Tuesday, August 19 2014

8-19-2014

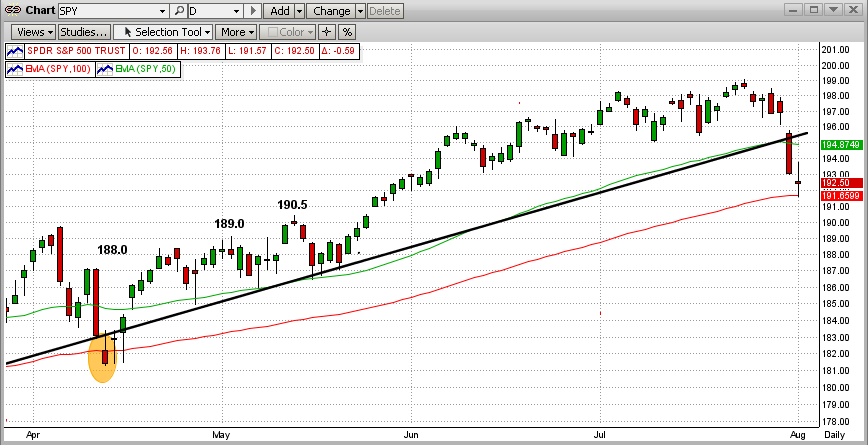

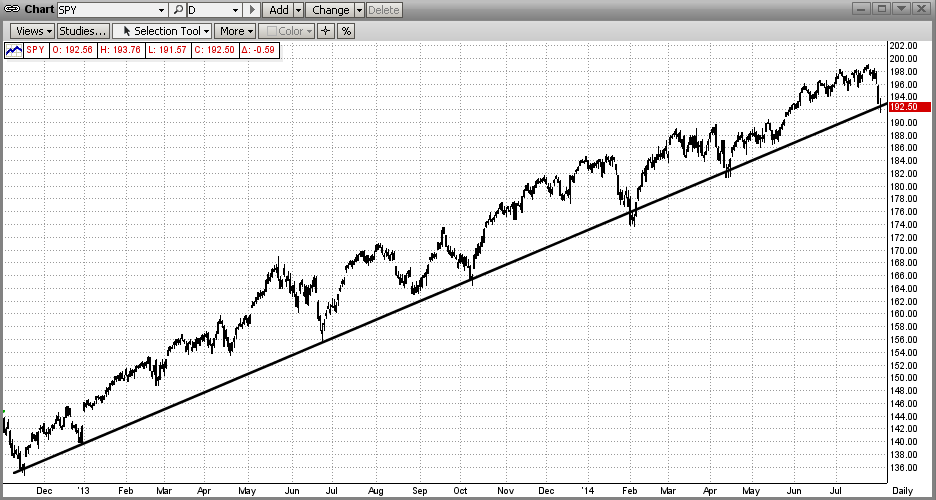

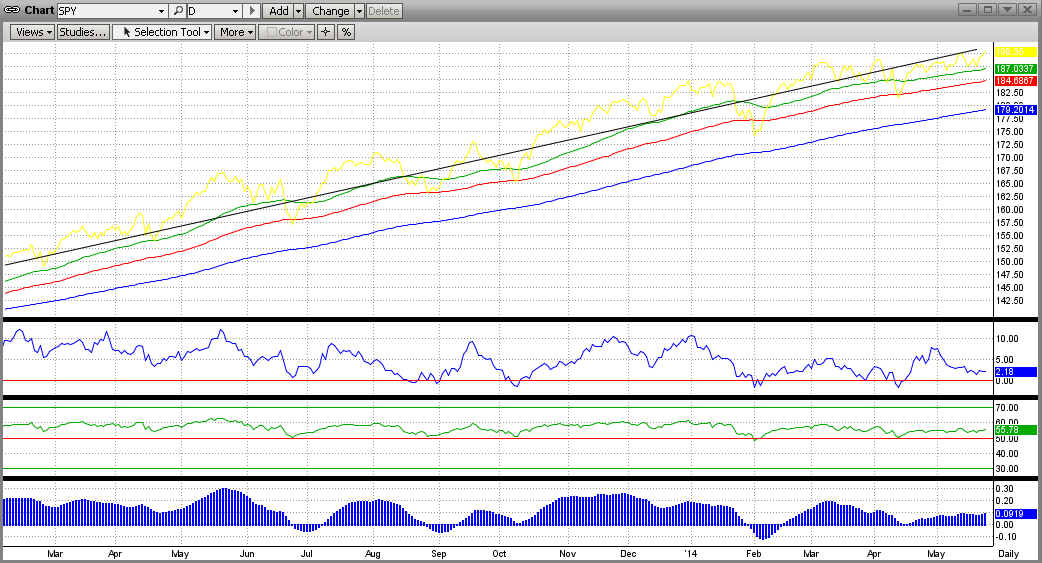

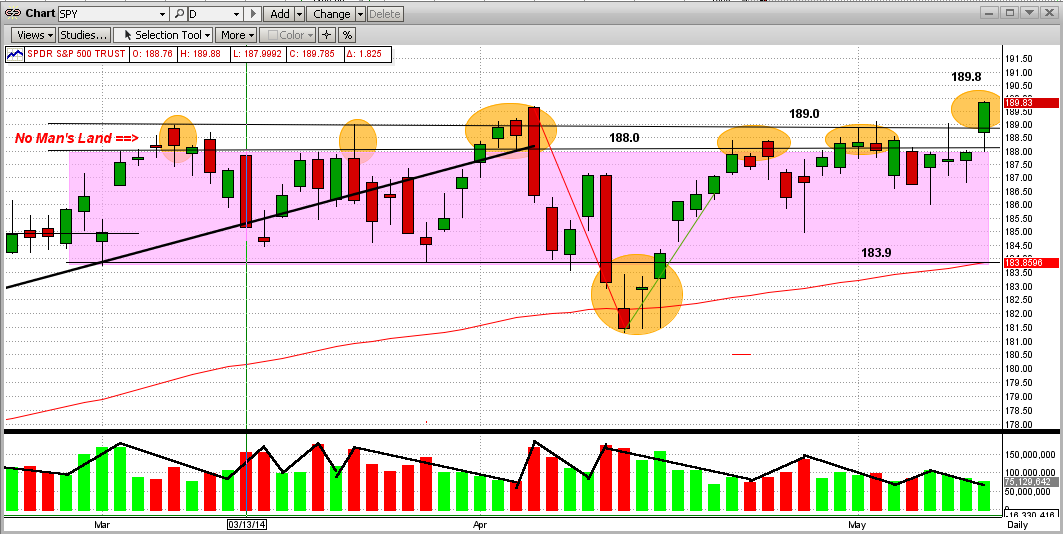

This blog is all about the latest short-term trend in the market, which started on 5/22/2014 with a breakout of the SPY after a 2-1/2 month sideways/flat market (remember "No Man's Land" in the purple box below). Of course, this is the tail end (so far) of a strong intermediate-term uptrend that started almost 2 years ago in Nov 2012 (black line). See the graph below.

Legend:

Green Curved Line = 50-Day EMA

Red Curved Line = 100-Day EMA

Black Line = Intermediate-Term Trend Line

Green Lines - Short-Term Trend Lines

Purple Box = Sideways/Flat Trading Pattern

Orange Circles = Significant Points

We are most interested in the pattern that started developing at the beginning of June 2014. This has evolved into what is called an "up channel". Swing trades will trade this as follows: Buy when the SPY hits the bottom channel line and Sell when it hits the upper channel line. Some very experienced swing traders can make money at this, but most amateurs get crushed (surprise, surprise). Most of the time, trading these patterns leads to getting whipsawed badly. For most investors, it is best to ride the uptrend by staying long (or short in downtrends).

