Monday, December 26 2016

Santa Claus Rally, December Rally, Trump Rally... what difference does it make... a rally is a rally !!!

Traditionally the Santa Claus Rally in December is believed to result from:

(1) Mutual funds, etc., "dressing up" their portfolio by selling all of their losers and buying winning

stocks that have done well during the year. This way, all stocks in their year-end portfolios look

really good (show gains), even though the fund did not actually participate in these gains. Some

fund's year-end portfolio may show 90% of the stocks up 10-30% in 2016, when in actuality

the fund was actually up only 2-3% for the year. Sounds like "cheating" doesn't it? At its best,

this very misleading.

(2) In the last half of December, the pros have done their dirty deeds and have left on vacation

for the rest of the year. Usually, the market sentiment is high from the runup in the first half

of December. And then, in the last half, the "little guys" come in and push the market even

higher on relatively low volume.

(3) In 2016, all of the above have been aided by the Trump rally.

So, according to the above, December should finish with a nice gain (see graph below).

BTW:

- all MIPS models went long on 7/11/2016.

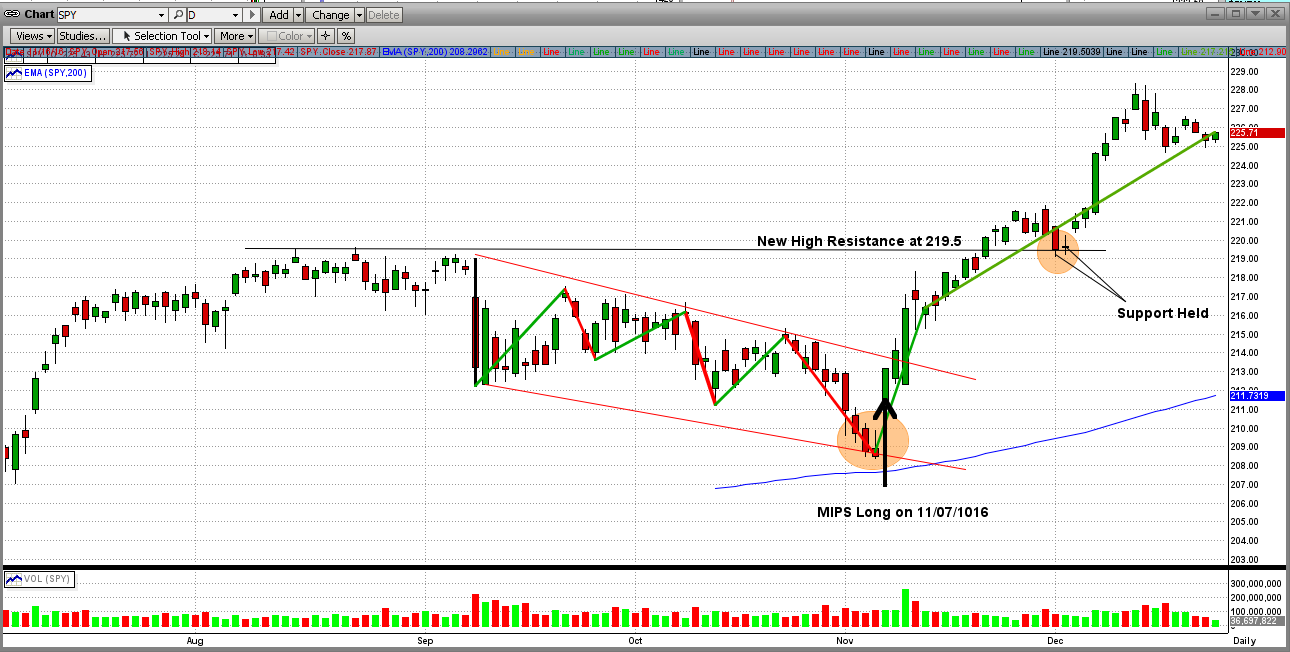

- MIPS4 was still long on 11/07/2016 (as was MIPS3, after it got called back to cash for a few days).

We MIPS members will wait for MIPS to tell use what to do next...

Stay tuned...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, Inc.

Houston, TX

281-251-MIPS(6477)

Sunday, December 11 2016

From the MIPS website at:

http://www.mipstiming.com/rias___nitro1

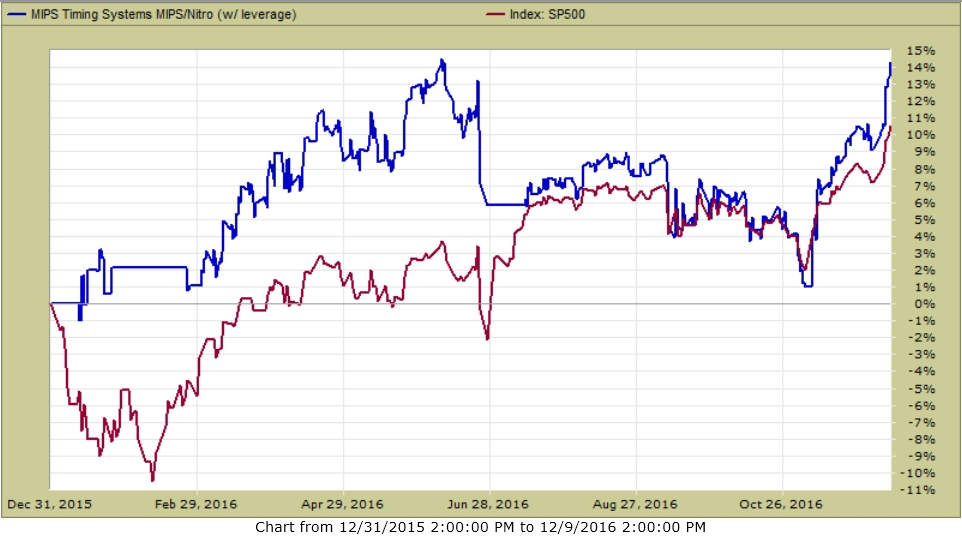

MIPS/Nitro up 14.3% thru 12/09/2016 (1.5x leverage long, 1.0x SH short)

