Friday, May 11 2018

Last week all markets made good moves up... Will that continue?

- please be aware that this behavior could reverse itself with NO warning...

- let's not guess, but wait for MIPS to tell us what to do next !!!

Today's graphs compared to last Friday's close (in 5/04/18 email below):

DOW / DIA

SP 500 / SPY

NASDAQ / QQQ

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

=================================================================

From 5/04/18

MIPS Members:

We never really know which way the market is heading in the near-term future (like in the next few weeks/months). But, there are some "patterns" that tell us where to start looking.

In this blog, we are concentrating on "triangle patterns" (aka TP). Like other patterns, TP comes into play after the market has made a long-term run, and has run out of steam. Because the bulls/bears are not willing to make a stand one way or the other, the TP acts like most other "Consolidation" pattern (sideways, but with defined, squeezing limits up and down). See below...

The good news is that, most of the time, the market makes future big moves in the direction that the market breaks out of the pattern. And, my experience shows that the market usually breaks out in the direction that it was moving before the pattern was formed (and, this time it was moving up) !!!

- Warning: that is just my opinion and has nothing to do with MIPS.

Graphs of the current state of the Dow (DIA), the SPY, and the Nasdaq (QQQ) are shown below.

Status:

1) DIA - hitting the tops and bottoms to near perfection - with the upside looking stronger

2) SPY - following the pattern and struggling to move to the upside, and

3) QQQ - has already broken out to the upside.

DOW / DIA

SP500/ SPY

NASDAQ / QQQ

Good Trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

support@mipstiming.com

www.mipstiming.com

Sunday, May 06 2018

We never really know which way the market is heading in the near-term future (like in the next few weeks/months). But, there are some "patterns" that tell us where to start looking.

In this blog, we are concentrating on "triangle patterns" (aka TP). Like other patterns, TP comes into play after the market has made a long-term run, and has run out of steam. Because the bulls/bears are not willing to make a stand one way or the other, the TP acts like most other "Consolidation" pattern (sideways, but with defined, squeezing limits up and down). See below...

The good news is that, most of the time, the market makes future big moves in the direction that the market breaks out of the pattern. And, my experience shows that the market usually breaks out in the direction that it was moving before the pattern was formed (and, this time it was moving up) !!!

- Warning: that is just my opinion and has nothing to do with MIPS.

Graphs of the current state of the Dow (DIA), the SPY, and the Nasdaq (QQQ) are shown below.

Status:

1) DIA - hitting the tops and bottoms to near perfection - with the upside looking stronger

2) SPY - following the pattern and struggling to move to the upside, and

3) QQQ - has already broken out to the upside.

DOW / DIA

SP500/ SPY

NASDAQ / QQQ

Good Trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

support@mipstiming.com

www.mipstiming.com

Monday, April 23 2018

The "votes" are in from our recent "Survey", where the possibilities for the SPY from Apr 15th to the end

of May 2018 are (see graph below):

A) complete the W-Pattern and make new highs, or

B) at or near the new high level, turn around and head back down, or

C) hit the top of the Triangle line, turn around and head back down, or

D) stall before reaching the top of the Triangle pattern, and head back down.

The final results are:

A) 42%

B) 13%

C) 30%

D) 15%

From above:

o 42% of MIPS followers are VERY optimistic and see the SPY breaking above and making new highs, but

o 30% feel that the SPY will go up from Apr 15th but will fail to reach its all-time high; and then drop way

back down.

I am glad the we have MIPS and don't have to "guess" what to do next...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

==============================================================

April 15, 2018

MIPS Members:

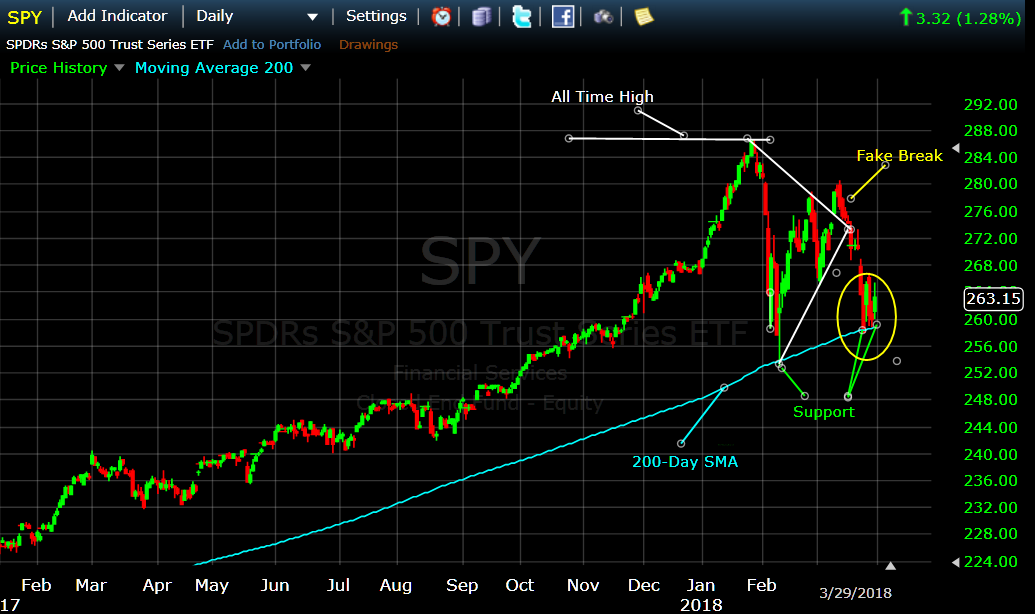

We are all very much aware that the unstoppable bull run since March 2009 was punched straight in the nose at the end of January 2018 and the S&P 500 went tumbling down about -10%. Good things for the market, like corporate earnings, new jobs, and lower unemployment have been offset by new tariffs, trade wars, real wars, the Fed, rising interest rates and fears of increasing inflation.