The market (the SPY) traded in this range almost to perfection until the 3rd week in July when it failed to "hit" the upper trendline, and then it fell 4.3% over the next 2 weeks (from about 199-190). Also, during that fall, the SPY broke both its 50-Day EMA and 100-Day EMA. Of course, this caused many traders to go short, only to get whipsawed with a quick reversal a couple of days later. MIPS dodged this "Bear Trap" and stayed long. At the close today, MIPS was under its all-time high price by only 1/3 of 1% !!!.

For the uptrend to be re-established, the SPY will need to climb above its all-time high of $199.1 (on 7/21/2014). If it does we, along with 200 million other investors in the US stock markets from all over the world, will make more money on this uptrend (even better if you have a percent of your money in double leverage, like the SSO). Better yet, if the market does tank, we (along with a relatively few individual investors that "short" like the hedge fund managers do) will make lots of money. So, don't be afraid of the "Big One". Hope for and embrace it !!!

Sleep Well !!!

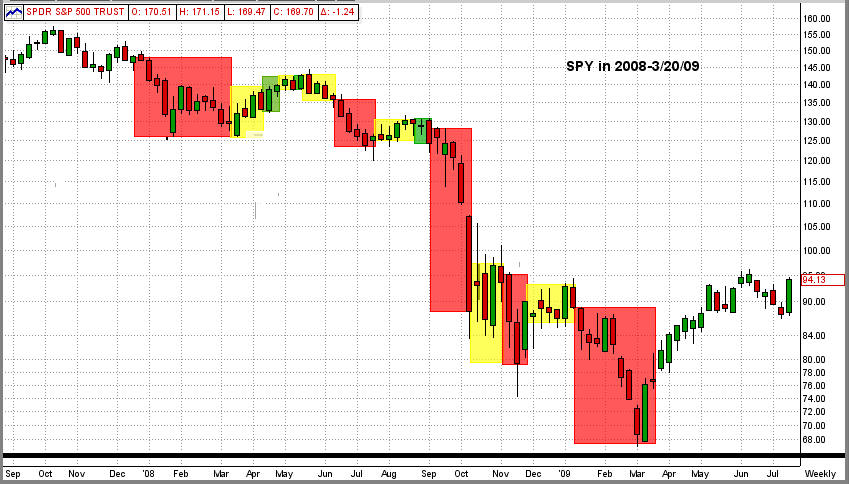

Remember what MIPS did in 2008?

- If not, see below

Red=Shorts, Green=Longs, Yellow=Cash

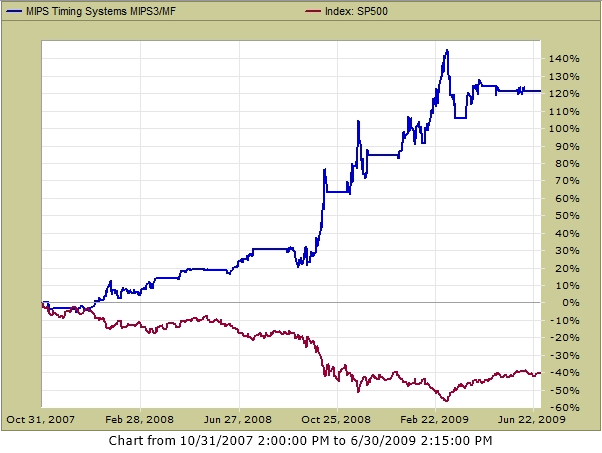

MIPS in 2008 (from TImerTrac.com)

- look forward to repeating something similar to that below

Sunday, August 03 2014

August 3, 2014

At the end of last week, we had a large number of members asking "Is this the beginning-of-the-end of our 5+ year bull market"? Of course, this was prompted by last week's terrible market performance.

Before we go too deep, let's take a look at some recent market action of the SPY (ETF for the S&P 500). (Remember, the SPY's price is about 1/10th of that of the S&P 500.)

