Wednesday, April 30 2014

The trading frequency of the MIPS models in the last 12-15 months has been the lowest in our history (e.g., just 2 trades in 2013 with MIPS3/MF). Historically, MIPS3/MF and MIPS4/MF+ trade an average of 12-15 times/year.

We have MIPS members that want to know more about why low-trade years happen, and what the consequences are. The answer is quite simple (and good). The MIPS models only trade when they feel strongly that the market (as measured by movements of the SPY) has changed direction from up-to-down or vice versa. MIPS does not trade just to trade!

In other words, a MIPS model trades only when it has identified an "Inflection Point" (and a new trend). If it turns out that MIPS does not experience a strong trend going forward, it may quickly reverse its decision. This is why the losses on our losing trades are only 1/3 the size of the gains on our winning trades.

So, getting back to the point, the market in 2013 was in one big, continuous, strong up-trend for the entire year (see the 1st graph of the SPY benchmark below). This is about as smooth as a market can get. In 2013, the SPY was up about 26% and MIPS3 trading IWM was up 28%. Hard to complain about that !!!

Remember that it is hard if not impossible to "beat the index" in up-markets that do not present any opportunities to make money by being short. On the other hand, it is hard if not impossible not to make good money in these markets by just being long the entire time. The only way that you can lose money or not make money in these markets is by getting whipsawed.

You will notice that there are no real practical, intermediate-term down-trends in 2013, where MIPS could have made money by being short. Most of the "dips" in 2013 reversed themselves quickly before any new real trends formed, thus presenting a pattern where many fast-acting timing models got whipsawed. MIPS3 made only two trades in 2013, one on 6/24/13 (short) and a quick reversal on 7/3/13 (back to long).

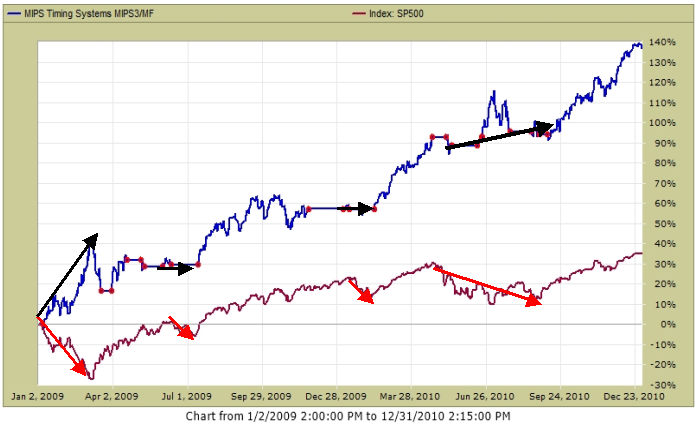

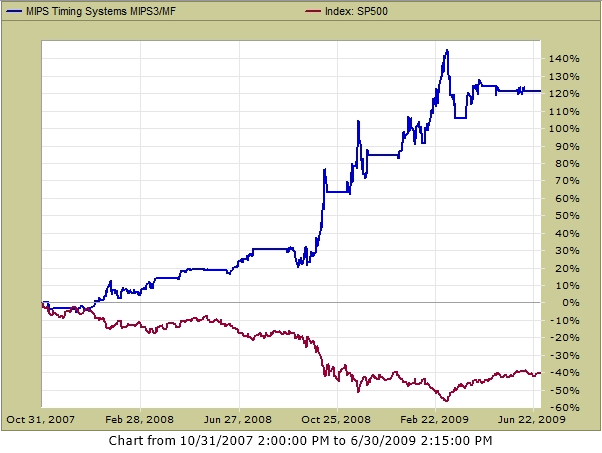

MIPS3/MF in 2013 (2 trades - red dots) SPY +26% MIPS IWM +28%

Now the question should be: "How did MIPS3/MF do in other fast, high-growth markets in the past"?

A good time period to examine to help answer that question is in 2009 and 2010. Remember, in strong up-markets, you can only really "best the index" by a healthy margin if and when your timing model identifies and trades real down-trends where "shorts" make money.

So, let's look at how MIPS3 trading IWM did along that line in 2009 and 2010 (two up-years).

- For that, see the graph immediately below. In the several times when the SPY went south, MIPS3 went

either "short" or to "cash".

As you can see from the graph below, if the market presents "tradable" down-trends where "shorts" make money, the MIPS models will most likely identify and trade them.

- MIPS3 below issued 10 trades in 2009 and 15 trades in 2010.