At any rate, since the end of January 2018, the SPY has waffled down and up several times forming either a "W-Pattern" as in the yellow lines below (similar to a double bottom) or a "Triangle Pattern" as in the white lines below.

The possibilities for the SPY from today to the end of May 2018 are:

A) complete the W-Pattern and make new highs, or

B) at or near the new high level, turn around and head back down, or

C) hit the top of the Triangle line, turn around and head back down, or

D) stall before reaching the top of the Triangle pattern, and head back down.

We are asking for your opinion, and will offer a one month free MIPS monthly subscription ($39 refund) to the first 10 responders that call the correct or closest outcome (A,B, C, or D) that happens by the end of May 2018.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, April 15 2018

We are all very much aware that the unstoppable bull run since March 2009 was punched straight in the nose at the end of January 2018 and the S&P 500 went tumbling down about -10%. Good things for the market, like corporate earnings, new jobs, and lower unemployment have been offset by new tariffs, trade wars, real wars, the Fed, rising interest rates and fears of increasing inflation.

At any rate, since the end of January 2018, the SPY has waffled down and up several times forming either a "W-Pattern" as in the yellow lines below (similar to a double bottom) or a "Triangle Pattern" as in the white lines below.

The possibilities for the SPY from today to the end of May 2018 are:

A) complete the W-Pattern and make new highs, or

B) at or near the new high level, turn around and head back down, or

C) hit the top of the Triangle line, turn around and head back down, or

D) stall before reaching the top of the Triangle pattern, and head back down.

We are asking for your opinion, and will offer a one month free MIPS monthly subscription ($39 refund) to the first 10 responders that call the correct or closest outcome (A,B, C, or D) that happens by the end of May 2018.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Wednesday, April 11 2018

The MIPS3, MIPS4, and MIPS/Nitro models issued two “signal changes” (trades) in just three days last week, after being in a Long signal position for over 15 months. Lots of MIPS members have asked us for an explanation.

The MIPS models are very complex models that use more of our own proprietary mathematical algorithms (applied math, pattern recognition, artificial intelligence, etc.) than simple tactical indicators. In total, however, “votes” from over 150+ technical indicators and market behavior algorithms decide in which direction “the market” is moving (for us, “the market” is the S&P 500 Index, or SPY).

OFFENSIVE SIGNALS

Please understand that we run the MIPS models each and every day from scratch. When a MIPS model indicates, with a strong degree of confidence, that the direction of the market has changed, it will issue a “signal change” and this goes out in an email to MIPS members (and is updated on the MIPS website immediately thereafter). Of course, if the model does not identify a new change in the market direction with high confidence that day, it will keep the same position (Long, Short, or Cash). And, this can go on as long as the market keeps growing (or declining) as in the last 15+ months. In all of the above cases, we call these signals “Offensive Signals”, and over 80-90% of our signals are Offensive (see Defensive Signals below).

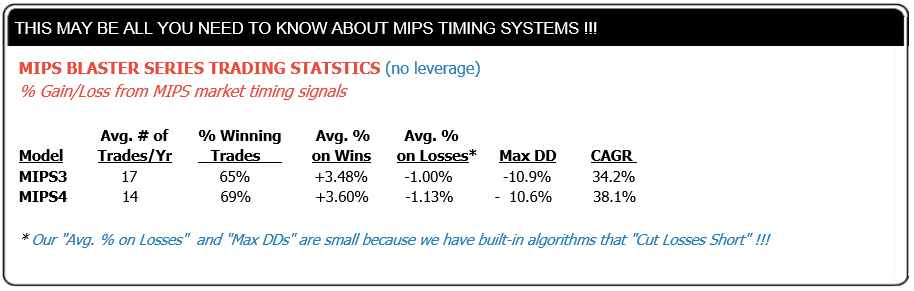

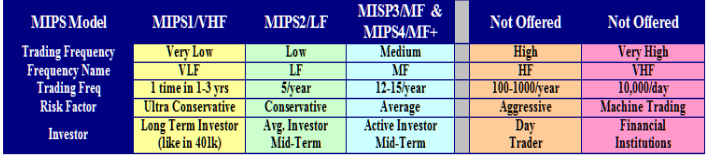

Now, things get interesting (and pseudo confidential for all recipients). To understand this Blog from here on, please take a second to “study” the table below (from the Home page on our website).

DEFENSIVE SIGNALS

MIPS3 has been tracked and its signals have been verified since Nov 2005. MIPS4 is a more recent model and is slightly better than MIPS3. So, let’s concentrate on MIPS4 for this blog. BTW, the results in the table above result from the MIPS models with the Blaster Series algorithms.

What is obvious in the above table is that, on average, the MIPS4 models traded a little over one time per month, the trades were winners almost 70% of the time, the CAGR was almost 40%, and the maximum drawdown was just a little over -10%.

