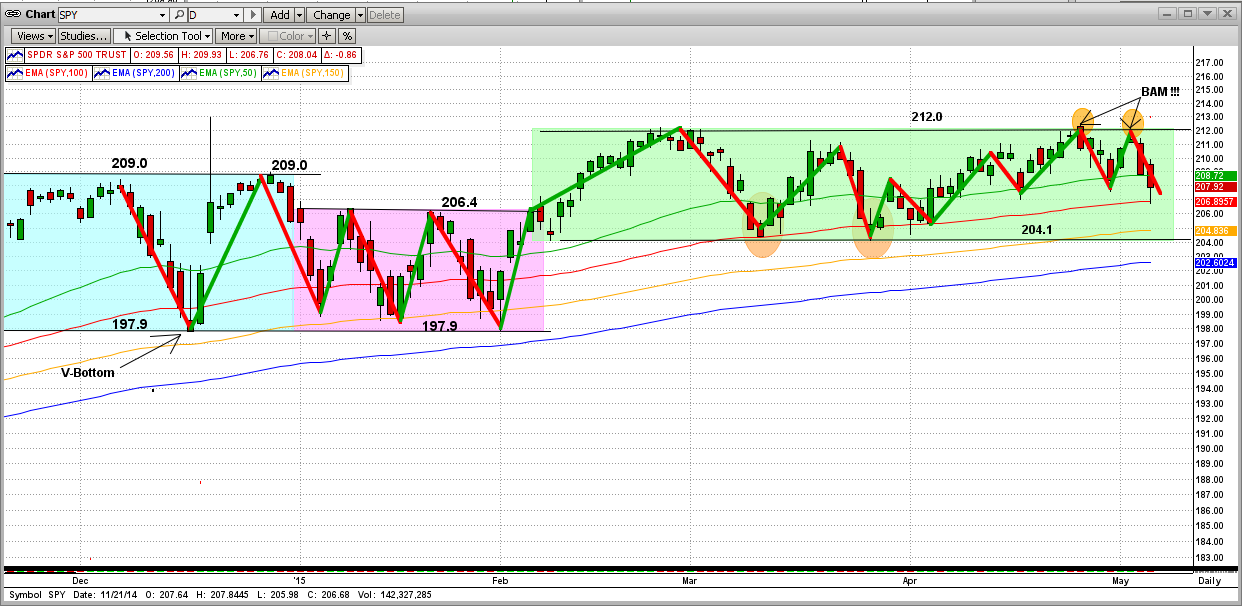

The graph below shows the SPY over the last 6-7 months. It seems obvious that, from the things that we can see, it is almost impossible to determine anything useful. The SPY has traded in a tight sideways "channel" of plus and minus 2.5% around its meanline of 209.0 over the last 6 months and the market has changed direction 24 times in this 6 month period. That represents a change in direction about every 5 days !!! Most of the time, trying to react to this rapidly changing behavior (like by trying to trade faster) will lead to getting horribly whipsawed. Let's try to ascertain more from looking at this very same market period from slightly different vantage points in 2) and 3) below.

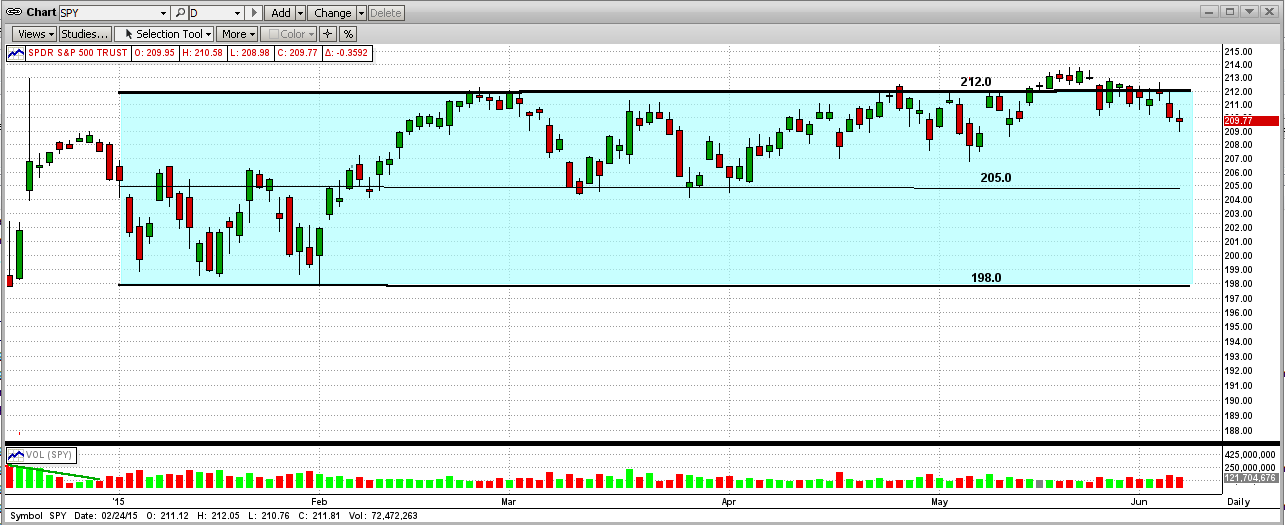

2) Intermediate-Term movements in the markets (SPY) - Bullish

- SPY in the last 2 years...