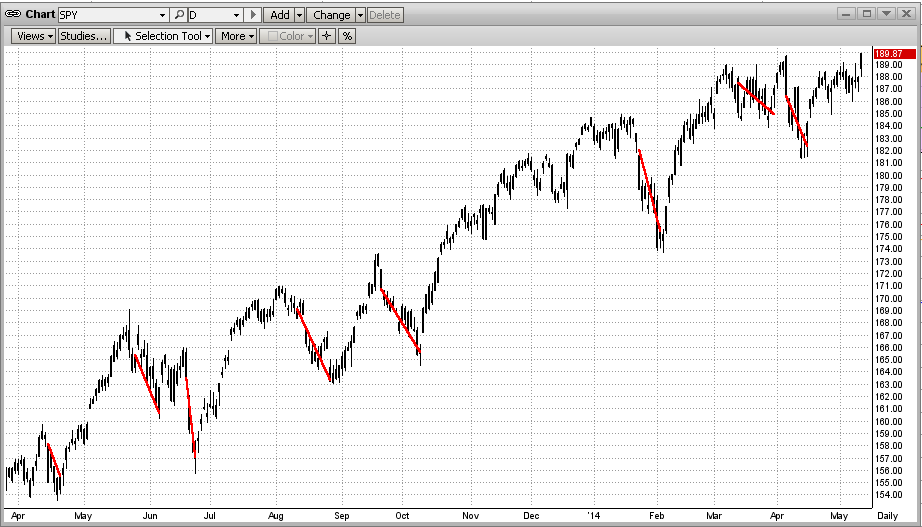

Look at the 1st Graph below (SPY).

In this recent time period, the last 6 trading days were bad. But how bad is bad and where does it take us?

- The SPY dropped almost 4.5% in the last 6 trading days in the graph below.

- On the last day in the graph below, the SPY broke down through the 100-day EMA and the long-term trendline.

- On the day before that, the SPY had one of its worst one-day drops in over a year (-2% in one day).

1) Does the price action of the SPY (steep drops) upset you?

2) Are you having trouble sleeping because of it?

3) Do you think that this the beginning of a real Bear Market?

4) How far do you think the SPY will drop from here?

5) Are you ready to "override" the MIPS long signal and go to cash or short?

1st Graph

Usually when we look at price action graphs, I try to explain what I think happened and what might happen from here on. Well, this time I know 100% what happens next. Yes 100%, and guaranteed. And no, I have not lost my mind nor do I think that I have somehow acquired divine status.

This reason that I can make this iron-clad guarantee is that the graph above (that looks so much last week's price action) is actually from 4/11/14 (3-1/2 months ago). From that exact day, the SPY reversed itself and continued up (+8.5%) until 7/30/14. See Graph #2 below.

Graph #2

Now how do you feel about the price action in Graph #1 from 4/11/14? Now that you have seen a nice recovery and more up-side gains, your fear and confusion most likely just sank into a sinkhole. So, are we through with those kinds of scares. Heck no, and the market is no place for the weak of heart or mind (unless, of course, you have MIPS covering your back).

Let's truly visit what we thought we were looking at in the very beginning of this blog - the price action of the SPY last week (see Graph #3 below). Do you see the resemblance of this graph that goes through 8/01/14 to that in Graph #1 that goes through 4/11/14? The markets do repeat themselves.

Graph #3

Now we can go back to our old way of playing the game. Where do we go from here? We believe that there is just as good a chance of the market turning around and heading back up (as it did 8-10 times in the last 20 months - Graph #4 below) as of it heading down into a large correction or a real bear market. Each of these scenarios have credibility and each is possible.

But, that is just what we think. MIPS is looking at this from a completely different angle. I can say that some of the MIPS models are on the brink of going short, but one or two up-days can change that. Let's keep a close eye on changes in the MSI and watch for MIPS signals.

Graph #4

Hope this helps !!!

Monday, July 14 2014

As most MIPS members already know, we show several possible trading profiles for our MIPS models under the "Services" tab on our main menu at www.mipstiming.com.

CONSERVATIVE TRADING

Trading the SPY long only is the most conservative trading profile for our MIPS models, and trading SPY/SH is the most conservative for long/short trading.

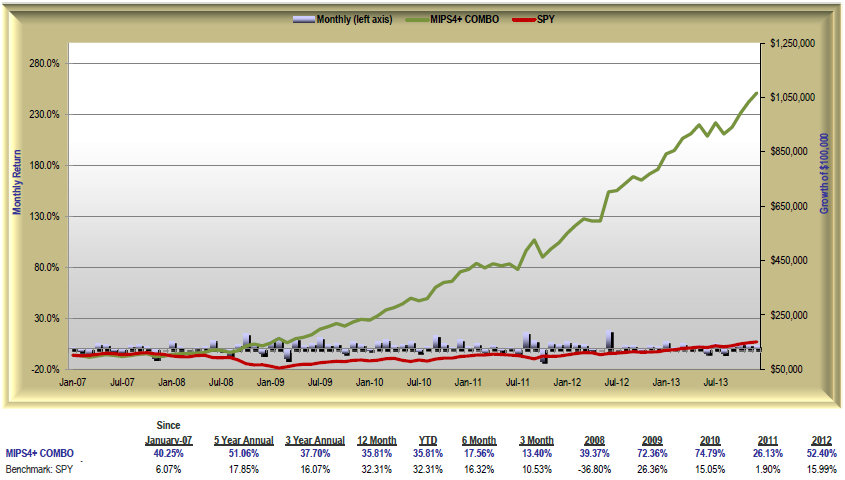

AGGRESSIVE TRADING

Shown below are several trading profiles that are more aggressive than simply trading SPY/SH long/short. Of course, these trading profiles are for more aggressive investors. And, since we are NOT overly aggressive , we recommend trading a "mix" of ETFs, like 1/3 each of SPY, IWM, SSO on long signals and the inverse ETFs, SH, RWM, SH* on short signals (* where SH is the single leverage inverse fund for SPY because we do not like trading double leverage on shorts). This is the trading profile #4 below (CAGR=40.3%, Max DD=-12.1%).