The stats above are all great, but there is “one thing” that all MIPS members should be aware of and be happy about. I am sorry to say that we have been publishing this chart for years, and we have gotten very few questions about one important entity in it. If one digs a little deeper, they would realize that this “one thing” that makes such a huge improvement in performance is that the average GAIN on winning trades is +3.5%, but the average LOSS on losing trades is only -1.1%. That is pretty good proof that a timing model that is programmed to automatically “cut its losses short” is working with darn near perfection.

This is NOT a Coincidence!!!

The much lower average LOSS above does not “just happen”, but rather it results from highly effective “stops” that we designed and built into the MIPS models. The MIPS very low average LOSS is only about 1/3 of the size of its average GAIN. If we had done nothing in the MIPS models to cut LOSSES, instead of the average loss being -1.1% as it is now, it is highly likely that the average loss would be close to the opposite of the average gain (or about -3.5%). The reason that we defined our “stops” with quotation marks is that our “stops” are NOT derived simply from a designated loss from the last actual initial trade or from a trailing high. Our "stops" are designed so that, as a MIPS model “learns” about its most recent bad performance (e.g., it losses 3-4 days in a row, or it losses 4 days out of 5, and many more), other algorithms take over and either reverse the current signal or takes the model to a Cash position.

We have many of these proprietary “stops” built into all MIPS models, and they can either take a new Long or Short signal that is not working well to Cash, or they can take a Cash signal that is being left behind in performance to a new Long or Short position !!!

The MIPS models are more likely to issue both offensive and defensive signals quickly in relatively flat, horizontal market patterns than in markets with a strong up or down trend with low volatility; but it can happen at any time. The Defensive signal algorithms In our MIPS models work exceptionally well, and this is one reason why our average losses are so low.

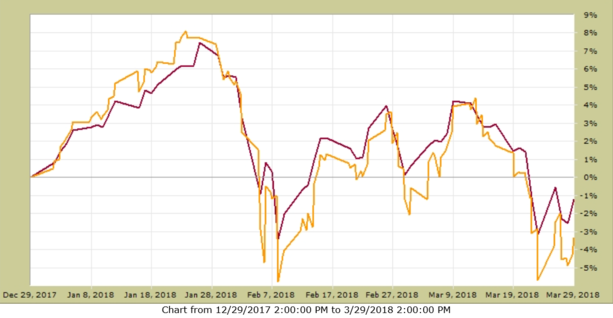

LAST WEEK and 2018 YTD

The MIPS3, MIPS4, MIPS/Nitro models that had been long for over 15 months issued two trade signals last week (a Cash signal on 4/3/18 and a Long signal on 4/5/18). Since 4/2/18, all of the MIPS models are up approximately +1.5% as of the close on 4/10/18; but the MIPS models are down -4.6% for the year.

Good Trading !!!

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, April 01 2018

What a surprise !!!

After an almost straight up market since the presidential election in Nov’16, the market kind of “exploded” in 1Q’18.

However, it should not have been such a big surprise if one had only paid attention to the market performance several months before the explosion. For example, it can be seen in the graph immediately below that, instead of the market completing its normal up-down cycle in the channel below in November 2017, it "blasted off" like a cannon ball until all indices were greatly overbought by the end of January 2018.

2nd Graph

In an overbought situation like this, it usually does not take a big catalyst to start the market spiraling down. In this case, it was things like Trump’s tariffs, talk of trade wars, uncertainty with North Korea, investigation of Russian collusion, etc. For whatever reason, it happened and the results were not pretty. Since there are no free lunches in the stock market, after the big 4th quarter 2017 run up it seems like all professional traders decided to dump their winners and “take profits” on the first bad news in 2018. Of course, this action indeed prompted the market to explode (see graph below). If this continues, things could really get ugly.

On the other hand, it is now at least some form of comfort that the market (SPY) tested its Support Level (200-Day SMA) five trading days in a row, and it bounce back up on Thursday, March 29th (see the very last 5 bars at the “Support Level” on the right-hand side in the chart below).

It seems that the SPY got high enough above its trend line that “reversion-to-the-mean” mentality took over and drove the market back down to its 200-day SMA support level. Hopefully (and most likely) the market will continue up after testing the support level and having the bulls win (i.e., the market may have drained the overbought swamp).

Graph #3

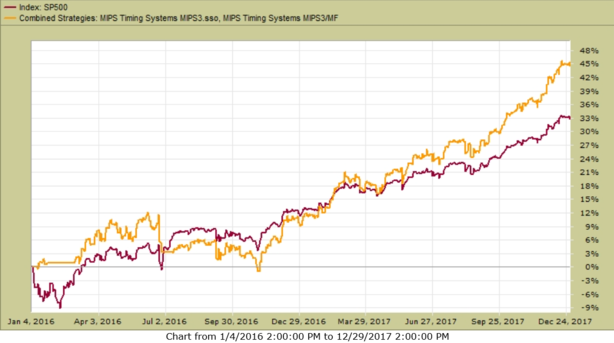

If we step back and look at the steep, steady growth in the market since 2009 (graph below), and if we compare the last 2 years’ performance to the prior 8-year uptrend, it is easy to see why the MIPS models have traded only a few times since the beginning of 2016. In most cases, models that chased every “dip” in the market over the last 10 years ended up getting whipsawed at least a few times along the way. More trades DO NOT automatically lead to better performance as many people think (and in most cases the opposite is true).