Paul Distefano

--

--- Contact Info ---

Paul Distefano, PhD

CEO/Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

www.mipstiming.com

pdistefano@mipstiming.com

Sunday, December 11 2016

From the MIPS website at:

http://www.mipstiming.com/home

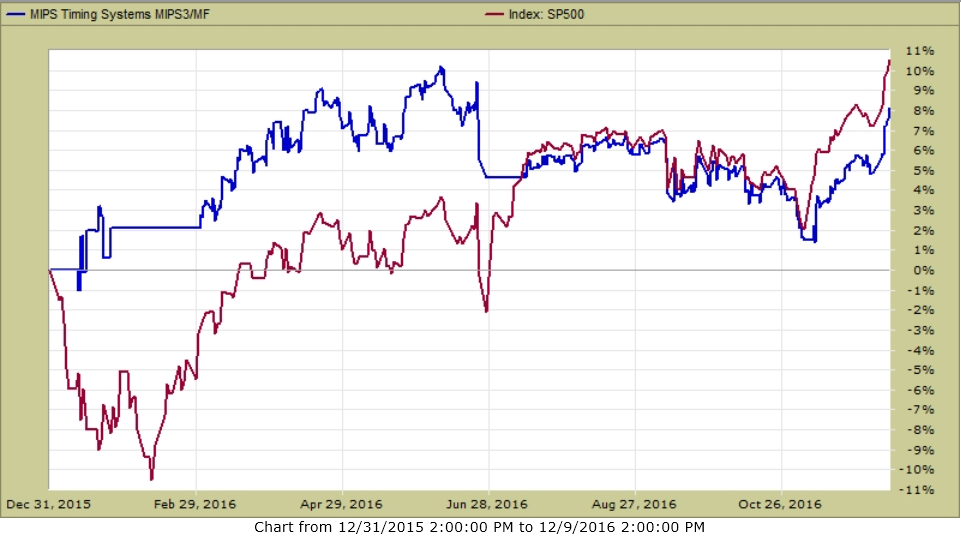

MIPS3 up 8% thru 12/09/2016 (no leverage)