See Perfromnace Results for the various trading profiles below:

Note: The scale on the Y-axis is different in each graph below.

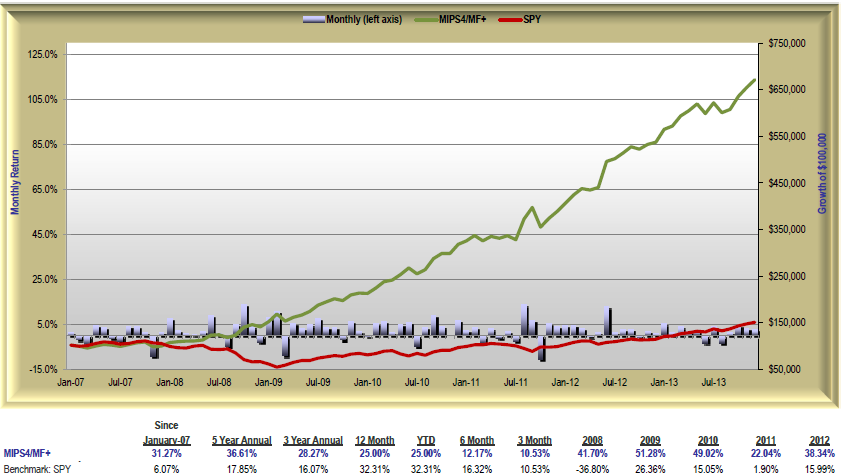

1.) MIPS4/MF+ Trading SPY/SH from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+31.3% Max Drawdown= -10.6%

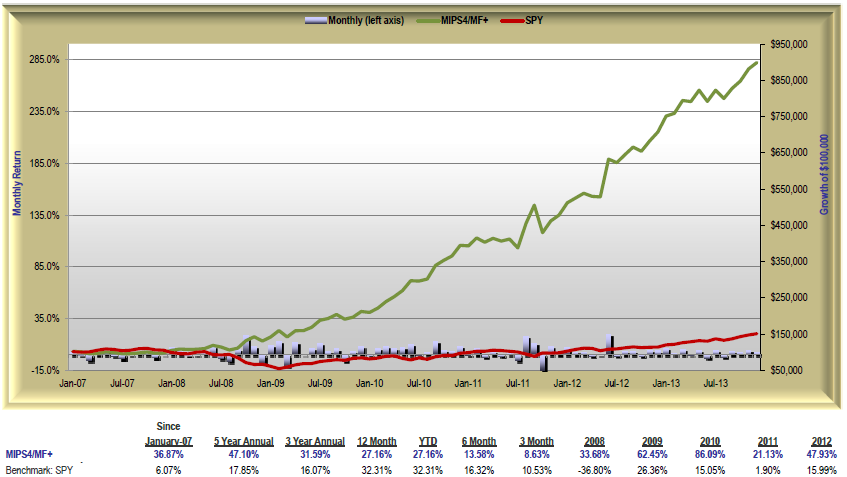

2.) MIPS4/MF+ Trading IWM/RWM from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+36.9% Max Drawdown= -15.1%

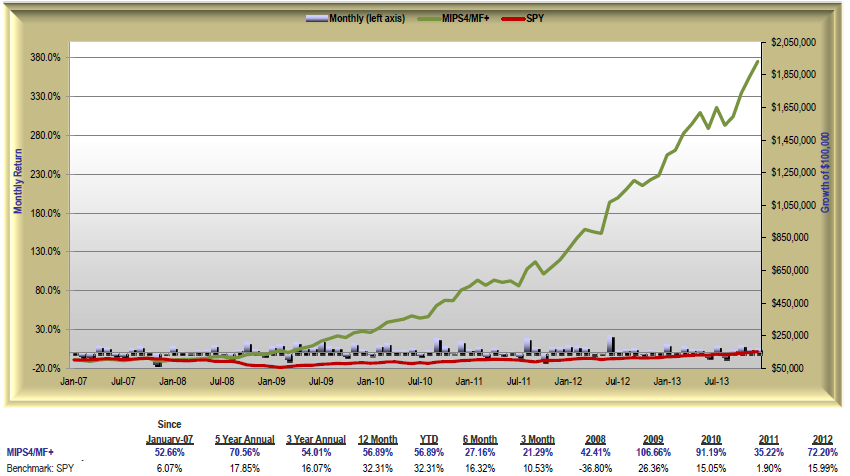

3.) MIPS4/MF+ Trading SSO/SH from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+52.7% Max Drawdown= -16.1%

4.) MIPS4/MF+ Trading 1/3 each of SPY/SH, IWM/RWM, SSO/SH from 2007-2013

CAGR since Jan'07 SPY=+6.1% vs. MIPS=+40.3% Max Drawdown= -12.1%

Sunday, July 13 2014

In our previous Blog from 6/07/2014 below, we showed the "breakout" of the SPY after months of sideways trading. The market (the SPY) broke decisively to the upside. In the graph in that Blog, we pointed out that the new uptrend could continue for a while (green arrow), or go back down (red arrow) to "test" the long-term trendline (black line). Of course, we did not expect a downside "breach" at that time.

So, what has happened since then. As can be seen in the new graph immediately below, the SPY has made a few minor dips, but it is still fighting its way up. And, it has only experienced 3 tiny downdrafts since the breakout. One problem with the uptrend since last February is that it has "climbed the wall" on ever decreasing (but not really low) volume. We can live with that for now. The new support level for the SPY is at $194, the point at which both the long-term trendline (black line) and the 50-day EMA (green line) converge. So, if the SPY should break below $194, we will have grave concerns about a major dip (if not the "biggie" itself). Keep your eyes open because this is where the 3rd "dip" (2nd red arrow) could be heading.