BTW, when one looks at the “explosion” in February 2018 from a long-term perspective as in the graph below, it can be seen that relative to the prior growth in the market, the drawdown in 1Q’18 does not seem so “damaging” after all. From a mathematical standpoint, the MIPS models have a form of “relativity” built in. This means that algorithms that could signal a “sell or short” with a dip of 3-4% in a flat or slow growth market, might ignore a dip of 8-9% in a very high growth market (as in the last 2 years).

First Quarter of 2018

Even with the great degree of volatility in the market in 1Q’18 and the big drop in the SPY from its highs, the MIPS3 (and MIPS4) models performed exceptionally well in 2007-2017, and only lost back -3.5% in 1Q'18.

MIPS3 Model

Trading SPY with 1.5x Leverage Long and 0.5x Short

The MIPS3 model gained +45% in 2016-2017 and it only lost back -3.5% in 1Q’18

2016-2017

1Q'18

PS – Lots of analyzing (and guessing) going on here, and that is why we use MIPS to tell us what to do with a MUCH GREATER degree of accuracy.

Good Trading…

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Sunday, March 25 2018

There are many trading models/strategies that are categorized as being in the High Frequency Trading domain.

However, that definition has greatly different meanings depending upon what type of investor it is referring to.

A simplified broad range of “investors” is something like that below:

- Individual Investors like us (10-80 trades/year)

- Day Traders (4-5 trades/day)

- Machine Trading (1000’s of trades/day)

Over 90% of day traders lose money and machine trading is out of our reach. So, for the purpose of this blog,

let’s concentrate on individual investors.

In the category of “Individual Investors” there is at least three different kind of investors

1) buy-and-hold investors,

2) investors somewhat like buy-and-hold investors that use timing models to tell them when to buy/sell, and

3) Investors somewhat like day traders that believe that timing models that trade more often produce better

results.

.

The purpose of the blog is to show our MIPS members the FLAW in category #3 above. There are certainly

times when the market moves from up-to-down, and then from down-to-up in such a fashion that good timing

models can track the market successfully, and there are times when this is not the case.

Bad timing models chase every single dip in the market no matter how small, and regardless of whether or not

the market has actually changed direction (new trend). Good timing models (like MIPS) are extensive enough

to judge if the dip is “sufficient enough” for investors to change their position (long, short, cash) and/or if the main

trend has changed direction. And, good timing models have mathematical models built in that can ascertain the

“relatively” of the dip compared to the recent past. For example, with a good timing model, a 3% dip may issue a

signal change in a market that has been flat or in very low growth, whereas it may take an 8-9% drop for the

model to issue a signal change in a market that has grown 20-25% in the last 6-12 months. Models that are not

good enough to determine the above can trade 60-100 times per year with pathetic performance (mainly because

they trade on almost every single dip with no additional analysis).

Below is an example of a market that should not require an average of over 10-15 trades/year in the period of 2009-18.