Paul Distefano

--

--- Contact Info ---

Paul Distefano, PhD

CEO/Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

www.mipstiming.com

pdistefano@mipstiming.com

Monday, December 05 2016

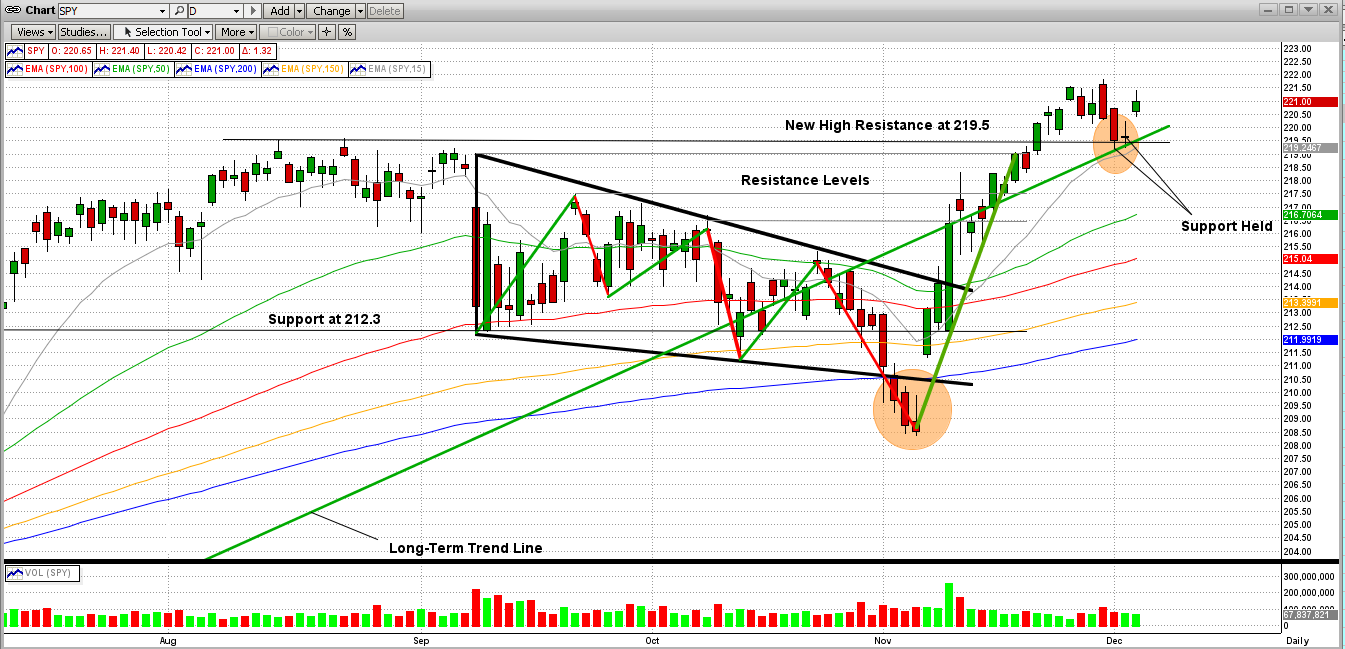

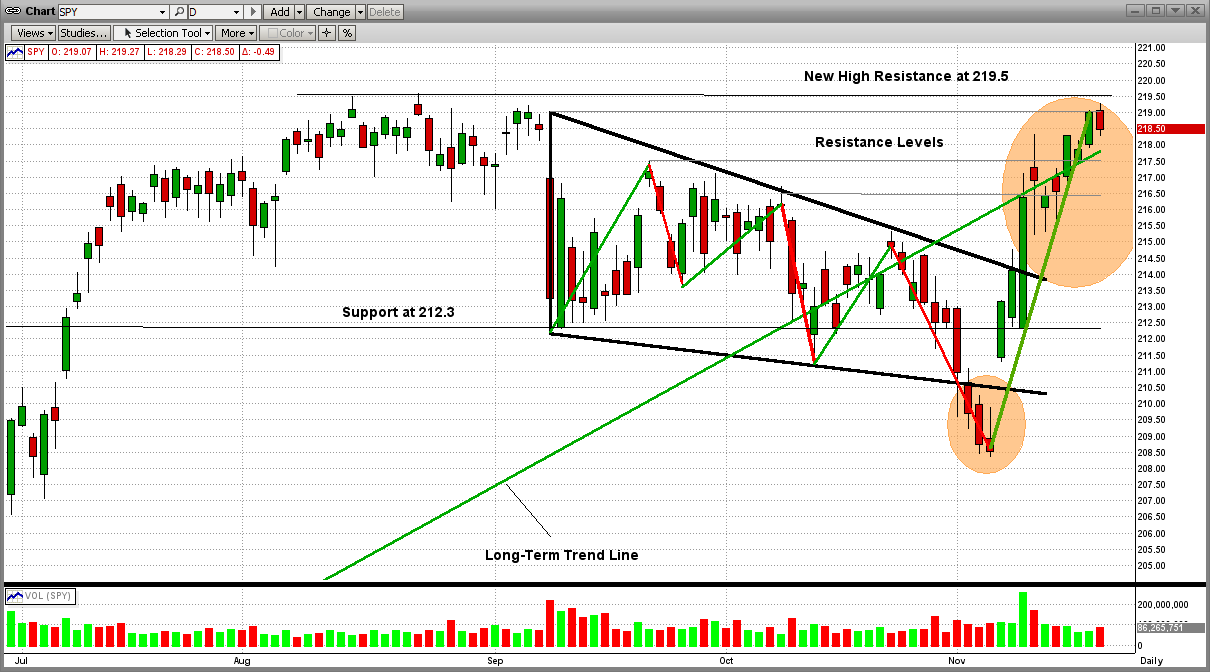

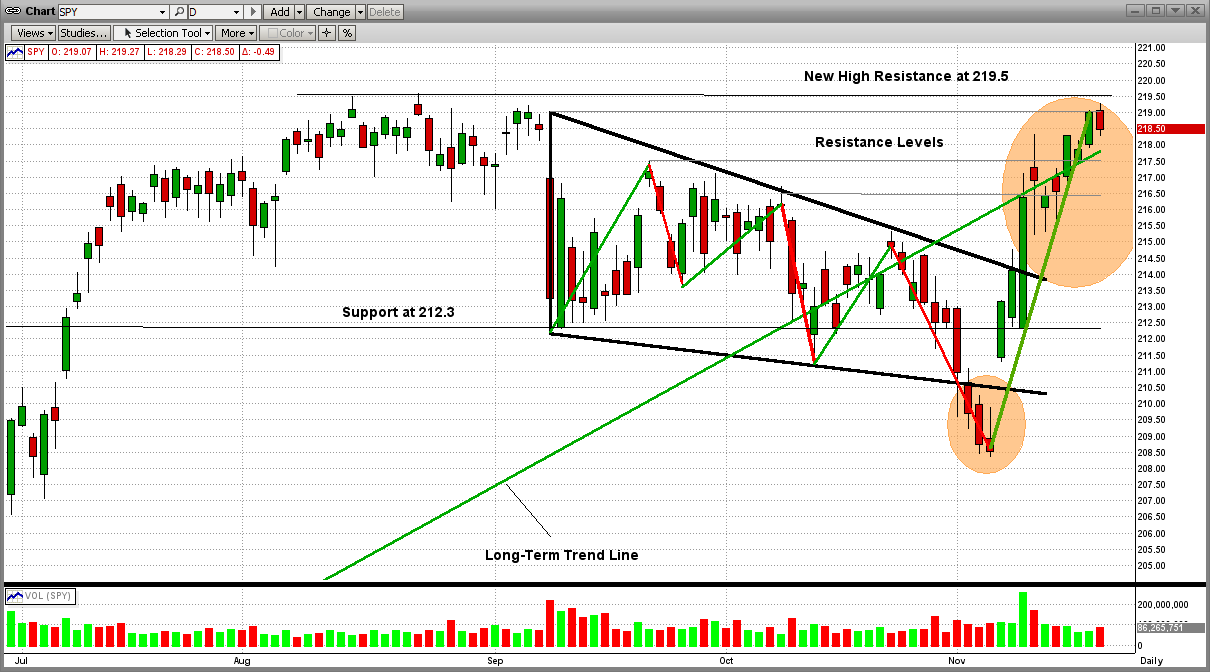

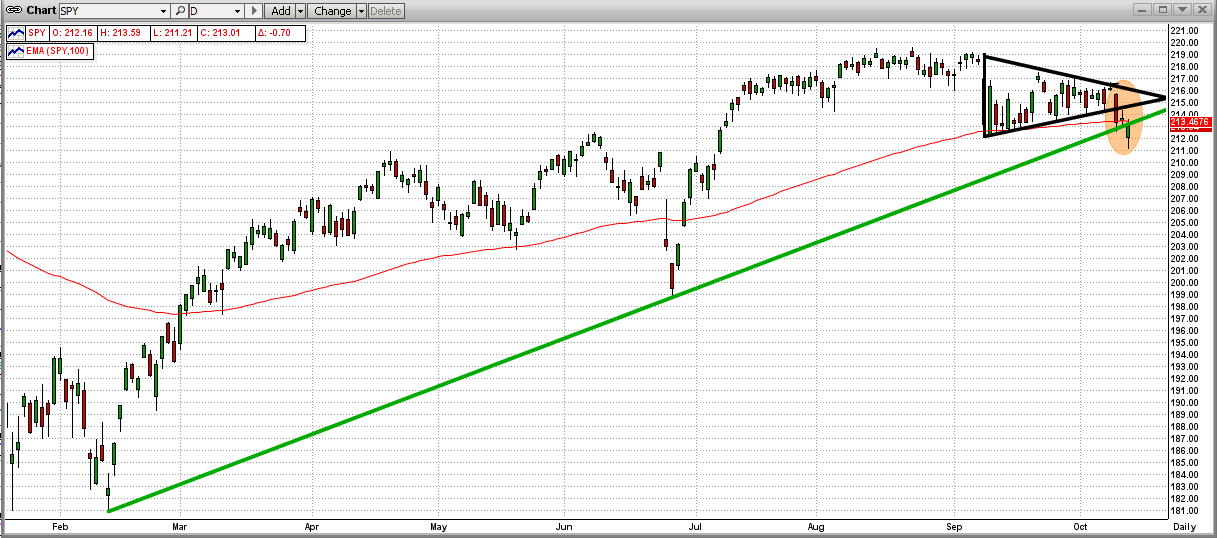

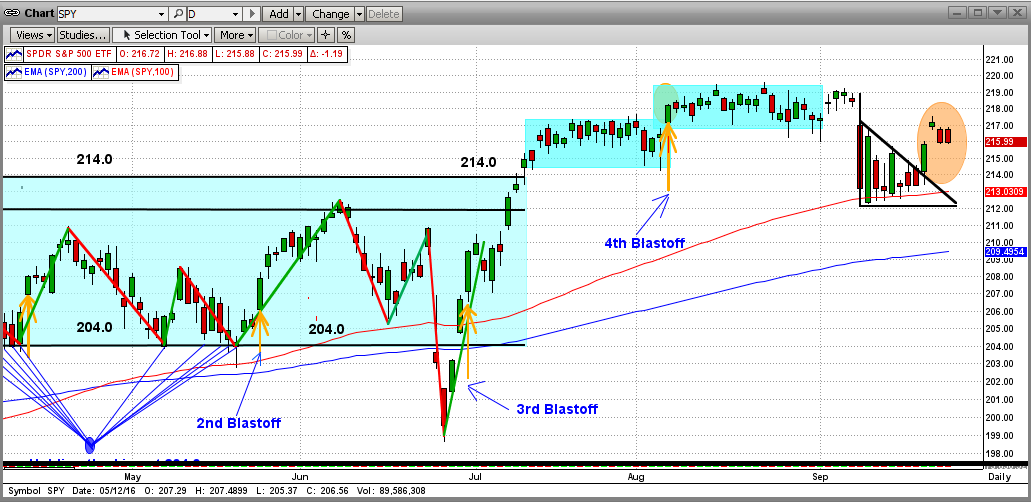

Good News - The recent new highs are beginning to look like traditional new highs. The S&P 500 broke out above its long-time resistance at 2165 (216.5 on the SPY) on 11/20/2015. This was a BIG event !!!

Since then, the SPY has done what markets making new highs do. That is: (1) break to the upside, (2) come back to test its support level (the old resistance level), and (3) bounce back above the support level with force. And bounce back it did.

Seven days after the SPY "broke out", for next two days it bounced off of its support level, its long-term trend line, and its 12-day EMA; and then it gapped up today (orange ellipse on the top right in the graph below) . From here, the sky should be the limit; but what "should be" does not always happen.

Stay aware, and watch for the MIPS signals to tell us what to do from here...

Stay tuned...