Let's stay alert and wait for MIPS to tell us what to do next.

<<< Previous Blog >>>

Saturday, 07 June 2014

After six failed attempts in a three-month sideways trading pattern, the market (the SPY) finally broke out to the upside from inside a "No Man's Land". And, what a breakout it has been! In the graph below, you can now see a new, powerful up-trend (green line).

It seems that this breakout has, so far, followed the tradition for sideways/flat patterns, that is:

1) markets usually breakout of a sideways pattern in the same way that they entered (i.e., if the market was moving up prior to the sideways pattern, it will usually break out to the upside and vice versa), and

2) the length of time that the market will follow the resulting move and the size of the resulting gains/losses is closely correlated to the amount of time that the market traded in the tight pattern.

My opinion on the reason for #2 above is that after a long battle, the losers (in this case, the bears) quit trading and go away for a long time. I also believe that this is how the market (like now) can make sizeable, sustainable gains on relatively low volume (little or no competition).

It seems that the most likely direction of the market from here is up. But, even though it could, this does NOT mean that the market will follow the green-line trendline in the graph below going forward. It's just as likely that the SPY could drop back some or go sideways until it hits the long-term trendline (black line in graph below), and then follow that trend up going forward. That would be like a "reversion to the trendline". Either way, we make money.

Also, do not rule out a correction after these healthy gains. It is not what I expect, but MIPS does not pay one bit of attention to my expectations. If the market does somehow unexpectedly drop from here, MIPS will get us out.

===================================================================================

Tuesday, July 01 2014

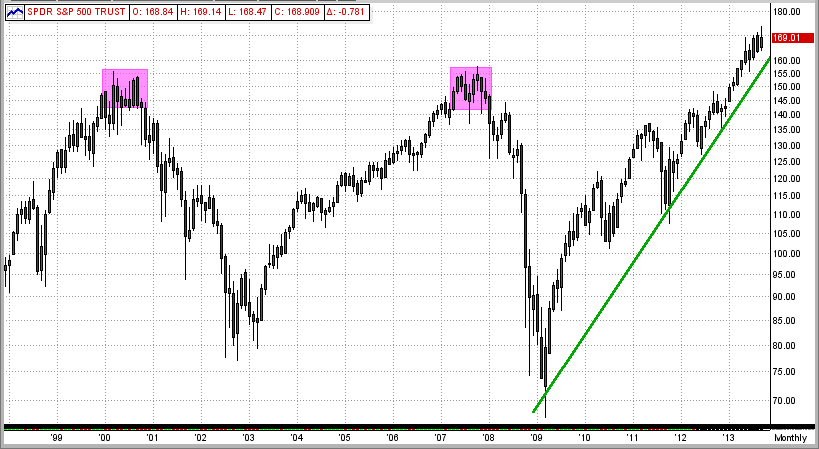

Many investors think that the bull market that resulted from the massive market crash of 2008 is over, or very near its end. That is highly possible, of course, but NOT a certainty. Many individual investors are basing their opinions on the bull market "recovery" between the two market crashes in 2000 and 2008.

See the 1st graph below:

The bull market between the bottom of the 2000 crash (in 2003) and the top of the resulting bull market in 2007 lasted 5 years. And, the bull market since 2008 is already older than 5 years.

Also, in the 20-year-period between 1960-1980, the stock market experienced 5 crashes of 35% or more

(4 year averages). => http://www.mipstiming.com/behavior

So, is it not time for another market crash?

SPY Between 1998-2014

Maybe so, and maybe not. If you follow the market "logic" in the 2000's, a market crash is definitely due. But, let's look back at the most recent crash before 2000. This would be the notorious crash of 1987.

See the first 5 years after the crash of 1987 in the graph below. Using the "2000" logic above, this market recovery would have run out of steam at or near the end of 1992. But, did it ?

SPY Between 1987-1993

As can be seen below, this 1988 bull did not quit running until the end of 1999 or beginning of 2000

(12 years after the crash of 1987) !!!

SPY Between 1987-2000

So, history shows that bull markets (like our current 2009 bull market) do NOT necessarily have to stop running up because they are "old" after just 5 years.

The moral of this story is that:

1) it is very difficult to arbitrarily call the end of either a bull or bear run,

2) the MIPS models are very good at finding "Market Inflection Points" (when markets change direction), and

3) since the MIPS models work as well (or actually better) in down markets as they do in up markets, we need to quit worrying about "market crashes" (and, in fact, welcome them).

Our belief is that this 5-year bull run will continue for some time (but probably not 7 more years). And, we will see "corrections" on the way up. Of course, this is only my personal opinion, and we will follow (as you should) the much "smarter" MIPS models.

Saturday, June 07 2014

After six failed attempts in a three-month sideways trading pattern, the market (the SPY) finally broke out to the upside from inside a "No Man's Land". And, what a breakout it has been! In the graph below, you can now see a new, powerful up-trend (green line).

It seems that this breakout has, so far, followed the tradition for sideways/flat patterns, that is:

1) markets usually breakout of a sideways pattern in the same way that they entered (i.e., if the market was moving up prior to the sideways pattern, it will usually break out to the upside and vice versa), and

2) the length of time that the market will follow the resulting move and the size of the resulting gains/losses is closely correlated to the amount of time that the market traded in the tight pattern.

My opinion on the reason for #2 above is that after a long battle, the losers (in this case, the bears) quit trading and go away for a long time. I also believe that this is how the market (like now) can make sizeable, sustainable gains on relatively low volume (little or no competition).

It seems that the most likely direction of the market from here is up. But, even though it could, this does NOT mean that the market will follow the green-line trendline in the graph below going forward. It's just as likely that the SPY could drop back some or go sideways until it hits the long-term trendline (black line in graph below), and then follow that trend up going forward. That would be like a "reversion to the trendline". Either way, we make money.