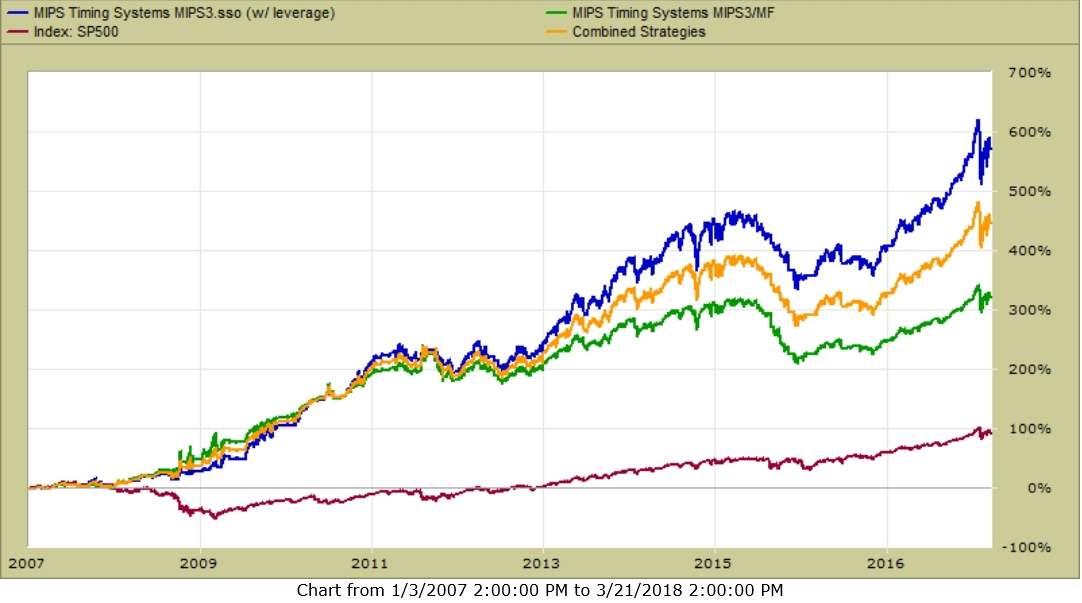

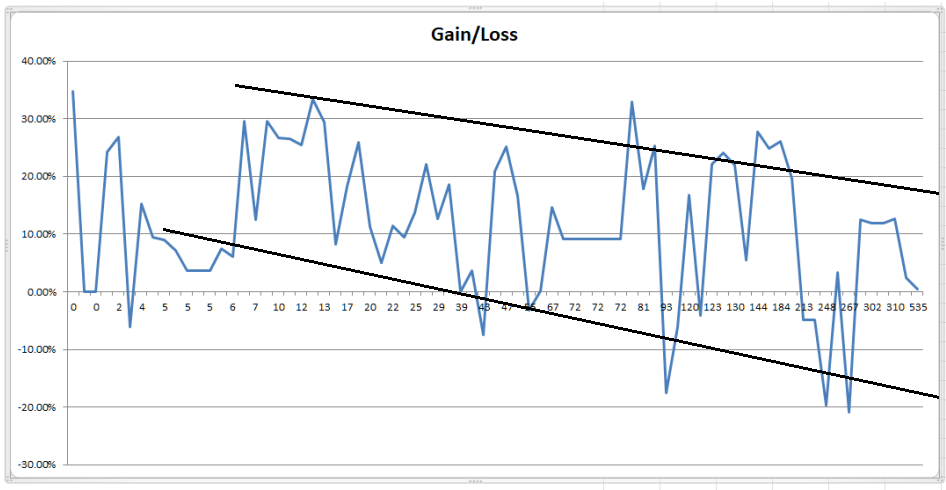

The graph below shows the MIPS3 model performance 2007-03/21/2018

- the performance definitely defines MIPS3 as a “good model”

MIPS3 trading SPY Long/Short

- Blue Line -- 1.50x Long / Long Only

- Orange Line – 1.25x Long / 0.5x Short

- Green Line – 1.00x Long / 1.0x Short

TRADING FREQUENCIES

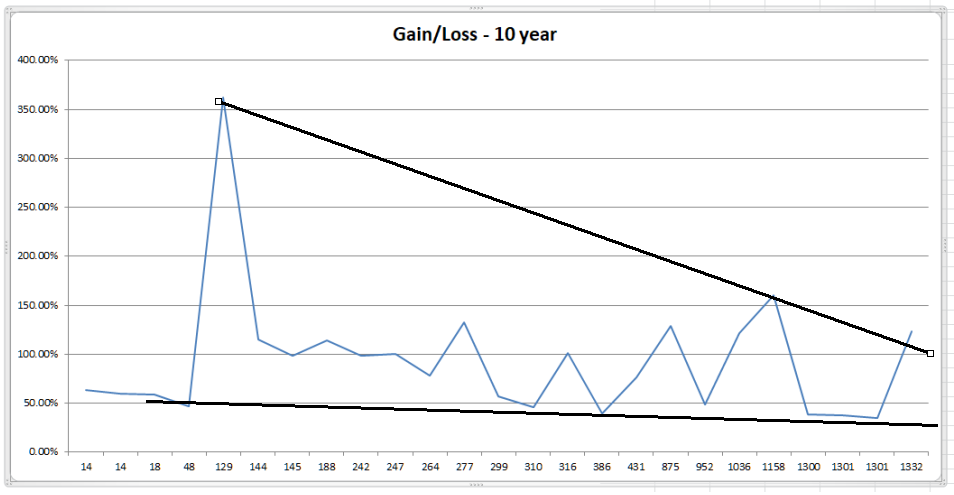

The charts and graphs below are from TimerTrac.com. Our objective is to analyze the relationship between trading

frequencies of the 20+ best timing models on TimerTrac.com versus their 2-year and 10-year performances. This

certainly teaches us a lesson, but is not a very comprehensive study for professionals.

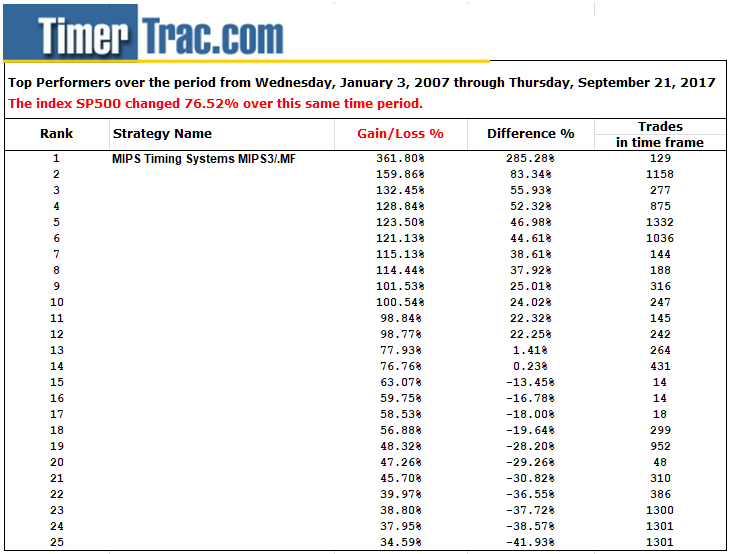

ELEVEN YEAR PERFORMANCE (2007-2017)

- The MIPS3 model issued 129 trades in this period (average of 12 trades/year)

Performance

Number of Trades issued between 2007-2017

-----------------------------------------------------------------------------------------------------------------------------

TWO YEAR STUDY (2017-2018)

- The MIPS4 model issued 9 trades in this period (avg. 5 trades/year)

|

Top Performers over the period from January 3, 2016 through September, 2017

|

|

|

The index SP500 changed 34.75% over this same time period.