The graph below shows what the time period above (Feb-Aug 2015 in the blue rectangle below) looks like by "backing up" over the last 2 years and viewing where the market has come from to get where it is today and where it might go from where it is now. It can be seen that the SPY had been in a steady uptrend until Feb'15, where it stalled and went into a very obvious "Consolidation Pattern". While in this pattern, neither the bulls nor the bears would "commit" their money to pushing the market out of this tight trading pattern. The bulls buy the market up to its "upper" resistance level at (SPY at 214.0), where the bears come in and sell the market back down to its "lower" support level (SPY at 204.0), over and over again.

An recent study has shown that there were only 10 times since 1950 where the S&P 500 traded in a tight 3.5% (or less) trading range for 6 months or more. And, every time this happened, these flat markets broke to the upside over the following 6 months (average +6%). This is an interesting "statistical" metric and one to pay strong attention to, but there is really no solid reason for similar behavior for the remainder of this year. [BTW - In our case today, the SPY has traded in an even tighter trading range (2.5%) over the last 6 months.]

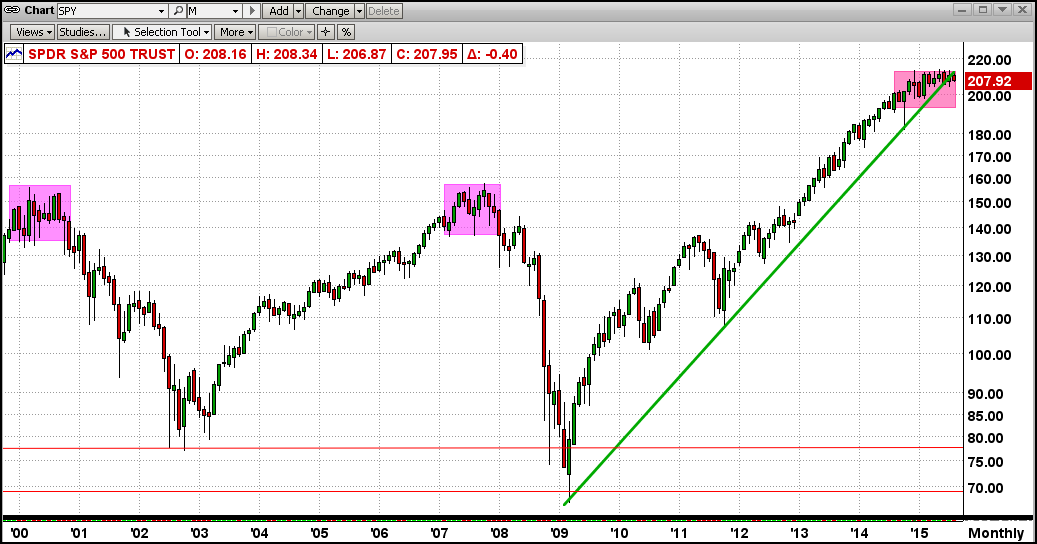

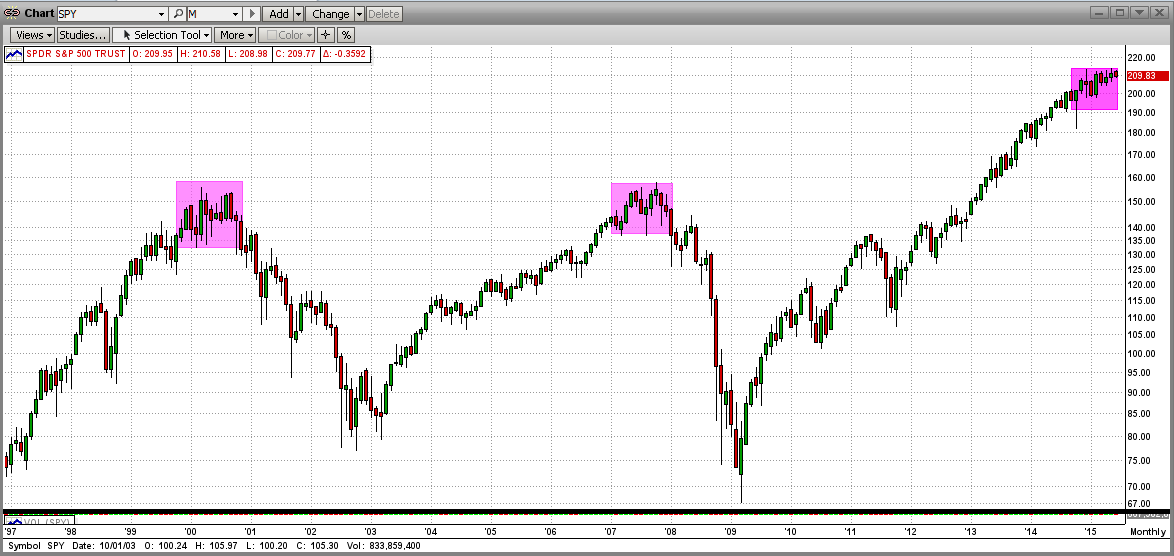

3) Long-Term movements in the markets (SPY) - Bearish

- SPY in the last 15+ years (with monthly bars)...