MIPS3/MF in 2009 and 2010 (25 trades - red dots) SPY +36 MIPS +138%

So, let's sit back and follow MIPS...

- remember, MIPS3 is a good model, but MIPS4 is even better

- if you can trade ETFs on the next day's open, use MIPS4

- but, if you must trade mutual funds on the next day's close, use MIPS3.

Wednesday, April 23 2014

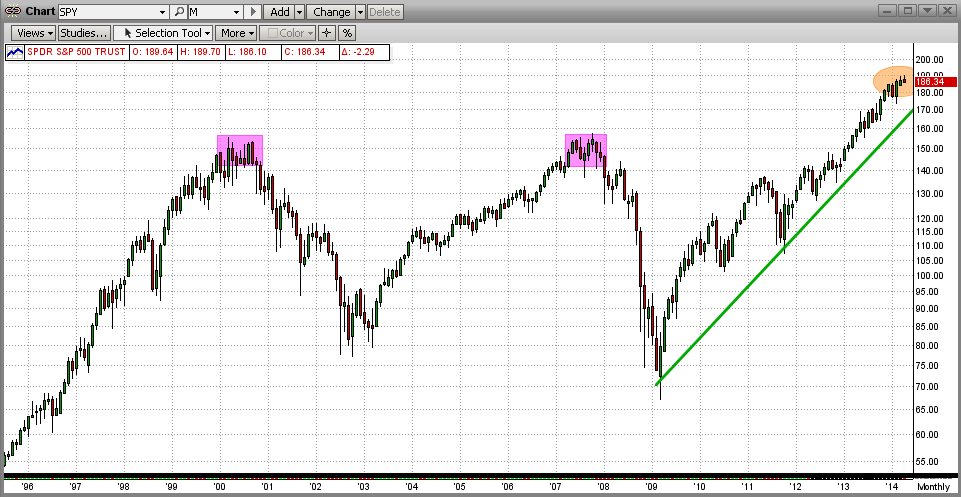

Are we in an up market now? It may look like one or feel like one, but that does not make it one. Besides, to answer that, we need a time frame. Over the last 5 years, we have definitely been in a strong up-market.