Thanks,

Paul Distefano

<<< Contact Info >>>

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

================================================================

<<< Previous Blog >>>

MIPS - New Highs Coming ???

MIPS Members:

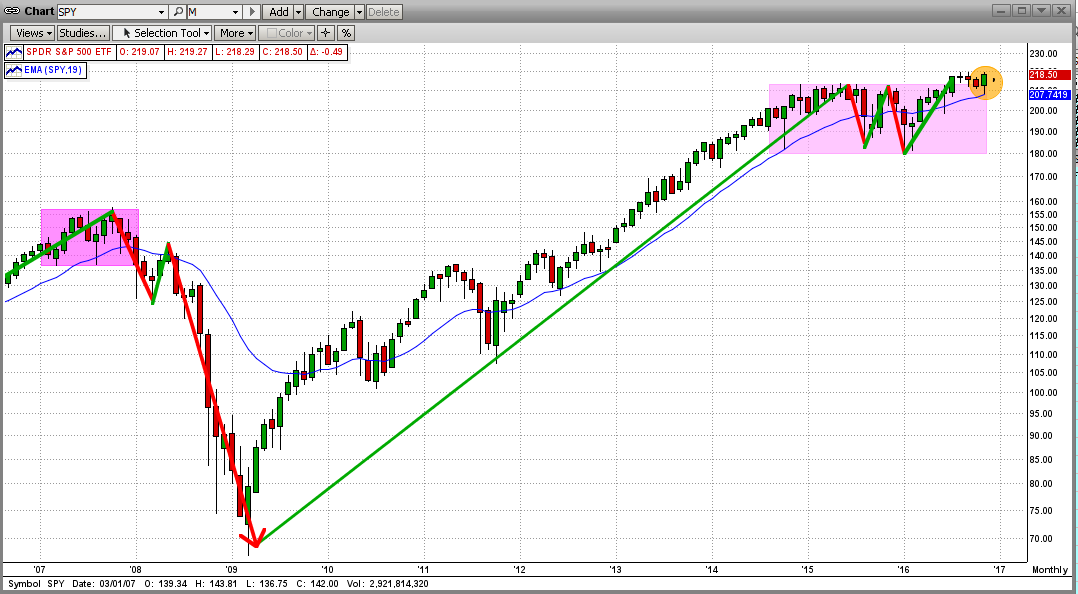

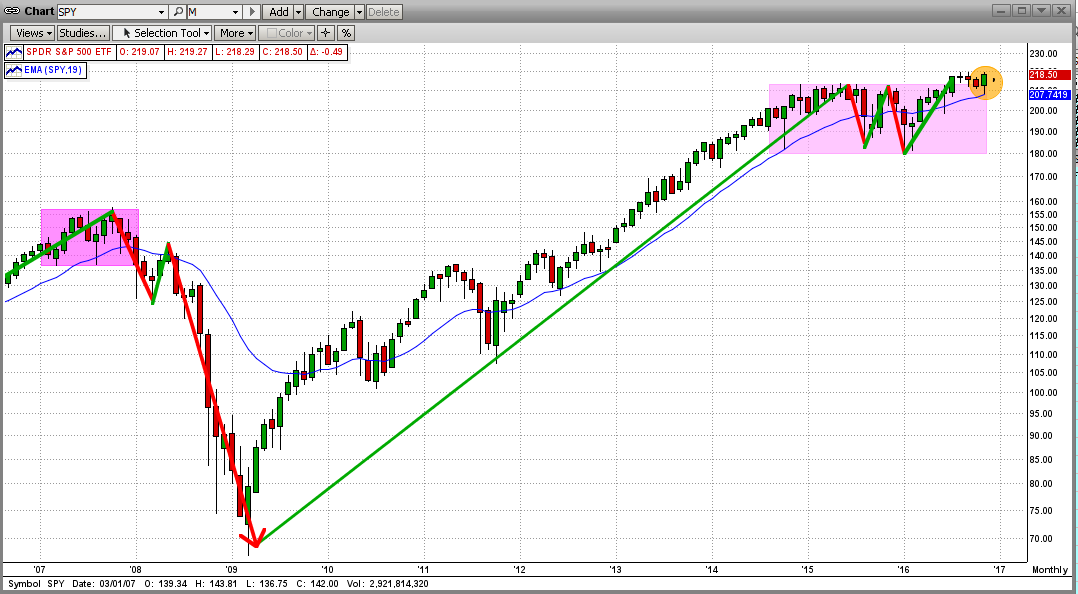

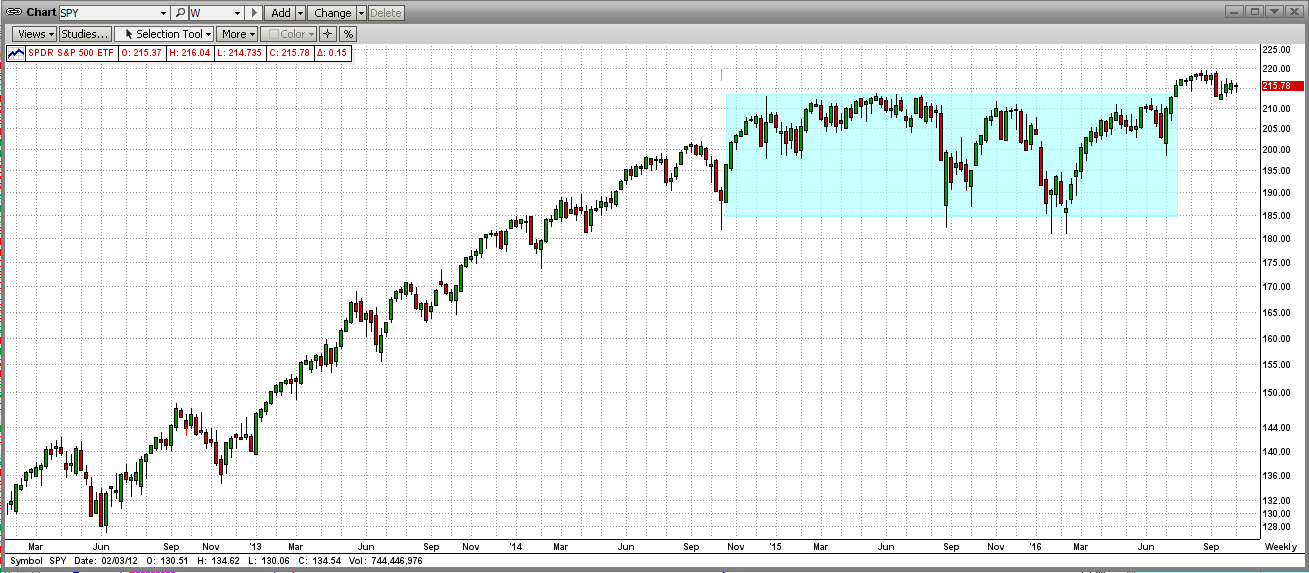

After going sideways for almost two years now, the market could be about to break out to the upside. This is somewhat obvious when we look at the long-term trend in the markets. Keep in mind that the Dow, the NASDAQ, and the Russ2K have already hit new highs. Is the mighty SPY next? Instead of looking at daily graphs now, let's first look at a monthly graph of the SPY (ETF for the S&P500).