Also, do not rule out a correction after these healthy gains. It is not what I expect, but MIPS does not pay one bit of attention to my expectations. If the market does somehow unexpectedly drop from here, MIPS will get us out.

===================================================================================

<<< Previous Blog >>>

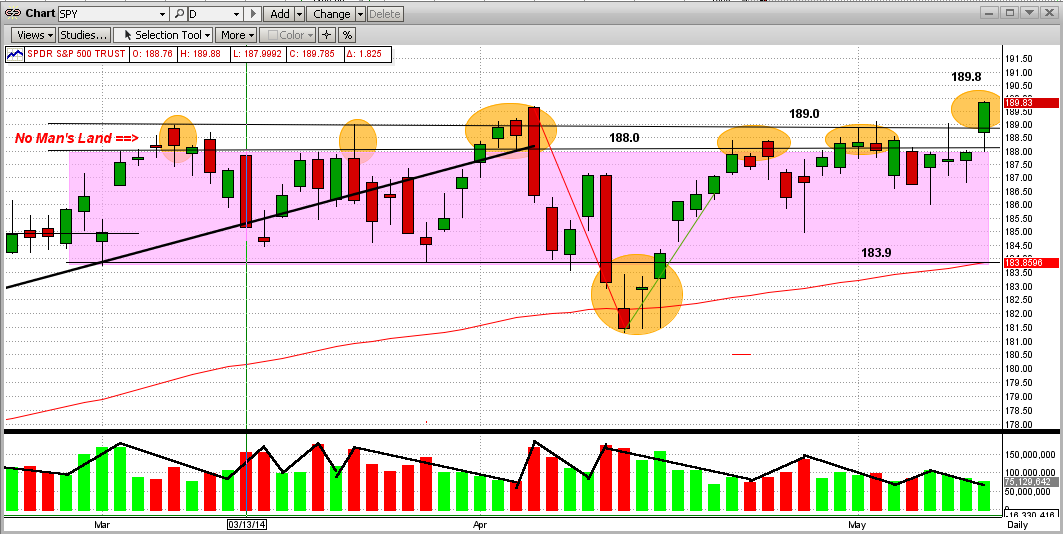

For some time, we have been talking about this war between the Bulls and Bears, but we never really defined it. We call it a war, because that is what it is like.

To help explain this, let's refer to the "Battleground" map below, with the following "definitions".

1) The SPY numbers ($188/share) are kind of like "mile markers".

2) The main battlefield is the purple area between markers 184 and 188.

3) The first wall of resistance in the battle is at 188 and the absolute "stone wall resistance" is at 189.

4) Between 188-189 lies an area that we call No Man's Land, that is deadly to try to cross or occupy.

It is like the Normandy Beach in WWII, the Shenandoah River in the Civil War, or a "moat" in the

Middle Ages. The casualties in this "zone" are almost unbearable, but sometimes attackers manage

to cross it. (Like now?)

So, using the above definitions, the History of the Battle of No Man's Land is:

1) Let's say the green bars are attacks by the Bulls and the red bars are retreats.

2) The Bulls attacked the Bear's first resistance level at 188 in the first week of March 2014 and then

pushed through No Man's land to 189 before getting stopped, routed on 3/13/14 and pushed back

to about 183.5 by mid-March.

3) Then there were 5 more broad attacks during the battle (orange ellipses).

4) The Bulls camped at the 188 level or hunkered down in No Man's Land for 26 days/nights in this

2-1/2 month battle.

5) The Bulls hit or broke over the wall at 189 nine times in this battle and failed every time, except on

its ninth try (today), where it stopped at 189.8.

6) One major problem is that the breach today above 189 came on low volume (kind of like the Bear's

super troops were not in this battle).

7) Now it is up to the Bulls to "hold their ground" and/or capture more territory, while the Bears must

concentrate on re-claiming the territory that it lost today.

The Bulls should not celebrate until the market moves higher or at least they retain what they have gained so far.

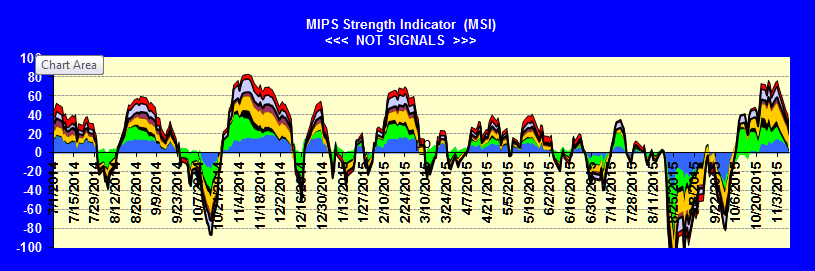

Our MIPS Market Strength Indicator is strong to the upside now, but we all know that this can change quickly.

- see 2nd graph below.

Remember, MIPS may see this somewhat differently, so let's wait for MIPS' signals.

Battleground Map

Sunday, May 25 2014

During most of 2013 and 2014, we have received emails from MIPS members wanting to know why the MIPS models stayed Long for so long without often going short. This was due to the fact that our MIPS3/MF model, for example, traded only 2 times in 2013 and 2 times in 2014, the lowest in the MIPS3/MF eight-year-plus history.

When asked why they thought that MIPS should have traded more often, they mainly said the "volatility in the market" (as in the SPY). On the surface, I can certainly see why they would feel that way. See the graph below. From this, it looks like there were several good opportunities to short, but the risk of getting whipsawed in a market like this is very high. In fact, many timing models did get sucked in to short positions several times, only to get whipsawed almost every time.

It is very difficult to ascertain from the "surface" of a price action graph where the market will go next or what the underlying strength of the market is at any point in time. This is one reason why MIPS provides its proprietary Market Strength Indicator (MSI) graph on its website for MIPS members at:

=> http://www.mipstiming.com/msi___mips_members .