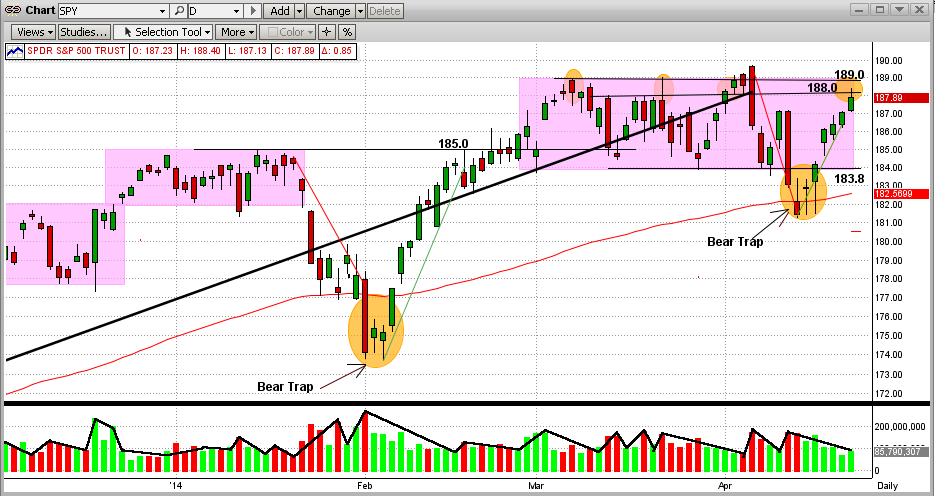

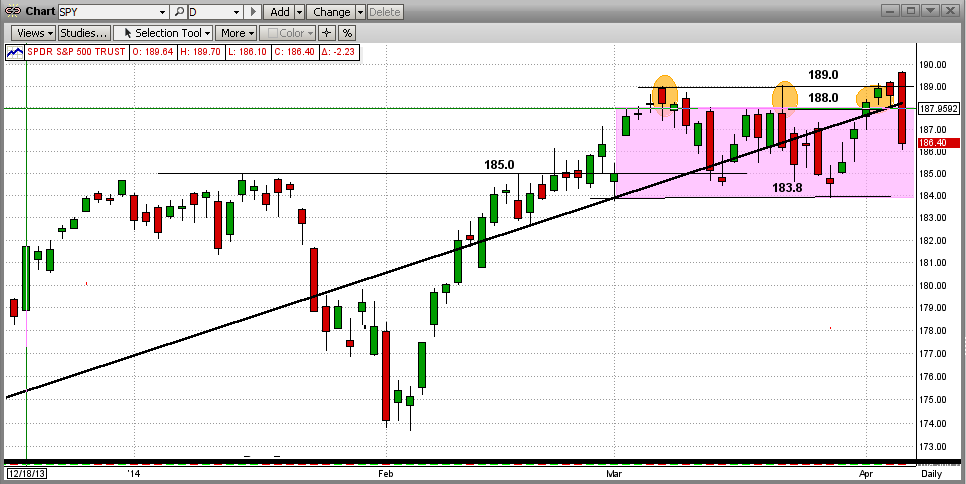

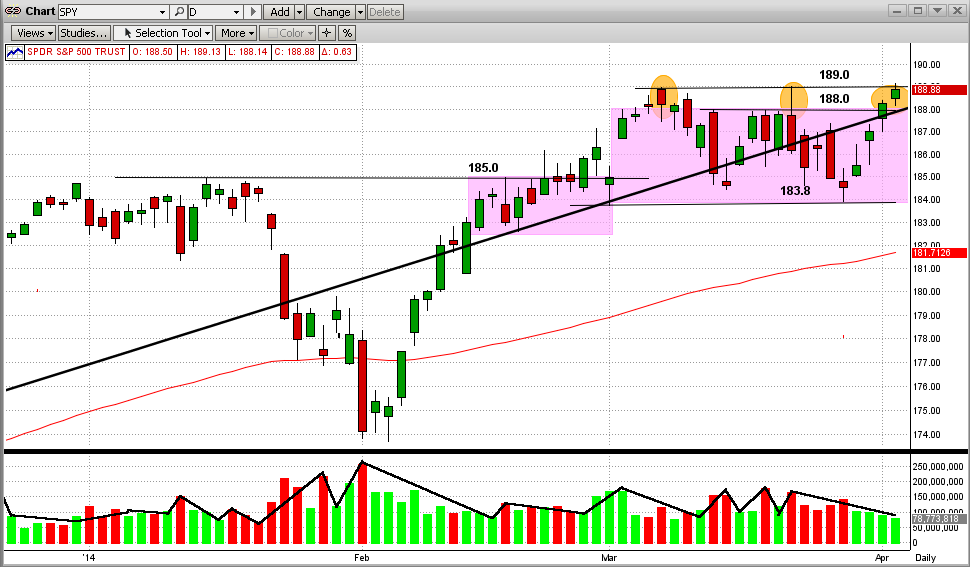

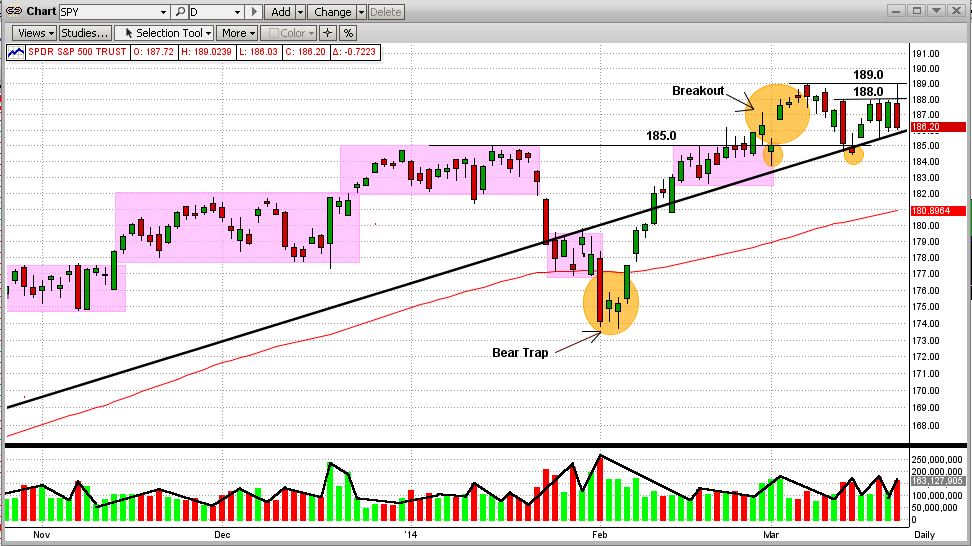

OK then, what about now? Well, the SPY has basically been relatively flat for most of 2014. Since the beginning of the year, the SPY is up about 4%, but almost all of that has happened in the last 6 days !!! See the graph below.