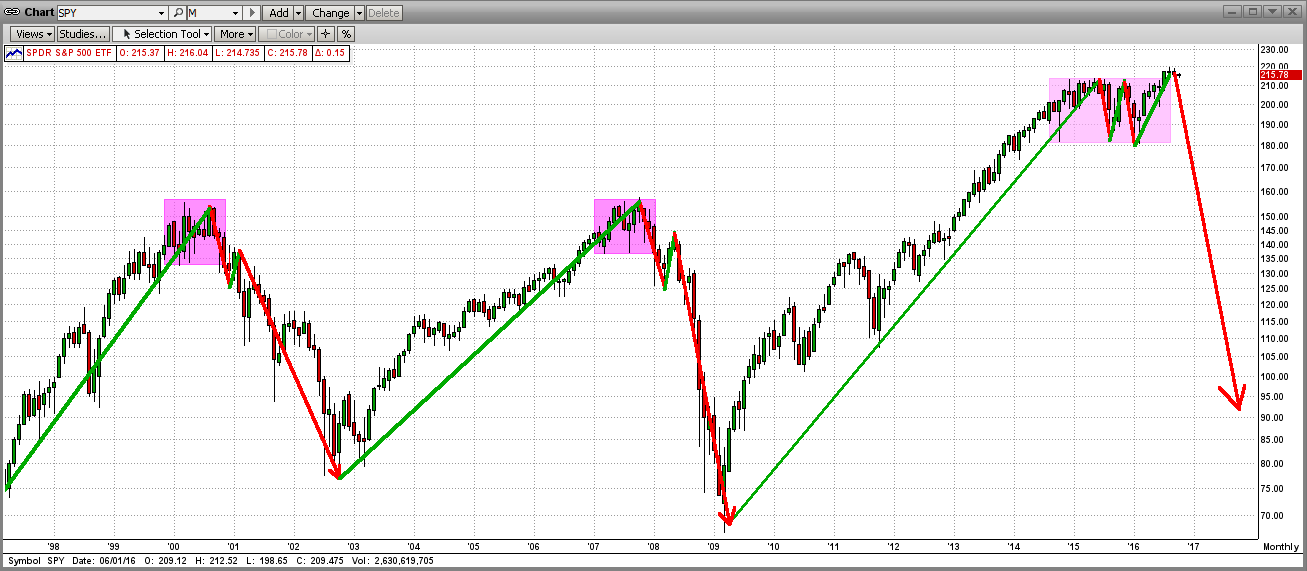

In the graph below, you will see that our long uptrend is still in effect, but the SPY has waffled for 2 years (24 monthly bars up-and-down in a tight range), with a rather weak breakout 4 months ago. Usually when this happens, the SPY is "topping" and a crash is imminent; but not always. For example, if the market gets a catalyst that results in a strong rally at a time like this, the bull market can run higher, at least for a few months. Of course, if whatever caused the catalyst is the "real thing", we could see a strong market for a long time. Read on...

Of course, the "catalyst" this time was the surprising Trump victory in the presidential election ("Trexit"). Because of Trump's bold plans for infrastructure spending, bringing "blue collar" jobs back to the good old USA, etc., the Trump win led big investors to rotate their holdings into industrials (like Caterpillar) and financials (like Goldman Sachs) at the expense of the laggards (like utilities). And, this happened very quickly. So far, the buying has continued.

Even with (and maybe because of) the bullish sentiment of, and rally in, the markets in the last few weeks, the market could experience a setback soon. See the next graph below.

The all-time high for the S&P 500 is 2195 (approx 219.5 on the SPY). As you can see, the SPY reached a resistance strong point of 219.0 on Thursday, and got beaten back by the bears lurking there. That was not good, but not overly bearish (yet). Almost surely, the SPY will make another set of "charges" at the strong resistance levels at 219.0-219.5 in the next few days/weeks, and the winner will then be known (bulls or bears).

Keep your eyes fixed on these price levels in the next few days/weeks, while letting MIPS tell you how and when to trade, if at all ... MIPS members can see the current signals for all MIPS models here: http://www.mipstiming.com/current_signals

History has shown that breaking (and staying) in new-high territory is very difficult. On the other hand, if the bulls prevail with a strong break (say on high volume), the sky will be the limit for a while (nice sailing).

Thanks,

Paul Distefano

<<< Contact Info >>>

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, November 20 2016

After going sideways for almost two years now, the market could be about to break out to the upside. This is somewhat obvious when we look at the long-term trend in the markets. Keep in mind that the Dow, the NASDAQ, and the Russ2K have already hit new highs. Is the mighty SPY next? Instead of looking at daily graphs now, let's first look at a monthly graph of the SPY (ETF for the S&P500).

In the graph below, you will see that our long uptrend is still in effect, but the SPY has waffled for 2 years (24 monthly bars up-and-down in a tight range), with a rather weak breakout 4 months ago. Usually when this happens, the SPY is "topping" and a crash is imminent; but not always. For example, if the market gets a catalyst that results in a strong rally at a time like this, the bull market can run higher, at least for a few months. Of course, if whatever caused the catalyst is the "real thing", we could see a strong market for a long time. Read on...

Of course, the "catalyst" this time was the surprising Trump victory in the presidential election ("Trexit"). Because of Trump's bold plans for infrastructure spending, bringing "blue collar" jobs back to the good old USA, etc., the Trump win led big investors to rotate their holdings into industrials (like Caterpillar) and financials (like Goldman Sachs) at the expense of the laggards (like utilities). And, this happened very quickly. So far, the buying has continued.

Even with (and maybe because of) the bullish sentiment of, and rally in, the markets in the last few weeks, the market could experience a setback soon. See the next graph below.

The all-time high for the S&P 500 is 2195 (approx 219.5 on the SPY). As you can see, the SPY reached a resistance strong point of 219.0 on Thursday, and got beaten back by the bears lurking there. That was not good, but not overly bearish (yet). Almost surely, the SPY will make another set of "charges" at the strong resistance levels at 219.0-219.5 in the next few days/weeks, and the winner will then be known (bulls or bears).

Keep your eyes fixed on these price levels in the next few days/weeks, while letting MIPS tell you how and when to trade, if at all ... MIPS members can see the current signals for all MIPS models here: http://www.mipstiming.com/current_signals

History has shown that breaking (and staying) in new-high territory is very difficult. On the other hand, if the bulls prevail with a strong break (say on high volume), the sky will be the limit for a while (nice sailing).