|

|

|

|

|

|

|

|

|

|

Ranking

|

|

Strategy Name

|

Gain/Loss %

|

Difference %

|

Trades

|

|

1

|

|

|

34.74%

|

0.00%

|

0

|

|

2

|

|

|

33.42%

|

-1.32%

|

13

|

|

3

|

|

|

32.94%

|

-1.80%

|

77

|

|

4

|

|

MIPS Timing Systems MIPS4/MF+

|

29.61%

|

-5.14%

|

9

|

|

5

|

|

MIPS Timing Systems MIPS3/MF

|

29.57%

|

-5.18%

|

7

|

|

8

|

|

|

29.49%

|

-5.25%

|

13

|

|

9

|

|

|

27.68%

|

-7.06%

|

144

|

|

10

|

|

|

26.85%

|

-7.89%

|

2

|

|

11

|

|

|

26.71%

|

-8.04%

|

10

|

|

12

|

|

MIPS Timing Systems MIPS2/LF

|

26.45%

|

-8.30%

|

10

|

|

13

|

|

|

26.13%

|

-8.61%

|

184

|

|

14

|

|

|

25.86%

|

-8.88%

|

19

|

|

15

|

|

|

25.39%

|

-9.35%

|

12

|

|

16

|

|

|

25.30%

|

-9.44%

|

88

|

|

17

|

|

|

25.18%

|

-9.56%

|

47

|

|

18

|

|

|

24.90%

|

-9.85%

|

169

|

|

19

|

|

|

24.23%

|

-10.51%

|

1

|

|

20

|

|

|

24.03%

|

-10.71%

|

124

|

|

21

|

|

|

22.10%

|

-12.65%

|

123

|

|

22

|

|

|

22.07%

|

-12.68%

|

29

|

|

23

|

|

|

21.97%

|

-12.78%

|

130

|

|

24

|

|

|

20.81%

|

-13.94%

|

44

|

|

25

|

|

|

19.73%

|

-15.02%

|

193

|

|

26

|

|

|

18.54%

|

-16.20%

|

38

|

|

27

|

|

|

18.27%

|

-16.48%

|

17

|

|

28

|

|

|

17.81%

|

-16.94%

|

81

|

|

29

|

|

|

16.70%

|

-18.04%

|

120

|

|

30

|

|

|

16.68%

|

-18.06%

|

52

|

|

31

|

|

|

15.31%

|

-19.44%

|

4

|

|

32

|

|

|

14.62%

|

-20.13%

|

67

|

|

33

|

|

|

13.76%

|

-20.98%

|

25

|

|

35

|

|

|

12.67%

|

-22.08%

|

29

|

|

36

|

|

|

12.65%

|

-22.10%

|

310

|

|

37

|

|

|

12.47%

|

-22.28%

|

302

|

|

38

|

|

|

12.45%

|

-22.29%

|

7

|

|

39

|

|

|

11.91%

|

-22.83%

|

302

|

|

39

|

|

|

11.91%

|

-22.83%

|

302

|

|

40

|

|

|

11.47%

|

-23.28%

|

22

|

|

41

|

|

|

11.21%

|

-23.53%

|

20

|

|

43

|

|

|

9.49%

|

-25.26%

|

5

|

|

42

|

|

|

9.49%

|

-25.25%

|

23

|

|

44

|

|

|

9.21%

|

-25.54%

|

72

|

|

44

|

|

|

9.21%

|

-25.54%

|

72

|

|

44

|

|

|

9.21%

|

-25.54%

|

72

|

|

44

|

|

|

9.21%

|

-25.54%

|

72

|

|

44

|

|

|

9.21%

|

-25.54%

|

72

|

|

44

|

|

|

9.21%

|

-25.54%

|

72

|

|

45

|

|

|

8.96%

|

-25.78%

|

5

|

|

46

|

|

|

8.28%

|

-26.47%

|

14

|

|

47

|

|

|

7.40%

|

-27.34%

|

6

|

|

48

|

|

|

7.20%

|

-27.54%

|

5

|

|

49

|

|

|

6.03%

|

-28.71%

|

6

|

|

50

|

|

|

5.46%

|

-29.28%

|

134

|

|

51

|

|

|

4.99%

|

-29.76%

|

21

|

|

52

|

|

|

3.67%

|

-31.08%

|

5

|

|

52

|

|

|

3.67%

|

-31.08%

|

5

|

|

52

|

|

|

3.67%

|

-31.08%

|

5

|

|

53

|

|

|

3.59%

|

-31.16%

|

41

|

|

54

|

|

|

3.40%

|

-31.35%

|

253

|

|

55

|

|

|

2.36%

|

-32.38%

|

523

|

|

56

|

|

|

0.42%

|

-34.32%

|

535

|

|

57

|

|

|

0.18%

|

-34.56%

|

61

|

|

58

|

|

|

0.02%

|

-34.72%

|

39

|

|

59

|

|

|

0.00%

|

-34.74%

|

0

|

|

59

|

|

|

0.00%

|

-34.74%

|

0

|

|

60

|

|

|

-3.16%

|

-37.90%

|

55

|

|

61

|

|

|

-4.15%

|

-38.89%

|

121

|

|

62

|

|

|

-4.86%

|

-39.60%

|

213

|

|

63

|

|

|

-4.88%

|

-39.62%

|

213

|

|

64

|

|

|

-6.10%

|

-40.84%

|

114

|

|

65

|

|

|

-6.12%

|

-40.86%

|

2

|

|

66

|

|

|

-7.52%

|

-42.26%

|

43

|

|

67

|

|

|

-17.57%

|

-52.32%

|

93

|

|

68

|

|

|

-19.62%

|

-54.36%

|

248

|

|

69

|

|

|

-20.90%

|

-55.64%

|

267

|

Performance

Number of Trades Issues in 2016 - 2017

---------------------------------------------------------------------------------------------------------------------------