Short-term, we can see that the SPY has been in a "trading range" of 183.8-188.0 since the beginning of March 2014. We had a big drop near the beginning of April, when the SPY dropped from an intraday high of 189.6 to a low of 181.2 (-4.4%). That drop ended in a "bear-trap", when the SPY reversed itself the very next day and climbed all the way back to an intraday high of 188.4 today (and a close at 187.9). That's a gain of almost 4% in six days (impressive, but on low volume).

The worry comes from the fact that the SPY is very close to going back into "no-man's-land" (the "strip" between 188-189 on the SPY) for the 4th time in the last seven weeks !!! What happens next is anybody's guess. I will not feel comfortable on the upside unless the SPY breaks and holds above 189 for a few days/weeks (remember, where there are Bear Traps, there can also be Bull Traps).

By definition, what we can see is "on the surface". Even though our Market Strength Indicator sees a little deeper, it is not nearly as comprehensive as the MIPS models themselves ( http://www.mipstiming.com/msi___mips_members ). That is, the market could look weak on the outside (like in the most recent Bear Trap in the graph below), but the MIPS models were not "fooled" by what was happening only on the surface. While the surface looked weak, the guts were indeed stronger.

Sleep well, we have MIPS doing all of the heavy lifting

Monday, April 14 2014

We received a of lot questions in the last few days from MIPS members wanting to know what was MIPS assessment of the market (SP500 or SPY). Unless we would do an extensive, several day analysis of the internals of the MIPS models, we really can't honestly answer that question.

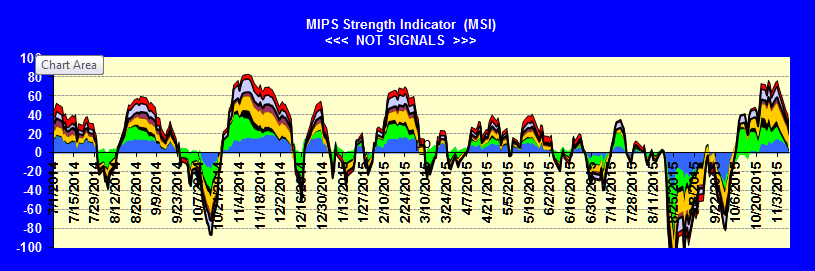

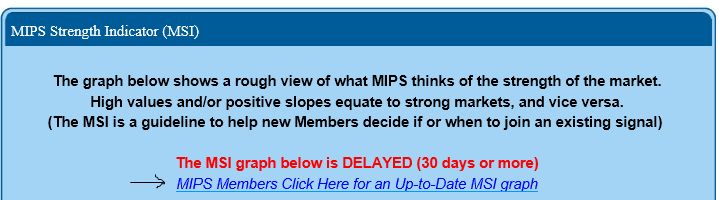

But, we have developed a "tool" that does just that, and it is available to MIPS members only. We call it the MIPS Market Strength Indicator (MSI) and it has been on our website for over one year. Recently, we improved the MSI, took it off of the front page, and made it available to MIPS members only. A "sample" MSI is still on our homepage for illustrative purposes, but it is delayed by 30 days or more.

You can access the up-to-date MSI by clicking on the link => http://www.mipstiming.com/msi___mips_members

- at the bottom of this email, we show you where to find this link on our homepage.

The MSI consists of several of our most accurate indicators. Hence, the MSI shows things like the relative strength of the market on a scale of -100 to +100. It aslo shows if the market is getting stronger (up-slope) or weaker (down-slope), etc. But it is NOT accurate enough to trade with.

The MSI can be compared to the "Vital Signs" charts that are available to physicians who "make the rounds" of their patients in a hospital. This Vital Signs Chart shows "indicators" of each patient's medical status, like their temperature, blood pressure, heart rate, etc. If any of these look bad, their physician will most likely dig deeper (like put them on medical alert, order more tests, etc.).

Today's up-to-date MSI looks like that immediately below. This chart tells me that the MSI sees the market as being very weak and one that could go anywhere from here.