Thanks,

Paul Distefano

<<< Contact Info >>>

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Friday, October 28 2016

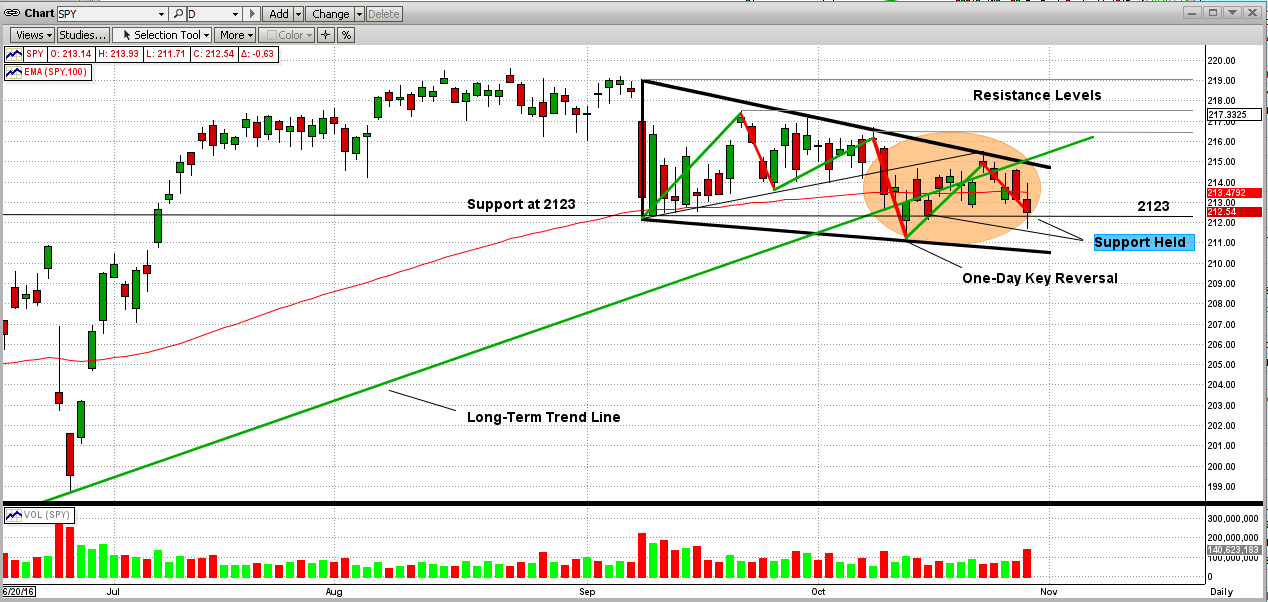

There was nothing really bullish in the news or in the markets this week except:

1) in total, corporate earnings were better than expected

2) our country's GDP was up, and

3) even after the FBI broke the news today that they will be examining more Hillary emails (and this

turned the markets upside-down), the SPY support gave way as it broke below 2123 but then

it bounced back up above its support to close slightly above 2125 (see graph below).

Stay tuned...

Paul Distefano

-----------------------

Contact Info

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems. LLC

Houston

281-251-MIPS(6477)

www.mipstiming.com

=============================================================

<<< Previous Blog >>>

MIPS Members:

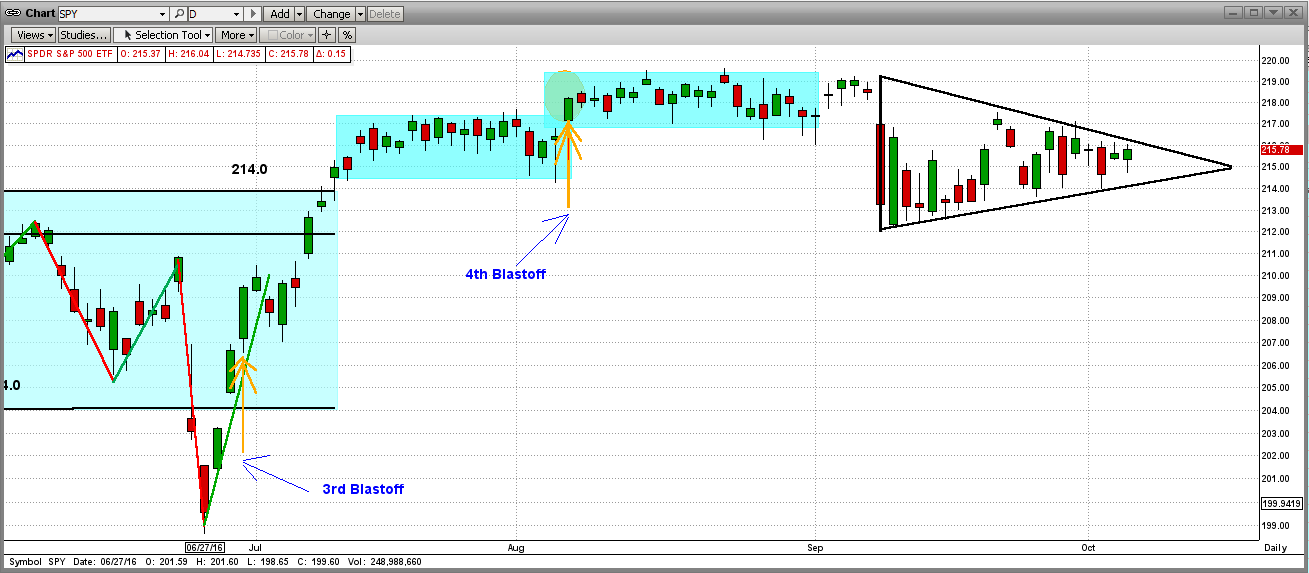

It's times like this when we need a good timing model (like MIPS) to help provide guidance for us in determining the next "big" moves in the market. When I say "big" moves, I mean future 2-6 month's trends, and NOT the 3-8 day "wiggles". Remember, our new Blaster Series algorithms are supposed to keep us away from trading short-term "wiggles".