The above shows that more frequent trading does not automatically produce better results. Most individual timing models

that trade frequently do not have ample time to sell and buy back in short time periods end up getting whipsawed. For

example, a model that trades an average of 50 times/year, has an average “signal life” of just 5 trading days (where “signal life”

is the average time any given signal is in effect). This means that the model would have to decide when to buy and when

to sell in just 5 trading days over-and over, all year long without getting whipsawed often. This is damn near impossible

using data from daily bars (1 data point/day), instead of say like hourly bars (for roughly 8 data points/day). MIPS fixed

this in its “Blaster Series” models, released in 1Q’16.

So, you should pick a timing model with a good, long-term verified track record, and follow it. If you can’t simply

do that, start with say 3 models and migrate to the model that does the best over time. If everyone does this,

then it’s a good chance that all may end up following the MIPS models

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Saturday, March 17 2018

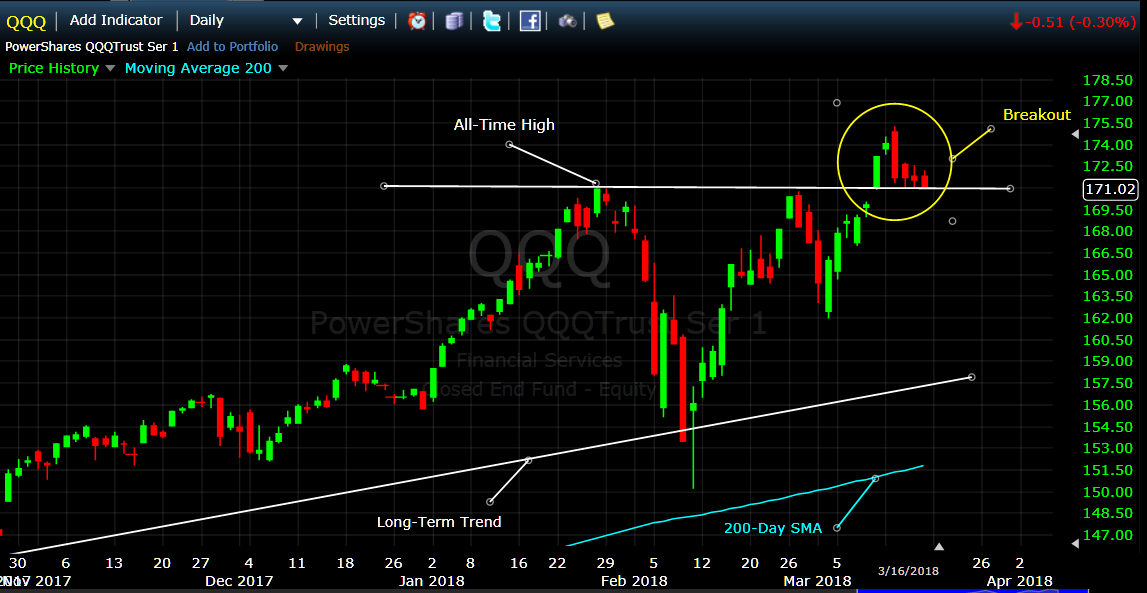

Week before last, the QQQ broke out to the upside and formed a new all-time high. The main

question then, of course, was "where does it go from here" ?

My answer then was:

"I expect the QQQ to climb higher, drop back to "test" this all-time high support level, and then

continue higher in 2018."

The first part of this was completed this week when the QQQ dropped back to test its support level at

around $171 for four straight days (see graph below). As you can see, the current support level held

steadfast at almost exactly $171 on each day.

From here, the QQQ could hold its support level and head back up for months; or of course, it could

break its all-time high support level to the downside and head back to test its previous support level at

around $150. My bet would be on the 1st option above, but I am no MIPS.

{BTW - In my opinion, the SPY will follow the same path as the QQQ.}

As far as which position we should be in going forward (long, short, cash), we need to rely on MIPS to

answer that.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

===============================================================

<<< Previous Blog >>>

03/12/2018

MIPS Members:

In our previous blog below, we pointed out that the SPY had broken out of its "triangle" pattern to the

upside, and that the Nasdaq 100 (QQQ) had climbed about 65% of the way back to its all-time high.

Since then, the QQQ has completed a "V-Bottom" pattern and has broken out above its all-time high

(see graph below).

From here, I expect the QQQ to climb higher, drop back to "test" this all-time high support level, and then

continue higher in 2018. Of course, this "climb" will be challenged by real dips, fake drops, volatility,

etc. Top management from many well-respected advisory firms see a strong possibility for this bull market

to thrive for another 2-3 years.

The challenge, of course, is to know when to get out of the market (or go short) WITHOUT chasing every

little fake dip and ending up getting whipsawed (nothing worse). The algorithms built into the Blaster

Series version of MIPS were designed to avoid getting suckered into trading every dip and ending up losing

a lot of your hard earned money. After much research, and through inputs from our MIPS family, we

have not seen nor been told about any other model on the market today that can beat MIPS in that game.