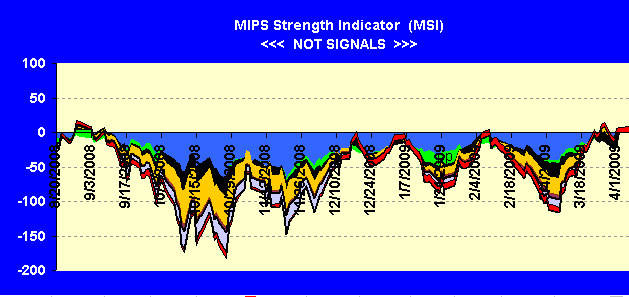

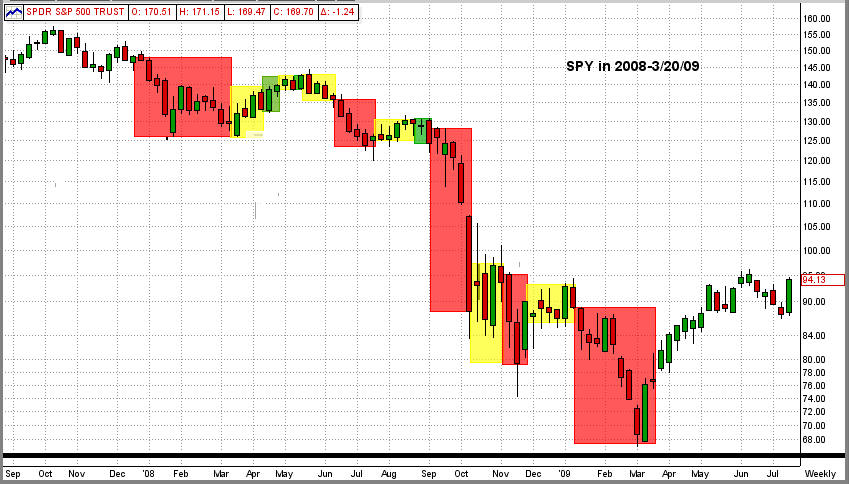

BEAR MARKET (from Sept'08 - Apr'09)

Does the little "dip" recently (in the graph above) constitute the beginning of a bear market ???

If you are surprised at the answer below, you most likely have never seen a bear market from the eyes of technical indicators. To help with that, we went back to 2008-09 and recreated the MSI. Surprised at the outcome ???

When you see this again (most likely sometime this year) MIPS should be short and we should be making money hand-over-fist.

Another little secret. When the bear comes, he comes fast, wreaks havoc, and NEVER lets up. Therefore, MIPS is almost never tempted to join a "fake" up-trend in a market crash, because there are NOT many to be found.

HOW TO ACCESS THE UP-TO-DATE MSI

MIPS Members can gain access to the current MSI graph by clicking on the "Up-To-Date" link in the MSI window on our homepage (see immediately below).

------> http://www.mipstiming.com/msi___mips_members

Sunday, April 06 2014

The stock market took a dive on Friday, but how bad was it? Actually, not so bad. On 4/03/2014, we sent out a blog with the title :"Hold Your Breath, We're In No-Man's Land". In this, we pointed out that the SPY had traded the range of $184-189 for the last 30+ days and had hit $189 three times, but had failed to break above that "all-time high" resistance level. You can see that in the graph immediately below. Well, it tried to do so again in the last two days, only to be "slapped" all the way back to $186.4 on the second try !!! That was about 1.7% from its high that day.

How bad was that? Well, we had comparable days like last Friday on Mar 26th, Mar 13th, and Feb 3rd, only to see the SPY come roaring back each time. So, how bad will last Friday really prove to be? And, how would you like it if this turns into a big "market crash"?

What "bad" should mean to you (or not mean to you) and what you should be (and should not be) worried about is discussed below. So, read on !!!

Another way to look at "How bad a day was last Friday" is to step back and look at Friday from a longer-term perspective. The graph below is the last two decades using monthly bars. From this we can see two things:

1) Looking at the last few bars (months), you can see that the market has been virtually unchanged.

2) In 2000 and 2007, it took the SPY 9-10 months each time to change direction from bull to bear markets.

Again, all of that watching and worrying for nothing !!!

PS - One of our most devoted MIPS members called Friday a collapse until she saw the graph below.

NOW FOR THE REAL POINT OF THIS BLOG.

MIPS members should NOT be worried about a market crash, they should be excited about one.

- The real reason that I am (and lots of our long-term MIPS members are) so relaxed is because of

the way that our MIPS3/MF model performed in 2008 (verified by TimerTrac.com)

1.) MIPS Signals

Green = Long Red = Short Yellow = Cash

2.) MIPS3 Performance in 2008 (4Q'07 - 2Q'09)

FEEL BETTER NOW ???