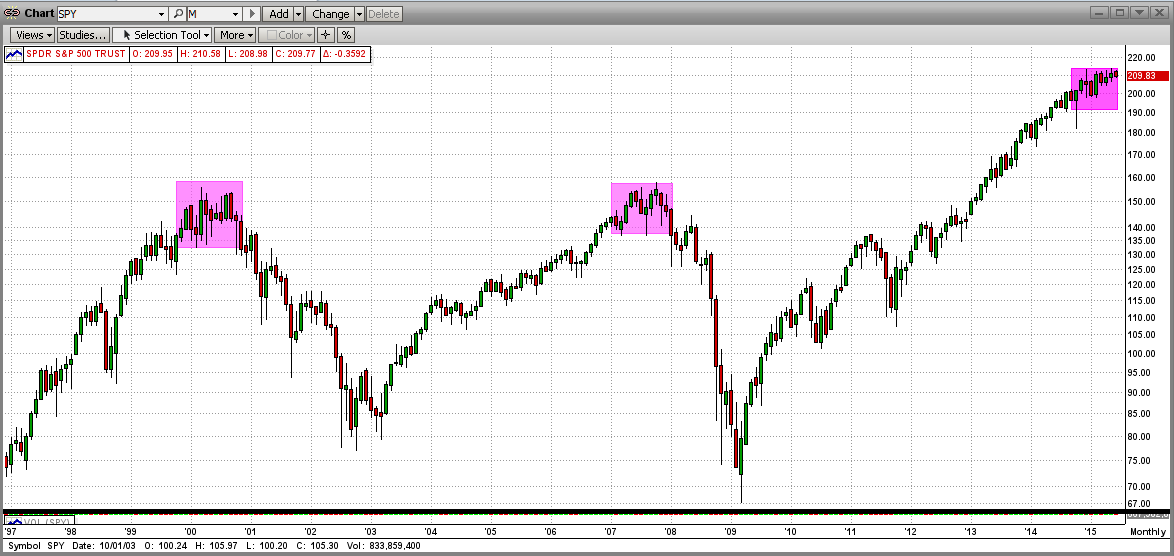

See the purple rectangle in the upper right in the graph below. This could very well be a so-called "Topping Pattern", like the two that preceded the big market crashes in 2000 and 2008. In both of these previous market crashes, the SPY traded in a tight plus/minus 5% trading pattern around its meanline for about 12 months each time, before crashing about 50% to the downside. In today's market, the SPY has "topped" for just about 12 months now, leading to fears of another big drop relatively soon.

BTW, my definition of the "topping pattern" behavior is a market where the big guys decide to unload most of their then current holdings over a relatively long period of time. This "dumping" process by the big guys takes a lot of time to implement in order to prevent stock prices from being driven through the floor before these fat kats unload the majority of their long positions. The fat kats sell and drive the market down 3-6%, and then they quit selling and let the little guys "buy on the dips" and push stock prices all the way back up the the top, where the fat kats start selling again. This goes on until either the little guys are fully invested and cannot buy the prices back up, or the fat kats have unloaded most of what they wanted to unload. And then, the fat kats start selling short. Along with the fat kats shorting, the little guys go into "panic selling" and drive the market down 40-50%. Of course, at this time, any big "catalyst" (like a big market crash in China, a surprise from the Fed in rate hikes, etc.) could expedite such a crash.

Obviously, none of us know what will happen from here but the above clearly defines where we are now and what could happen soon. The good news resulting from the current long-term flat market is that the MIPS "triggers" are now like "hair" triggers, and hence MIPS should react to either an upside or downside market move quickly.

Stay tuned...

PS - Please do not ignore the possibility of a big market crash and protect your nest egg now. Contrary to the outdated buy-and-hold philosophy, the next big drop will most likely NOT bounce back in the following 5-7 years as it has in the last 50 years, mainly because our economy has slowed down considerably (baby boomers no longer working, stronger competition from abroad, etc.), and the Fed cannot possibly "buy the market back up" again.

The recovery time of the next big market drop could be 25-30 years, like that after the market crash of 1929 (it took almost until 1960 for the market to reach the high of 1929, and stay above it). Or, it may be like the 35-year "non-recovery" of the stock market in Japan (the Nikkei), which dropped from 40,000 in 1980 and bottomed at 10,000 in 2010 (-75%), and which is only 20,600 today (still down 50% over the last 35 years). SO, A QUICK RECOVERY TO THE NEXT MARKET CRASH IS NOT A GIVEN !!!!

|

Thursday, July 16 2015

I received an email today from a loyal MIPS member and his opening line was "Up, Up, and Away!!!". As Robert explained, he is thinking (and hoping) that the acceptance of the aGreekment by the Greek Parliament will clear the slate for worldwide markets to go up from here. I am in the same boat, but at this point, I would say "Up, Up, and Away???"

As I told Bob, the 3 "Things" controlling the market that I mentioned in one of my recent blogs (see below), have all dissipated.

1. The Greeks caved in,

2. China "fixed" its stock market bubble problem by "outlawing" trading, and

3. Aunt Yellen repeats that there will be rate hikes later, but they will be small and gradual (thank

you, Aunt Yellen).