Even though the human eye and mind may have trouble "reading the tea leaves" from the price action of the market on a bar chart or other graph, the underlying mathematics and intricate indicators in a " very good" timing model see things differently, and have a much better chance at interpreting the most likely direction of the market in the short term. Of course, you never want to bet against the trend. By a "very good" timing model above, we mean a timing model that has sufficient built-in "coverage" of the movements in the market to arrive at sound decisions going forward. This means timing models with enough math and enough technical indicators to work well at least in slow up-markets, fast up-markets, slow down-markets, fast down-markets, and flat/sideways markets. This CANNOT be done with any degree of consistency or accuracy with a timing model (if you could even call it that) that is made up of simply 6-12 "off the shelf" market indicators. On the other hand, a timing model with, say, 100 or more published and/or proprietary market indictors does have a good chance to be consistent in calling the market trends correctly. Even then, the degree of accuracy of a model like this depends on how well the various indicators are "matched" with each other, how the model's voting algorithms are designed, the degree of self-learning/self-correcting capability of the model, its ability to identify certain market patterns that cause timing models to waver, etc.

To show a simple example of what the guts of a market timing model looks like, the graph below is an X-ray view of part of the MIPS3 model. This is how some of the internals of the MIPS3 model see the raw price data from the first graph above. [This is a visual illustration of just a very small fraction of the internals of the MIPS3 model.]

In the graph below, the top straight line is a long-term trend line and the colored lines come from things like moving averages and other trend lines, or combos thereof (the up-trends here are obvious). The three indicators in the bottom half of the graph below come from things like various slopes of the SPY price, proprietary rate-of-change, modified relative-strength-index, and various mixed oscillators. In all cases, the indicators are "Long" when they are above the zero line, and "Short" when they are below zero.

Hence you can see that, even though the first graph above seems to show various opportunities to go "Short", the majority of the internal MIPS3 indicators in the graph below have been highly bullish throughout the entire period. Ditto for the rest of the MIPS3 model. Therefore, the real reason why the MIPS models have stayed Long for the majority of 2013 and 2014 is that the up-trend was very strong the entire time period and so there were no good reasons to trade otherwise (i.e., don't fight the trend) !!!

This is not to say that the market cannot go south quickly. It can, but the guts of the MIPS models can also change quickly. History has shown that the MIPS models react quickly to big market crashes and/or corrections.

The above is similar to the process followed by doctors who examine patients who come in with obvious "markers" on their body (welts, sores, moles, bruises, coated tongue, yellow eyes, unusual skin color, etc). If the patient's condition is not obvious from the outside, doctors resort to modern-day medical equipment that allow them to look deep inside of a patient's head, heart, back, stomach, etc. (like using X-rays, EKGs, CAT scans, MRIs, colonoscopies, etc). MIPS sort of behaves in a similar way.

So, instead of just looking at the surface data and guessing, we have the guts of the MIPS models to break down every movement of the market into segments, and to examine each one separately to come up with a consensus.

Monday, May 12 2014

For some time, we have been talking about this war between the Bulls and Bears, but we never really defined it. We call it a war, because that is what it is like.

To help explain this, let's refer to the "Battleground" map below, with the following "definitions".

1) The SPY numbers ($188/share) are kind of like "mile markers".

2) The main battlefield is the purple area between markers 184 and 188.

3) The first wall of resistance in the battle is at 188 and the absolute "stone wall resistance" is at 189.

4) Between 188-189 lies an area that we call No Man's Land, that is deadly to try to cross or occupy.

It is like the Normandy Beach in WWII, the Shenandoah River in the Civil War, or a "moat" in the

Middle Ages. The casualties in this "zone" are almost unbearable, but sometimes attackers manage

to cross it. (Like now?)

So, using the above definitions, the History of the Battle of No Man's Land is:

1) Let's say the green bars are attacks by the Bulls and the red bars are retreats.

2) The Bulls attacked the Bear's first resistance level at 188 in the first week of March 2014 and then

pushed through No Man's land to 189 before getting stopped, routed on 3/13/14 and pushed back

to about 183.5 by mid-March.

3) Then there were 5 more broad attacks during the battle (orange ellipses).

4) The Bulls camped at the 188 level or hunkered down in No Man's Land for 26 days/nights in this

2-1/2 month battle.

5) The Bulls hit or broke over the wall at 189 nine times in this battle and failed every time, except on

its ninth try (today), where it stopped at 189.8.

6) One major problem is that the breach today above 189 came on low volume (kind of like the Bear's

super troops were not in this battle).

7) Now it is up to the Bulls to "hold their ground" and/or capture more territory, while the Bears must

concentrate on re-claiming the territory that it lost today.

The Bulls should not celebrate until the market moves higher or at least they retain what they has gained so far.

Our MIPS Market Strength Indicator is strong to the upside now, but we all know that this can change quickly.

- see 2nd graph below.

Remember, MIPS may see this somewhat differently, so let's wait for MIPS' signals.

Battleground Map

MIPS Market Strength Indicator (5/12/19140

===============================================================================

<<< Previous Blog >>>

MIPS Members:

On yesterday's close, the SPY again stuck its head above 188.0 into No Man's Land (e.g., between 188.0 and 189.0). In fact, there is a very interesting phenomenon going on in this very tight range. Let's look at the stats from the graph below.

1) The SPY has been in a rather tight, sideways trading range since 3/03/14 (for over 9 weeks). This is also called a flat or horizontal "pattern", and 9 weeks in this pattern is somewhat rare.

2) The SPY has not been able to break firmly above its strong resistance level at $189.0/share except for a few hours on 4/04/14, then it got "slapped" back down. And, in the entire time period, the SPY hit or stuck its head above the 189.0 level seven times, again only to be slapped back each time.