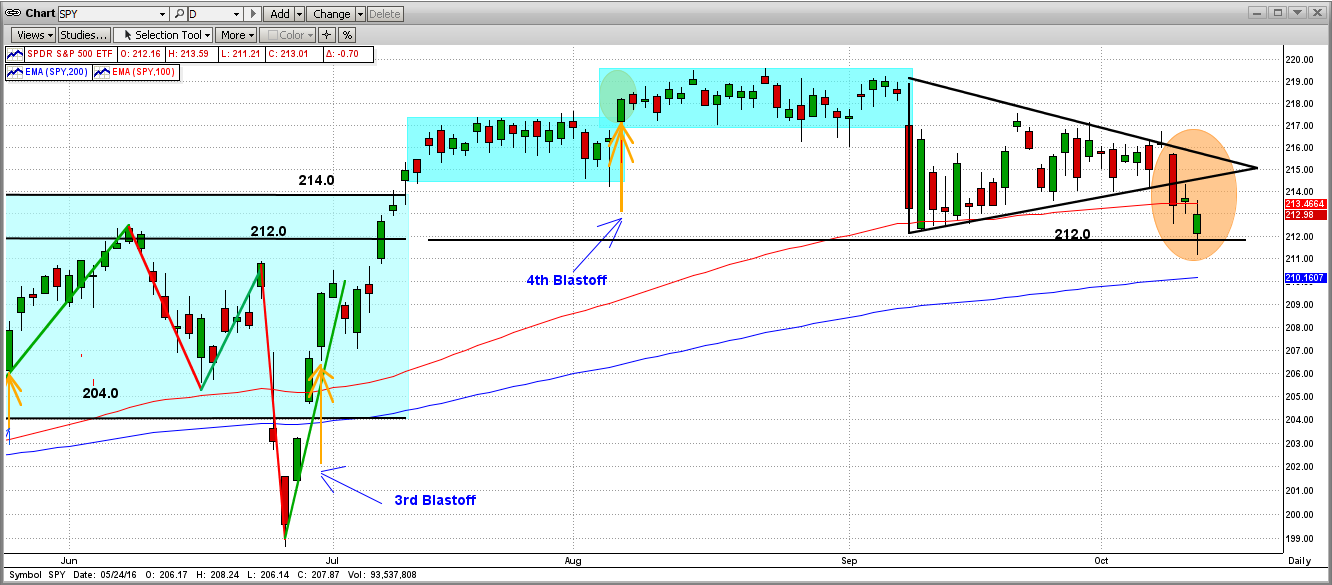

As you can see in the graph below, the market (namely the S&P 500 index, or its ETF the SPY) is basically in a "Standoff", where the market can easily go either way from here.

On 10/10/16, the SPY hit the top of the "Triangle" pattern, and was followed by three additional days of drops. Fortunately, on the third trading day (10/13/16), the SPY dropped substantially in early trading and crossed well below its strong support level at 2123 (horizontal black line); but then, the SPY came fighting its way back up (rebounded) and closed way over its support at 2130. This would constitute what is called a "One Day Key Reversal" to the upside, a very bullish move.

After climbing back above the long-term trend line (green line), the market tried but failed to stay well above the LT trend line. Actually, the SPY closed the week basically "ON" the trend line, which is neither bullish or bearish. Or maybe, its just a little bullish since the SPY was facing a sudden downdraft, but somehow managed to "hold the line" right on the LT trend-line (and not below it).

Bearish Bullish

The SPY broke below the triangle pattern The SPY was able to hold above its support of 2123

The SPY gave up its rebound and stopped The SPY closed on or above the LT Trend Line in all of the last 4 days

The SPY was on or above its 100-Day EMA for the last 4 days

Stay tuned...

- All MIPS models are still Long...

Thanks,

Paul Distefano

-----------------------

Contact Info

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems. LLC

Houston

281-251-MIPS(6477)

www.mipstiming.com

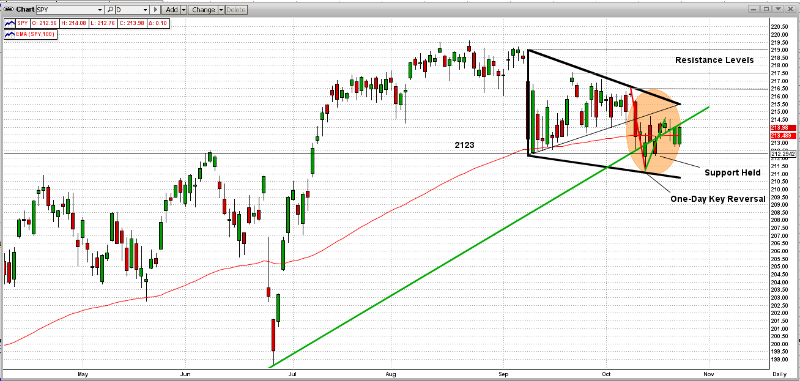

Sunday, October 23 2016

This market remains one that is very difficult to call. There are lots of things going on that influence the direction of the markets; like The Fed, extremely low interest rates, poor corporate earnings, wild Presidential campaigns, weak international economies, etc. It seems like when any one of these "pops" just a little, the market goes crazy. That is why the market is relatively flat, but with high volatility.

From a "technical" standpoint, we have had a really interesting standoff, with the Bulls winning most and the Bears winning a few. However, the Bears have been in charge so far this week, but the Bulls may have pulled off a "turnaround" today. Still too close to call, but let's lay out what we see.

SHORT TERM

From the graph below, we can analyze the pros and cons for each side:

Bears Bulls _ ________ __

Broke triangle pattern down 3 days ago Today the SPY closed above its support at 212.0

Continued down for the next two days Today's "candle" is in a positive "Hammer" position

The SPY broke it's 100-Day EMA today Today may have been a "One Day Key Reversal"

LONG TERM

From the graph below:

Bears Bulls _ ________ _______

Broke below triangle pattern Market re-bound performed like a "One Day Key Reversal"

Broke just below the Long-Term trend line Rebounded to closed almost on the Long-Term trend line

Broke just below its 200-Day EMA

The short-term future of the market is very difficult to call under these conditions. The current MIPS signals are "LONG", so we should hold our long positions for now.

Thanks,

Paul Distefano

----------------------------------

Paul Distefano, PhD

MIPS Timing Systems

Houston, TX

281-251_MIPS(6477)

www.mipstiming.com

Thursday, October 13 2016

This market remains one that is very difficult to call. There are lots of things going on that influence the direction of the markets; like The Fed, extremely low interest rates, poor corporate earnings, wild Presidential campaigns, weak international economies, etc. It seems like when any one of these "pops" just a little, the market goes crazy. That is why the market is relatively flat, but with high volatility.

From a "technical" standpoint, we have had a really interesting standoff, with the Bulls winning most and the Bears winning a few. However, the Bears have been in charge so far this week, but the Bulls may have pulled off a "turnaround" today. Still too close to call, but let's lay out what we see.

SHORT TERM

From the graph below, we can analyze the pros and cons for each side:

Bears Bulls _ ________ __

Broke triangle pattern down 3 days ago Today the SPY closed above its support at 212.0

Continued down for the next two days Today's "candle" is in a positive "Hammer" position

The SPY broke it's 100-Day EMA today Today may have been a "One Day Key Reversal"

LONG TERM

From the graph below:

Bears Bulls _ ________ _______

Broke below triangle pattern Market re-bound performed like a "One Day Key Reversal"

Broke just below the Long-Term trend line Rebounded to closed almost on the Long-Term trend line

Broke just below its 200-Day EMA

The short-term future of the market is very difficult to call under these conditions. The current MIPS signals are "LONG", so we should hold our long positions for now.