I will remain hesitant until the recent rise in the SPY "plays out". In the graph below, you will see that the SPY has risen from $204 on 7/7/15 to $212 on 7/16/15. That's about +4% in 7 trading days. And, the SPY moved into what we call "No Man's Land" today.

The real challenge lies at the all-time high resistance level in the SPY at $213.8 (from two months ago on 5/20/15). We are now less than 1% below that level, but would need to break above it with some degree of "force" (like maybe a big "gap" up), and stay above it for a while.

If that happens we can expect some significant gains; but if not, the outcome will most likely NOT be pretty.

Either way, MIPS will "map out" what we should do, so we should make money either way.

STAY TUNED !!!

==================

<<< Previous Blog >>>

7/2/2015

MIPS Members:

Here we go again. The markets are trading back and forth, with no clear direction. That is because there IS no direction, other than sideways. And, as we have said many times before, sideways or flat markets result from uncertainty amongst everyone in the market. The volatility you see in flat market comes from the floor traders that can trade with up to $200 billion in a very short time period. Their time horizon is in minutes/hours, NOT days/months like us. The floor traders can trade long in the morning and short a few minutes/hours later, often more than one round-trip per day. The ignorant little "day traders" usually get whipsawed trying to trade in these types of markets.

The uncertainty in the recent past has been about "nothing". The market has been mainly focused on things going on in Greece, China, and the Fed. The events surrounding all of the above are all very important, but most likely have very little long-term ramifications for the USA.

Greece

There are really only two choices in the current Greek situation, and neither will greatly effect the USA. Why? Because, the GDP for Greece is less than that of most states in the USA and even less than some of our larger cities. Where Greece can affect the USA/Europe/the World is if it causes great pain in the Euro Zone. I don't see that happening; but, of course, it could.

China

After a stock market "bubble" of almost unbelievable growth (kind of like our 1990-2000 tech bubble), the China market fell over 25-35% in the last 3 months. About 85% of the stocks on the China stock exchange are owned by the "little guys", who have been coming in to the Chinese markets in record numbers (mostly on margin). Of course, that is a recipe for disaster. The Chinese gov't. handled it this way - they made it against the law for big guys to trade for several months. Simple in a communist state, but not so here. Anyway, short-term this stopped the slide and their markets have even bounced back almost to their "pre-crash" levels (no harm really done outside of China).

The Fed

The Fed has been awfully quiet and timid about raising interest rates even just a little. Aunt Yellen, the STOCK MARKET HERO, is not going to do anything to upset our markets, so you can rest easy here (at least for 2015). Of course, the press will probably scream "Disaster" when the Fed first raises rates, even if only by 1/4 of 1%; but it should not get much attention from investors or cause any noticeable pain.

Here is where we stand now:

So there you have it... nothing out there now to upset our markets, but the big guys and the press can make a big issue out of any news (no mater how important or unimportant), and put the market on a new trend of their choosing (up or down).

In the graph below, you will see that the market dropped about 4% in the ten trading days between 6/8/15 and 7/7/15, and has bounced back some since then. The market movement in the next few days will depend on what happens in Greece, and then it will go on from there on the next wave of useless news.

But, we still need to know how to trade this market; and for that we will depend upon the MIPS signals.

Current MIPS Signals (MIPS Members only)

MIPS 1,2,34 Signals... http://www.mipstiming.com/current_signals

MIPS/Nitro Signals..... http://www.mipstiming.com/current_nitro_

Monday, July 13 2015

Re: Announcement from the European "Liars" this morning...

Bull S... Deal

Agreement finally reached in Greek financial crisis

After months of acrimony, European leaders announced a breakthrough early Monday, avoiding an exit from the euro and a global financial crisis.

Reality

This Agreekment is not a final deal. It is an "agreement" just like their last 100 agreements; that is, "to Agree to try to Agree again". For the deal to actually happen, the Greeks must start doing their part by Wednesday of this week in order to "start formal negotiations". What the heck was the "deal" that they all announced this morning, an "informal agreement"? And, after that, any "formal" deal will have to be passed by the Greek parliament and many other Eurozone members. What kind of a "deal" did they announce today ?

Needless to say, the Greek public is very disappointed with this current deal, as the terms are much worse for Greece than the deal the public voted "IXO" against in their recent referendum. This could have a VERY negative impact on the Greek Parliament's vote to accept such terms, so this is not the end.

The "Greek deal" is still up in the air.

Sunday, July 12 2015

Here we go again. The markets are trading back and forth, with no clear direction. That is because there IS no direction, other than sideways. And, as we have said many times before, sideways or flat markets result from uncertainty amongst everyone in the market. The volatility you see in flat markets comes from the floor traders that can trade with up to $200 billion in a very short time period. Their time horizon is in minutes/hours, NOT days/months like us. The floor traders can trade long in the morning and short a few minutes/hours later, often more than one round-trip per day. The ignorant little "day traders" usually get whipsawed trying to trade in these types of markets.

The uncertainty in the recent past has been about "nothing". The market has been mainly focused on things going on in Greece, China, and the Fed. The events surrounding all of the above are all very important, but most likely have very little long-term ramifications for the USA.