3) Anomaly - the SPY had been "trapped" in the trading range of 188.0-189.0 (No Man's Land) five times during this period (see orange ellipses in graph below). This is very unusual. In fact, the SPY has hit 188.0 or closed in No Man's Land 23 days (or 47% of the time in the sideways trading range). So far, every time the SPY has stuck its head above the fence at 188.0, it got slapped back to the lower end of the trading range (184-185).

Of course, the SPY will not stay flat forever. It will break out of this flat trading range, and most likely soon. And, when it does, the market's move up or down from the trading range will be bigger the longer the SPY was in the flat pattern.

Which way will it break?

We need to trust MIPS to answer that.

|

Tuesday, May 06 2014

On yesterday's close, the SPY again stuck its head above 188.0 into No Man's Land (e.g., between 188.0 and 189.0). In fact, there is a very interesting phenomenon going on in this very tight range. Let's look at the stats from the graph below.

1) The SPY has been in a rather tight, sideways trading range since 3/03/14 (for over 9 weeks). This is also called a flat or horizontal "pattern", and 9 weeks in this pattern is somewhat rare.

2) The SPY has not been able to break firmly above its strong resistance level at $189.0/share except for a few hours on 4/04/14, then it got "slapped" back down. And, in the entire time period, the SPY hit or stuck its head above the 189.0 level seven times, again only to be slapped back each time.

3) Anomaly - the SPY had been "trapped" in the trading range of 188.0-189.0 (No Man's Land) five times during this period (see orange ellipses in graph below). This is very unusual. In fact, the SPY has hit 188.0 or closed in No Man's Land 23 days (or 47% of the time in the sideways trading range). So far, every time the SPY has stuck its head above the fence at 188.0, it got slapped back to the lower end of the trading range (184-185).

Of course, the SPY will not stay flat forever. It will break out of this flat trading range, and most likely soon. And, when it does, the market's move up or down from the trading range will be bigger the longer the SPY was in the flat pattern.

Which way will it break?

We need to trust MIPS to answer that.

| |

Wednesday, April 30 2014

The trading frequency of the MIPS models in the last 12-15 months has been the lowest in our history (e.g., just 2 trades in 2013 with MIPS3/MF). Historically, MIPS3/MF and MIPS4/MF+ trade an average of 12-15 times/year.

We have MIPS members that want to know more about why low-trade years happen, and what the consequences are. The answer is quite simple (and good). The MIPS models only trade when they feel strongly that the market (as measured by movements of the SPY) has changed direction from up-to-down or vice versa. MIPS does not trade just to trade!

In other words, a MIPS model trades only when it has identified an "Inflection Point" (and a new trend). If it turns out that MIPS does not experience a strong trend going forward, it may quickly reverse its decision. This is why the losses on our losing trades are only 1/3 the size of the gains on our winning trades.

So, getting back to the point, the market in 2013 was in one big, continuous, strong up-trend for the entire year (see the 1st graph of the SPY benchmark below). This is about as smooth as a market can get. In 2013, the SPY was up about 26% and MIPS3 trading IWM was up 28%. Hard to complain about that !!!

Remember that it is hard if not impossible to "beat the index" in up-markets that do not present any opportunities to make money by being short. On the other hand, it is hard if not impossible not to make good money in these markets by just being long the entire time. The only way that you can lose money or not make money in these markets is by getting whipsawed.

You will notice that there are no real practical, intermediate-term down-trends in 2013, where MIPS could have made money by being short. Most of the "dips" in 2013 reversed themselves quickly before any new real trends formed, thus presenting a pattern where many fast-acting timing models got whipsawed. MIPS3 made only two trades in 2013, one on 6/24/13 (short) and a quick reversal on 7/3/13 (back to long).

MIPS3/MF in 2013 (2 trades - red dots) SPY +26% MIPS IWM +28%

Now the question should be: "How did MIPS3/MF do in other fast, high-growth markets in the past"?

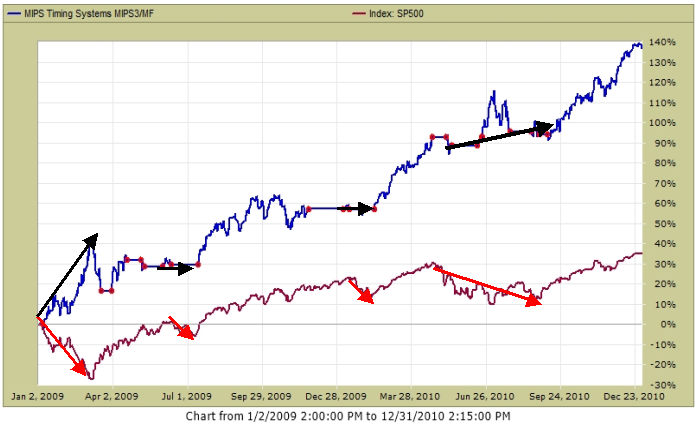

A good time period to examine to help answer that question is in 2009 and 2010. Remember, in strong up-markets, you can only really "best the index" by a healthy margin if and when your timing model identifies and trades real down-trends where "shorts" make money.

So, let's look at how MIPS3 trading IWM did along that line in 2009 and 2010 (two up-years).

- For that, see the graph immediately below. In the several times when the SPY went south, MIPS3 went

either "short" or to "cash".

As you can see from the graph below, if the market presents "tradable" down-trends where "shorts" make money, the MIPS models will most likely identify and trade them.

- MIPS3 below issued 10 trades in 2009 and 15 trades in 2010.

MIPS3/MF in 2009 and 2010 (25 trades - red dots) SPY +36 MIPS +138%

So, let's sit back and follow MIPS...

- remember, MIPS3 is a good model, but MIPS4 is even better

- if you can trade ETFs on the next day's open, use MIPS4

- but, if you must trade mutual funds on the next day's close, use MIPS3.

|