Thanks

Paul Distefano

----------------------------------

Paul Distefano, PhD

MIPS Timing Systems

Houston, TX

281-251_MIPS(6477)

www.mipstiming.com

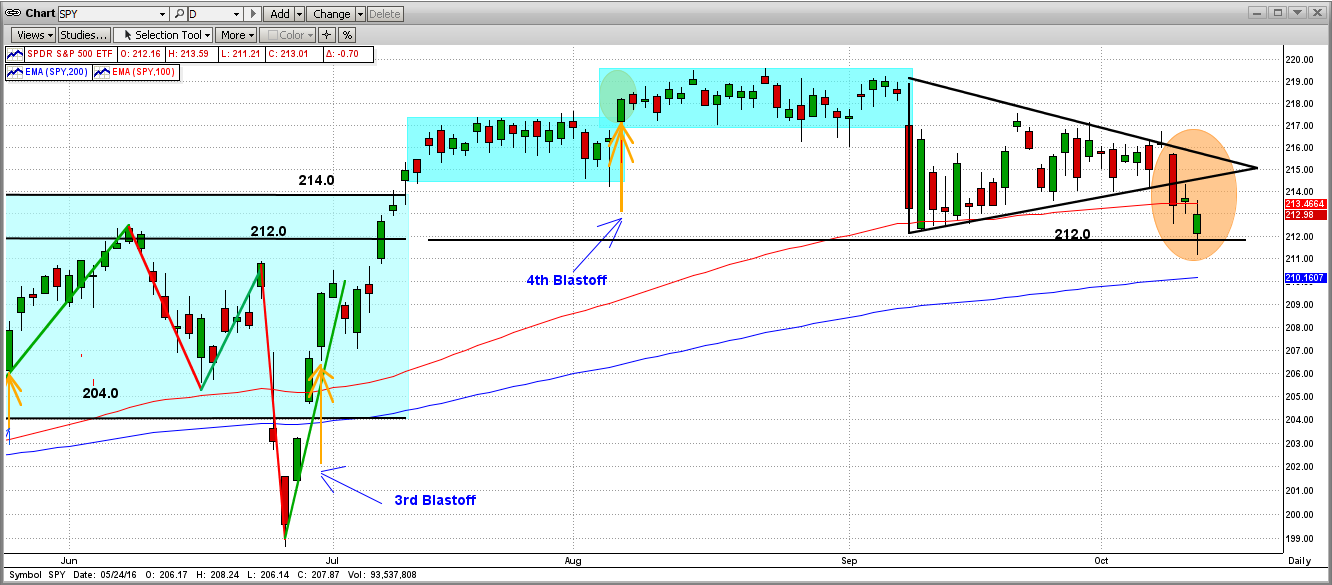

Friday, October 07 2016

Over long periods of time, investors disagree with each other’s views of “what” will happen to the market and what the catalyst will be that causes the “what” to happen. Some of the downside catalysts have been weak economics, poor profits, global unrest, etc.

Now, most all of us agree that the ultimate “catalyst” has been, and for the next 3-6 months will continue to be, Freddy Yellen and her near zero interest rates. No doubt that the Fed’s QE and its interest rate policy is what has kept the market from dropping or even falling apart. Money coming into the markets at a very high rate (as in the last 2 years) moves markets up; and extremely low interest rates is one of the strongest forces of money movement into the markets (round robin).

Freddy Yellen is running out of excuses, but will not raise rates until December of this (election) year. Of course, the fact that this is after the presidential election is just a coincidence, because we all know that the Fed does not let politics affect its decisions. If you believe that, call me about the ocean view property that I have for sale in Arizona.

Because of the above, the market has been moving sideways for almost two years, one of the longest periods in U.S. market history. Multiple trillions have traded hands and the market has been flat for almost two years (see the graph below – weekly bars). You will notice that the “break-out” (if you want to call it that) over the last few weeks was weak and seems to be fading out.

In the past, markets that have been flat at their recent highs for 1-2 years have been in a “topping” pattern, that is, forming a top. The “toppings” in 1999 and 2007 lasted 10-12 months and the topping in 2015-16 has been forming for almost 20 months (see graph below, with monthly bars). Does this mean that the market is ready for the “big drop”? Maybe, but maybe not… read on…

The last stand in the topping process may be happening now. See the “triangle pattern” in the graph below (daily bars). Even though it appears or feels that the market is ready for a dive, any good news for the Fed (like some bad economic or jobs data), could get this market back into the upside breakout mode.

For the last few weeks we have been in this trading triangle, and now this one is coming to an end. In the majority of times, a big market move happens in same the direction as that of the breakout from the triangle pattern itself. Time will tell, and we believe that that time is now upon us. Stay alert…

At the very beginning of this year, we released new versions of our MIPS models (Blaster series) that contain new algorithms that greatly reduce the probability of the models getting whipsawed in flat markets. Instead of trying (and failing) to find new trends in flat “trendless” markets, the models will stop trading in flat markets, and either keep the same signal or go to cash until the market starts moving in a definitive direction again.

This was a major project (9 months) that will undoubtedly provide much better results for the users of our models. The performances of the MIPS models YTD are approximate in sync with the performance of the SPY.

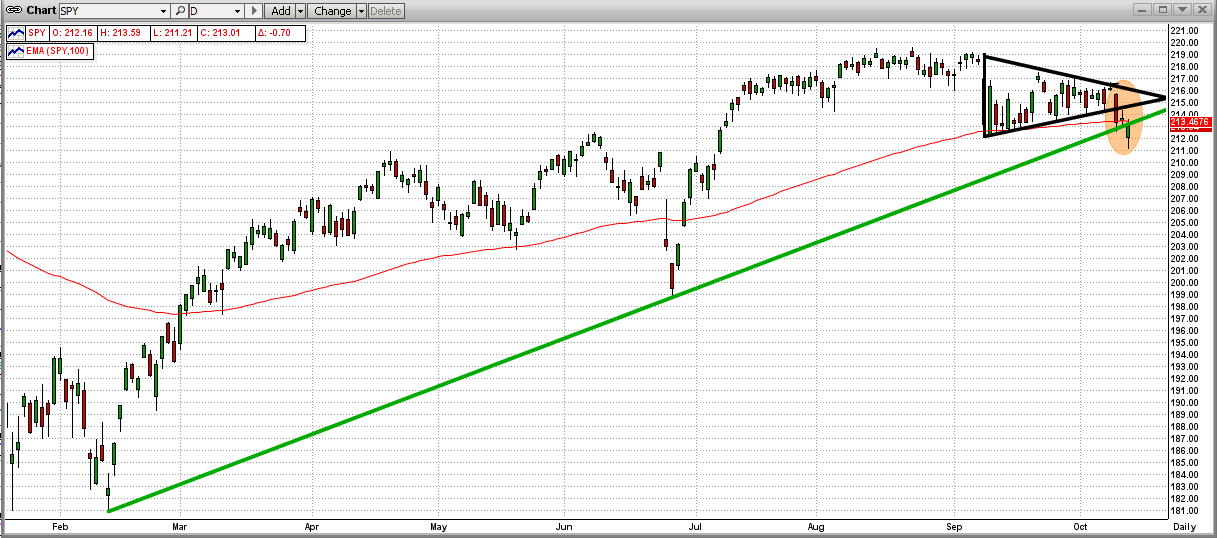

Sunday, September 25 2016

On Wednesday of last week, the Fed's "No Hike" decision overshadowed lots of bad economic and worldwide news, and sent the market up against all odds (see orange "ellipse"). WHAT A SURPRISE !!!

Independent of what fundamental economics indicates or what traditional technical analysis predicts, nothing compares to Ms. Yellen's "Fed Power" to move the market.

Now, let's see how this "break-out" goes from here. Based on all of the negative news that we all know, the market should not go up; but based on extremely low interest rates and lots of free money, it definitely could make new highs from here.

Let's wait for MIPS to tell us what to do ... Stay tuned !!!

|