Greece

There are really only two choices in the current Greek situation, and neither will greatly effect the USA. Why? Because, the GDP for Greece is less than that of most states in the USA and even less than some of our larger cities. Where Greece can affect the USA/Europe/the World is if it causes great pain in the Euro Zone. I don't see that happening; but, of course, it could.

China

After a stock market "bubble" of almost unbelievable growth (kind of like our 1990-2000 tech bubble), the China market fell over 25-35% in the last 3 months. About 85% of the stocks on the China stock exchange are owned by the "little guys", who have been coming in to the Chinese markets in record numbers (mostly on margin). Of course, that is a recipe for disaster. The Chinese gov't handled it this way - they made it against the law for big guys to trade for several months. Simple in a communist state, but not so here. Anyway, short-term this stopped the slide and their markets have even bounced back almost to their "pre-crash" levels (no harm really done outside of China).

The Fed

The Fed has been awfully quiet and timid about raising interest rates even just a little. Aunt Yellen, the STOCK MARKET HERO, is not going to do anything to upset our markets, so you can rest easy here (at least for 2015). Of course, the press will probably scream "Disaster" when the Fed first raises rates, even if only by 1/4 of 1%; but it should not get much attention from investors or cause any noticeable pain.

Here is where we stand now:

So there you have it... nothing out there now to upset our markets, but the big guys and the press can make a big issue out of any news (no mater how important or unimportant), and put the market on a new trend of their choosing (up or down).

In the graph below, you will see that the market dropped about 4% in the ten trading days between 6/8/15 and 7/7/15, and has bounced back some since then. The market movement in the next few days will depend on what happens in Greece, and then it will go on from there on the next wave of useless news.

But, we still need to know how to trade this market; and for that we will depend upon the MIPS signals.

Current MIPS Signals (MIPS Members only)

MIPS 1,2,34 Signals... http://www.mipstiming.com/current_signals

MIPS/Nitro Signals..... http://www.mipstiming.com/current_nitro_

Sunday, July 05 2015

In case you have not heard by now, the results today (Sunday) of the Greek vote for the Refurendum below ended with a large majority (61%) of the Greek citizens voting "NO" !!!

Refurendum:

1) YES, accept more austerity conditions laid out by the European lenders (higher

taxes, pension cuts, etc.) in exchange for extended credit, or

2) NO, reject the offer (and hopefully negotiate a better deal from its lenders).

Their socialist Prime Minister, Alexis Tsipras, strongly urged the Greek people to vote "NO"; thus (in his mind only) putting him in a better position to negotiate a better deal with his European creditors. Most likely, the outcome will be just the opposite.

Needless to say, the rest of the world thinks this "NO" vote could lead to a disaster for Greece [financial ruin, exit from the Euro (Grexit), etc.]. If all of this mess affects Greece only, the worldwide ramifications may not be too bad; but if this type of behavior spreads to the other PIIGS countries (Portugal, Italy, Ireland, and Spain), it could lead to a worldwide crisis and stock market crashes throughout the rest of the world.

To this end, the e-mini futures are down tonight (Dow -200; SP500 -25, Nasdaq -50).

And, the MIPS2, MIPS3, MIPS4, models are all "SHORT" as of the EOD on 6/29/2015 !

Thursday, July 02 2015

This is a re-visit of my blog of Mar 15, 2015

- see updated graph below !!!

- are we getting close to the end ?

- is Grexit going to be the final catalyst "IF" it defaults ?

- do we need to get out now ?

Wait for MIPS to tell us what to do (stay tuned) !!!

================================================

C O N F ID E N T I A L

From Paul D.

- this is simply my opinion / observation and it has nothing to do with our MIPS models...

Expect a market crash before August 2015 ???

In the graph below, you will see that it took 11-12 months of sideways trading for the market (the SPY) to "top out" in both 1999-2000 and in 2007-2008.

My opinion is that this is roughly how long it takes for the big guys (Goldman Sachs, Morgan Stanley, UBS, etc) to liquidate the holdings that they want to dump at the top (call me and I will explain this). For example, it would take months for a big guy to sell 100 million shares each of GE and Walmart and Merck, etc without driving their prices through the floor. And, at the top, they hold 1,000's of positions just like that.

In the graph below, you can see that in 2014-2015 the market has basically traded sideways for 6 full months through Feb 2015, or 7 months counting March 2015 [it has been10 months now through June 2015; and the SPY is sitting on, or breaking through, the long-term trendline]. So, after 7 months in this sideways trading pattern, if the market stays in this relatively flat range for a few more months (highly likely), I believe that a Big Crash will come in July or August 2015 (most likely July 2015). If not, we could see the S&P 500 at 2500 or higher before the big crash finally comes. [New - The end of July 2015 will mark the 11th month this sideways market has been in effect. Previous crashes happened after "topping" for 11-12 months !!! ]

This definitely does not mean that the MIPS models see the market the same way that I do (thankfully), so let's be patient while the market makes up its mind and MIPS follows it. Stay tuned ... Updated on 7/01/2015

Wednesday, June 24 2015

Since our previous blog (below), the "Market to Nowhere" has kept on going nowhere. The very tight trading range for the SPY in the last 6 months has changed its direction between 207.0 and 213.8 thirteen times, with no breakout above 213.8. That is a plus and minus change of only $3.4 around a mid-line of $210.4 (or 1.6%), which is not worth paying a lot of attention to from a pure performance standpoint. But, it does give a lot to think about.