Thursday, April 03 2014

In our previous blog (immediately below), we showed that the SPY was having trouble breaking above its all-time high of $189/share.

Many times the stock market seems to follow the simple rule that after it tries something 3 times, it's time to move on and try something different (triple bottoms, head and shoulders tops, etc.). It seems like we are there again.

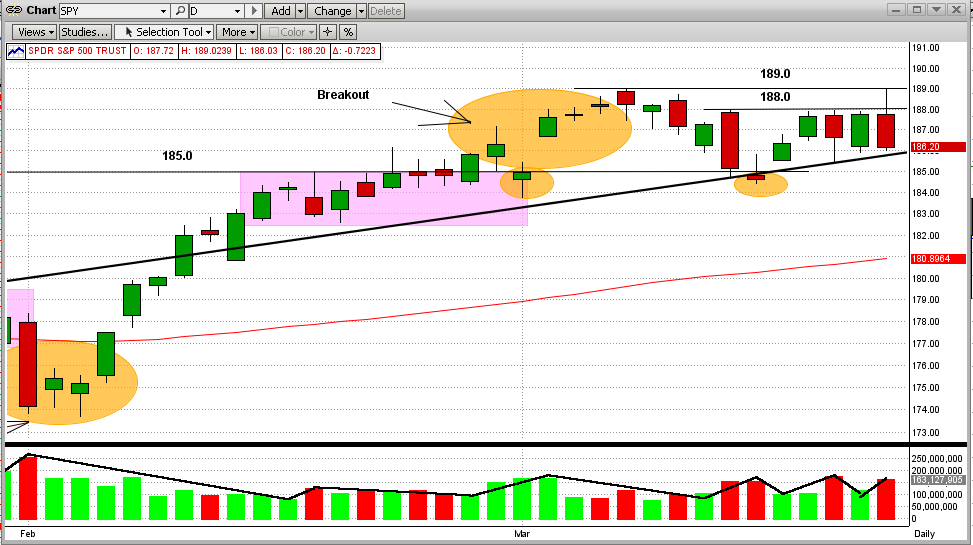

Better hold your breath as we seem to be in another "no-man's land". For the last 30+ days the highs/lows for the SPY were between about $184-189/share (plus/minus 1.3%). Looking closely at the graph immediately below, you can see that most of that time the SPY was actually between $184-188/share, breaking above $188 only three times. The first two times this happened, the SPY rose only to $189/share and was "slapped" all the way back to $184/share(actually to $183.8).

In the last couple of days, we see a "here we go again" movement. The SPY is back to $189/share again, and it did stick its nose slightly above that level for a short period of time today. If it gets slapped back again at this level, then $183.8 becomes the next support level (and then, it ain't pretty after that). On the other side, we are at the verge of the SPY breaking above its all-time high. Knowing that the S&P 500 closed above its all-time high today is very comforting.

But, when we remember that MIPS makes money in up and down markets, we really should not care which way the market moves from here. We have MIPS to tell us what to do, and when!!!

<<< Previous Blog >>>

MIPS Members:

The SPY proved today that the market's "Stone Wall" that has prevented it from surpassing its all-time high is still there.

To see this plainly, please look at Graph #1 below:

1) The SPY hit its all-time high at $189 on 3/07/2014.

2) Then it trickled down for a few days followed by a big drop on 3/13/2014.

3) The SPY bounced back on the intersection of its trendline and support level at $185.

4) This uptick met an abrupt halt at $188, exactly where the big drop started several days before.

5) Since then, the SPY has tried and failed 3 more times to break above this "Stone Wall" at $188.

6) In fact, early today the SPY did pierce this level and climbed all the way to the all-time high level at $189,

only to be slapped all the way back down to the low of the day at $186.2 (see the 2nd Graph below).

7) The volume on down days was higher than on up days (bearish, but certainly not conclusive).

These movements in the SPY are more pronounced in Graph #2 below

Graph #1

In Graph #2 below, the SPY now appears to be in an "Reverse Pennant" or "Widening Wedge" pattern, either or both of which could prove to be bearish. As we all know by now, there are plenty of reasons why this market should have had a correction by now and really only one big reason why it should continue to climb higher. However, the one big reason (the Fed) is starting to lose traction.

It's anybody's guess where the market will move from here. But MIPS does not guess, it calculates all the likely options and chooses the one with the highest probably. And, it almost always beats my guesses.

Graph #2

|