This is a time when we can either have a few more years with 20%+ gains, or a time when we give back

most or all of our gains from the last 8-10 years. Please don't "go it alone". Either use MIPS or find

another good quantitative model that did well in the market crash of 2008, and since then.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Monday, March 12 2018

In our previous blog below, we pointed out that the SPY had broken out of its "triangle" pattern to the

upside, and that the Nasdaq 100 (QQQ) had climbed about 65% of the way back to its all-time high.

Since then, the QQQ has completed a "V-Bottom" pattern and has broken out above its all-time high

(see graph below).

From here, I expect the QQQ to climb higher, drop back to "test" this all-time high support level, and then

continue higher in 2018. Of course, this "climb" will be challenged by real dips, fake drops, volatility,

etc. Top management from many well-respected advisory firms see a strong possibility for this bull market

to thrive for another 2-3 years.

The challenge, of course, is to know when to get out of the market (or go short) WITHOUT chasing every

little fake dip and ending up getting whipsawed (nothing worse). The algorithms built into the Blaster

Series version of MIPS were designed to avoid getting suckered into trading every dip and ending up losing

a lot of your hard earned money. After much research, and through inputs from our MIPS family, we

have not seen nor been told about any other model on the market today that can beat MIPS in that game.

This is a time when we can either have a few more years with 20%+ gains, or a time when we give back

most or all of our gains from the last 8-10 years. Please don't "go it alone". Either use MIPS or find

another good quantitative model that did well in the market crash of 2008, and since then.

Good trading...

Paul Distefano, PhD

CEO / Founder

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

===========================================

<<< Previous MIPS Blog >>>

MIPS - Was Last Week's Market Move a Breakout ?

MIPS Members:

Of course, everyone wants to know if the most recent "correction" was the beginning of new "bear

market", or just a scare. Let me say that, to my knowledge, there has never been a real "bear market"

without the country being in on near a "recession".

I won't bore you with the details, but by all measures the economy is very strong (growth in the GDP,

more jobs, etc.). So strong, in fact, that investors were initially worried about inflation and rising interest

rates.

I personally believe that this all began after the market that had been climbing for the last year or so

started to soar at a much higher rate and put itself in a position of being highly overbought. Of course, the

fat kats that had ridden the market up did not want to give back a single dime, so they dumped from fear

of inflation and higher interest rates in this booming economy. Then, a few days later, the fat kats who

had driven the market down by about 9% started re-buying, and the little guys joined them with their

"buy on the dips" strategy.

When the market was heading back up quickly to form a near perfect "V-Bottom" pattern, the up-tick was

reversed on a very good jobs report, because investors were sucked in by the crap from the press

claiming that the low unemployment numbers would surely lead to inflation. Then, the crap was negated

by the fact that many new jobs were filled by a small percentage of the massive number of people that had

given up hope for a job and hence were in the "not looking for a job" space. In other words, the new jobs

had not only lowered the jobless rate, but they had INCREASED the "participation level". This means that

many of the new jobs went to some of the millions of people that had given up finding a job and had run

out of gov't unemployment benefits. If this is correct, the labor force is not close to being tight.

As a result of that above, the market seems to have broken out of the current "triangle pattern" seen in

the graph below.

Of course, this does not mean that the market will reach highs in the near future. I think it will, but I am

not MIPS. To be comfortable about when to go in and get out of the market, follow MIPS.

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

Saturday, March 10 2018

Of course, everyone wants to know if the most recent "correction" was the beginning of new "bear

market", or just a scare. Let me say that, to my knowledge, there has never been a real "bear market"

without the country being in on near a "recession".

I won't bore you with the details, but by all measures the economy is very strong (growth in the GDP,

more jobs, etc.). So strong, in fact, that investors were initially worried about inflation and rising interest

rates.

I personally believe that this all began after the market that had been climbing for the last year or so

started to soar at a much higher rate and put itself in a position of being highly overbought. Of course, the

fat kats that had ridden the market up did not want to give back a single dime, so they dumped from fear

of inflation and higher interest rates in this booming economy. Then, a few days later, the fat kats who

had driven the market down by about 9% started re-buying, and the little guys joined them with their

"buy on the dips" strategy.

When the market was heading back up quickly to form a near perfect "V-Bottom" pattern, the up-tick was

reversed on a very good jobs report, because investors were sucked in by the crap from the press

claiming that the low unemployment numbers would surely lead to inflation. Then, the crap was negated

by the fact that many new jobs were filled by a small percentage of the massive number of people that had

given up hope for a job and hence were in the "not looking for a job" space. In other words, the new jobs

had not only lowered the jobless rate, but they had INCREASED the "participation level". This means that

many of the new jobs went to some of the millions of people that had given up finding a job and had run

out of gov't unemployment benefits. If this is correct, the labor force is not close to being tight.

As a result of that above, the market seems to have broken out of the current "triangle pattern" seen in

the graph below.

Of course, this does not mean that the market will reach highs in the near future. I think it will, but I am

not MIPS. To be comfortable about when to go in and get out of the market, follow MIPS.

Paul Distefano, PhD

MIPS Timing Systems, LLC

Houston, TX

281-251-MIPS(6477)

|