As you can see in the graph immediately below, we again deemed the territory between the top two resistance levels ($212.0 and $213.8) as "No Man's Land". Every time in the 60 trading days that the Bulls have pushed the SPY into "No Man's Land" (pink area), it has gotten beaten back by the Bears. The only good news here is that this behavior cannot last forever, and is most likely coming to an end soon.

This rare kind of behavior shows extreme confusion and uncertainty as to which way this market will break out. Of course, since we cannot go sideways forever, there are only two ways the market can go, Up or Down. See our take on which way is the most likely under the graph.

UP or DOWN MARKET ???

In this market, there are compelling reasons as to why this market will continue up as in the last 6 years, but also some compelling reasons as to why it will turn down big-time. In short, the main reasons are:

Reasons for a Down Market Reasons for an Up Market

- Economy not doing well - The behavior of the Fed

- Potential higher interest rates - The behavior of the Fed

- Potential Greek default - The behavior of the Fed

- China economy slowing - The behavior of the Fed

- Oil price and energy profits - The behavior of the Fed

- Stocks overbought - No other place to invest outside of the stock market

- The market may be "topping" - Long-term, tight-range markets break up 70% of the time

- Will go where the big guys want it to - Will go where the big guys want it to go

See more about the last 2 reasons in both columns in our "previous blog" below.

Ok, I gotta say it... I think the SPY will break to the upside in the short-term, followed by a big crash in the next 4-6 months. But, as we all know, MIPS knows better than me (or you), so let's speculate as long as we want to (for fun), but follow the MIPS signals to manage our money (for gains).

And, we may not know why, but WE DO KNOW that the market will go the way the big guys want it to go. Even though the big guys don't like it, they leave a footprint when they are buying and/or selling, and MIPS knows how to track their action, and follow it.

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

===============================================================

<<< Previous Blog >>>

MIPS Members:

As you know by now, the market's "march to nowhere" continues. As said on CNBC, "The biggest story in the stock market this year has been, well, no story at all." And, according to technical analyst Jonathan Krinsky (MKM Partners), "The Dow hasn't done this in over 100 years."

What has the Dow not done in its history going back to the 1890's? The Dow has never traded in a narrow trading range of less than 6.2% for the first 6 months of any year. We are about 3 weeks short of that record time now, and the Dow's max top-to-bottom range has been about 6.2%. That's a plus-or-minus deviation of 3.1% around its mean-line in 6 months !!!

Yes, multiple trillions of dollars have been traded in this time frame with almost no real gains/losses in the indices. Needless to say, that shows a lot of uncertainty. See the graph for the SPY below (with a couple of "fakeout" breakouts).

No one has any idea where this market will go from here, and there are two good cases.

- you need to follow this market daily.

THE BULL's CASE

According to technical analyst Jonathan Krinsky, the Dow has traded in a narrow trading range of 10% (as opposed to 6% now) in the first 6 months of any given year 19 times since 1896. Of these 19 times, almost 70% or the time (13 out of 19), the market ended up higher for the remainder of the year. We have 3 weeks left to go in the 1st 6 months of this year. This market may still have steam, and the little guys could push it much higher with euphoric buying.

THE BEAR's CASE

There is a good chance that all of this "flatness" is NOT all about uncertainty, but is part of a "rollover" of this 6.5 year bull market into a full-fledged bear market. Of course, all rollovers are caused by the big guys selling at the top of a bull market (like now), or buying at the bottom of a bear market (like in 2009). At a top, the big guys sell the market down, and the little guys buy the dips right back up to the tops. A "topping" market takes the form of a "rollover" (instead of an immediate "reversal") because it takes the big guys at least 12 months to dump the major part of their portfolios; and then they let the little guys ride it down all the way to the bottom for the umpteenth time. SEE THE GRAPH IMMEDIATELY BELOW. If this indeed what is going on, we only have a few months left, so watch closely.

OUR ADVANTAGE

We can't "go this alone" and try to pick the time that this market is going to crash. We are not smart enough and we do not think fast enough to even come close. We are not going to out-think the mathematics that make up good models and go through even one thousandth of the conditions that the computer can analyze in milliseconds.

For example, study the graph below (from TimerTrac.com with verified signals) to see how MIPS3 actually traded the SPY in 2008. Who would you bet on: yourself, or MIPS, or some other model that you have not seen successfully handle a market crash? I know how I would answer that question. Stay tuned !!!

Monday, June 08 2015

As you know by now, the market's "march to nowhere" continues. As said on CNBC, "The biggest story in the stock market this year has been, well, no story at all." And, according to technical analyst Jonathan Krinsky (MKM Partners), "The Dow hasn't done this in over 100 years."

What has the Dow not done in its history going back to the 1890's? The Dow has never traded in a narrow trading range of less than 6.2% for the first 6 months of any year. We are about 3 weeks short of that record time now, and the Dow's max top-to-bottom range has been about 6.2%. That's a plus-or-minus deviation of 3.1% around its mean-line in 6 months !!!

Yes, multiple trillions of dollars have been traded in this time frame with almost no real gains/losses in the indices. Needless to say, that shows a lot of uncertainty. See the graph for the SPY below (with a couple of "fakeout" breakouts).

No one has any idea where this market will go from here, and there are two good cases.

- you need to follow this market daily.

THE BULL's CASE

According to technical analyst Jonathan Krinsky, the Dow has traded in a narrow trading range of 10% (as opposed to 6% now) in the first 6 months of any given year 19 times since 1896. Of these 19 times, almost 70% or the time (13 out of 19), the market ended up higher for the remainder of the year. We have 3 weeks left to go in the 1st 6 months of this year. This market may still have steam, and the little guys could push it much higher with euphoric buying.

THE BEAR's CASE

There is a good chance that all of this "flatness" is NOT all about uncertainty, but is part of a "rollover" of this 6.5 year bull market into a full-fledged bear market. Of course, all rollovers are caused by the big guys selling at the top of a bull market (like now), or buying at the bottom of a bear market (like in 2009). At a top, the big guys sell the market down, and the little guys buy the dips right back up to the tops. A "topping" market takes the form of a "rollover" (instead of an immediate "reversal") because it takes the big guys at least 12 months to dump the major part of their portfolios; and then they let the little guys ride it down all the way to the bottom for the umpteenth time. SEE THE GRAPH IMMEDIATELY BELOW. If this indeed what is going on, we only have a few months left, so watch closely.

OUR ADVANTAGE

We can't "go this alone" and try to pick the time that this market is going to crash. We are not smart enough and we do not think fast enough to even come close. We are not going to out-think the mathematics that make up good models and go through even one thousandth of the conditions that the computer can analyze in milliseconds.

For example, study the graph below (from TimerTrac.com with verified signals) to see how MIPS3 actually traded the SPY in 2008. Who would you bet on: yourself, or MIPS, or some other model that you have not seen successfully handle a market crash? I know how I would answer that question. Stay tuned !!!

Thursday, May 14 2015

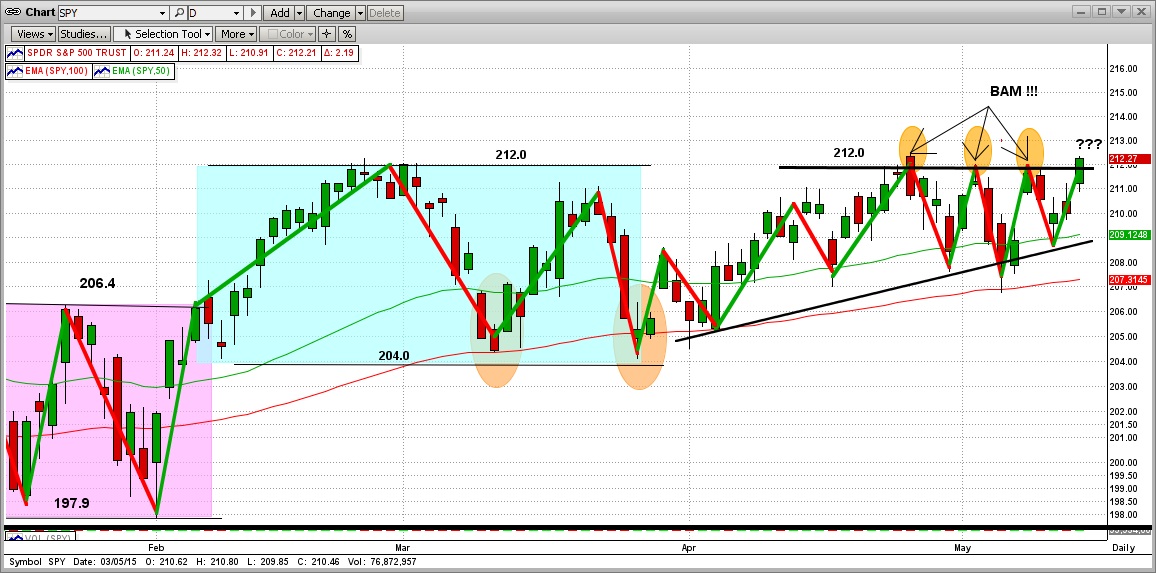

After 3 failed attempts in the last 15 days, the SPY finally broke up above its very strong resistance level and closed on a new high at 212.2 (and 2121 on the S&P500). While we are pleased that the S&P 500 made a new high, and the breakout was on a big rise today following an "up-gap" from yesterday, the volume was relatively low for a breakout (just a little negative, but very bullish overall).

The market movement seems to have transitioned from a sideways market to a "rising wedge" pattern, which usually breaks out following the trend that got it there in the first place (up, in this case). So far it has, and all is good. However, as we all know, the Bears are most likely NOT going to give up easily (they have a ton of short positions to "protect", so they may be selling big-time). On the other hand, if the Bears decide to "cover" their outstanding shorts, that would be VERY bullish. So, although things look bullish, this market can go either way from here. We can watch the price movements and chart patterns as they happen, but we can't analyze these volume-weighted movements anywhere close to how intricately MIPS does. For that reason (and many more), let's rely on MIPS to help us navigate our portfolio in these uncertain times.

Stay tuned...

===========================================================================

<<< Previous Blog >>>

Needless to say, in the last few days the market has not performed well. In fact, some emails that we have received are borderline "panic". So, how bad is the market now and where are we headed?

If we look at a daily chart, as usual it looks like the market is coming apart (see the 1st graph below). From this viewpoint, we can see very clearly that the SPY hit the Bear's front-line resistance at 212.0 twice in five days, and got slammed back both times ("Bam"). Even though the market has been flat for over 5 months, the daily action has been very volatile. So, even though it is very obvious that the short-term trend is "flat", it is difficult to see where the intermediate-term is going.

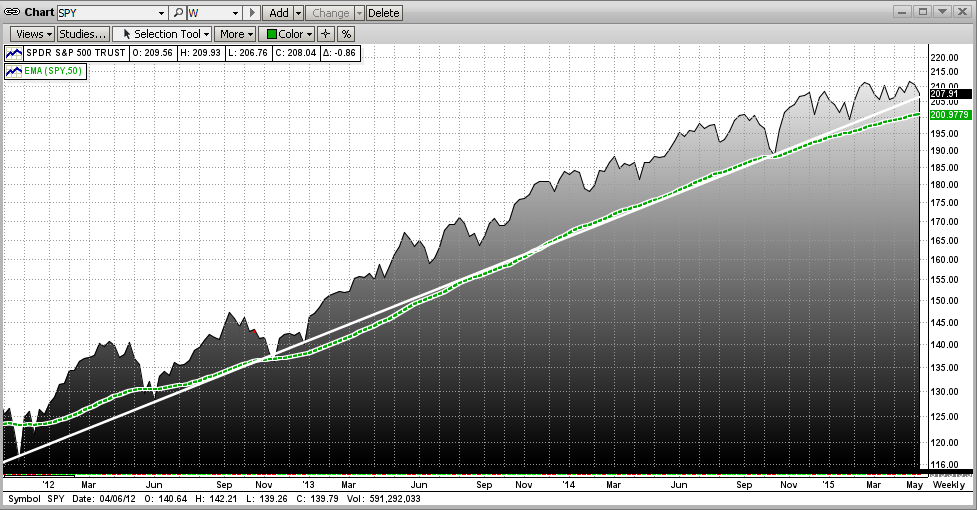

Like most other things in life, if we want to see the "big picture" we need to step back and look at the situation from afar. In this case, let's turn to a graph with weekly data instead of daily data (kind of smooths out the crazy ups-and-downs of everyday activities, as the "floor trades" sell one day and buy back the next.

The next graph shows the rare, "near perfect" 3-year trend from January 2012 through today (5/06/2015). [The trend line is white and the 50-week EMA is green.] As you can see, the SPY hit (or dropped back close to), its trend line (or EMA line) 7-8 times, but the trend line proved to be excellent resistance as the SPY bounced back up every time. As you can see, we are there again today.

Lots of smallish short-term "traders" (if we can call them that) got whipsawed mercilessly in this "froth" above the trendline, a place where the big floor traders live. Little guys trying to navigate that territory usually get killed. And, what for? Why take the risk of trading against the big guys IN THEIR OWN EXCLUSIVE TERRITORY when you can experience good returns following the trend. Greed, maybe?

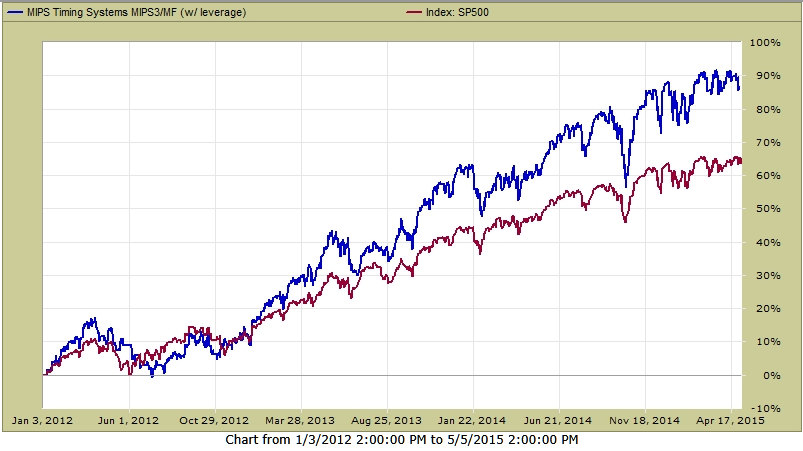

We just said the you could make good money following the trend instead of jumping into the froth above the trendline and getting killed. OK, so how did MIPS do in this time period? For that, we refer to TimerTrac.com, where MIPS3 has been "verified" since late 2005 (MIPS4 would have done better, but it was not introduced until 1Q'13).

As you can see below, MIPS3 trading 1.5x leverage SPY ended up +87%, while the SPY was up +64%.

- Just in case you don't know, if you did that well for the next 21 years, your portfolio then would be

about 80 times the value of what you have now (e.g., $50,000 would be about $4,000,000) !!!

- Still want to "play the froth" and lose your butt, or can you be patient and possibly get rich ?

Stay tuned and follow MIPS !!!

|